DUBAI, UAE, April 19, 2020 /PRNewswire/ -- Hubpay is excited to announce its Seed funding round led by a leading US venture capital firm - Signal Peak Ventures. The investment raised will support the launch of Hubpay's digital wallet in the Middle East market. Managing Partner of Signal Peak Ventures, Brandon Tidwell, commented: "Hubpay represents Signal Peak's first investment in the Middle East. We recognise the enormous potential the market has and have great confidence in Hubpay's team to capitalise on this unique opportunity."

Additionally, a UAE angel investment group - the Falcon Network, is participating in Hubpay's Seed round. Falcon Network has backed a number of high impact businesses in the region.

Hubpay is in the advanced stages of the licensing process to receive a Money Services Licence in the United Arab Emirates market, enabling low cost digital remittances and international bill payment.

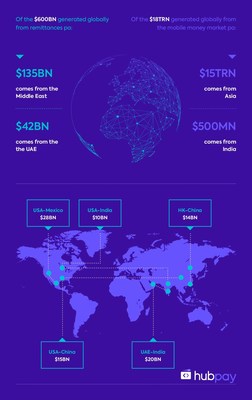

The UAE is the third largest market for remittances globally, with $44bn of payments made last year. The regional market is vast, with Gulf countries remittances exceeding those of the USA, and the majority of these flows going to the fastest growing mobile money markets in the world; India, Pakistan, Philippines, Bangladesh and Indonesia. The remittance channels provide a direct route to the $3trn digital wallet market across Asia.

Hubpay will address both the remittance market and the mobile money market by launching a digital wallet for both the senders and receivers.

As part of Hubpay's international strategy, Hubpay has been welcomed onto the Visa Fast Track program, enabling Hubpay to leverage Visa's payment infrastructure and further scale the business. Otto Williams, Vice President - Strategic Partnerships, Ventures and Fintechs, CEMEA at Visa said: "The Visa Fintech Fast Track program makes it easier for fintechs to partner with us and access the global Visa payments network. Channelling the payment capabilities, brand assets and expertise of Visa, with the ideas, passion and entrepreneurial spirit of fintechs, enables our continued growth. We look forward to working with Hubpay and connecting them and their solutions with our bank and merchant partners, so that innovative new commerce experiences can be delivered with scale and with pace."

Founder and CEO, Kevin Kilty, remarked: "The fintech market in the Middle East is at a turning point. A wave of new digital regulatory regimes has been launched enabling businesses like Hubpay to offer fully digital solutions to users in one of the largest remittance markets in the world. The UAE represents Hubpay's first market launch, as part of a wider strategy to offer the leading digital wallet for the remittance community across the Middle East and Asia. In a post Covid-19 world, the digitalisation of remittances will accelerate, creating better access and supporting financial inclusion for the international remittance community."

https://www.linkedin.com/company/hubpay/

Notes to Editors:

Signal Peak Ventures (https://www.spv.com/) are a leading US venture capital firm, based in Salt Lake City, investing in early-stage technology companies. The Signal Peak fund invests in exceptional teams that are attacking big problems in a unique way, with the potential to transform markets and create lasting value. The firm are currently closing their latest fund, a $200m cross-sector fund.

The Falcon Network (falconnetwork.org) is an angel investment network connecting impact-driven individual investors with gifted entrepreneurs. The network enables promising start-ups, which operate in high growth markets in the Middle East, Asia and Africa, to realise their potential by providing seed capital and strategic advice.

Visa Inc are a global payments technology company working to enable consumers, businesses, banks and governments to use digital currency. Visa Fast Track speeds up the process of integrating with Visa. This allows nimble start-ups the ability to leverage the reach, capabilities, and security of the Visa network. VisaNet, the company's global payment network, helps fintechs scale more quickly. Fast Track is one part of a broader Visa strategy to support fintechs' growth and development globally. In addition to Fast Track, Visa is consistently engaging with the fintech community through a variety of strategic initiatives and programs.

Remittance Data see Central Bank of the UAE: https://www.centralbank.ae/en

Photo - https://mma.prnewswire.com/media/1157081/Hubpay_Infographic.jpg

info@hubpay.ae