Technavio analysts forecast the global subsea umbilicals, risers, and flow lines (SURF) marketto grow at a CAGR of almost 8% during the forecast period, according to their latest report. The research study covers the present scenario and growth prospects of the global SURFmarketfor 2017-2021.

This press release features multimedia. View the full release here: http://www.businesswire.com/news/home/20171125005025/en/

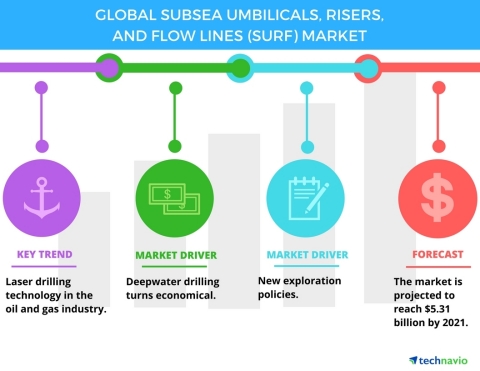

Technavio has published a new report on the global subsea umbilicals, risers, and flow lines market from 2017-2021. (Graphic: Business Wire)

Global SURF market at a glance

SURF act as a vital link between various operation centers in subsea drilling. They are designed to withstand high mechanical and chemical stresses and high operating temperatures and pressures to ensure the continuous and reliable supply of services in challenging environmental conditions below the sea. The global SURF market is highly dependent on the growth of the upstream oil and gas industry, which, in turn, is dependent on global crude oil prices. The rise in demand for oil and gas globally is expected to be the major driver for the market during the forecast period. The slump in crude oil prices has affected the upstream industry significantly while benefitting the downstream industry.

This report is available at a USD 1,000 discount for a limited time only: View market snapshot before purchasing

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free

Technavio analysts highlight the following three factors that are contributing to the growth of the global SURF market:

- Deepwater drilling turns economical

- Rising global oil and gas demand

- New exploration policies

Looking for more information on this market? Request a free sample report

Technavio's sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Deepwater drilling turns economical

The shale boom that led to a sharp decline in oil prices in mid-2014 made it difficult for companies operating in deepwater to extract oil feasibly. Since crude oil prices slipped below the $50/barrel mark, it became almost impossible for companies drilling in deepwater to break-even, since costs incurred in deep sea drilling were high. As a consequence, many oil and gas companies reduced their capex and many planned projects were shelved or deferred.

Gaurav Mohindru, a lead unit operations research analyst at Technavio, says, "Though the deepwater technology has been in existence for years, the process has become economically feasible only in recent times. The streamlining of operations by producers and prioritizing drilling in core wells resulted in reduced costs, which made producers capable of achieving breakeven at lower crude oil prices

Rising global oil and gas demand

Oil producers, especially OPEC countries, need to increase their production or venture into drilling new wells to meet the rising fuel demand. Most oil-producing countries do not have large additional capacities. Therefore, to meet the high fuel demand, oil companies will be required to explore and drill greenfield wells in new and existing oil fields.

"Natural gas has seen a higher rise in consumption than oil and the adoption of natural gas as a fuel is increasing. The continuous growth in the demand for oil and natural gas is expected to drive onshore and offshore exploration activities, in turn driving the growth of the global SURF market," adds Amit.

New exploration policies

In a move to attract companies to explore oil and gas fields, countries, such as India, Brazil, and Israel, have made noteworthy changes to their existing oil and gas exploration policies. To encourage the influx of investments in the oil and gas industry, the federal government of Brazil announced a change in its policies. The existing Brazil policy requires a number of goods and services produced in the country to be hired or contracted.

Numerous changes have been made to existing policies. A single license for conventional and unconventional hydrocarbon exploration, decrease in royalty values, and change in fiscal regime to revenue sharing contracts are a few of the major changes. HELP is still in the formulation stage and is expected to be rolled out shortly. These policy changes are anticipated to attract new investments from global players and drive the global SURF market.

Top vendors:

- Aker Solutions

- Prysmian Group

- Schlumberger (OneSubsea)

- TechnipFMC

Browse Related Reports:

- Global Smart Transformer Market 2017-2021

- Global Submarine Power Cable Market 2017-2021

- Global Advanced HVAC Controls Market 2017-2021

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio's report library consists of more than 10,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20171125005025/en/

Contacts:

Technavio Research

Jesse Maida

Media Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

www.technavio.com