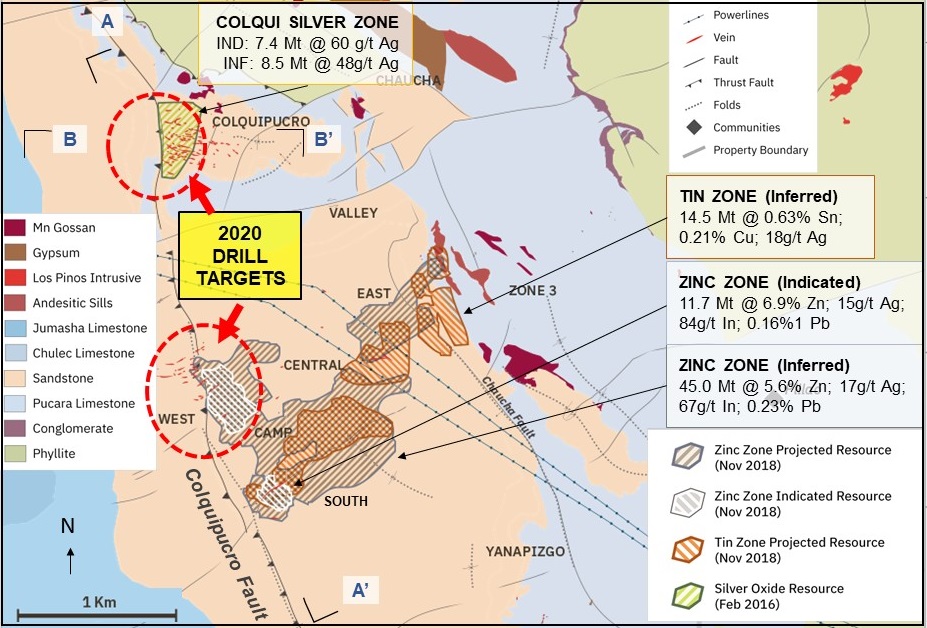

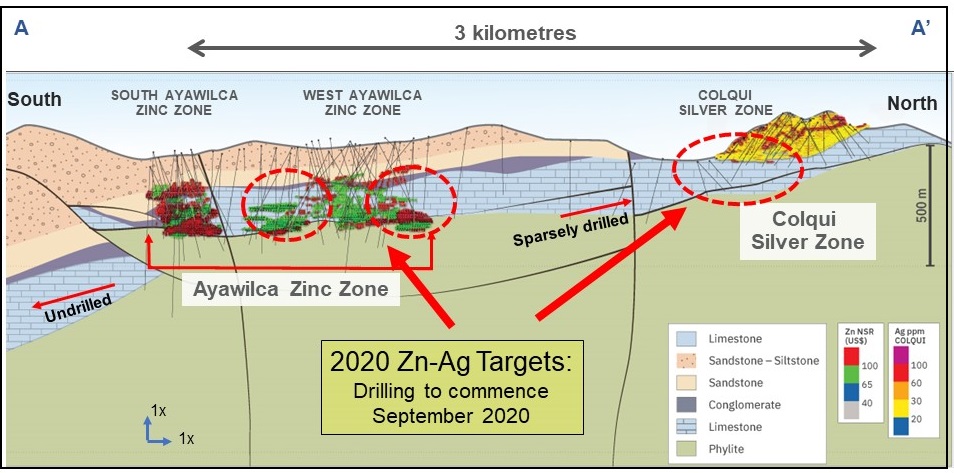

VANCOUVER, BC / ACCESSWIRE / September 9, 2020 / Tinka Resources Limited ("Tinka" or the "Company") (TSXV:TK)(BVL:TK)(OTC PINK:TKRFF) is pleased to provide an update on exploration activities at its 100%-owned Ayawilca zinc-silver project in Peru. Preparations are underway for a ~7,000 metre drill program consisting of approximately 20 diamond drill holes. Three drill rigs are expected to mobilize to site and commence drilling by the end of September 2020. The program will target areas where earlier drilling identified high grade zinc and silver mineralization, often outside of the known resources. Most of these zones lie adjacent to the Colquipucro Fault, an important north-northwest trending regional structure (Figures 1 and 2). It is anticipated that the drill program will be completed in early 2021, subject to potential delays as a result of the COVID-19 pandemic. A framework of stringent health and safety measures has been implemented, which includes protocols to prevent the spread of COVID-19, and, as a result, the timing of the start and completion of the drill program may vary.

The 2020 drill program will focus on a combination of resource step-out drilling in areas where mineralization remains open to increase resources, and infill drilling to upgrade the category of the Ayawilca resources in areas of high grade mineralization. Priority targets include:

- West Ayawilca: Step-out holes down-dip of previous drill hole intersections, which include 10 metres grading 665 g/t silver, 1.4% zinc and 1.9% lead in drill hole A18-131 (not included in resource estimate) and 31.9 metres grading 9.6% zinc & 19 g/t silver in hole A18-118 (included in inferred resource) (see news releases dated October 15, 2018, and May 24, 2018).

- West Ayawilca: Infill drilling to upgrade Inferred resources into Measured or Indicated categories (approximately 50% of program). Current Inferred resource includes drill hole intercepts such as 10.4 metres grading 44.0% zinc & 43 g/t silver in hole A18-129 (see news release dated June 26, 2018).

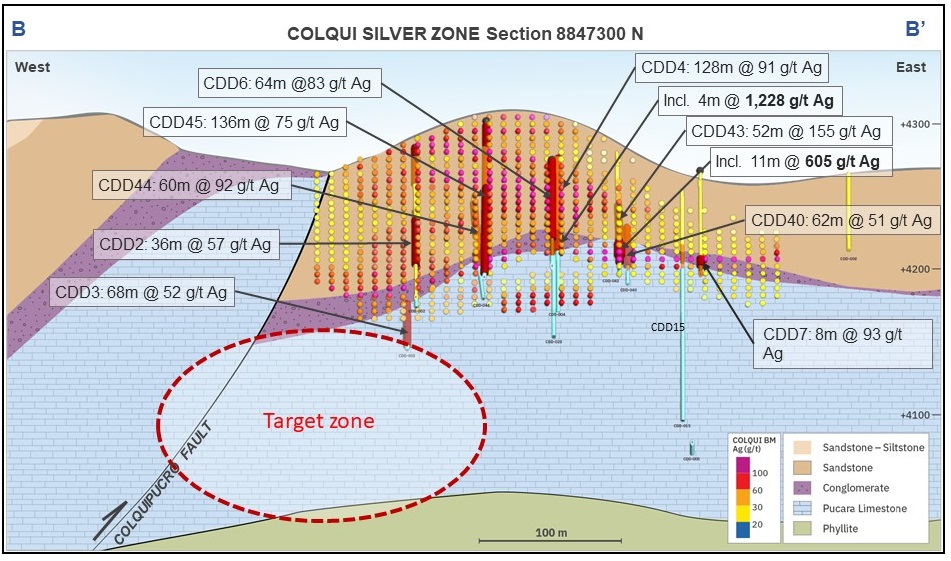

- The Colqui Silver Zone: Step-out holes are planned to test for possible down-dip extensions of the oxide silver mineralization. Previous drill hole highlights include 128 metres grading 91 g/t silver in CDD4, and 52 metres grading 155 g/t silver in hole CDD43 (see Figure 3).

The Ayawilca Zinc Zone (sulphide) contains an estimated 1.8 billion pounds zinc and 5.8 million ounces silver in the Indicated category, and 5.6 billion pounds zinc and 25.2 million ounces silver in the Inferred category (see news release dated November 26, 2018). The Colqui Silver Zone (oxide) contains an estimated 14.3 million ounces silver in the Indicated category and 13.2 million ounces silver in the Inferred category, with mineralization starting from surface (see link to Technical Report dated July 2, 2019).

Tinka has in place a rigorous health protocol including extensive COVID-19 testing and monitoring of its employees, contractors and community workers. Lodgings at the Ayawilca camp have been increased to accommodate additional personnel including community workers, adhering to strict social distancing guidelines and minimizing movement. A doctor and an ambulance are available at site at all times with appropriate testing and monitoring equipment. Tinka has also hired a consulting specialist doctor based in Lima to assist with clinical diagnoses and the follow-up of suspect COVID-19 cases. The objective is to avoid COVID-19 infections at the Ayawilca camp site, and to keep our workers and communities safe.

President and CEO of Tinka, Dr. Graham Carman, stated: "Tinka is excited to reinitiate its drill programs at Ayawilca. We have some great targets, including possible extensions of the Zinc Zone, as well as silver-rich areas not yet included in the resource estimate at West Ayawilca, and at the Colqui Silver Zone. We believe there is significant silver upside which is not currently realized. We are taking all necessary steps to minimise health risks to our employees and communities with strict health protocols in place. The health and wellbeing of our employees and neighbours is of paramount importance, and our team has gone to great lengths to ensure that the coming program is executed with as low risk as possible."

On behalf of the Board, | Investor Information: |

Figure 1. Geology and Mineral Resources of the Ayawilca Project, highlighting 2020 drill targets

Figure 2. Longitudinal section A-A' (north to south) along the Colquipucro Fault, highlighting 2020 drill targets

Figure 3. Cross section B-B' (west to east) of the Colqui Silver Zone showing the resource blocks (coloured by grade) and target zone

About Tinka Resources Limited

![]()

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver project in central Peru. The Ayawilca Zinc Zone (sulphide) has an estimated indicated resource of 11.7 Mt grading 6.9% zinc, 15 g/t silver & 0.2% lead and an inferred resource of 45.0 Mt grading 5.6% zinc, 17 g/t silver & 0.2% lead (dated November 26, 2018). The Colqui Silver Zone (oxide) has an estimated indicated resource of 7.4 Mt grading 60 g/t silver, and an inferred resource of 8.5 Mt grading 48 g/t silver occurring from surface (dated May 25, 2016). A Preliminary Economic Assessment for the Ayawilca Zinc Zone was released on July 2, 2019 (see release). The Qualified Person, Dr. Graham Carman, Tinka's President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned drill programs and results varying from expectations; delay in obtaining results; expectations regarding the Ayawilca Project PEA; the potential impact of epidemics, pandemics or other public health crises, including the current outbreak of the novel coronavirus known as COVID-19 on the Company's business, operations and financial condition; changes in world metal markets; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE: Tinka Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/605336/Tinka-Provides-Update-on-Upcoming-Drill-Program-at-Ayawilca-Zinc-Silver-Project