VANCOUVER, BC / ACCESSWIRE / November 19, 2020 / Tinka Resources Limited ("Tinka" or the "Company") (TSXV:TK)(BVL:TK)(OTC PINK:TKRFF) is pleased to provide an update on the ongoing drill program at the Company's 100% owned Ayawilca zinc-silver project in central Peru.

As at today's date, 2,000 metres have been drilled in the 2020 program and the overall program is about 30% complete. A third rig has been mobilized to site and has commenced drilling. We now expect the drill program to continue until February 2021, at which time we will take a break in the drilling to compile data and update the project resource estimations.

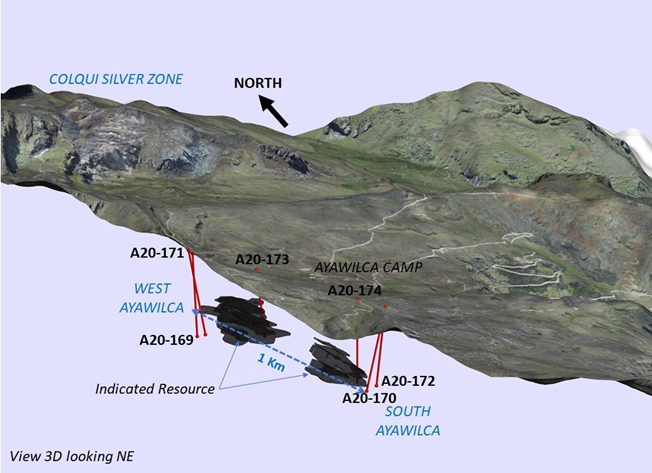

Three holes have been completed since the program commenced in October (drillholes A20-169, 170, and 171), and three holes are in progress (drillholes A20-172, 173 and 174). Samples for the first two drillholes are in the laboratory, and we expect assay results to be received by the end of November.

Drilling is currently targeting extensions of the Zinc Zone Indicated Resources at the West and South areas (Figure 1), the portions of the resource with the greatest thickness and the highest grades. Drillholes at the Colqui Silver Zone are planned later in the program to test for extensions of high-grade silver mineralization along the Colquipucro Fault.

President and CEO of Tinka, Dr. Graham Carman, stated: "We are pleased with progress of drilling to date, and we look forward to the results from the first drillholes. The arrival of a third rig will speed up the program, while allowing us to also complete a limited number of geotechnical holes within the framework of our work program and budget."

"The prices of industrial metals and precious metals have increased significantly in recent times. In the case of zinc, prices are at 18 month highs (~US$1.20/lb) while inventories remain low. Silver prices have also excelled due to global currency devaluation and fiscal stimulus, with silver prices up over 40% in the past year (~US$24/oz). The sharp move higher in silver is the reason we have been re-emphasizing our silver resources, as Ayawilca has substantial silver in the Zinc Zone and also at our nearby Colqui Silver Zone."

"A Preliminary Economic Assessment (PEA) completed in July 2019 on the Ayawilca Zinc Zone resulted in an after-tax NPV8% of US$363 million (using US$1.20/lb Zn and US$18/oz Ag) with initial capex of US$262 million, which is modest for a base metal project of this size. Tinka is continuing to evaluate ways to add value to the project through optimization of the PEA, which could eventuate in an even more compelling project on the back of an updated resource in 2021."

About Ayawilca: The Ayawilca Zinc Zone (sulphide) contains an estimated 1.8 billion pounds zinc and 5.8 million ounces silver in the Indicated category, and 5.6 billion pounds zinc and 25.2 million ounces silver in the Inferred category (see news release dated November 26, 2018). The Colqui Silver Zone (oxide) contains an estimated 14.3 million ounces silver in the Indicated category and 13.2 million ounces silver in the Inferred category, with mineralization starting from surface (see link to Technical Report dated July 2, 2019).

On behalf of the Board, | Investor Information: |

Figure 1. 3D image of Ayawilca highlighting 2020 drill holes in the current drill program (all with assays pending) and Zinc Zone Indicated Resources

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver project in central Peru. The Ayawilca Zinc Zone has an estimated Indicated resource of 11.7 Mt grading 6.9% zinc, 15 g/t silver & 0.2% lead and an Inferred resource of 45.0 Mt grading 5.6% zinc, 17 g/t silver & 0.2% lead (dated November 26, 2018). The Colqui Silver Zone (oxide) has an estimated Indicated resource of 7.4 Mt grading 60 g/t silver, and an Inferred resource of 8.5 Mt grading 48 g/t silver occurring from surface (dated May 25, 2016). A Preliminary Economic Assessment for the Zinc Zone was released on July 2, 2019 (see release). The Qualified Person, Dr. Graham Carman, Tinka's President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned drill programs and results varying from expectations; delay in obtaining results; expectations regarding the Ayawilca Project PEA; the potential impact of epidemics, pandemics or other public health crises, including the current outbreak of the novel coronavirus known as COVID-19 on the Company's business, operations and financial condition; changes in world metal markets; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

SOURCE: Tinka Resources Limited

View source version on accesswire.com:

https://www.accesswire.com/617538/Tinka-Provides-Update-on-the-Drill-Program-at-Ayawilca-Mobilizes-a-Third-Drill-Rig