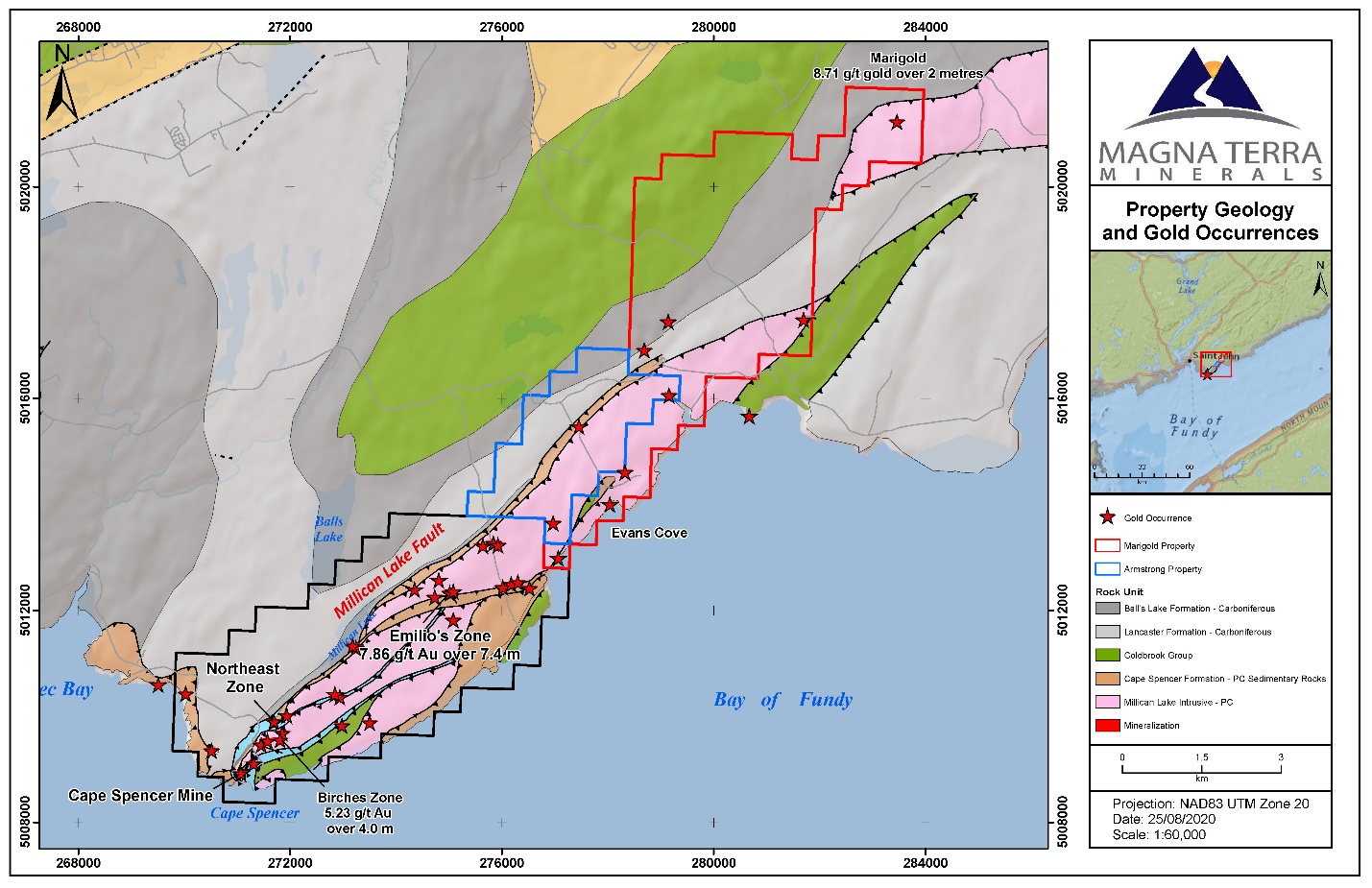

TORONTO, ON / ACCESSWIRE / August 27, 2020 / Magna Terra Minerals Inc. (the "Company" or "Magna Terra") (TSX-V:MTT) is pleased to announce that it has expanded the Cape Spencer Project ("Cape Spencer" or "Project"), located in Southern New Brunswick, via two option agreements on the Marigold and Armstrong Properties. The acquisition of these 5 mineral claims (118 units), immediately along strike to the northeast of the Cape Spencer Deposit and numerous other prospects, expands the property size by 2,680 hectares (113%) and adds additional strategic exploration targets along a 15 kilometer strike (Exhibit A). The Company has also initiated a systematic exploration program at Cape Spencer that comprises prospecting, geological mapping, soil sampling and geophysical surveying to refine existing targets and generate new gold targets. These will be followed up by a planned fall and winter program consisting of trenching and diamond drilling.

Project Highlights

- 5,045 hectares along 15 kilometres of strike of a regional-scale gold bearing structure - the Millican Lake Fault and associated structures;

- Newly expanded Project is host to large untested gold bearing alteration systems including:

- 2.5-kilometre alteration and gold bearing Emilio Trend with drill intercepts up to 7.86 grams per tonne ("g/t") gold over 7.4 metres;

- Marigold Prospect with drill intercepts up to 8.71 g/t gold over 2 metres;

- Birches Zone with drill intercepts up to 5.23 g/t gold over 4.0 metres;

- The Cape Spencer Deposit has an Inferred Mineral Resource Estimate of 1,720,000 tonnes at an average grade of 2.72 g/t gold for 151,000 contained ounces in two zones:

- Northeast Zone - Inferred Mineral Resource of 740,000 tonnes at an average grade of 4.07 g/t gold, for 96,000 contained ounces at a cut-off grade of 2.5 g/t gold in a conceptual underground development; and

- Pit Zone - Inferred Mineral Resource of 990,000 tonnes at an average grade of 1.71 g/t gold, for 54,000 contained ounces at a cut-off grade of 0.5 g/t gold in a conceptual open pit.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. All Mineral Resource Estimates were prepared in accordance with NI 43-101 and the CIM Standards (2014). Please refer to the NI 43-101 Technical Report with effective date January 23, 2019 by Harrington and Cullen (2019) as detailed below for the Cape Spencer Project. See further details on Technical Reports below.

"We are pleased to acquire these additional prospective mineral lands immediately along strike of the Cape Spencer Project. The addition of ground extends our control over the eastern extension of the Millican Lake fault and the faulted contacts between the Millican Lake Granite and bounding sedimentary and volcanic rocks that represent the ideal host environment to gold mineralization. The addition of the Marigold Prospect provides another excellent, early stage, high-grade gold target and is in a similar geological environment to the Cape Spencer Deposits. With Galway Metals demonstrating (at their Clarence Stream Gold Project) that southern New Brunswick can be host to large gold deposits, Magna Terra is launching exploration at Cape Spencer with the goal of making the next significant gold discovery in the region."

~ Lew Lawrick, President and CEO, Magna Terra Minerals

Acquisition Details

At the Marigold Property, 4 mineral claims (88 units, 1,998 hectares) were acquired via an option agreement with a local prospector ("Marigold Vendor"), covering the Marigold Prospect and adjacent ground. Under the terms of the agreement, the Company can earn a 100% interest in the Marigold Property by paying to the Marigold Vendor a total of $95,000 and issuing $105,000 in cash or equivalent-value MTT shares (subject to TSX-V and regulatory approval) over a 4-year period. The Property is subject to a 2% Net Smelter Return Royalty ("NSR") payable to the Marigold Vendor with 1% NSR purchasable by MTT for $1,500,000 and right of first refusal on the remaining 1% NSR.

At the Armstrong Property, 1 mineral claim (30 units, 682 hectares) was acquired via an option agreement with a local prospector ("Armstrong Vendor"), covering the along strike continuation of the Emilio Trend. Under the terms of the agreement, the Company can earn a 100% interest in the Armstrong Property by paying to the Armstrong Vendor a total of $45,000 and issuing $45,000 in cash or equivalent value MTT shares (subject to TSX-V and regulatory approval) over a 3-year period. The Property is subject to a 2% Gross Metal Royalty ("GMR") payable to the Armstrong Vendor with 1% purchasable by MTT for $1,000,000 and right of first refusal on the remaining 1%.

Exploration Program

The Company has started a systematic exploration program focussed on the Cape Spencer Project that will comprise collection of 2,000 B-horizon soil samples, systematic prospecting and geological mapping, and airborne magnetic and electromagnetic surveys. The initial exploration program will be followed up with trenching of priority targets in late 2020 and diamond drilling in early 2021. The current program will initially focus on the Emilio Trend targeting the 2.5 by 0.3 kilometre altered and mineralized zone, the Marigold Prospect and assessing the regional potential of the property.

The Company has critically considered logistical matters given the ongoing COVID-19 pandemic, to ensure that this Exploration Program and all future programs are executed in a way that ensures the absolute health and safety of our personnel, contractors, and the communities where we operate.

The Company would like to thank the Government of New Brunswick for partial funding of the exploration program under the NBJMAP Program.

About the Cape Spencer Project

The Cape Spencer Project is an exploration stage project that has a history of past-production and the potential for near-term discovery and resource growth. Cape Spencer is located 15 kilometres southeast of Saint John, New Brunswick, comprising 8 mineral claims (224 units) covering 5,045 hectares of land.

The Cape Spencer Project is centered along the gold bearing Millican Lake Fault, a regional splay of the Caledonia and Cobequid Fault zones. The Property is underlain by Precambrian Millican Lake granite, and Coldbrook and Cape Spencer volcanic and sedimentary rocks. The Precambrian stratigraphy is unconformably overlain by and in fault contact with younger Carboniferous sedimentary rocks of the Lancaster Formation.

Gold mineralization at Cape Spencer is hosted within Precambrian Millican Lake granite or bounding Coldbrook and Cape Spencer volcanic and sedimentary rocks, with mineralization and alteration focussed along strongly faulted and sheared contacts between the two lithologies. Alteration consists of pervasive and patchy illite + pyrite + quartz ± iron carbonate ± sulfide veins and stockworks with 2-5% total sulfides consisting of pyrite, galena, chalcopyrite or sphalerite, and locally show trace amounts of visible gold.

There are several gold prospects that warrant additional exploration over a 15-kilometre strike outside of the Pit and Northeast Zones particularly in the eastern half of the property that will initially be a primary focus for Magna Terra.

Highlights from historic exploration work outside of the main deposit areas from 1982 to 2004 include:

Emilio Trend - includes the Emilio Prospect at Eastern end of Property

- 7.86 g/t gold over 7.4 m (AB-04-06; near surface);

- 12.00 g/t gold over 1.4 m (chip) and 2.77 g/t gold over 3.0 m (chip); and

- Surface grab samples up to 168.00 g/t gold

- Zone A - Grab samples up to 53.50 g/t gold.

- Zone C - Grab samples up to 8.92 g/t gold and chip sample of 2.77 g/t gold over 3.0 m.

- Zone D - Five occurrences of visible gold with grab samples up to 7.12 g/t gold.

Birches Zone - 300-metre-long gold-bearing alteration zone south of the Northeast Zone.

- 17.85 g/t gold over 1.0 metre within a zone grading 5.23 g/t gold over 4.0 metres (MR-150);

- 9.48 g/t gold over 1.0 metre within a zone grading 4.01 g/t gold over 4.0 metres (MR-149); and

- 3.60 g/t gold over 5.0 metres (AB-04-08).

Marigold Prospect

- Historic drill assays of 8.71 g/t gold over 2.0 metres (drillhole MGB-88-2); and

- Historic grab samples up to 4.41 g/t gold.

Note: Analytical results in this press release section are sourced in the Cape Spencer Project Technical Report (2019) - see "Technical Reports and Documentation Notes" below; "grab samples" are selected samples and are not necessarily indicative of mineralization that may be hosted on the property.

Qualified Person and Technical Reports

This news release has been reviewed and approved by David A. Copeland, P. Geo., Chief Geologist with Anaconda Mining Inc., a "Qualified Person," under National Instrument 43-101 - Standard for Disclosure for Mineral Projects. Widths from drill core intervals reported in this press release are presented as core lengths only. True widths are unknown. All quoted drill core sample intervals, grades and production statistics have been compiled from historic assessment reports obtained from either the Government of New Brunswick.

The Mineral Resource Estimate quoted in this press release regarding the Cape Spencer Project refers to the technical report: "NI 43-101 Technical Report and Mineral Resource Estimate on The Cape Spencer Gold Deposit, Saint John County, New Brunswick, Canada," (the "Cape Spencer Report") with an effective date of January 23, 2019, and authored by Michael Cullen, P.Geo. (Independent Qualified Person), and Matthew Harrington, P.Geo. (Independent Qualified Person).

About Magna Terra

Magna Terra Minerals Inc. is a precious metals focused exploration company, headquartered in Toronto, Canada. Magna Terra owns two district-scale, advanced gold exploration projects in the world class mining jurisdictions of New Brunswick and Newfoundland and Labrador. Further, the Company maintains a significant exploration portfolio in the province of Santa Cruz, Argentina which includes its precious metals discovery on its Luna Roja Project, as well as an extensive portfolio of district scale drill ready projects available for option or joint venture.

Forward Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

Some statements in this release may contain forward-looking information. All statements, other than of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding potential mineralization) are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "may," "will," "should," "continue," "expect," "anticipate," "estimate," "believe," "intend," "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, without limitation, failure to establish estimated mineral resources, the possibility that future exploration results will not be consistent with the Company's expectations, changes in world gold markets or markets for other commodities, and other risks disclosed in the Company's public disclosure record on file with the relevant securities regulatory authorities. Any forward-looking statement speaks only as of the date on which it is made and except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement.

Exhibit A: Marigold and Armstrong Property acquisitions, property geology and gold occurrences

FOR FURTHER INFORMATION PLEASE CONTACT:

Magna Terra Minerals Inc.

Lewis Lawrick

President and CEO, Director

647-478-5307

Email: info@magnaterraminerals.com

Website: www.magnaterraminerals.com

SOURCE: Magna Terra Minerals Inc.

View source version on accesswire.com:

https://www.accesswire.com/603614/Magna-Terra-Doubles-Land-Position-and-Initiates-Exploration-at-the-Cape-Spencer-Project