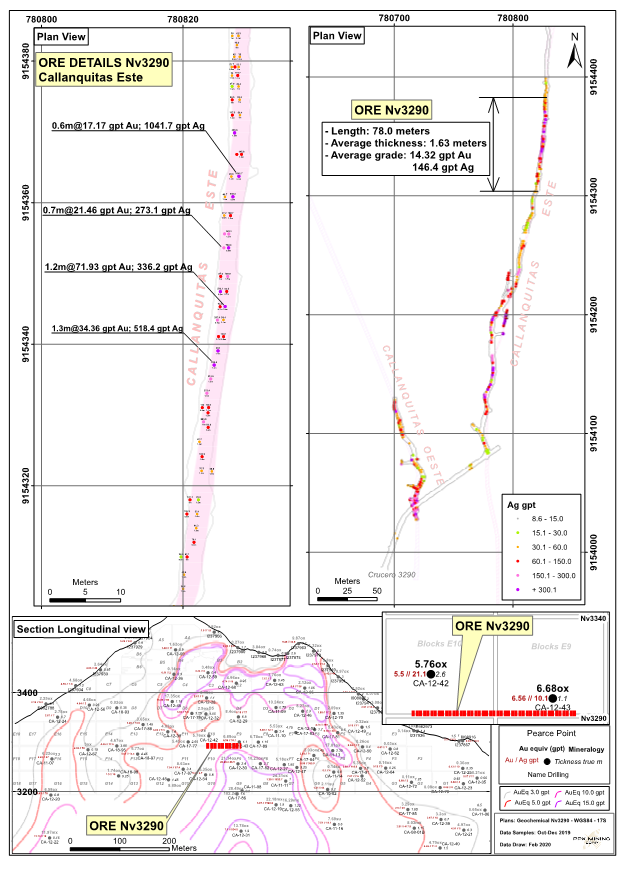

VANCOUVER, BC / ACCESSWIRE / February 25, 2020 / PPX Mining Corp. (the "Company" or "PPX") is pleased to announce that development work on the 3290 level of Mina Callanquitas has cut a high-grade ore shoot within the previously defined reserves for Mina Callanquitas (please see press release dated December 4, 2018 and Pre-Feasibility Study posted on SEDAR), an area of the mine where surface exploration drilling produced only modest results. Systematic underground channel sampling, part of the Company's normal ore control protocol, outlined a high-grade ore shoot over a strike length of 78 metres with a true width of 1.6 metres. The average grade over this area, based on 62 channel samples, is 14.32 gpt Au and 146 gpt Ag. Individual samples contained up 71.93 gpt Au and 1042 gpt Ag as described in more detail below. Higher than anticipated grades and good ore continuity highlight the significance of this discovery:

- The two diamond core drill holes nearest the 3290 level ore shoot contained 5.50 and 6.56 gpt Au (CA-12-42 and -43, please see diagram below and on the Company's website). In contrast, the 62 channel samples ranged from 2.12 to 71.93 gpt gold yielding a weighted average true thickness of 1.6 metres grading 14.32 gpt gold over a strike length of 78 metres. The results for Ag are more striking, the drill holes contained 21.1 and 10.1 gpt Ag, while the channel samples ranged from 27.9 to 1042 gpt Ag. Precious metal mineralization in this portion of Mina Callanquitas is completely oxidized and it is possible that some of the silver oxide minerals were not adequately recovered or sampled in the core drilling process. As has been noted previously (please see PPX Press Release dated February 5, 2020), the Au grade of ore delivered to the Malin Plant of Silver Cascas S.A.C., has consistently been higher than the grades shown in the Company's reserve and resource model. The sampling also demonstrates good continuity within the ore shoot, an important characteristic in mine planning and exploitation.

- The 3290 level cuts the Callanquitas ore body in an area above a high-grade ore chute defined by previous diamond core drilling. Drill holes CA-11-08, -11, CA-12-19, -30, -31, -55, and CA-17-86 outline an area with a strike length in excess of 150 metres over a similar vertical range that grades between 13.78 and 102.0 gpt Au Eq (please see diagram below and on the Company's website). The 3290 level ore shoot is a vertical continuation of this ore chute and expands the vertical range of the ore shoot to a minimum of 200 metres. The down dip continuation of this zone is unconstrained by drilling.

- As shown in the longitudinal section below, other high-grade ore shoots have been identified by surface diamond drilling. The 3290 ore shoot confirms the earlier diamond drilling results and supports an exploration/development model that focuses on the drill defined areas of higher grade that could increase resource and reserve ounces.

Brian J. Maher, President and CEO of PPX Mining Corp commented: "The underground sampling results from the 3290 level provide verification of the tenor and volume of high-grade gold and silver ore shoots at Mina Callanquitas. The high grades, couple with elevated gold and silver prices, provide opportunities to optimize mine planning. The existing NI 43-101 Pre-Feasibility Study utilized a $1250 gold price and a life of mine average grade of only 4.66 gpt Au Eq, clearly current metal prices and confirmation of the high-grade ore shoots presents a significant economic opportunity for the Company."

Channel sampling protocols and QA/QC: PPX Mining geologists collect channel samples underground on each working face prior to advancing the excavation. Samples are collected orthogonal to the structure edge or boundary and do not exceed 2.0 metres in length. Channels are broken at obvious geologic boundaries to correctly separate rock types, mineralization styles and hydrothermal alteration assemblages. The samples are collected by cutting a channel approximately 2.5 cm deep by 25 cm wide along a line painted on the face by the mine geologist. Sample weight is typically 1.5 to 2.5 kg. Samples are sealed, labeled and stored in a secure area prior to shipment to a qualified assay laboratory. Gold and silver analyses are conducted by the fire assay method with a CN leach. Blanks and standards are inserted approximately every 15 samples; duplicate channel samples are included at the same intervals. Duplicate fire assays for approximately every 30 samples are sent to a second assay laboratory for umpire analysis

About PPX Mining Corp: PPX Mining Corp. (TSX.V: PPX.V, SSE: PPX, BVL: PPX) is a Canadian-based mining company with assets in northern Peru. Igor, the Company's 100%-owned flagship gold and silver project, is located in the prolific Northern Peru gold belt in eastern La Libertad Department. PPX is developing the Callanquitas Mine and heap leach facility to exploit high grade, underground-minable gold and silver ore. Based on the Company's Pre-Feasibility Study ("PFS"), PPX expects the Callanquitas Mine to produce up to 26,000 AuEq* ounces per year over a seven-year mine life at cash cost of less than US$610/AuEq* ounce (the Igor PFS is available on the Company's website and SEDAR). Simultaneously, PPX is accelerating its exploration program at Igor in order to fully evaluate the resource potential of the entire Igor project area. The Callanquitas structure is open along strike and at depth, parallel structures are unexplored. New discoveries at Portachuelos, coupled with the Domo and Tesoros exploration targets, emphasize that the Igor Project is evolving into a district-scale project with multiple deposits and mineralized zones.

*AuEq is calculated as follows: AuEq ounces = Au ounces + Ag ounces/75. Per PFS, inclusive of metallurgical recovery.

All scientific and technical information in this press release has been reviewed and approved by Quentin J. Browne, P.Geo., Independent Consulting Geologist to PPX Mining Corp., who is a qualified person under the definitions established by National Instrument 43-101.

On behalf of the Board of Directors

Brian J. Maher

President and Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

PPX Mining Corp.

Brian J. Maher, President and Chief Executive Officer

Phone: 1-530-913-4728

Email: brian.maher@ppxmining.com

Website: www.ppxmining.com

Cautionary Statement:

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Certain disclosure in this release, June constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and Canadian securities legislation. In making the forward-looking statements in this release, the Company has applied certain factors and assumptions that the Company believes are reasonable. However, the forward-looking statements in this release are subject to numerous risks, uncertainties and other factors that June cause future results to differ materially from those expressed or implied in such forward-looking statements. Such uncertainties and risks are detailed from time to time in the Company's filings with the appropriate securities commissions, and June include, among others, market conditions, and delays in obtaining or failure to obtain required regulatory approvals or financing. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: PPX Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/577683/PPX-Discovers-New-High-Grade-Ore-Shoot-at-Mina-Callanquitas-Samples-12m-Grading-7193-gpt-Au-336-gpt-Ag