Infill drilling results confirm model grades and thickness of main orebodies:

Orebody BF2: 10.64 g/t Au over 9.8m; Orebody BF: 9.88 g/t Au over 3.88m;

Orebody BA: 6.16 g/t Au over 10.00m

Over 18,000 metres of planned growth exploration drilling

TORONTO, ON / ACCESSWIRE / February 12, 2020 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG) is pleased to announce results of its 2019 Infill diamond drilling campaign and the resumption of growth exploration drilling activities at its Pilar Mine Operation ("Pilar").

Infill Drilling completed in 2019 confirms expected modelled grade and thickness of the main and subsidiary Pilar Banded Iron Formation ("BIF") Orebodies which are the source of current production. This drilling is expected to support replacement of Mineral Reserves net of 2019 production depletion.

Definitions: ETW - estimated true width, g/t Au - grams per tonne gold, m - metres, grade (g/t Au) x thickness (m) = GM (gram - metres).

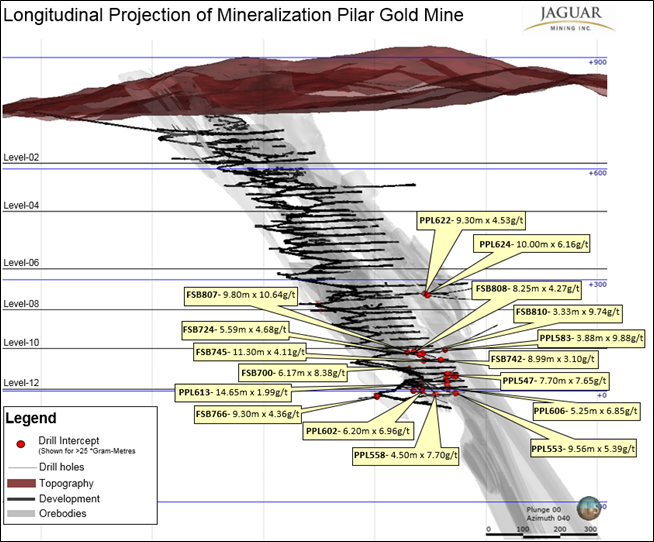

At Pilar, 26 infill drilling intersections have grade (g/t Au) x thickness (m) results > 25 gram metres (GM) with the best results from Orebody BF2, reporting 10.64 g/t Au over 9.8m, Orebody BF, reporting 9.88 g/t Au over 3.88m and Orebody BA reporting 6.16 g/t Au over 10.00m. (see Table 1, Figure 1 and Appendix 1 and 2). The 2019 infill drilling program completed 14,300 metres.

Geological mapping of development, especially at the lower levels of the mine has allowed a greater appreciation and understanding of the complex, structural fold geometries which are prominent features of the BIF hosted mineralization. Updated schematics derived from ongoing geological mapping activities and current structural interpretation are presented in Figure 2.

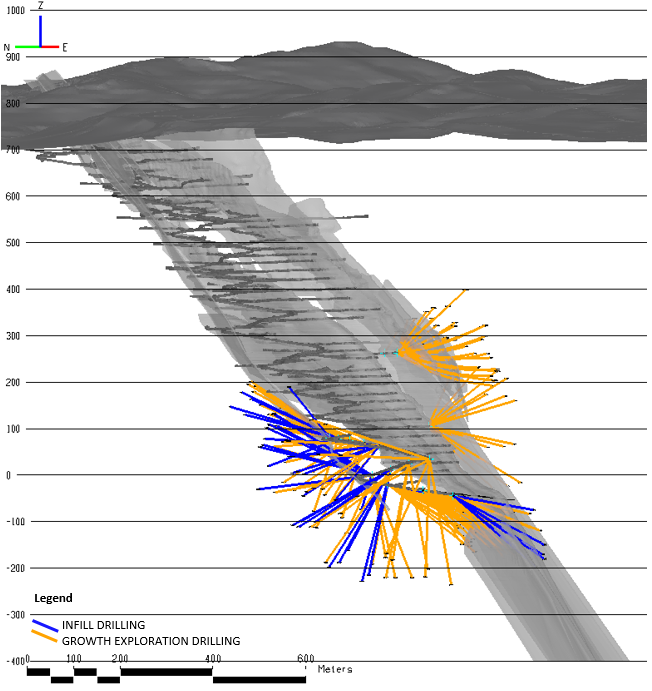

Contractor, Major Drilling, have mobilized an underground diamond rig dedicated to growth exploration at Pilar through 2020. This drilling (18,600 metres) will focus on further delineation of depth and lateral extensions to the currently exploited and known mineralized BIF packages (BF, BF2, BF3 and BA orebodies) as well as the more recently identified SW, Sao Jorge and Torre mineralization packages (see Press Release dated June 4, 2019). The location of targeted 2020 infill and growth exploration drilling (9,000 metres) is presented in Figure 3.

Vern Baker CEO, Jaguar Mining commented: "The positive infill drilling results reported today from Pilar follow the equally positive results recently reported for the Turmalina Mine (see press release dated January 28, 2020). Resumption of growth exploration is a key part of our plan to build long-term, sustainable mines with growth upside for increasing our resource base. Our Infill drilling activities are expected to continue replacing depleted reserves. Exploration drilling at Pilar will target extending our consistent production zones, which are centred on our BIF orebodies, as well as developing new resources in areas higher up in the mine. Sustaining our four-year reserve inventory continues to provide the foundation of our sustained production. I look forward to more positive results from this next phase of growth drilling at Pilar.

Jon Hill, Expert Advisor, Geology and Exploration, Jaguar Mining Management Committee commented: "this new phase of growth exploration drilling will continue to leverage our geological knowledge gathered from previous underground structural mapping, development and infill drilling completed in 2018 and 2019. The current drilling program will target further delineation and evaluation of the Pilar Mineralized Zones laterally from the existing mine infrastructure as well as down plunge extensions located below current mining levels. This strategy will target additional productivity via increased ounces per vertical metre and increase life of mine via depth extensions to mineralized zones."

Figure 1. 2019 Infill Drilling Results Pilar Mine - Intercepts with greater than 25 gram metres.

Table 1. 2019 Infill Drilling Results Pilar Mine - Intercepts with greater than 25 gram metres.

Summary of Significant Intersections, Drilling Program | |||||||

Hole ID | From | To | Down Hole Interval (m) | Estimated True Width (m) | Gold Grade (g/t Au) | GT | Date (mm/dd/yyyy) |

Orebody BA | |||||||

PPL621 | 16.38 | 23.42 | 7.04 | 6.75 | 4.61 | 31.12 | 9/23/2019 |

PPL622 | 11.00 | 21.24 | 10.24 | 9.30 | 4.53 | 42.13 | 9/30/2019 |

PPL624 | 20.00 | 32.00 | 12.00 | 10.00 | 6.16 | 61.60 | 12/6/2019 |

Orebodies BF, BF2 and BF3 | |||||||

FSB745 | 0.00 | 11.60 | 11.60 | 11.30 | 4.11 | 46.44 | 6/3/2019 |

PPL547 | 178.65 | 186.90 | 8.25 | 7.70 | 7.65 | 58.91 | 6/3/2019 |

PPL551 | 198.15 | 204.20 | 6.05 | 5.20 | 6.25 | 32.50 | 7/1/2019 |

FSB810 | 0.00 | 6.70 | 6.70 | 3.33 | 9.74 | 32.43 | 12/6/2019 |

FSB847 | 18.80 | 29.40 | 10.60 | 6.50 | 7.11 | 46.22 | 1/3/2020 |

PPL583 | 17.60 | 21.80 | 4.20 | 3.88 | 9.88 | 38.33 | 1/4/2020 |

PPL553 | 159.00 | 219.00 | 60.00 | 9.56 | 5.39 | 51.53 | 8/9/2019 |

PPL604 | 164.00 | 181.00 | 17.00 | 3.50 | 15.97 | 55.90 | 6/3/2019 |

FSB700 | 12.60 | 18.85 | 6.25 | 6.17 | 8.38 | 51.70 | 6/3/2019 |

FSB724 | 0.00 | 13.60 | 13.60 | 5.59 | 4.68 | 26.16 | 6/3/2019 |

FSB742 | 2.85 | 12.50 | 9.65 | 8.99 | 3.10 | 27.87 | 6/27/2019 |

FSB763 | 0.00 | 11.50 | 11.50 | 9.65 | 3.32 | 32.04 | 6/27/2019 |

PPL550 | 162.45 | 186.25 | 23.80 | 4.50 | 7.75 | 34.88 | 6/27/2019 |

PPL551 | 162.15 | 194.15 | 32.00 | 4.60 | 8.61 | 39.61 | 7/1/2019 |

PPL606 | 145.50 | 158.80 | 13.30 | 12.80 | 1.95 | 24.96 | 7/1/2019 |

PPL606 | 176.05 | 181.40 | 5.35 | 5.25 | 6.85 | 35.96 | 8/28/2019 |

PPL613 | 58.00 | 73.00 | 15.00 | 14.65 | 1.99 | 29.15 | 8/28/2019 |

FSB807 | 0.00 | 10.08 | 10.08 | 9.80 | 10.64 | 104.27 | 12/6/2019 |

FSB808 | 1.95 | 13.40 | 11.45 | 8.25 | 4.27 | 35.23 | 12/6/2019 |

PPL604 | 87.80 | 120.10 | 32.30 | 5.31 | 6.26 | 33.24 | 6/3/2019 |

PPL602 | 69.40 | 76.00 | 6.60 | 6.20 | 6.96 | 43.15 | 6/3/2019 |

PPL616A | 36.00 | 48.90 | 12.90 | 12.30 | 3.00 | 36.90 | 8/28/2019 |

PPL558 | 137.00 | 142.00 | 5.00 | 4.50 | 7.70 | 34.65 | 11/4/2019 |

Orebody LPA | |||||||

PPL547 | 201.90 | 206.45 | 4.55 | 4.30 | 9.13 | 39.26 | 6/3/2019 |

PPL552 | 195.00 | 206.00 | 11.00 | 10.57 | 4.18 | 44.18 | 9/30/2019 |

FSB848 | 0.00 | 2.30 | 2.30 | 1.90 | 23.93 | 45.47 | 1/3/2020 |

Orebody SW | |||||||

FSB766 | 19.45 | 29.40 | 9.95 | 9.30 | 4.36 | 40.55 | 6/27/2019 |

Figure 2. Pilar Mine - Schematic Plan showing the relative geological setting and location of Pilar Orebodies BA, BF, BFII, BFIII, Torre, SW and Sao Jorge.

Figure 3. Location of planned 2020 Infill and Growth Exploration Drilling at Pilar Mine.

Table 2. Meterage of 2020 Infill and Growth Exploration Drilling Pilar Mine.

Qualified Person

Scientific and technical information contained in this press release has been reviewed and approved by Jonathan Victor Hill, BSc (Hons) (Economic Geology - UCT), FAUSIMM, Senior Expert Advisor Geology and Exploration to the Jaguar Mining Management Committee, who is also an employee of Jaguar Mining Inc., and is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Quality Control

Jaguar continues to use a quality-control program that includes insertion of blanks and commercial standards in order to ensure best practice in sampling and analysis.

HQ, NQ, and BQ size drill core is sawn in half with a diamond saw. Samples are selected for analysis in standard intervals according to geological characteristics such as lithology and hydrothermal alteration. All diamond drill hole collars are accurately surveyed using a Total Station instrument and down-hole deviations are surveyed using a non-magnetic north seeking Reflex GyroTM

Mean grades are calculated using a variable lower grade cut-off (generally 0.5g/t Au). No upper gold grade cut has been applied to the data. However, the requirement for assay top cutting will be assessed during future resource work.

Half of the sawed sample is forwarded to the analytical laboratory for analysis while the remaining half of the core is stored in a secure location. The drill core samples from growth exploration drillholes are transported in securely sealed bags and sent for physical preparation to the independent ALS Brazil (subsidiary of ALS Global) laboratory located in Vespasiano, Minas Gerais, Brazil.The analysis is conducted at ALS Global's respective facilities (fire assay are conducted by ALS Global in Lima, Peru, and multi-elementary analysis are conducted by ALS Global in Vancouver, Canada). ALS has accreditation in a global management system that meets all requirements of international standards ISO/IEC 17025:2005 and ISO 9001:2015. All major ALS geochemistry analytical laboratories are accredited to ISO/IEC 17025:2005 for specific analytical procedures.

The infill drilling results presented on this news release are from drill holes completed by both Major Drilling on contract and Jaguar Mining Inc's own drilling machines. The infill samples are transported for physical preparation and analysis in securely sealed bags to the Jaguar in-house laboratory located at the Roça Grande Mine, Caeté, Minas Gerais.

For a complete description of Jaguar's sample preparation, analytical methods and QA/QC procedures, please refer to the "Technical Report on the Roça Grande and Pilar Operations, Minas Gerais State, Brazil", a copy of which is available on the Company's SEDAR profile at www.sedar.com.

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar holds the second largest gold land position of a gold producer in the Iron Quadrangle with just over 25,000 hectares.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims covering an area of approximately 64,000 hectares. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the Turmalina Gold Mine Complex and Caeté Mining Complex (Pilar and Roça Grande Mines, and Caeté Plant). The Company also owns the Paciência Gold Mine Complex, which has been on care and maintenance since 2012. The Roça Grande Mine has been on temporary care and maintenance since April 2018. Additional information is available on the Company's website at www.jaguarmining.com.

For further information, please contact:

Vern Baker

Chief Executive Officer

Jaguar Mining Inc.

vbaker@jaguarmining.com

+55 (31) 3232-7101

Hashim Ahmed

Chief Financial Officer

Jaguar Mining Inc.

hashim.ahmed@jaguarmining.com

416-847-1854

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information set forth in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected", "is forecast", "is targeted," "approximately," "plans," "anticipates," "projects," "continue," "estimate," "believe," or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. These forward-looking statements are made as of the date of this news release and the dates of technical reports, as applicable. This news release contains forward-looking information regarding potential and, among other things, expected future mineral resources, potential mineral production opportunities, geological and mineral exploration statistics, ore grades, current and expected future assay results, and definition/delineation/exploration drilling at the Pilar Gold Mine and the Turmalina Gold Mine in Brazil, as well as forward-looking information regarding costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, capital requirements, project studies, mine life extensions, and continuous improvement initiatives. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the estimated timeline and for the development of the drill program at the Pilar Gold Mine (and its expanded exploration footprint) and the Turmalina Gold Mine; its mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; and political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting its plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labor disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including without limitation environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Appendix 1

2019 Infill Drilling Results Pilar Mine.

Summary of Significant Intersections, Drilling Program | |||||||

Hole ID | From | To | Down Hole Interval (m) | Estimated True Width (m) | Gold Grade (g/t Au) | GT | Date (mm/dd/yyyy) |

Orebody BA | |||||||

PPL621 | 6.02 | 8.60 | 2.58 | 2.40 | 2.89 | 6.94 | 9/23/2019 |

PPL621 | 16.38 | 23.42 | 7.04 | 6.75 | 4.61 | 31.12 | 9/23/2019 |

PPL622 | 11.00 | 21.24 | 10.24 | 9.30 | 4.53 | 42.13 | 9/30/2019 |

PPL623 | 16.00 | 19.55 | 3.55 | 3.40 | 7.15 | 24.31 | 11/4/2019 |

PPL623 | 21.47 | 26.95 | 5.48 | 2.63 | 2.85 | 7.50 | 11/4/2019 |

PPL624 | 20.00 | 32.00 | 12.00 | 10.00 | 6.16 | 61.60 | 12/6/2019 |

Including | 20.00 | 24.23 | 4.23 | 3.53 | 13.48 | 47.51 | 12/6/2019 |

PPL583 | 54.40 | 58.90 | 4.50 | 2.70 | 6.66 | 17.98 | 1/4/2020 |

Orebodies BF, BFII and BFIII | |||||||

FSB740 | 3.50 | 5.85 | 2.35 | 1.33 | 3.58 | 4.76 | 6/3/2019 |

FSB740 | 14.25 | 16.25 | 2.00 | 1.06 | 1.21 | 1.28 | 6/3/2019 |

FSB741 | 0.95 | 3.70 | 2.75 | 1.54 | 1.31 | 2.02 | 6/3/2019 |

FSB745 | 0.00 | 11.60 | 11.60 | 11.30 | 4.11 | 46.44 | 6/3/2019 |

FSB756 | 11.90 | 16.10 | 4.20 | 4.00 | 1.85 | 7.40 | 6/3/2019 |

FSB789 | 7.85 | 11.15 | 3.30 | 3.30 | 1.05 | 3.47 | 7/1/2019 |

PPL547 | 178.65 | 186.90 | 8.25 | 7.70 | 7.65 | 58.91 | 6/3/2019 |

PPL547 | 222.80 | 226.00 | 3.20 | 3.04 | 7.14 | 21.71 | 6/3/2019 |

PPL549 | 192.00 | 195.00 | 3.00 | 2.77 | 2.87 | 7.95 | 7/23/2019 |

PPL550 | 187.00 | 204.35 | 17.35 | 4.60 | 4.22 | 19.41 | 6/27/2019 |

PPL551 | 198.15 | 204.20 | 6.05 | 5.20 | 6.25 | 32.50 | 7/1/2019 |

PPL552 | 172.00 | 193.00 | 21.00 | 5.45 | 3.83 | 20.87 | 9/30/2019 |

PPL552 | 212.00 | 217.50 | 5.50 | 5.10 | 2.79 | 14.23 | 9/30/2019 |

PPL554 | 187.65 | 204.68 | 17.03 | 3.50 | 4.34 | 15.19 | 9/23/2019 |

PPL554 | 221.82 | 229.60 | 7.78 | 7.60 | 3.10 | 23.56 | 9/23/2019 |

FSB697A | 0.00 | 6.60 | 6.60 | 3.87 | 1.13 | 4.37 | 11/4/2019 |

FSB759 | 2.10 | 6.55 | 4.45 | 3.00 | 6.16 | 18.48 | 11/4/2019 |

FSB748 | 6.80 | 13.80 | 7.00 | 2.00 | 1.83 | 3.66 | 11/4/2019 |

FSB697 | 0.00 | 5.70 | 5.70 | 3.40 | 1.99 | 6.77 | 11/4/2019 |

FSB739 | 0.00 | 7.55 | 7.55 | 1.90 | 8.11 | 15.41 | 11/4/2019 |

PPL557 | 186.00 | 193.00 | 7.00 | 1.10 | 2.35 | 2.59 | 12/6/2019 |

PPL557 | 217.00 | 238.00 | 21.00 | 3.78 | 2.88 | 10.89 | 12/6/2019 |

FSB810 | 0.00 | 6.70 | 6.70 | 3.33 | 9.74 | 32.43 | 12/6/2019 |

FSB810 | 9.45 | 13.70 | 4.25 | 2.16 | 4.02 | 8.68 | 12/6/2019 |

FSB810 | 19.70 | 39.10 | 19.40 | 9.64 | 1.59 | 15.33 | 12/6/2019 |

FSB778 | 1.00 | 5.30 | 4.30 | 3.80 | 3.11 | 11.82 | 1/2/2020 |

FSB803 | 0.00 | 6.80 | 6.80 | 4.55 | 3.53 | 16.06 | 1/2/2020 |

PPL556 | 197.30 | 198.50 | 1.20 | 0.45 | 7.38 | 3.32 | 1/2/2020 |

PPL556 | 237.40 | 242.45 | 5.05 | 1.72 | 4.71 | 8.10 | 1/2/2020 |

FSB847 | 8.30 | 16.80 | 8.50 | 3.25 | 3.65 | 11.86 | 1/3/2020 |

FSB847 | 18.80 | 29.40 | 10.60 | 6.50 | 7.11 | 46.22 | 1/3/2020 |

Including | 25.30 | 29.40 | 4.10 | 2.51 | 10.20 | 25.65 | 1/3/2020 |

FSB848 | 15.85 | 26.50 | 10.65 | 3.97 | 3.26 | 12.94 | 1/3/2020 |

PPL593 | 15.00 | 16.70 | 1.70 | 1.45 | 4.79 | 6.95 | 1/3/2020 |

PPL583 | 0.00 | 9.00 | 9.00 | 8.44 | 1.42 | 11.98 | 1/4/2020 |

PPL583 | 17.60 | 21.80 | 4.20 | 3.88 | 9.88 | 38.33 | 1/4/2020 |

PPL594 | 16.60 | 20.10 | 3.50 | 3.00 | 2.65 | 7.95 | 1/4/2020 |

PPL594 | 28.90 | 31.80 | 2.90 | 2.48 | 1.92 | 4.76 | 1/4/2020 |

PPL650 | 206.60 | 212.00 | 5.40 | 1.45 | 2.40 | 3.48 | 1/2/2020 |

PPL553 | 159.00 | 219.00 | 60.00 | 9.56 | 5.39 | 51.53 | 8/28/2019 |

PPL604 | 164.00 | 181.00 | 17.00 | 3.50 | 15.97 | 55.90 | 6/3/2019 |

FSB700 | 1.45 | 4.00 | 2.55 | 2.50 | 2.04 | 5.10 | 6/3/2019 |

FSB700 | 12.60 | 18.85 | 6.25 | 6.17 | 8.38 | 51.70 | 6/3/2019 |

FSB703 | 17.75 | 20.05 | 2.30 | 2.20 | 5.96 | 13.11 | 6/27/2019 |

FSB724 | 0.00 | 13.60 | 13.60 | 5.59 | 4.68 | 26.16 | 6/3/2019 |

FSB724 | 27.70 | 34.00 | 6.30 | 2.72 | 2.06 | 5.60 | 6/3/2019 |

FSB725 | 0.00 | 7.25 | 7.25 | 2.58 | 2.18 | 5.62 | 6/3/2019 |

FSB742 | 2.85 | 6.40 | 3.55 | 3.20 | 2.78 | 8.90 | 6/27/2019 |

FSB742 | 2.85 | 12.50 | 9.65 | 8.99 | 3.10 | 27.87 | 6/27/2019 |

FSB750 | 1.10 | 9.20 | 8.10 | 7.99 | 1.69 | 13.50 | 6/3/2019 |

FSB750 | 12.70 | 14.90 | 2.20 | 2.15 | 2.31 | 4.97 | 6/3/2019 |

FSB751 | 7.60 | 12.50 | 4.90 | 3.22 | 6.29 | 20.25 | 6/3/2019 |

FSB752 | 1.65 | 5.95 | 4.30 | 2.59 | 2.95 | 7.64 | 6/3/2019 |

FSB752 | 20.80 | 24.20 | 3.40 | 1.98 | 8.64 | 17.11 | 6/3/2019 |

FSB754 | 0.00 | 4.40 | 4.40 | 4.20 | 2.46 | 10.33 | 6/27/2019 |

FSB755 | 0.95 | 4.40 | 3.45 | 3.38 | 1.83 | 6.19 | 6/27/2019 |

FSB763 | 0.00 | 11.50 | 11.50 | 9.65 | 3.32 | 32.04 | 6/27/2019 |

FSB765 | 0.00 | 5.40 | 5.40 | 2.17 | 1.36 | 2.95 | 6/3/2019 |

FSB765 | 16.55 | 21.80 | 5.25 | 2.80 | 1.71 | 4.79 | 6/3/2019 |

PPL547 | 135.70 | 147.75 | 12.05 | 11.25 | 1.06 | 11.93 | 6/3/2019 |

PPL549 | 117.00 | 119.00 | 2.00 | 1.83 | 2.02 | 3.70 | 6/27/2019 |

PPL549 | 147.35 | 152.00 | 4.65 | 4.15 | 1.74 | 7.22 | 6/27/2019 |

PPL549 | 164.00 | 190.00 | 26.00 | 3.00 | 6.78 | 20.34 | 7/23/2019 |

PPL550 | 162.45 | 186.25 | 23.80 | 4.50 | 7.75 | 34.88 | 6/27/2019 |

PPL551 | 111.08 | 118.00 | 6.92 | 6.00 | 1.42 | 8.52 | 7/1/2019 |

PPL551 | 162.15 | 194.15 | 32.00 | 4.60 | 8.61 | 39.61 | 7/1/2019 |

PPL553 | 135.07 | 139.53 | 4.46 | 4.20 | 3.53 | 14.83 | 8/28/2019 |

PPL553 | 145.44 | 154.00 | 8.56 | 8.00 | 1.14 | 9.12 | 8/28/2019 |

PPL554 | 173.65 | 184.10 | 10.45 | 3.16 | 4.14 | 13.08 | 9/23/2019 |

PPL602 | 119.40 | 123.45 | 4.05 | 3.89 | 1.76 | 6.85 | 6/3/2019 |

PPL604 | 151.08 | 153.00 | 1.92 | 1.80 | 3.06 | 5.51 | 6/3/2019 |

PPL606 | 102.50 | 124.90 | 22.40 | 3.50 | 2.80 | 9.80 | 7/1/2019 |

PPL606 | 145.50 | 158.80 | 13.30 | 12.80 | 1.95 | 24.96 | 7/1/2019 |

PPL606 | 176.05 | 181.40 | 5.35 | 5.25 | 6.85 | 35.96 | 8/28/2019 |

PPL612 | 63.10 | 67.00 | 3.90 | 3.75 | 1.10 | 4.13 | 8/1/2019 |

PPL612 | 86.45 | 88.00 | 1.55 | 1.50 | 1.74 | 2.61 | 8/1/2019 |

PPL613 | 58.00 | 73.00 | 15.00 | 14.65 | 1.99 | 29.15 | 8/28/2019 |

PPL614 | 64.00 | 67.00 | 3.00 | 2.90 | 1.23 | 3.57 | 6/27/2019 |

PPL615 | 87.20 | 91.10 | 3.90 | 3.79 | 4.87 | 18.46 | 7/1/2019 |

PPL555 | 128.45 | 145.05 | 16.60 | 2.68 | 7.99 | 21.41 | 11/4/2019 |

FSB697A | 11.10 | 17.10 | 6.00 | 3.55 | 5.11 | 18.14 | 11/4/2019 |

FSB729 | 22.10 | 30.00 | 7.90 | 2.50 | 8.62 | 21.55 | 11/4/2019 |

FSB772 | 15.10 | 19.10 | 4.00 | 1.82 | 1.89 | 3.44 | 11/4/2019 |

FSB775 | 10.30 | 13.25 | 2.95 | 1.24 | 5.17 | 6.41 | 11/4/2019 |

FSB776 | 0.00 | 7.10 | 7.10 | 1.20 | 3.97 | 4.76 | 11/4/2019 |

PPL555A | 131.40 | 142.82 | 11.42 | 3.65 | 2.46 | 8.98 | 11/4/2019 |

PPL555A | 149.00 | 158.14 | 9.14 | 2.60 | 3.07 | 7.98 | 11/4/2019 |

PPL555A | 162.82 | 186.00 | 23.18 | 3.90 | 1.90 | 7.41 | 11/4/2019 |

PPL555A | 192.00 | 198.00 | 6.00 | 2.02 | 2.36 | 4.77 | 11/4/2019 |

PPL555A | 200.00 | 211.00 | 11.00 | 3.78 | 5.56 | 21.02 | 11/4/2019 |

FSB800 | 4.70 | 8.00 | 3.30 | 1.20 | 7.22 | 8.66 | 12/6/2019 |

FSB800 | 14.45 | 21.30 | 6.85 | 1.90 | 8.47 | 16.09 | 12/6/2019 |

FSB807 | 0.00 | 10.08 | 10.08 | 9.80 | 10.64 | 104.27 | 12/6/2019 |

Including | 4.00 | 8.23 | 4.23 | 4.11 | 19.98 | 82.18 | 12/6/2019 |

FSB808 | 1.95 | 13.40 | 11.45 | 8.25 | 4.27 | 35.23 | 12/6/2019 |

Including | 8.80 | 12.40 | 3.60 | 2.59 | 8.94 | 23.20 | 12/6/2019 |

FSB809 | 4.80 | 8.80 | 4.00 | 1.57 | 1.10 | 1.73 | 12/6/2019 |

FSB809 | 13.40 | 16.40 | 3.00 | 1.02 | 2.18 | 2.22 | 12/6/2019 |

FSB809 | 22.35 | 28.35 | 6.00 | 2.04 | 10.28 | 20.97 | 12/6/2019 |

FSB809 | 37.35 | 42.80 | 5.45 | 1.90 | 1.66 | 3.15 | 12/6/2019 |

FSB811 | 0.00 | 4.63 | 4.63 | 3.29 | 3.75 | 12.34 | 12/6/2019 |

PPL604 | 87.80 | 120.10 | 32.30 | 5.31 | 6.26 | 33.24 | 6/3/2019 |

FSB711 | 5.75 | 8.35 | 2.60 | 2.55 | 6.96 | 17.75 | 6/3/2019 |

PPL527 | 141.25 | 143.75 | 2.50 | 2.33 | 1.16 | 2.70 | 6/3/2019 |

PPL602 | 69.40 | 76.00 | 6.60 | 6.20 | 6.96 | 43.15 | 6/3/2019 |

PPL602 | 84.00 | 87.00 | 3.00 | 2.90 | 3.99 | 11.57 | 6/3/2019 |

PPL614 | 44.80 | 62.40 | 17.60 | 4.50 | 4.62 | 20.79 | 6/27/2019 |

PPL615 | 42.07 | 46.00 | 3.93 | 3.70 | 3.81 | 14.10 | 7/1/2019 |

PPL616A | 36.00 | 48.90 | 12.90 | 12.30 | 3.00 | 36.90 | 8/28/2019 |

PPL617 | 47.15 | 49.00 | 1.85 | 1.75 | 2.27 | 3.97 | 9/30/2019 |

FSB729 | 2.75 | 5.40 | 2.65 | 2.40 | 7.76 | 18.62 | 11/4/2019 |

PPL558 | 137.00 | 142.00 | 5.00 | 4.50 | 7.70 | 34.65 | 11/4/2019 |

PPL558 | 145.10 | 148.00 | 2.90 | 2.60 | 6.60 | 17.16 | 11/4/2019 |

FSB801 | 10.20 | 13.20 | 3.00 | 2.50 | 4.75 | 11.88 | 12/6/2019 |

FSB801 | 14.20 | 19.95 | 5.75 | 3.15 | 4.68 | 14.74 | 12/6/2019 |

FSB802 | 0.00 | 12.10 | 12.10 | 2.15 | 3.70 | 7.96 | 12/6/2019 |

PPL650 | 22.00 | 24.00 | 2.00 | 1.71 | 13.68 | 23.39 | 1/2/2020 |

PPL618 | 44.00 | 49.00 | 5.00 | 4.45 | 3.89 | 17.31 | 11/4/2019 |

FSB773 | 5.15 | 7.73 | 2.58 | 0.66 | 2.55 | 1.68 | 11/4/2019 |

FSB773 | 16.75 | 22.75 | 6.00 | 1.16 | 1.55 | 1.80 | 11/4/2019 |

PPL619 | 42.00 | 49.00 | 7.00 | 6.45 | 2.16 | 13.93 | 12/6/2019 |

PPL547 | 111.65 | 113.55 | 1.90 | 1.80 | 1.96 | 3.53 | 6/3/2019 |

PPL547 | 124.75 | 127.05 | 2.30 | 2.23 | 2.43 | 5.42 | 6/3/2019 |

Orebody LPA | |||||||

PPL549 | 197.35 | 201.50 | 4.15 | 3.73 | 1.06 | 3.95 | 7/23/2019 |

PPL547 | 201.90 | 206.45 | 4.55 | 4.30 | 9.13 | 39.26 | 6/3/2019 |

PPL549 | 205.50 | 215.00 | 9.50 | 8.50 | 1.49 | 12.67 | 7/23/2019 |

PPL552 | 195.00 | 206.00 | 11.00 | 10.57 | 4.18 | 44.18 | 9/30/2019 |

PPL554 | 207.85 | 212.42 | 4.57 | 4.50 | 1.38 | 6.21 | 9/23/2019 |

FSB847 | 0.00 | 2.20 | 2.20 | 1.55 | 13.76 | 21.33 | 1/3/2020 |

FSB848 | 0.00 | 2.30 | 2.30 | 1.90 | 23.93 | 45.47 | 1/3/2020 |

PPL593 | 6.31 | 10.90 | 4.59 | 3.95 | 3.88 | 15.33 | 1/3/2020 |

Orebody LFW | |||||||

FSB782 | 5.65 | 8.45 | 2.80 | 1.93 | 1.62 | 3.13 | 6/3/2019 |

PPL604 | 43.00 | 46.00 | 3.00 | 2.88 | 1.75 | 5.04 | 6/3/2019 |

PPL604 | 65.00 | 73.00 | 8.00 | 7.69 | 1.21 | 9.30 | 6/3/2019 |

PPL614 | 18.15 | 21.00 | 2.85 | 2.80 | 5.13 | 14.36 | 6/27/2019 |

PPL558 | 66.00 | 74.00 | 8.00 | 7.20 | 1.98 | 14.26 | 11/4/2019 |

PPL619 | 13.00 | 15.00 | 2.00 | 1.85 | 10.34 | 19.13 | 12/6/2019 |

FSB813 | 30.75 | 34.60 | 3.85 | 2.39 | 1.40 | 3.35 | 1/2/2020 |

Orebody SW | |||||||

FSB766 | 19.45 | 29.40 | 9.95 | 9.30 | 4.36 | 40.55 | 6/27/2019 |

FSB769 | 1.00 | 4.00 | 3.00 | 2.20 | 2.03 | 4.47 | 6/27/2019 |

FSB769 | 10.00 | 14.00 | 4.00 | 3.06 | 0.84 | 2.57 | 6/27/2019 |

FSB770 | 0.70 | 1.65 | 0.95 | 0.90 | 1.60 | 1.44 | 7/1/2019 |

FSB771 | 8.05 | 12.00 | 3.95 | 3.80 | 3.31 | 12.58 | 6/3/2019 |

FSB774 | 0.00 | 3.05 | 3.05 | 1.70 | 2.80 | 4.76 | 6/3/2019 |

FSB774A | 0.00 | 3.65 | 3.65 | 1.48 | 4.54 | 6.72 | 6/3/2019 |

FSB774A | 6.20 | 11.00 | 4.80 | 1.73 | 5.84 | 10.10 | 6/3/2019 |

FSB785 | 2.20 | 8.40 | 6.20 | 2.38 | 2.53 | 6.02 | 6/27/2019 |

FSB787 | 41.05 | 44.45 | 3.40 | 3.30 | 3.15 | 10.40 | 6/27/2019 |

FSB812 | 4.90 | 7.90 | 3.00 | 2.40 | 4.88 | 11.71 | 1/2/2020 |

FSB812 | 21.00 | 24.90 | 3.90 | 3.05 | 2.65 | 8.08 | 1/2/2020 |

Orebody TORRE | |||||||

PPL621 | 61.30 | 66.92 | 5.62 | 5.35 | 2.55 | 13.64 | 9/23/2019 |

PPL622 | 77.00 | 91.95 | 14.95 | 3.50 | 5.22 | 18.27 | 9/30/2019 |

PPL583 | 114.15 | 117.95 | 3.80 | 3.50 | 4.76 | 16.66 | 1/4/2020 |

NO IMPACT | |||||||

FSB696 | No significant impacts | 6/3/2019 | |||||

FSB737 | No significant impacts | 8/28/2019 | |||||

FSB738 | No significant impacts | 8/28/2019 | |||||

FSB753 | No significant impacts | 6/27/2019 | |||||

FSB784 | No significant impacts | 6/3/2019 | |||||

FSB784A | No significant impacts | 6/3/2019 | |||||

FSB786 | No significant impacts | 7/1/2019 | |||||

FSB788 | No significant impacts | 6/27/2019 | |||||

FSB790 | No significant impacts | 7/1/2019 | |||||

FSB791 | No significant impacts | 7/1/2019 | |||||

PPL620 | No significant impacts | 9/23/2019 | |||||

FSB744 | No significant impacts | 11/4/2019 | |||||

FSB730 | No significant impacts | 11/4/2019 | |||||

FSB743 | No significant impacts | 11/4/2019 | |||||

PPL620A | No significant impacts | 12/6/2019 | |||||

PPL532 | No significant impacts | 1/2/2020 | |||||

FSB815 | No significant impacts | 1/3/2020 | |||||

Appendix 2

Drill Hole location data for holes reported in this Press-Release - Pilar Mine.

Hole ID | Easting (m) | Northing (m) | Elevation (m) | Total Depth (m) | Collar Azimuth (°) | Collar Dip (°) | Orebody | Drilling Company |

FSB696 | 662718.62 | 7788570.17 | 60.20 | 35.25 | 329.82 | -0.76 | BF | Jaguar |

FSB700 | 662712.26 | 7788549.49 | 60.01 | 25.15 | 94.66 | 2.32 | BFII | Jaguar |

FSB703 | 662717.56 | 7788550.62 | 81.23 | 20.05 | 88.82 | -1.23 | BF | Jaguar |

FSB711 | 662699.03 | 7788529.53 | 59.74 | 12.05 | 274.60 | 0.24 | BFIII | Jaguar |

FSB724 | 662703.51 | 7788488.92 | 102.05 | 34.85 | 158.09 | -27.67 | BFII | Jaguar |

FSB725 | 662697.67 | 7788479.37 | 101.48 | 26.20 | 169.01 | -35.11 | BFII | Jaguar |

FSB740 | 662777.15 | 7788451.90 | 84.81 | 25.30 | 0.41 | -0.92 | BF | Jaguar |

FSB741 | 662762.81 | 7788450.70 | 84.22 | 25.20 | 180.00 | 0.57 | BF | Jaguar |

FSB742 | 662762.05 | 7788456.76 | 84.16 | 20.45 | 358.49 | 0.00 | BFII | Jaguar |

FSB745 | 662734.61 | 7788490.41 | 82.51 | 20.85 | 270.81 | -1.08 | BF | Jaguar |

FSB750 | 662715.22 | 7788595.26 | 82.11 | 35.05 | 271.31 | 0.75 | BFII | Jaguar |

FSB751 | 662715.91 | 7788596.61 | 82.12 | 30.50 | 328.67 | 3.59 | BFII | Jaguar |

FSB752 | 662717.91 | 7788597.25 | 82.15 | 41.25 | 18.28 | -1.00 | BFII | Jaguar |

FSB753 | 662720.47 | 7788567.22 | 81.26 | 8.45 | 315.00 | 1.16 | BFII | Jaguar |

FSB754 | 662713.81 | 7788552.62 | 81.19 | 5.00 | 319.40 | 0.00 | BFII | Jaguar |

FSB755 | 662705.01 | 7788540.18 | 81.05 | 5.25 | 319.89 | 1.43 | BFII | Jaguar |

FSB756 | 662717.42 | 7788589.07 | 81.68 | 26.25 | 129.89 | 0.38 | BF | Jaguar |

FSB763 | 662711.00 | 7788482.15 | 24.48 | 28.60 | 88.37 | 1.77 | BFII | Jaguar |

FSB765 | 662721.54 | 7788567.50 | 80.65 | 30.00 | 327.73 | -29.98 | BFII | Jaguar |

FSB766 | 662624.13 | 7788534.13 | -13.79 | 87.50 | 271.81 | -2.32 | SW | Jaguar |

FSB769 | 662624.51 | 7788550.01 | -11.23 | 57.75 | 269.48 | 0.65 | SW | Jaguar |

FSB770 | 662628.22 | 7788566.06 | -9.03 | 63.55 | 301.04 | -1.49 | SW | Jaguar |

FSB771 | 662633.27 | 7788564.09 | -8.87 | 15.55 | 98.73 | -0.04 | SW | Jaguar |

FSB774 | 662645.54 | 7788573.59 | -6.06 | 3.05 | 178.18 | 0.91 | SW | Jaguar |

FSB774A | 662645.31 | 7788573.59 | -6.17 | 14.25 | 178.11 | -4.00 | SW | Jaguar |

FSB782 | 662658.17 | 7788569.11 | -3.95 | 16.60 | 52.59 | -44.46 | LFW | Jaguar |

FSB784 | 662658.87 | 7788565.59 | -3.68 | 8.10 | 199.65 | -45.73 | SW | Jaguar |

FSB784A | 662660.33 | 7788571.86 | -4.25 | 15.50 | 187.84 | -44.04 | SW | Jaguar |

FSB785 | 662656.15 | 7788568.94 | -3.57 | 20.15 | 354.29 | -44.86 | SW | Jaguar |

FSB786 | 662621.82 | 7788472.76 | -22.81 | 92.20 | 268.34 | 1.28 | SW | Jaguar |

FSB787 | 662623.59 | 7788515.86 | -16.43 | 46.70 | 269.74 | -0.43 | SW | Jaguar |

FSB788 | 662622.89 | 7788495.35 | -19.58 | 5.30 | 270.80 | -3.18 | SW | Jaguar |

FSB789 | 662709.42 | 7788545.36 | 196.14 | 32.15 | 89.15 | -0.14 | BF | Jaguar |

FSB790 | 662709.04 | 7788546.36 | 196.28 | 26.55 | 59.94 | 1.29 | BF | Jaguar |

FSB791 | 662708.71 | 7788546.97 | 196.23 | 32.35 | 34.48 | 0.10 | BF | Jaguar |

PPL527 | 662602.63 | 7788350.52 | 32.24 | 257.75 | 64.30 | -27.47 | BFIII? | Jaguar |

PPL547 | 662602.67 | 7788350.50 | 33.04 | 241.20 | 65.24 | -3.68 | BF - BFII- LPA | Jaguar |

PPL549 | 662602.67 | 7788350.32 | 32.87 | 260.50 | 66.74 | -10.71 | BF - BFII- LPA | Jaguar |

PPL550 | 662602.67 | 7788350.35 | 32.89 | 242.65 | 66.84 | -6.99 | BF - BFII | Jaguar |

PPL551 | 662602.61 | 7788350.10 | 32.73 | 234.95 | 67.33 | -9.47 | BF - BFII | Jaguar |

PPL552 | 662602.65 | 7788349.90 | 32.94 | 230.55 | 72.00 | -7.84 | BF - LPA | Jaguar |

PPL553 | 662602.61 | 7788349.70 | 32.73 | 245.05 | 76.43 | -20.29 | BF - BFII | Jaguar |

PPL602 | 662606.29 | 7788407.71 | 24.41 | 215.15 | 72.20 | -21.20 | BFII- BFIII | Jaguar |

PPL604 | 662607.66 | 7788407.41 | 24.50 | 215.45 | 78.00 | -8.84 | BF - BFII - BFIII | Jaguar |

PPL606 | 662607.67 | 7788407.29 | 24.36 | 222.30 | 79.90 | -13.45 | BFII | Jaguar |

PPL612 | 662658.21 | 7788490.27 | 10.73 | 161.45 | 73.24 | -2.42 | BFII | Jaguar |

PPL613 | 662658.23 | 7788489.73 | 10.75 | 172.50 | 88.59 | -2.02 | BFII | Jaguar |

PPL614 | 662658.19 | 7788489.23 | 10.77 | 173.10 | 105.42 | -1.41 | BFII - BFIII | Jaguar |

PPL615 | 662658.06 | 7788489.73 | 10.38 | 186.85 | 90.20 | -18.58 | BFII - BFIII | Jaguar |

PPL616A | 662658.18 | 7788490.12 | 10.49 | 192.95 | 75.67 | -14.29 | BFIII | Jaguar |

PPL617 | 662657.96 | 7788490.16 | 9.74 | 181.15 | 79.94 | -22.68 | BFIII | Jaguar |

PPL622 | 662754.50 | 7788541.44 | 263.64 | 200.20 | 117.00 | -2.52 | BA - TORRE | Jaguar |

PPL555 | 662602.60 | 7788350.03 | 32.74 | 146.55 | 71.08 | -18.24 | BFII | Jaguar |

FSB697A | 662740.50 | 7788479.56 | 102.89 | 20.10 | 183.57 | -46.47 | BFII - BFIII | Jaguar |

FSB729 | 662692.73 | 7788502.03 | 45.43 | 46.55 | 60.29 | -2.39 | BFII - BFIII | Jaguar |

FSB744 | 662625.74 | 7788429.70 | -28.28 | 15.80 | 89.62 | -1.76 | - | Jaguar |

FSB759 | 662757.54 | 7788466.58 | 103.70 | 20.15 | 180.58 | -39.04 | BF | Jaguar |

FSB748 | 662767.82 | 7788482.41 | 104.43 | 44.00 | 124.50 | 1.65 | BF | Jaguar |

FSB730 | 662692.62 | 7788502.28 | 45.44 | 51.10 | 58.77 | -1.46 | BFIII | Jaguar |

FSB743 | 662626.68 | 7788444.79 | -25.98 | 15.70 | 90.13 | -0.72 | - | Jaguar |

PPL618 | 662657.73 | 7788489.46 | 9.78 | 181.10 | 93.35 | -25.03 | BFIII? | Jaguar |

FSB697 | 662740.51 | 7788479.55 | 102.87 | 18.45 | 184.13 | -46.31 | BF | Jaguar |

FSB739 | 662746.24 | 7788473.78 | 104.30 | 25.95 | 159.36 | 0.80 | BF | Jaguar |

PPL558 | 662602.64 | 7788350.45 | 32.56 | 174.15 | 61.23 | -19.75 | BFIII - LFW | Jaguar |

FSB772 | 662709.15 | 7788431.59 | 45.13 | 26.10 | 206.48 | 0.02 | BFII | Jaguar |

FSB773 | 662704.82 | 7788431.75 | 44.81 | 26.15 | 229.66 | -1.71 | BFIII? | Jaguar |

FSB775 | 662724.71 | 7788434.46 | 45.66 | 30.95 | 179.75 | -1.72 | BFII | Jaguar |

FSB776 | 662740.17 | 7788440.86 | 46.02 | 30.90 | 177.33 | -0.69 | BFII | Jaguar |

PPL623 | 662754.52 | 7788541.04 | 263.58 | 155.05 | 125.67 | -3.85 | BA | Jaguar |

PPL555A | 662602.49 | 7788349.92 | 32.82 | 253.30 | 71.08 | -18.24 | BFII | Jaguar |

PPL557 | 662602.42 | 7788349.45 | 32.73 | 246.50 | 81.87 | -17.47 | BF | Jaguar |

PPL619 | 662657.89 | 7788490.39 | 9.75 | 215.10 | 71.68 | -19.53 | BFIII - LFW | Jaguar |

PPL620A | 662608.15 | 7788406.69 | 24.33 | 99.05 | 79.13 | -13.40 | BFIII | Jaguar |

PPL624 | 662754.52 | 7788540.92 | 263.30 | 176.15 | 127.93 | -14.00 | BA | Jaguar |

FSB800 | 662704.69 | 7788460.19 | 44.74 | 30.70 | 89.43 | -0.20 | BFIII | Jaguar |

FSB801 | 662700.16 | 7788460.50 | 44.76 | 30.05 | 278.88 | 0.68 | BFIII | Jaguar |

FSB802 | 662693.01 | 7788476.47 | 45.14 | 36.65 | 270.54 | -1.24 | BFIII | Jaguar |

FSB807 | 662681.79 | 7788505.22 | 102.52 | 30.30 | 214.44 | 30.11 | BFII | Jaguar |

FSB808 | 662700.15 | 7788500.13 | 103.61 | 31.95 | 202.72 | 30.99 | BFII | Jaguar |

FSB809 | 662700.92 | 7788499.69 | 102.26 | 48.30 | 169.18 | -17.97 | BFII | Jaguar |

FSB810 | 662719.45 | 7788487.60 | 102.44 | 40.95 | 149.88 | -17.53 | BF | Jaguar |

FSB811 | 662713.86 | 7788493.11 | 104.13 | 25.75 | 148.32 | 34.55 | BFII | Jaguar |

FSB778 | 662769.64 | 7788426.50 | 47.41 | 25.40 | 179.25 | -0.50 | BF | Jaguar |

FSB803 | 662772.38 | 7788425.90 | 47.41 | 33.70 | 180.84 | -1.79 | BF | Jaguar |

PPL532 | 662852.65 | 7788513.69 | 289.16 | 132.80 | 271.76 | 23.40 | TORRE | Jaguar |

PPL556 | 662602.48 | 7788349.33 | 32.71 | 248.45 | 84.59 | -20.21 | BF | Jaguar |

FSB812 | 662635.47 | 7788814.31 | 216.13 | 45.90 | 343.26 | 10.08 | SW | Jaguar |

FSB813 | 662635.67 | 7788813.45 | 216.01 | 60.35 | 186.61 | 10.80 | LFW? | Jaguar |

PPL650 | 662657.74 | 7788488.86 | 9.81 | 250.55 | 106.52 | -24.62 | BF - BFIII | Jaguar |

FSB815 | 662746.66 | 7788568.80 | 26.43 | 30.60 | 90.67 | -0.71 | BFII | Jaguar |

FSB847 | 662784.17 | 7788444.20 | 47.21 | 50.00 | 182.77 | -19.02 | LPA - BF | Jaguar |

FSB848 | 662783.24 | 7788444.62 | 47.13 | 26.50 | 210.14 | -20.46 | LPA - BF | Jaguar |

PPL593 | 662767.53 | 7788470.69 | 103.72 | 254.45 | 95.20 | -31.83 | LPA - BF | Major |

PPL583 | 662767.78 | 7788470.65 | 105.53 | 200.70 | 95.79 | 19.48 | BF - Torre | Major |

PPL594 | 662767.28 | 7788470.23 | 103.68 | 251.90 | 107.79 | -30.66 | BF | Major |

SOURCE: Jaguar Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/576071/Jaguar-Intercepts-High-Grade-Gold-Mineralization-at-Pilar-Gold-Mine-Resumes-Growth-Exploration-Drilling-at-Pilar