VANCOUVER, BC / ACCESSWIRE / July 3, 2020 / Doubleview Gold Corp ("Doubleview"), (the "Company") (TSXV: DBG) announces recent developments with respect to estimations of metal values at its Hat Gold-Copper Project in northwestern British Columbia. The Company has reviewed all drill hole data, including that from holes completed in 2019, and in recognition of recent significant increases in the market price of gold, the company presents both gold equivalent (AuEq) and copper equivalent (CuEq) grade estimates. The Company has not undertaken metallurgical processing tests and has no information concerning possible recoveries that may result from mining operations. Porphyry type mines typically have recoveries of 85 to 90%.

Micon International Limited, mineral industry consultants, following an independent review of the Hat Project, confirms Doubleview's identification of the Lisle Zone as an alkalic copper-gold porphyry deposit with significantly elevated gold values. Copper and gold comprise approximately 85% of the total value of the deposit, with copper accounting for 45 to 52% of the value, and gold accounting for 32 to 41%. Although cobalt could contribute 13 to 15% to the value, it is not included in the following metal equivalent estimates due to unresolved issues about its recovery and payability. Similarly silver and palladium are not included.

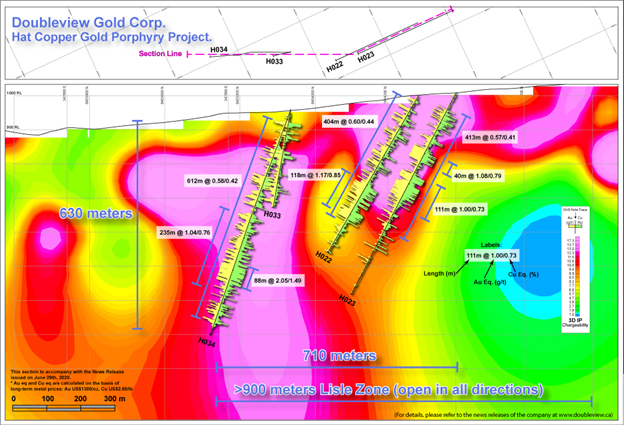

The Company notes that the Lisle Zone, of the Hat deposit, is not fully delineated in any direction but present drilled dimensions are approximately 920 metres north-south, 650 metres east-west and about 620 metres vertical. As previously announced and detailed below, the most recent hole, H034, that was directed to a high resolution 3D induced polarization and magnetic anomalous area in the southwest of the Zone, intersected 689 metres of strong disseminated sulphide mineralization. This is the strongest mineralization drilled on the property and presents a very compelling target for expansion that will be further explored when drilling resumes.

Mr. Farshad Shirvani, President and CEO, observes that "The strong results obtained from holes H031 and H034 demonstrate the ability of 3D IP and magnetic geophysical surveys to identify areas of high potential within a porphyry environment. Several large targets with coincident geological, geophysical and geochemical anomalies that are close to and may be extensions of the Lisle Zone have yet to be drill-tested. Doubleview has refined its geophysical and geological models and is planning its 2020 exploration program that will be announced once finalized. The 2020 exploration generally is targeting the deposit at greater depths, east and north of the Lisle deposit. Doubleview is working to open the Hat exploration Camp in middle of July."

The following is a tabulation of significant assay intercepts from drill holes at Lisle Zone of the Hat deposit.

Table 1: Significant Assay Results of The Lisle Zone (of the Hat deposit):

DDH | From | To | Length | Au | Cu | Co | CuEq* | AuEq* | |

H008 | 44.0 | 44.8 | 0.8 | 0.29 | 1.24 | 510 | 1.45 | 1.99 | |

H008 | 113.6 | 400.7 | 287.1 | 0.21 | 0.18 | 86 | 0.33 | 0.45 | |

H008 | Inc. | 141.8 | 151.5 | 9.8 | 0.65 | 0.34 | 56 | 0.82 | 1.12 |

H008 | And | 177.6 | 192.4 | 14.8 | 0.69 | 0.32 | 191 | 0.82 | 1.13 |

H008 | 244.5 | 400.7 | 156.2 | 0.18 | 0.20 | 80 | 0.33 | 0.45 | |

H009 | 8.2 | 70.4 | 62.2 | 0.66 | 0.29 | 107 | 0.77 | 1.06 | |

H009 | Inc. | 8.2 | 17.4 | 9.1 | 3.93 | 1.87 | 478 | 4.74 | 6.49 |

H011 | 15.0 | 407.1 | 392.1 | 0.20 | 0.24 | 92 | 0.38 | 0.52 | |

H011 | Inc. | 78.3 | 102.7 | 24.4 | 0.43 | 0.72 | 173 | 1.03 | 1.41 |

H011 | And | 263.1 | 293.8 | 30.7 | 0.45 | 0.55 | 116 | 0.88 | 1.20 |

H011 | And | 375.1 | 407.1 | 32.0 | 0.38 | 0.58 | 122 | 0.85 | 1.17 |

H012 | 151.0 | 434.0 | 283.0 | 0.21 | 0.18 | 89 | 0.33 | 0.46 | |

H012 | Inc. | 192.0 | 194.0 | 2.0 | 3.19 | 0.57 | 285 | 2.89 | 3.97 |

H012 | And | 272.0 | 315.0 | 43.0 | 0.67 | 0.41 | 117 | 0.90 | 1.23 |

H012 | And | 340.0 | 356.0 | 16.0 | 0.51 | 0.48 | 87 | 0.85 | 1.17 |

H016 | 252.0 | 335.6 | 83.6 | 0.31 | 0.31 | 94 | 0.53 | 0.73 | |

H016 | Inc. | 284.2 | 333.6 | 49.4 | 0.46 | 0.44 | 98 | 0.78 | 1.07 |

H016 | Inc. | 308.8 | 333.6 | 24.8 | 0.51 | 0.69 | 126 | 1.06 | 1.46 |

H017 | 221.0 | 442.4 | 221.4 | 0.24 | 0.28 | 92 | 0.45 | 0.62 | |

H017 | Inc. | 250.0 | 338.0 | 88.0 | 0.33 | 0.33 | 100 | 0.57 | 0.78 |

H017 | Or | 278.0 | 348.0 | 70.0 | 0.41 | 0.38 | 108 | 0.68 | 0.93 |

H017 | And | 306.6 | 348.0 | 41.4 | 0.53 | 0.46 | 134 | 0.84 | 1.16 |

H017 | And | 306.6 | 310.9 | 4.3 | 2.15 | 0.68 | 746 | 2.25 | 3.08 |

H018 | 94.5 | 314.0 | 219.5 | 0.20 | 0.17 | 68 | 0.31 | 0.43 | |

H018 | Inc. | 170.7 | 314.0 | 143.3 | 0.27 | 0.23 | 82 | 0.43 | 0.59 |

H018 | Inc. | 256.0 | 301.8 | 45.7 | 0.41 | 0.43 | 117 | 0.73 | 1.00 |

H022 | 43.4 | 447.6 | 404.2 | 0.25 | 0.25 | 90 | 0.44 | 0.60 | |

H022 | Inc. | 45.5 | 52.1 | 6.6 | 1.24 | 0.13 | 131 | 1.03 | 1.42 |

H022 | And | 116.4 | 419.0 | 302.6 | 0.28 | 0.30 | 101 | 0.50 | 0.68 |

H022 | Inc. | 302.9 | 461.5 | 158.6 | 0.32 | 0.44 | 108 | 0.67 | 0.92 |

H022 | Inc. | 302.9 | 421.3 | 118.4 | 0.41 | 0.55 | 132 | 0.85 | 1.17 |

H023 | 56.7 | 470.0 | 413.3 | 0.22 | 0.25 | 89 | 0.41 | 0.57 | |

H023 | Inc. | 186.3 | 226.7 | 40.4 | 0.61 | 0.35 | 131 | 0.79 | 1.08 |

H023 | And | 270.6 | 381.6 | 110.9 | 0.36 | 0.47 | 96 | 0.73 | 1.00 |

H023 | Inc. | 271.9 | 347.5 | 75.6 | 0.45 | 0.61 | 117 | 0.94 | 1.29 |

H023 | Inc. | 303.3 | 346.2 | 42.8 | 0.54 | 0.68 | 116 | 1.07 | 1.47 |

H026 | 10.6 | 27.8 | 17.2 | 0.46 | 0.45 | 89 | 0.79 | 1.08 | |

H026 | 189.8 | 522.0 | 332.2 | 0.16 | 0.22 | 66 | 0.34 | 0.47 | |

H026 | Inc. | 189.8 | 310.5 | 120.7 | 0.22 | 0.25 | 86 | 0.41 | 0.56 |

H027 | 7.6 | 417.3 | 409.8 | 0.20 | 0.20 | 68 | 0.34 | 0.47 | |

H027 | Inc. | 7.6 | 263.8 | 256.2 | 0.24 | 0.24 | 79 | 0.42 | 0.58 |

H027 | Inc. | 7.6 | 36.6 | 29.0 | 0.53 | 0.34 | 91 | 0.72 | 0.99 |

H027 | Inc. | 19.6 | 30.0 | 10.4 | 1.01 | 0.69 | 95 | 1.43 | 1.96 |

H027 | And | 162.4 | 369.1 | 206.7 | 0.28 | 0.28 | 67 | 0.48 | 0.66 |

H027 | Inc. | 175.0 | 263.8 | 88.8 | 0.46 | 0.47 | 84 | 0.81 | 1.11 |

H031 | 88.0 | 527.0 | 439.0 | 0.14 | 0.22 | 76 | 0.32 | 0.44 | |

H031 | Inc. | 240.8 | 244.1 | 3.3 | 1.26 | 0.74 | 305 | 1.66 | 2.28 |

H031 | Inc. | 420.0 | 476.3 | 56.3 | 0.35 | 0.52 | 112 | 0.77 | 1.06 |

H031 | Or | 423.0 | 522.1 | 99.1 | 0.23 | 0.44 | 81 | 0.60 | 0.83 |

H031 | Inc. | 442.0 | 476.3 | 34.3 | 0.39 | 0.48 | 79 | 0.76 | 1.04 |

H034 | 49.0 | 660.9 | 611.9 | 0.19 | 0.28 | 84 | 0.42 | 0.58 | |

H034 | Inc. | 49.0 | 50.0 | 1.0 | 1.08 | 0.82 | 249 | 1.61 | 2.20 |

H034 | Inc. | 326.4 | 643.1 | 316.7 | 0.28 | 0.42 | 88 | 0.62 | 0.86 |

H034 | Or | 326.4 | 561.4 | 235.0 | 0.34 | 0.51 | 105 | 0.76 | 1.04 |

H034 | Or | 399.3 | 672.9 | 273.6 | 0.29 | 0.45 | 88 | 0.67 | 0.92 |

H034 | Inc. | 452.2 | 540.2 | 88.0 | 0.68 | 1.00 | 170 | 1.49 | 2.05 |

H034 | Or | 476.5 | 540.2 | 63.7 | 0.86 | 1.26 | 200 | 1.88 | 2.58 |

H034 | Inc. | 534.5 | 538.2 | 3.6 | 3.44 | 6.61 | 640 | 9.12 | 12.51 |

* AuEq and CuEq are calculated on the basis of long-term metal prices: Au US$1300/oz, Cu US$2.60/lb

CuEq (%) = ([(%Cu) x (22.0462) x ($2.6) + (g/t/Au) x (1/31.1035) x ($1300)]) ÷ ((22.0462) x ($2.60))).

AuEq (g/t) = ([(%Cu) x (22.0462) x ($2.6) + (g/t/Au) x (1/31.1035) x ($1300)])/($1300 x1/31.1035)

- The calcution of AuEq and CuEq does not include Cobalt.

- No metallurgical recovery tests have been conducted: Gold and Copper assays are reported at 100% recovery and were directly converted from copper and gold assays.

Selected north-south section on the Lisle zone is presented below.

Figure 1 illustrates IP data and drill holes.

Drill Plans and sections of previous drill results are located on the Company's website at https://www.doubleview.ca/projects/hat-gold-rich-copper-porphyry/hat-drill-plan/

Mr. Shirvani also stated that the Company is actively planning and preparing for the resumption of exploration of the Hat property. Start-up is subject to compliance with Provincial Covid-19 guidelines and the Company's ability to ensure the health and safety of all persons on the remote site, including employees, contractors and observers, and the Company's ability to fund exploration by raising capital in the public market. He also recognizes that the current difficult times may allow aggressive companies such as Doubleview to acquire new opportunities through partnerships and other arrangements.

Cobalt:

The Lisle Zone mineralization includes small, but possibly important, amounts of cobalt that are not included in gold and copper equivalent estimations reported in this news release. Cobalt has many industrial applications including in heat resistant and magnetic alloys, electroplating, ceramics and medical and, increasingly, in rechargeable batteries that feature large in the emerging alternative energy and electric vehicle industries, consumption and market prices have increased dramatically in recent years.

Cobalt, on the basis of core analyses, may contribute about 13 to 15% to the total value of Lisle Zone mineralization but metallurgical and other recovery testing is required before it can be included in estimates of metal equivalent grades. If funds are available, the company will initiate metallurgical studies later this year.

Quality Assurance and Quality Control

Core samples were prepared using PRP-910 package of MSALABS Terrace facility. Each core is dried and is crushed to 70% passing 2mm. A 250g is taken using an Automatic Splitter from a Boyd Crusher or a Riffle Splitter to obtain a homogenized, representative sample. This sub-sample is then pulverized to 85% passing a 75-micron screen. All samples are analyzed for Au, Pt, Pd by 30g fire-assay fusion/ICP-ES finish, using FAS-114 package. A separate 0.25g pulp split is analyzed by Four Acid digestion/ICP-MS finish, reporting 48 elements using IMS-230. Over limit Cu, Pb, and Zn are analyzed by Four Acid digestion/ICPES finish using ICP-240/ICF-6xx assay package. All analytical and assay procedures are conducted at independent ISO 17025 and ISO 9001 certified laboratories.

Qualified Persons:

Erik Ostensoe, P. Geo., a consulting geologist and Doubleview's Qualified Person with respect to the Hat Project as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the technical contents of this news release. He is not independent of Doubleview as he is a shareholder of the company.

Thomas C. Stubens, M.A.Sc., P. Eng., senior geologist, with Micon International Ltd., has completed a preliminary independent review of the Hat Project and verified the calculation of the metal equivalent grades disclosed in this news release. He has not verified the database against laboratory assay certificates, survey records or drill logs, nor has he reviewed the QA/QC results. Mr. Stubens does not, therefore, make any comments or claims about the quality or reliability of the Hat project database.

Cautionary Note: No mineral resources have been estimated at the Hat Property and there is no assurance that further work will result in the Lisle Zone, or other zones if present, being classified as mineral resources.

About Doubleview Gold Corp

Doubleview Gold Corp, a mineral resource exploration and development company, is based in Vancouver, British Columbia, Canada, and is publicly traded on the TSX Venture Exchange [TSX-V:DBG]. Doubleview identifies, acquires and finances precious and base metal exploration projects in North America, particularly in British Columbia. Doubleview increases shareholder value through acquisition and exploration of quality gold, copper and silver properties and the application of advanced state-of-the-art exploration methods. Doubleview's portfolio of strategic properties provides diversification and mitigates investment risk.

On behalf of the Board of Directors,

Farshad Shirvani, President & Chief Executive Officer

For further information please contact:

Doubleview Gold Corp

Vancouver, BC Farshad Shirvani

President & CEO

T: (604) 678-9587

E: corporate@doubleview.ca

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Doubleview cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Doubleview's control. Such factors include, among other things: risks and uncertainties relating to Doubleview's limited operating history and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward looking information. Except as required under applicable securities legislation, Doubleview undertakes no obligation to publicly update or revise forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

SOURCE: Doubleview Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/596243/Independent-Technical-Review-Confirms-the-Lisle-Zone-of-the-Hat-Deposit-as-an-Alkalic-Cu-Au-Porphyry-Deposit-with-Significantly-Elevated-Au-Grades-Featuring-235m-of-104-gt-AuEq-076-CuEq-within-a-Greater-Interval-of-612m-of-058-gt-AuEq-042Eq