VANCOUVER, BC / ACCESSWIRE / May 4, 2020 / Mawson Resources Limited ("Mawson" or the "Company") (TSX:MAW)(Frankfurt:MXR)(PINKSHEETS:MWSNF) is pleased to provide its first update for its 100%-owned Sunday Creek shallow orogenic ("epizonal") gold project (previously known as "Clonbinane") in the central Victorian goldfields of Australia.

Scheduled Webinar Time: May 5, 2020 08:00 Eastern Time (US and Canada) The Company will host a webinar to discuss the Company's Australian projects. Those wishing to join can do by registering in advance for this webinar. https://us02web.zoom.us/webinar/register/WN_0TkZL9WdRCG8KJNal8k3pA After registering, you will receive a confirmation email containing information about joining the webinar. |

Key points:

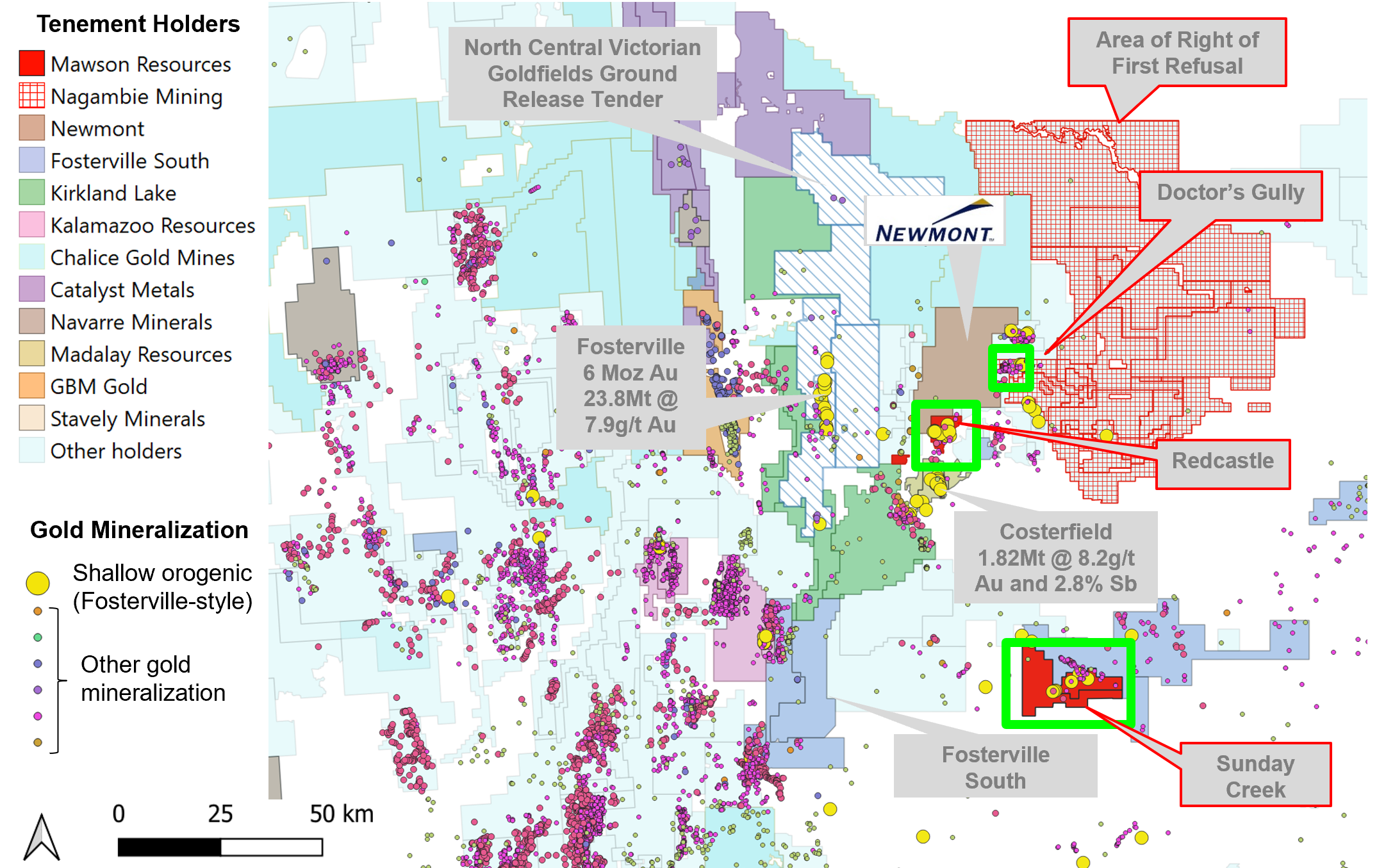

- In late March 2020 Mawson announced a comprehensive deal with Nagambie Resources Ltd to acquire or joint venture three Victorian epizonal projects and a right of first refusal over the largest contiguous tenement package prospective for epizonal-style gold in the State of Victoria (3,600 square kilometres; Figure 1);

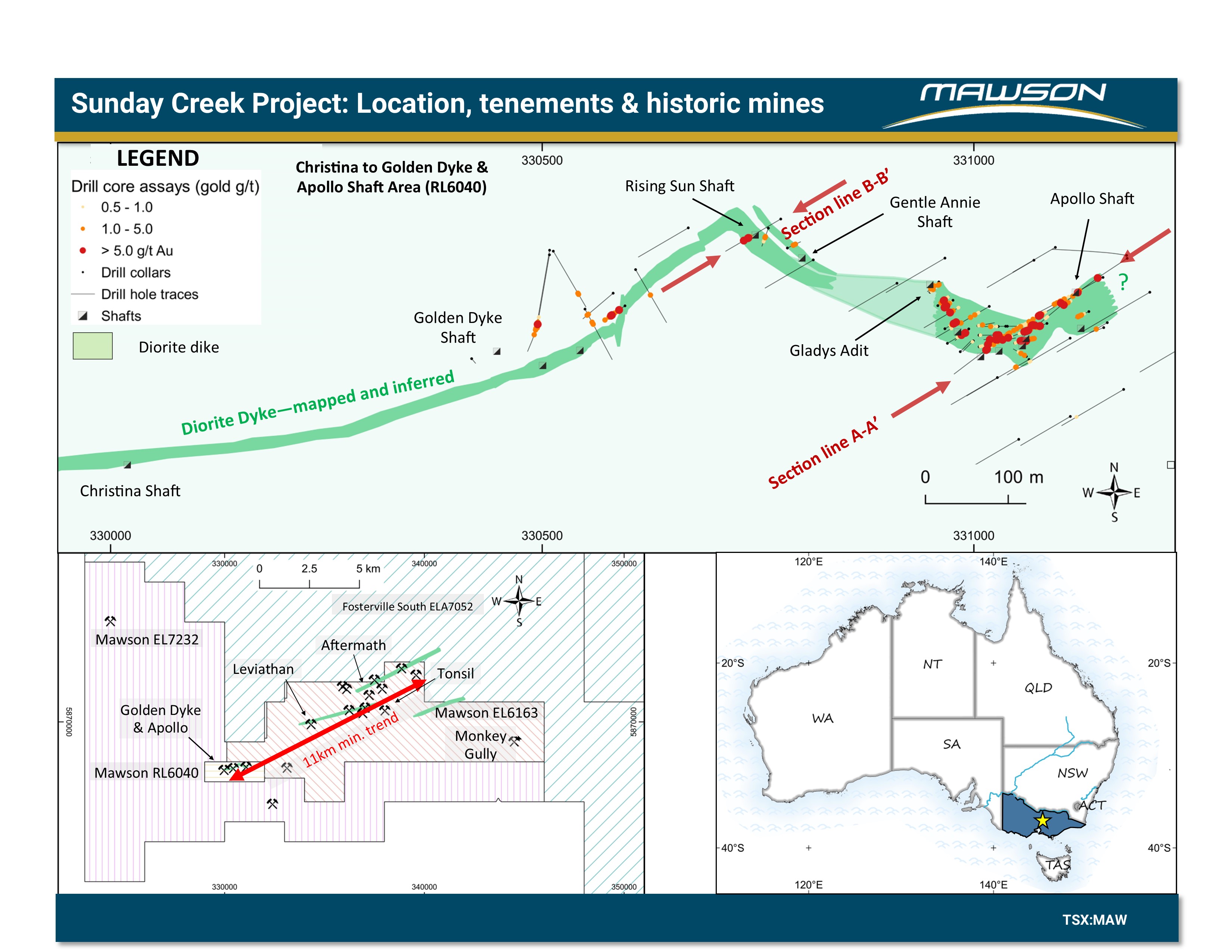

- Mawson has tripled its ground holding at Sunday Creek with the staking of exploration licence ("EL") 7232 application (13,243 hectares) for a total land holding of 19,365 hectares (Figure 2);

- Historic gold mines as Sunday Creek occur over a greater than 11 kilometre trend. Prior drilling has tested only 800 metres of this trend and to an average of 80 metres depth. Selected drill results include:

- CRC013: 21 metres @ 4.8 g/t gold from 9 metres including 2 metres @ 28.8 g/t gold from 15 metres (Figure 4), and;

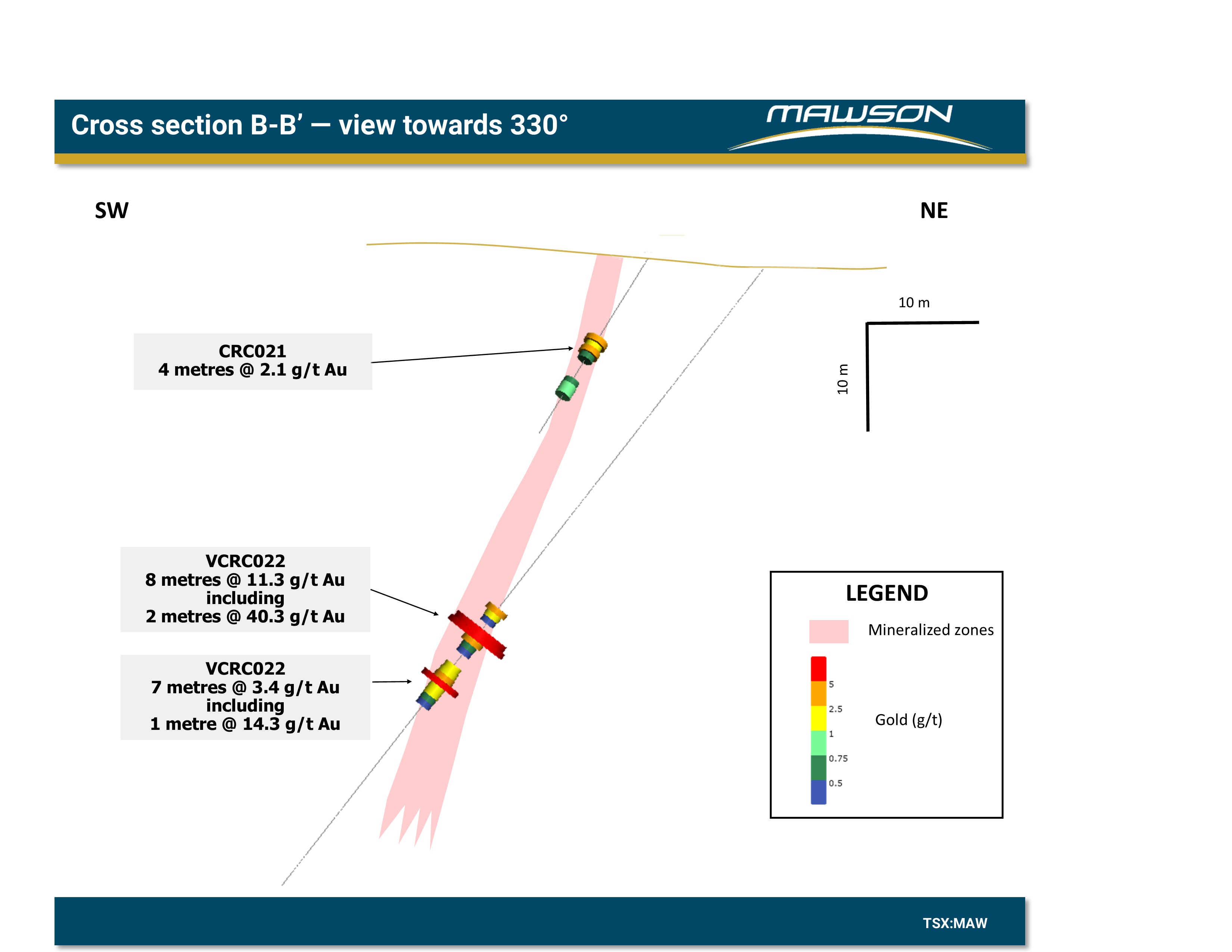

- VCRC022: 8 metres @ 11.3 g/t gold from 66 metres including 2 metres @ 40.3 g/t gold from 70 metres (Figure 5);

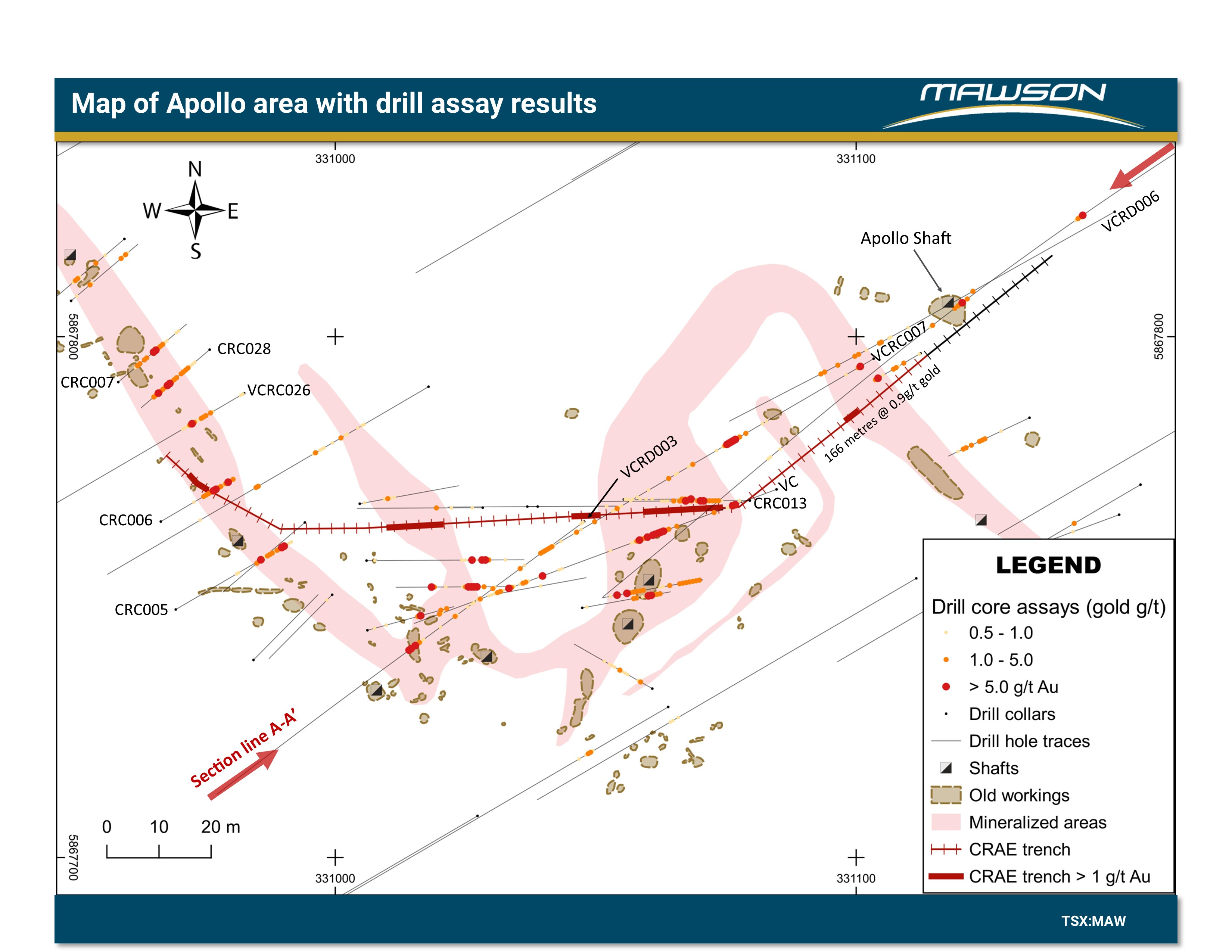

- Trenching has also revealed broad low-grade halos to higher grade mineralization with one surface trench returning 166 metres @ 0.9 g/t gold (Figure 3);

- Immediate plans at Sunday Creek are to apply tools to define vectors towards epizonal mineralization including geophysical surveys (microgravity, detailed ground magnetics and induced polarization) and alteration studies, followed by 5,000 metres of diamond drilling during Q3 and Q4 2020 to target high-grade and halo mineralization intersected by earlier drilling at Apollo-Golden Dyke and potential repeats of mineralization along the 11 kilometre historic mine trend.

Mr. Hudson, Chairman and CEO, states: "While we continue to drill with success in Finland, we are extremely excited to have also diversified into the Victorian goldfields in Australia, which are arguably the hottest gold ground in the world with the high-grade Fosterville mine rewriting the geological opportunity. Since acquiring our Victorian portfolio last month, we have moved to triple our ground holdings at Sunday Creek. Like Fosterville, Sunday Creek is an historic epizonal goldfield, mined during the 1800s to early 1900s and explored for near-surface oxide gold during the 1990s and early 2000s. Given the exploration success at Fosterville we now understand that epizonal systems can develop extremely high-grade zones. This has provided insight into a never-explored search space for high grades at depth in one of the most fertile gold regions in the world.

The Sunday Creek project is a significant historic high-grade epizonal gold mining area developed over multiple parallel zones over 11 kilometres of strike. While high-grade historic mines exist along these trends, limited systematic exploration has been undertaken within the 19,365 hectare project. Drilling over 800 metres of strike, down to a maximum average depth of 80 metres has taken place at the Golden Dyke-Apollo prospect area. Drill results demonstrate high grade gold with selected holes including 8 metres @ 11.3 g/t gold from 66 metres including 2 metres @ 40.3 g/t gold. Trenching has also revealed broad low-grade oxide gold with one trench returning 166 metres @ 0.9 g/t gold. Mawson has developed a good understanding of the project after the first month of data compilation since acquisition. The Company plans to undertake large-scale, deeper-seeking geophysical methods followed by diamond drilling during Q3 and Q4 2020 to target high-grade gold at depth and along strike."

Victoria has produced more than 80 million ounces of gold and has seen three booms: the 1850s, pre-World War I, and the last three years. Two different styles of gold mineralization predominate in Victoria. The deep orogenic ("mesozonal") style and the shallow orogenic "epizonal" style. The mesozonal style is represented by Bendigo and Ballarat, huge systems, which are nuggety and extremely difficult to put into modern resources calculations. Mawson are sharply focused on the epizonal (or Fosterville) style.

Mawson acquired the Sunday Creek project on March 25, 2020 with the acquisition of EL6163 (5,822 hectares) and RL 6040 (300 hectares). The recent application of EL7232 (13,243 hectares) has extended the total land holding at Sunday Creek to 19,365 hectares. The project is an epizonal Fosterville-style deposit located 56 kilometres north of Melbourne. Historically, the Golden Dyke Mine (Photo 1) at Sunday Creek was one of the larger producers of gold in the Melbourne Zone of Victoria. Total production from the Sunday Creek goldfield is reported as 20,000 ounces gold at a grade of 16.9 g/t gold between 1865 to 1920. Gold mineralization is hosted by breccia zones within, or proximal to dykes with mineralization continuing along structures that extend into the sedimentary country rock. The dykes form multiple undrilled parallel trends over more than 11 kilometres with historic epizonal gold-mines (Figure 2). At Golden Dyke, gold grades within quartz-stibnite veins ranged up to 120 g/t gold and 50% stibnite, while altered and stockworked diorite dyke averaged 6 g/t gold outside the high-grade veins. The epizonal Tonstal mine, located 8 kilometres north-east of the Golden Dyke mine extracted 2,814 tonnes at 23 g/t gold during the early 1900s, while the adjacent Tobin mine extracted 1.1 tonnes at 203 g/t gold in the late 1870s.

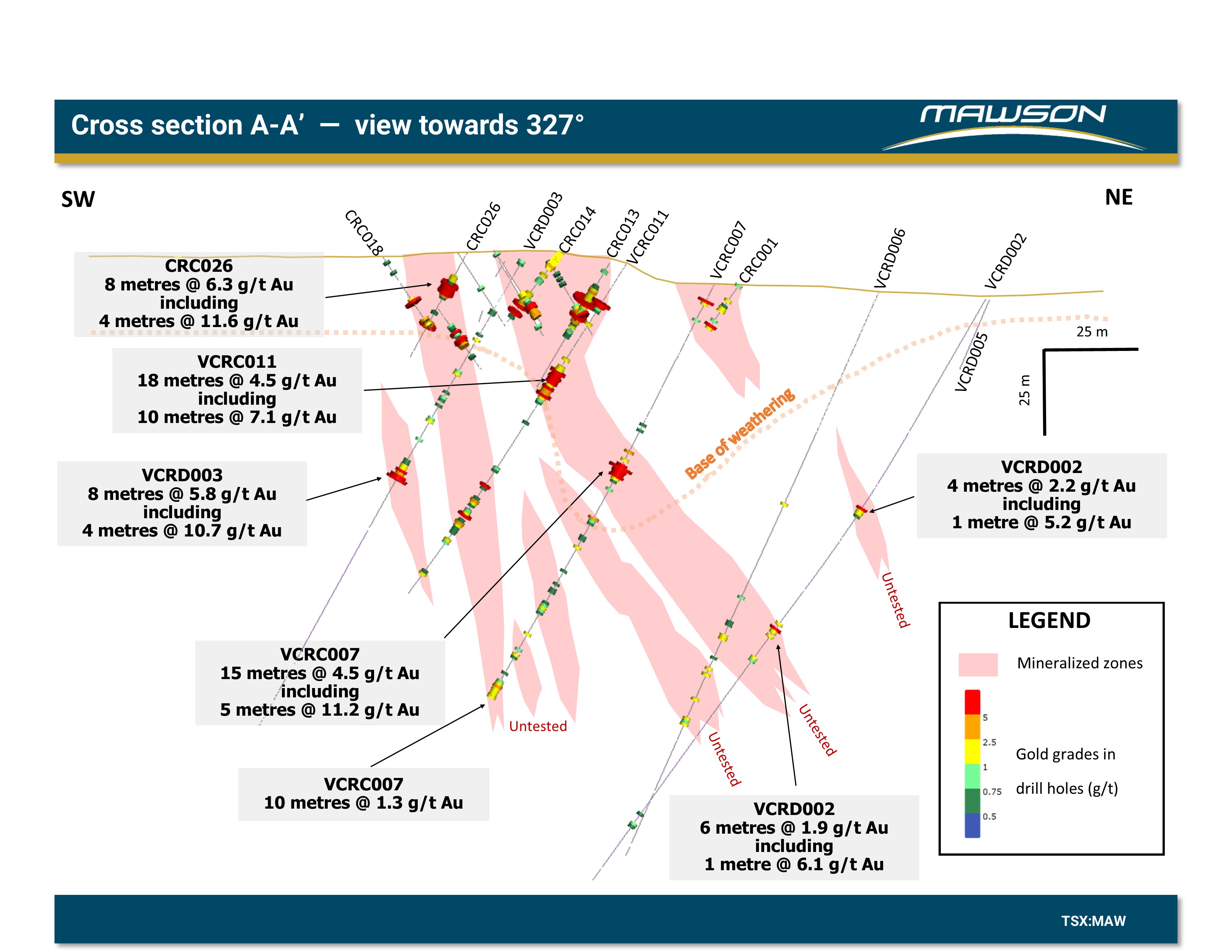

Trench sampling by CRA Exploration in the early 1980s at the Apollo prospect demonstrated extensive low-grade oxide gold over 166 metres at 0.9 g/t gold with results ranging from <0.04 g/t to 8.0 g/t gold, and including 30 metres @ 1.6 g/t gold. Two small drill campaigns tested the Golden Dyke-Apollo trend to 40-100 metres vertical depth over an 800 metre strike. In 1986, Ausminde Pty Ltd and Ausminde Holdings Pty Ltd (collectively "Ausminde") completed soil and rock chip sampling and undertook RC drilling in 1993 (29 RC drill holes). Beadell Resources Limited subsequently drilled at Golden Dyke-Apollo in 2008 (27 RC holes (4 with diamond drill tails) and 3 diamond drill holes). Drilling results from both these programs greater than 5 g/t gold are shown in Table 1. None of the drill or trench data has been independently verified at this time. Compilation of available data and 3D geologic modeling has progressed well since acquisition of the project in early March. The true thickness of the mineralized intervals is not known at this stage. Selected drill results with a 0.5 g/t and 5 g/t gold lower-cut from these two drill programs at Golden Dyke-Apollo included (Figures 3-5):

- CRC013: 21 metres @ 4.8 g/t gold from 9 metres including 2 metres @ 28.8 g/t gold from 15 metres

- VCRC022: 8 metres @ 11.3 g/t gold from 66 metres including 2 metres @ 40.3 g/t gold from 70 metres

- VCRC011: 18 metres @ 4.5 g/t gold from 37 metres including 10 metres @ 7.1 g/t gold from 42 metres

- VCRC007: 15 metres @ 4.5 g/t gold from 62 metres including 5 metres @ 11.2 g/t gold from 67 metres

- CRC020: 15 metres @ 4.1 g/t gold from 25 metres including 3 metres @ 15.4 g/t gold from 32 metres

The Company plans for 2020 are to commence geophysical surveys (micro-gravity, detailed ground magnetics and induced polarization) over the coming months, followed by 5,000 metres of diamond drilling during Q3 and Q4 2020 to target high-grade and adjacent mineralization intersected by earlier drilling at Apollo-Golden Dyke and potential repeats of mineralization along the 11 kilometre historic mine trend. The company also plans to undertake alteration studies on existing core and new drilling as prior work on epizonal gold deposits in Victoria has defined clear mineral and geochemical vectors towards mineralization.

The Sunday Creek Project has multiple historic mines that are open at depth and along strike. The project is a high value exploration project with affinity to the Fosterville Mine. Further information on work plans and prospectivity of the Company's two joint venture projects, Redcastle and Doctor's Gully will be made as further data compilation occurs over the coming months. Prior to starting work on any of the exploration concessions Mawson will undertake an effective and open community consultation with all stakeholders.

Qualified Person

Michael Hudson (FAusMM), Chairman and CEO for the Company, is a qualified person as defined by National Instrument 43-101 - Standards of Disclosure or Mineral Projects and has prepared or reviewed the preparation of the scientific and technical information in this press release.

None of the drill and trench data have been independently verified at this time. These historical data have not been verified by Mawson and are quoted for information purposes only. Drilling and trench information from Sunday Creek by CRA Exploration, Ausminde and Beadell Resources had a variety of assays and check assays reported in historical reports. It is reported that the primary analysis for gold was completed by fire assay with an atomic adsorption finish by NATA registered laboratories. XRF assays were used for antimony.

About Mawson Resources Limited (TSX:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Resources Limited is an exploration and development company. Mawson has distinguished itself as a leading Nordic Arctic exploration company with a focus on the flagship Rajapalot gold project in Finland. The Australian gold acquisition provides Mawson with a strategic and diversified portfolio of high-quality gold exploration assets in two safe jurisdictions.

On behalf of the Board, | Further Information |

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson's most recent Annual Information Form filed on www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Photo 1: The Golden Dyke Mine was one of the largest producers of gold in the Melbourne Zone. The photograph below is from the early 1900s.

From https://www.youtube.com/watch?v=V8hl_d7yIEk

Figure 1: Tenements of the Victorian goldfields, showing location of shallow orogenic (epizonal) Fosterville-style mineralization. Green outlines show the 100% purchase of Sunday Creek and the Redcastle and Doctor's Gully option and joint venture areas, while the hatched area represents the 3,600km2 where Mawson holds the right of first refusal.

Figure 2: Plan of the Sunday Creek project. The dyke and historic workings trend extend for 11 kilometres and remain undrilled WSW of the Golden Dyke shaft and NE of the Apollo shaft.

Figure 3: Drill plan of the Sunday Creek Project in the Apollo Shaft area. Drilling in two campaigns in 1994 and 2008 tested the system to 40-100 metres vertical depth. Gold mineralization is located within, or proximal to, the dykes with mineralization continuing along structures that extend into the sedimentary country rock with gradually diminishing grades.

Figure 4: Cross section A-A' (for location refer to Figure 3) from Sunday Creek (Apollo shaft area).

Figure 5: Cross section B-B' (for location refer to Figure 3) from Sunday Creek (Rising Sun shaft area).

Table 1: Sunday Creek Project: Significant results from drilling (>5 g/t gold lower cut).

Drill Hole | From (m) | To (m) | Interval (m) | Au (g/t) |

CRC001 | 16.0 | 17.0 | 1.0 | 6.6 |

CRC005 | 44.0 | 46.0 | 2.0 | 8.5 |

CRC006 | 21.0 | 23.0 | 2.0 | 9.7 |

CRC006 | 27.0 | 28.0 | 1.0 | 7.7 |

CRC007 | 15.0 | 17.0 | 2.0 | 12.9 |

CRC009 | 31.0 | 36.0 | 5.0 | 4.3 |

CRC012 | 22.0 | 23.0 | 1.0 | 10.6 |

CRC013 | 15.0 | 17.0 | 2.0 | 28.8 |

CRC013 | 21.0 | 22.0 | 1.0 | 16.8 |

CRC014 | 22.0 | 26.0 | 4.0 | 6.6 |

CRC016 | 22.0 | 24.0 | 2.0 | 6.6 |

CRC018 | 18.0 | 19.0 | 1.0 | 13.9 |

CRC020 | 14.0 | 15.0 | 1.0 | 5.9 |

CRC020 | 32.0 | 35.0 | 3.0 | 15.4 |

CRC023 | 21.0 | 23.0 | 2.0 | 6.9 |

CRC026 | 12.0 | 16.0 | 4.0 | 11.6 |

CRC026 | 28.0 | 29.0 | 1.0 | 13.8 |

CRC028 | 17.0 | 19.0 | 2.0 | 5.6 |

CRC028 | 22.0 | 23.0 | 1.0 | 14.2 |

VCRC007 | 6.0 | 7.0 | 1.0 | 10.9 |

VCRC007 | 67.0 | 72.0 | 5.0 | 11.2 |

VCRC011 | 15.0 | 17.0 | 2.0 | 12.4 |

VCRC011 | 42.0 | 52.0 | 10.0 | 7.1 |

VCRC011 | 102.0 | 103.0 | 1.0 | 5.2 |

VCRC022 | 70.0 | 72.0 | 2.0 | 40.3 |

VCRC022 | 80.0 | 81.0 | 1.0 | 14.3 |

VCRC026 | 22.0 | 23.0 | 1.0 | 5.9 |

VCRD002 | 80.0 | 81.0 | 1.0 | 5.2 |

VCRD002 | 129.0 | 130.0 | 1.0 | 6.1 |

VCRD003 | 80.0 | 84.0 | 4.0 | 10.7 |

VCRD004 | 160.0 | 161.0 | 1.0 | 14.3 |

SOURCE: Mawson Resources Limited

View source version on accesswire.com:

https://www.accesswire.com/588326/Mawson-Triples-Landholding-at-Sunday-Creek-and-Outlines-Exploration-Plans-for-Its-Victorian-Goldfields-Projects-in-Australia