MONTERREY, NUEVO LEON, MEXICO / ACCESSWIRE / October 22, 2019 / Servicios Corporativos Javer S.A.B. de C.V., (BMV:JAVER) ("Javer" or "the Company"), the largest housing development company in Mexico in terms of units sold, announced today its financial results for the third quarter ("3Q19") and first nine-month periods ("9M19") ended September 30, 2019. All figures presented in this report are expressed in nominal Mexican pesos (Ps.), unless otherwise stated.

3Q19 and 9M19 Highlights:

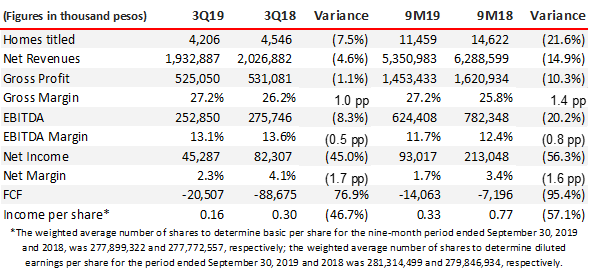

- Units sold decreased 7.5% to 4,206 units in 3Q19 compared to 4,546 units in 3Q18 and declined 21.6% to 11,459 units in 9M19 from 14,622 units in 9M18. The decrease was due to the elimination of the subsidy budget for 2019, since 38.4% and 35.4% of the total units titled in 3Q18 and 9M18, respectively, were subsidized units.

- Net Revenues declined by 4.6% to Ps. 1,932.9 million in 3Q19 and 14.9% to Ps. 5,351.0 million in 9M19, as a result of the volume contraction, however, the enhanced sales mix and the increase in the average sales price resulted in a lower drop in net revenues.

- EBITDA decreased by 8.3% to Ps. 252.9 million in 3Q19 and 20.2% to Ps. 624.4 million in 9M19, primarily due to the decline in the volume of units sold.

- Net Income was Ps. 45.3 million in 3Q19 and Ps. 93.0 million in 9M19 derived from the abovementioned effects. Earnings per share were Ps. 0.16 in 3Q19 and Ps. 0.33 in 9M19.

- Free cash flow (FCF) was Ps. (20.5) million in 3Q19 compared to Ps. (88.7) million in 3Q18, given a lower investment in land reserves. In 9M19, FCF was Ps. (14.1) million compared to Ps. (7.2) million in 9M18 as a result of the volume decline.

CEO STATEMENT

Mr. René Martínez, CEO of the Company commented, "It is a pleasure to report to you once again in this final phase of the year. Likewise, we are very pleased to inform you that in September we finalized a project that we were working on with great effort during the last few quarters. I'm referring to the closing of new financing, with which we will repay our current debt, the US- denominated 2021 Senior Notes.

The new debt, which will mostly be denominated in Mexican pesos (87% of the total principal) leaves us with a better maturity profile and improved financial conditions in terms of financing cost. Furthermore, the FX fluctuation issue practically disappears, which alleviates the Company and will allow us to fully concentrate on our projects in process.

Turning to operational matters, the comparison of the nine months ended September 30 of this year with respect to 2018, shows the impact in volume derived from the elimination of the subsidy program as 35.4% of the units sold in 2018 (5,183 houses) were subsidized. Nonetheless, the strategy we implemented a few years ago to move more towards the middle and residential segments allowed us to recover 34% of the subsidized units in these two segments; although this caused us to not fully recover in gross profit, we did improve our gross margin by 140 basis points.

Some delays in permits, especially in the business units of the state of Mexico and Quintana Roo, have hindered a greater level of recovery in volume and revenues. However, we have continued with the opening of projects; during the third quarter we launched 3 new projects, a residential project in Quintana Roo, another middle-income housing project in Jalisco, and finally our second vertical project in Mexico City of 21 residential apartments. We are very proud of this vertical project as it represents another milestone for the Company operationally. We hope these projects complement our product portfolio for the fourth quarter, together with the scheduled opening of 6 projects that are expected for the last months of 2019.

Regarding the new housing policy, we are still waiting for its publication, and we will be very attentive to it in order to properly plan our short-term budget, as well as the medium and long-term financial and operational planning.

In summary, the results obtained during this nine month period, the operational delays in permits and our outlook for the last quarter lead us to modify our guidance for the year slightly, going from a growth forecast of 2.5% to 5.0% in EBITDA, considering that we will end up with neutral or up to 2.0% growth, without significantly changing the free cash flow generation."

For a full version of this earnings release with financial statements, go to: http://www.javer.com.mx/investors.php

Veronica Lozano

IR, CSR and Planning Director

Tel. +52 (81) 1133-6699 Ext. 6515

vlozano@javer.com.mx

SOURCE: Servicios Corporativos Javer S.A.B. de C.V.

View source version on accesswire.com:

https://www.accesswire.com/563867/Javer-Announces-3Q19-and-9M19-Results-with-an-Improved-Gross-Margin