TORONTO, ON / ACCESSWIRE / January 7, 2020 / Avidian Gold Corp. ("Avidian" or the "Company") (TSXV:AVG) is pleased to report the results from its re-assaying of the 2019 Trenching program at its Amanita property. The Amanita property is comprised of State of Alaska claims totaling 1,460 hectares (14.6 sq. km) and is located 15 km northeast of Fairbanks, Alaska, and approximately 5 km southwest and contiguous to the Fort Knox open-pit gold mine (Figure 1).

During the summer of 2019, Avidian carried out an exploration program whereby a total of six trenches were excavated for 1,725 m with 722 samples collected with variable sample lengths of 1.5 m or 3.0 m depending on prospective geology. Initially samples were assayed using a standard fire assay analysis (October 21, 2019 release), however recognizing that visible gold occurs on the property, selected samples were re-assayed using metallic screen analysis. This analytical technique utilizes a larger sample size and also determines the concentration of free gold within the coarse fraction of the sample.

The table below provides a comparison of the October 21, 2019 results versus the re-assay results both on an uncut and top cut to 20.0 g/t Au as two individual samples returned 52.6 g/t Au and 27.3 g/t Au. The main intersection is now 94.5 m of 3.04 g/t Au (uncut) or 2.01 g/t Au (cut), including 22.5 m of 1.51 g/t Au (uncut) or 7.16 g/t Au (cut).

| October 21, 2019 Press Release | Re-assay Results | ||||||||||||||||||||||||||

| Using Metallic Screening Analysis | |||||||||||||||||||||||||||

| Trench | Length (m) | Grade | Grade | Difference | Grade | Difference | |||||||||||||||||||||

| Name | Au (g/t) | Au (g/t) | to Original | Au (g/t) | to Original | ||||||||||||||||||||||

| uncut | uncut | Reported Assays | Cut to 20 g/t Au | Reported Assays | |||||||||||||||||||||||

| A | 3.0 | 7.91 | 7.02 | -11 | % | ||||||||||||||||||||||

| B | 1.5 | 0.52 | Not Re-Assayed | ||||||||||||||||||||||||

| C | 6.0 | 1.87 | 2.31 | +24 | % | ||||||||||||||||||||||

| 109.5 | * | 1.18 | 2.76 | +134 | % | 1.86 | +58 | % | |||||||||||||||||||

| 94.5 | 1.24 | 3.04 | +145 | % | 2.01 | +62 | % | ||||||||||||||||||||

| 22.5 | 3.85 | 11.51 | +199 | % | 7.16 | +86 | % | ||||||||||||||||||||

| 10.5 | * | 6.88 | 22.80 | +231 | % | 13.5 | +96 | % | |||||||||||||||||||

| 6.0 | 11.48 | 13.10 | +14 | % | |||||||||||||||||||||||

| 6.0 | * | 6.07 | 6.13 | +1 | % | ||||||||||||||||||||||

| 3.0 | 12.15 | 10.71 | -12 | % | |||||||||||||||||||||||

| D | 7.5 | 0.96 | 1.13 | +18 | % | ||||||||||||||||||||||

| 9.0 | 1.82 | 1.82 | 0 | % | |||||||||||||||||||||||

| 6.0 | 2.56 | 2.55 | 0 | % | |||||||||||||||||||||||

| 27.0 | 3.48 | 4.22 | +21 | % | 3.41 | -2 | % | ||||||||||||||||||||

| 6.0 | 4.79 | 4.70 | -2 | % | |||||||||||||||||||||||

| 6.0 | 10.18 | 13.85 | +36 | % | 10.20 | 0 | % | ||||||||||||||||||||

| 12.0 | 1.34 | 0.67 | -50 | % | |||||||||||||||||||||||

| G | 1.5 | 1.1 | 0.77 | -30 | % | ||||||||||||||||||||||

| 6.0 | 2.67 | 2.48 | -7 | % | |||||||||||||||||||||||

| 3.0 | 1.47 | 1.69 | +15 | % | |||||||||||||||||||||||

* Not previously reported. Trench E not completed, Trench F abandoned. True widths of each mineralized zone have yet to be clearly established.

Ninety seven (97) samples were re-analyzed dominantly within the known mineralized trends as reported in the October 21, 2019 press release as well as other selected samples outside these mineralized trends. All the major mineralized intervals were re-assayed using the metallic screen technique, as were any samples containing elevated bismuth values (greater than 10 ppm), as there is a direct association of elevated bismuth with gold.

Dave Anderson, Chairman and CEO of Avidian states " Our prospecting crews have noted visible gold on the Amanita property on several occasions. This combined with the knowledge of historical placer mining and blaster analysis results completed by Kinross in the late 90's indicated the need for metallic screen analysis. Not surprisingly the new analyses confirmed the coarse gold content and translated into a significant increase in the reported grades. Going forward all assays returning elevated bismuth results will be reassayed using the metallic screen analysis. We look forward to following up on these results and exploring the entirety of the Tonsina Trend in our 2020 summer drilling and trenching programs".

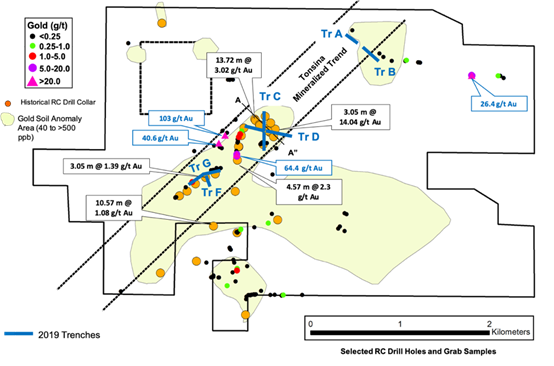

The objective of the 2019 trenching program was to expose and sample a portion of the Tonsina Trend which is a fault bounded, 800 metre wide, northeast trending structural corridor that can be traced along a strike length of approximately 4 km on the property. This corridor trends directly into Kinross's Fort Knox open-pit mine which produced over 255,000 ounces of gold at a mill grade of 0.50 g/t Au (Kinross press release, Feb 13, 2019). The mineralization at Fort Knox is associated with this northeast structural corridor (see Figure 1).

The Tonsina Trend has been sparsely drilled with 39 historical reverse circulation holes, of which 30 intersected oxide mineralization with grades > 1.0 g/t Au such as: 13.72 m of 3.02 g/t Au, 10.67 m of 1.08 g/t Au, 12.19 m of 2.28 g/t Au, 4.57 m of 11.49 g/t Au, and 3.05 m of 14.04 g/t Au. This previous drilling has only tested a portion of the Tonsina Trend (see Figure 2) to a depth of less than 150 m with the gold mineralization currently believed to be a series of steeply dipping oxidized bodies hosted within metamorphosed sediments proximal to intrusive Cretaceous age rocks. This setting is similar to Kinross's Gil project where gold mineralization occurs in quartz-sulphide and quartz-carbonate veins, clay-filled shear zones, and limonite-stained fractures, which crosscut nearly all lithologies. Gold mineralization is widespread, but both gold grade and continuity are related to complex interactions among hydrothermal fluids, host rocks, and structure (June 11, 2018 NI 43-101 Kinross Technical Report).

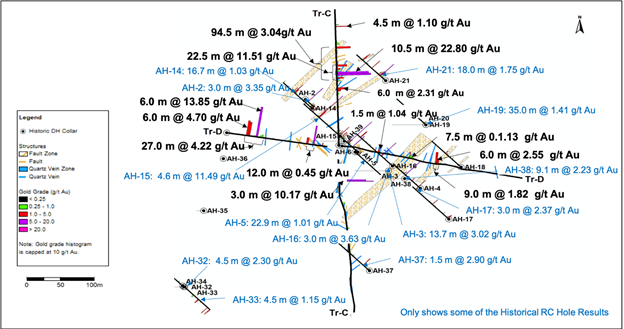

The 2019 trenching program was designed to delineate and map structures, geology and mineralization that may be related to the historical drill holes in order to establish the best orientations for a follow-up diamond drill program. The gold mineralization encountered in the trenches is associated primarily with N70W and N005 to 010E striking, high angle Quartz-Iron Oxide veins/shears/faults that also contain elevated arsenic, bismuth and antimony. The highest gold values are associated with elevated bismuth (> 10 ppm to 870 ppm). Vein widths range from 2 cm to 2 m. The intersection of 94.5 m of 3.04 g/t Au that occurs in Trench C, which trends due north, is hosted in mineralized structures trending from 003º to 055º and dipping steeply in variable directions. The results from trenches C & D in relation to the historical RC holes are shown in Figure 3 which highlights the wide distribution of gold mineralization greater than 1 g/t Au. While many of the mineralized zones are associated with veins/shears/faults, significant intersections can also be found within the metamorphosed sedimentary host rocks such as the 27.0 m of 4.22 g/t Au found in trench D.

The grades of the mineralized intersections encountered in the trenches are significant when compared to the resource cut-off grade at the adjacent Fort Knox mine (0.10 g/t Au) and at the Gil Project (0.21 g/t Au) (NI 43-101 Kinross Technical Report dated June 11, 2018). Also, the discovery of NW trending mineralized veins is important given that historical drilling was mainly in a NW direction; it appears that future drilling should be designed to intersect the mineralized NW structures.

The trench results combined with the historical drilling highlights the wide distribution of gold mineralization with significant widths and grades within the 4 km long Tonsina Trend. Avidian is currently compiling the results of the 2019 trenching program with the historical information in preparation for a follow-up drill program that is anticipated to test the full length and width of the Tonsina structural corridor on the Amanita property.

Figure 1. Amanita Property

Proximity to Fort Knox

Figure 2: Amanita Property - Trench Locations and Selected Historical Drill Hole Results

Figure 3: Plan View of Trench C and D with Historical RC Holes

Quality Control/Quality Assurance

Sampling included insertion of certified standards and blanks into the stream of samples for chemical analysis. Every twentieth trench sample was a standard or a blank. Samples were prepared at ALS Chemex's laboratory in Fairbanks, Alaska and shipped to their Vancouver facility for gold analysis by fire assay and other elements by ICP analysis for the October 21, 2019 reported results. ALS is a certified and accredited laboratory service. Original gold results varied from below detection to a high of 19.95 g/t. For the current re-assay program, approximately 1 kg of previously prepared reject material was analyzed by the metallic screen assay technique; results for total contained gold varied from below detection to 52.6 g/t.

The technical information contained in this news release has been approved by Dr. Tom Setterfield, P.Geo., Vice President Exploration of Avidian, who is a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Avidian Gold Corp.

Avidian brings a disciplined and veteran team of project managers together with a regional scale advanced stage gold-copper exploration portfolio in Alaska. Avidian's Golden Zone project also hosts a NI 43-101 Indicated gold resource of 267,400 ounces (4,187,000 tonnes at 1.99 g/t Au) plus an Inferred gold resource of 35,900 ounces (1,353,000 tonnes at 0.83 g/t Au). Additional projects include the Amanita gold property which is adjacent to Kinross Gold's Fort Knox gold mine in Alaska and the Jungo gold/copper property in Nevada.

Avidian is the majority owner of High Tide Resources, a private company, that owns the base metal Strickland Property, the Black Raven gold property and an option on the Labrador West Iron Ore property, all located in Newfoundland and Labrador, Canada.

Avidian is focused on and committed to the development of advanced stage mineral projects throughout first world mining friendly jurisdictions using industry best practices combined with a strong social license from local communities. Further details on the Corporation and the individual projects, including the NI 43-101 Technical report on the Golden Zone property, can be found on the Corporation's website at www.avidiangold.com.

For further information, please contact:

Bonnie Hughes, Manger Investor Relations

Mobile: +44 7538 296674

Email: info@avidiangold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-looking information

This News Release includes certain "forward-looking statements". These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, project development, reclamation and capital costs of the Company's mineral properties, and the Company's financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities law.

SOURCE: Avidian Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/572231/Avidian-Re-Assays-Amanita-Results-Using-Metallic-Screen-Analysis-Reports-304-gt-Au-over-945-m-from-Amanita-Property-Trenching-Program-Adjacent-to-Fort-Knox-Gold-Mine