As SaaS Management Takes Off, Torii Differentiates by Offering Solutions for Real-time "Autonomous IT"

TORONTO, ON / ACCESSWIRE / May 21, 2019 / Speaking from the stage at Collision, North America's fastest-growing tech conference, Torii CEO Uri Haramati announced today that his company has closed a $3.5 million seed round led by Uncork Capital, with additional investments from Global Founders Capital and Entrée Capital.

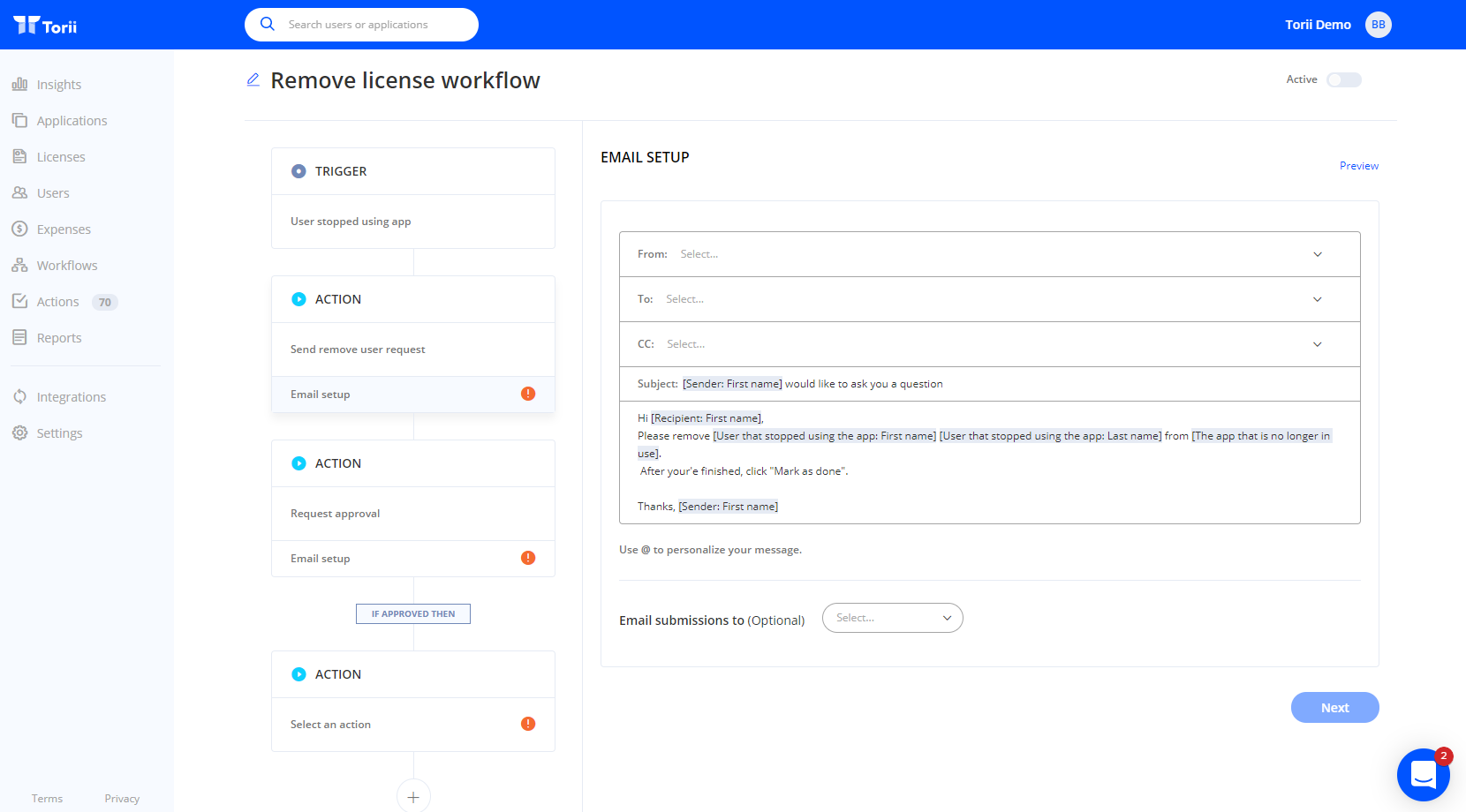

"In the near future, people will not need to manage software - it will be software that manages software," said Haramati. "This inevitability is the anchor of our vision for Torii - to create one software that manages all software, seamlessly, automatically and in real-time. And for that, you need a searchable and easily managed system of record, topped by a powerful and versatile engine for automated workflows. SaaS management needs the ability to automatically add and remove accounts, to optimize license utilization and to intelligently route alert notifications to the right stakeholders."

Benedikt Körling of Global Founders Capital believes that SaaS management will become an increasingly important category, "especially SaaS automation, which Torii tackles well," he said. "Torii's product is more sophisticated than many other offerings on the market today. It shows the founding team's deep product understanding, providing IT teams with an unprecedented user experience."

Andy McLoughlin of Uncork Capital said, "We chose to invest in Torii because we loved the team, the product, the early traction, and the market. The three founders are experienced tech innovators - they bring valuable experience working in high growth businesses, coupled with developing consumer products. This unique combination makes them an exceptionally compelling founding team. I think you only have to look at the quality of the product they are building and early customer traction to understand that."

Above, left to right: Torii co-founders Tal Bereznitskey, CTO; Uri Haramati, CEO; Uri Nativ, VP Engineering

One of Palo Alto's hottest VC funds, Uncork is known for its many portfolio success stories, including Eventbrite, SendGrid, Fitbit, About.me, Bitly and Mint. Global Founders Capital, on the other hand, is among Berlin's most globally active VC organizations, having invested in companies like Facebook, LinkedIn, Trivago, Slack and Canva.Torii's solution tackles a pain point many CIOs and IT managers face, with employees often adopting scores of SaaS applications on a self-service basis, making SaaS a primary culprit of the dreaded "shadow IT" phenomenon. In the age of GDPR compliance and elusive cyber threats, regaining control of all software in use in the enterprise is a mission-critical imperative.

Torii's tools allow IT managers to discover, audit, vet and control the SaaS apps that employees use and to make sure license utilization is optimized. To top that, workflow management can be automated, freeing the IT team up from many of their tedious, regularly mistake-prone processes.

Haramati sees the custom workflow automation capabilities of Torii as a key differentiator, one which will only strengthen its market positioning as post-funding development continues. "We started out focusing on SaaS visibility, then we added a layer of insights, and now a layer of workflow automation to provide our users with the value they need in a way that fits their challenges," he explained.

The seed round will allow Torii to pursue the next phase in its development roadmap, which will see them adding more sophisticated and customizable automation components into their product. It will also allow them to build a US-based sales and customer success team to handle the demand for the platform.

Torii is already being used by top brands and companies such as Monday.com, SimilarWeb, Typeform, Payoneer, ClassPass, Delivery Hero and Thrive Global.

About Torii

Torii offers a SaaS management solution that helps enterprises effectively manage their SaaS application use and subscriptions. The company was founded in 2017 and is currently based in Raanana, Israel and New York.

Torii's team is led by CEO Uri Haramati, a veteran product leader who previously co-founded Life on Air (Meerkat and Houseparty). With him in the executive team are Engineering VP Uri Nativ and CTO Tal Bereznitskey. Naveen Zutshi, the CIO of Palo Alto Networks, is also joining Torii's team as an advisor.

For more information: www.toriihq.com

Press contact:

Dan Edelstein

pr@inboundjunction.com

+972-545-464-238

SOURCE: Torii

View source version on accesswire.com:

https://www.accesswire.com/546047/SaaS-Management-Platform-Torii-Announces-35M-Seed-Round-at-Torontos-Collision-Conference