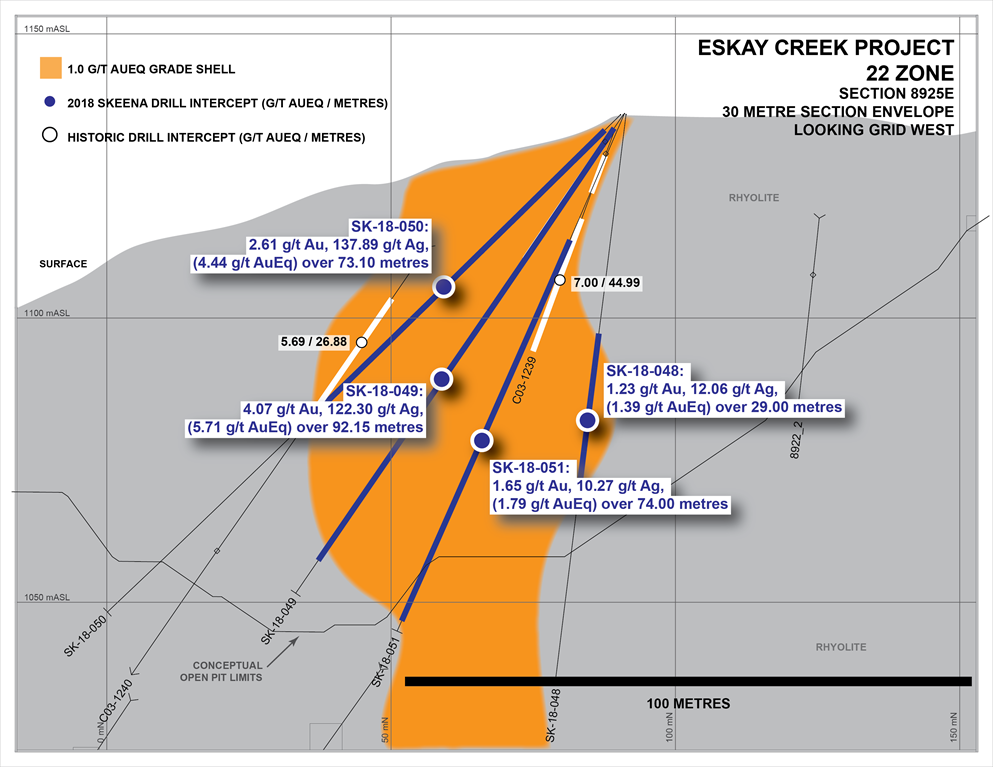

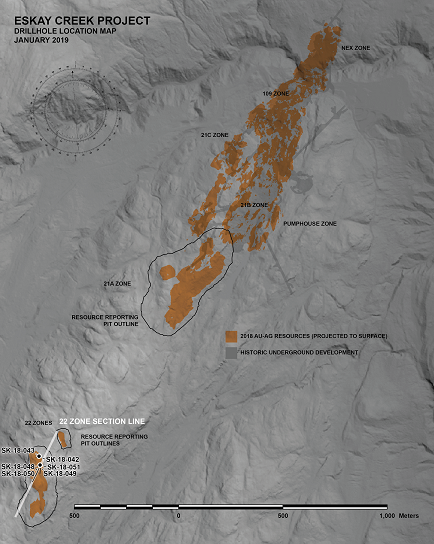

VANCOUVER, BC / ACCESSWIRE / January 24, 2019 / Skeena Resources Limited (TSX.V: SKE, OTCQX: SKREF) ('Skeena' or the 'Company') is pleased to announce final Au-Ag drill results for six holes from the recently completed Phase I surface drilling program at the Eskay Creek Project ('Eskay Creek') located in the Golden Triangle of British Columbia. The multifaceted Phase I program was performed in the 21A, 21C and 22 Zones. Assays reported in this release are from the 22 Zone. Reference images are presented at the end of this release as well as on the Company's website.

Eskay Creek 22 Zone Phase I Drilling - Current Highlights

- 4.07 g/t Au, 122.30 g/t Ag, (5.71 g/t AuEq) over 92.15 m (SK-18-049)

- Including: 20.10 g/t Au, 321.62 g/t Ag, (24.39 g/t AuEq) over 14.00 m

- 2.61 g/t Au, 137.89 g/t Ag, (4.44 g/t AuEq) over 73.10 m (SK-18-050)

- Including: 11.56 g/t Au, 63.01 g/t Ag, (12.40 g/t AuEq) over 7.60 m

- 1.65 g/t Au, 10.27 g/t Ag, (1.79 g/t AuEq) over 74.00 m (SK-18-051)

Gold Equivalent (AuEq) calculated via the formula: Au (g/t) + [Ag (g/t) / 75]. Core lengths are reported as true widths as exact zone geometries cannot be accurately determined from available drilling information. Grade capping of individual assays has not been applied to the Au and Ag assays informing the length weighted AuEq composites. Processing recoveries have not been applied to the AuEq calculation and are disclosed at 100%. Samples below detection limit were nulled to a value of zero.

22 Zone Phase I Drilling - Discussion

Originally outlined by limited surface drilling in 2003 and 2004, the 22 Zone is a tabular, sub-vertical, rhyolite-hosted feeder structure to the now eroded mudstone hosted mineralization typical of the Eskay Creek deposits. As such, mineralization within the 22 Zone is not enriched in the epithermal suite of elements (Hg-As-Sb) and is geologically and geochemically analogous to other non-deleterious rhyolite-hosted mineralization such as the 21C Zone and underlying mineralization of the 21A Zone.

The 22 Zone currently has a drill-defined strike length of 300 m and horizontal width in excess of 50 m; it has only been tested in the upper 100 m at average 40 m drill spacings. Further drill testing will take place during the 2019 field season. Due to the paucity of drilling in this area, 22 Zone mineralization remains open for expansion along strike and to depth.

The 2018 pit constrained inferred resources hosted within the 22 Zone are comprised of 171,000 AuEq ounces (1.452 Mt grading 2.5 g/t Au, 89 g/t Ag or 3.7 g/t AuEq; for full resource details including indicated and underground resources, refer to the Company's News Release dated September 17, 2018).

The 2018 Phase I drilling program was designed to infill and upgrade the inferred resources in the 22 Zone by increasing drill density to 20 m intercept spacing. Due to the onset of winter weather conditions, only six of the planned 20 holes were drilled. The outstanding portion of the program will be completed during the 2019 exploration season. This drill spacing will allow for future economic analyses and will also allow the Company to collect fresh material for an upcoming metallurgical characterization and testing program.

2018 Regional Snip Drilling

Three drillholes were completed at the Company's 100% owned Snip project in Q4 2018. These holes were designed to test regional soil targets outside of the former mine footprint as well as to collect new lithostructural information to inform regional targeting for the 2019 regional exploration programs. No material assay results are reported.

About Eskay Creek

In December 2017, Skeena secured an option to acquire 100% interest in the Eskay Creek property. Discovered in the Golden Triangle in 1988, the former Eskay Creek mine produced approximately 3.3 million ounces of gold and 160 million ounces of silver at average grades of 45 g/t gold and 2,224 g/t silver. Eskay Creek was once the world's highest-grade gold mine and fifth-largest silver mine by volume.

A precious and base metal-rich volcanogenic massive sulphide (VMS) deposit, Eskay-style mineralization has been the focus of considerable exploration activity in the Golden Triangle dating back to 1932. Exploration programs in 1988 led to the discovery of the 21A and 21B zones, followed by underground development of the 21B zone starting in 1990 with the official opening of the Eskay Creek mine in 1994. Over the 14-year life of the mine, approximately 2.2 million tonnes of ore were mined with cut-off grades ranging from 12 to 15 g/t AuEq for mill ore and 30 g/t AuEq for direct shipping smelter ore.

Eskay is endowed with excellent infrastructure including all-weather road access and proximity to the new 287-kilovolt Northwest Transmission Line. The Property consists of 8 mineral leases, 2 surface leases and several unpatented mining claims totaling 6,151 hectares.

About Skeena

Skeena Resources Limited is a junior Canadian mining exploration company focused on developing prospective precious and base metal properties in the Golden Triangle of northwest British Columbia, Canada. The Company's primary activities are the exploration and development of the past-producing Snip mine and the recently optioned Eskay Creek mine, both acquired from Barrick. In addition, the Company has completed a Preliminary Economic Assessment on the GJ copper-gold porphyry project.

On behalf of the Board of Directors of Skeena Resources Limited,

![]()

Walter Coles Jr.

President & CEO

Qualified Persons

Exploration activities at the Eskay Creek Project are administered on site by the Company's Exploration Managers, Colin Russell, P.Geo. and Adrian Newton, P.Geo. In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Paul Geddes, P.Geo. Vice President Exploration and Resource Development, is the Qualified Person for the Company and has prepared, validated and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting its exploration activities on its exploration projects.

Quality Assurance - Quality Control

Once received from the drill and processed, all drill core samples are sawn in half, labelled and bagged. The remaining drill core is subsequently securely stored on site. Numbered security tags are applied to lab shipments for chain of custody requirements. The Company inserts quality control (QC) samples at regular intervals in the sample stream, Including blanks and reference materials with all sample shipments to monitor laboratory performance. The QAQC program was designed and approved by Lynda Bloom, P.Geo. of Analytical Solutions Ltd., and is overseen by the Company's Qualified Person, Paul Geddes, P.Geo, Vice President Exploration and Resource Development.

Drill core samples are submitted to ALS Geochemistry's analytical facility in North Vancouver, British Columbia for preparation and analysis. The ALS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed and 1kg is pulverized. Analysis for gold is by 50g fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.01 ppm and upper limit of 100 ppm. Samples with gold assays greater than 100ppm are re-analyzed using a 50g fire assay fusion with gravimetric finish. Analysis for silver is by 50g fire assay fusion with gravimetric finish with a lower limit of 5ppm and upper limit of 10,000ppm. Samples with silver assays greater than 10,000ppm are re-analyzed using a gravimetric silver concentrate method. A selected number of samples are also analyzed using a 48 multi-elemental geochemical package by a 4-acid digestion, followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled Plasma Mass Spectroscopy (ICP-MS) and also for mercury using an aqua regia digest with Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) finish. Samples with sulfur reporting greater than 10% from the multi-element analysis are re-analyzed for total sulfur by Leco furnace and infrared spectroscopy.

Cautionary note regarding forward-looking statements

Certain statements made and information contained herein may constitute 'forward looking information' and 'forward looking statements' within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management's expectations. Forward-looking statements and information may be identified by such terms as 'anticipates', 'believes', "targets", 'estimates', 'plans', 'expects', ' may', 'will', 'could' or 'would'. Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws.

Neither TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Table 1: Eskay Creek Project Phase I 22 Zone length weighted drill hole gold and silver composites:

HOLE-ID | FROM (M) | TO (M) | CORE LENGTH (M) | AU (G/T) | AG (G/T) | AUEQ (G/T) |

SK-18-042 | 10.00 | 24.00 | 14.00 | 1.04 | <5 | 1.04 |

SK-18-043 | 11.50 | 20.75 | 9.25 | 0.49 | <5 | 0.49 |

SK-18-048 | 39.00 | 68.00 | 29.00 | 1.23 | 12 | 1.39 |

SK-18-049 | 2.85 | 95.00 | 92.15 | 4.07 | 122 | 5.71 |

INCLUDING | 12.00 | 26.00 | 14.00 | 20.10 | 322 | 24.39 |

INCLUDING | 16.50 | 18.00 | 1.50 | 10.95 | 36 | 11.43 |

AND | 18.00 | 18.70 | 0.70 | 20.80 | 113 | 22.31 |

AND | 18.70 | 19.50 | 0.80 | 32.10 | 257 | 35.53 |

AND | 19.50 | 21.00 | 1.50 | 3.05 | 154 | 5.10 |

AND | 21.00 | 22.50 | 1.50 | 28.00 | 177 | 30.36 |

AND | 22.50 | 24.00 | 1.50 | 78.10 | 1,840 | 102.63 |

AND | 24.00 | 25.10 | 1.10 | 33.60 | 633 | 42.04 |

AND | 25.10 | 26.00 | 0.90 | 8.30 | 193 | 10.87 |

AND | 45.00 | 46.00 | 1.00 | 6.94 | 465 | 13.14 |

AND | 48.00 | 48.65 | 0.65 | 9.86 | 2,220 | 39.46 |

SK-18-050 | 3.90 | 77.00 | 73.10 | 2.61 | 138 | 4.44 |

INCLUDING | 11.00 | 18.60 | 7.60 | 11.56 | 63 | 12.40 |

INCLUDING | 11.00 | 12.50 | 1.50 | 10.40 | 19 | 10.65 |

AND | 12.50 | 14.00 | 1.50 | 13.50 | 95 | 14.77 |

AND | 14.00 | 15.50 | 1.50 | 21.90 | 81 | 22.98 |

AND | 18.00 | 18.60 | 0.60 | 17.30 | 209 | 20.09 |

AND | 34.00 | 35.00 | 1.00 | 2.46 | 494 | 9.05 |

AND | 35.00 | 36.00 | 1.00 | 4.60 | 795 | 15.20 |

AND | 53.50 | 55.00 | 1.50 | 2.53 | 831 | 13.61 |

AND | 55.00 | 56.50 | 1.50 | 4.33 | 745 | 14.26 |

SK-18-051 | 24.50 | 98.50 | 74.00 | 1.65 | 10 | 1.79 |

INCLUDING | 26.00 | 27.50 | 1.50 | 5.36 | 11 | 5.51 |

AND | 82.00 | 83.50 | 1.50 | 4.93 | 20 | 5.20 |

Gold Equivalent (AuEq) calculated via the formula: Au (g/t) + [Ag (g/t) / 75]. Core lengths are reported as true widths as exact zone geometries cannot be accurately determined from available drilling information. Grade capping of individual assays has not been applied to the Au and Ag assays informing the length weighted AuEq composites. Processing recoveries have not been applied to the AuEq calculation and are disclosed at 100%. Samples below detection limit were nulled to a value of zero.

Table 2: Mine grid Phase I drill hole locations and orientations:

HOLE-ID | EASTING | NORTHING | ELEVATION | LENGTH (M) | AZIMUTH | DIP |

SK-18-042 | 9527.9 | 8962.2 | 1143.7 | 72.2 | 220.0 | -75.0 |

SK-18-043 | 9527.8 | 8962.9 | 1143.4 | 100.0 | 130.3 | -89.3 |

SK-18-048 | 9549.9 | 8925.6 | 1135.8 | 103.0 | 218.5 | -81.2 |

SK-18-049 | 9550.6 | 8925.1 | 1135.8 | 102.0 | 178.8 | -55.9 |

SK-18-050 | 9550.6 | 8924.7 | 1135.8 | 125.7 | 180.2 | -44.5 |

SK-18-051 | 9551.6 | 8925.3 | 1136.0 | 100.5 | 159.8 | -65.2 |

Contact:

info@skeenaresources.com

SOURCE: Skeena Resources Limited

View source version on accesswire.com:

https://www.accesswire.com/533441/Skeena-Intersects-571-gt-AuEq-over-9215-m-at-Surface-at-Eskay-Creek