WHITE ROCK, BC / ACCESSWIRE / December 16, 2020 / TDG Gold Corp. (formerly, Kismet Resources Corp.) (TSXV:KSMT.P) (the "Company" or "TDG") is pleased provide the following information regarding its newly acquired Baker-Shasta gold-silver project located in the Toodoggone Region of northern B.C.

Further to TDG's news release of December 11, 2020, TDG has completed the acquisition of the Toodoggone assets of Talisker Resources Ltd. consisting of the Baker and Shasta Mines, and the Mets and Bot properties. TDG will begin trading on the TSX Venture Exchange under the symbol "TDG" on December 17th, 2020. TDG is privileged to be working in the traditional territories of the Kwadacha, Tsay Keh Dene, Takla and Tahltan First Nations, and looks forward to open consultation and respectful dialogue regarding TDG's proposed mineral exploration programs.

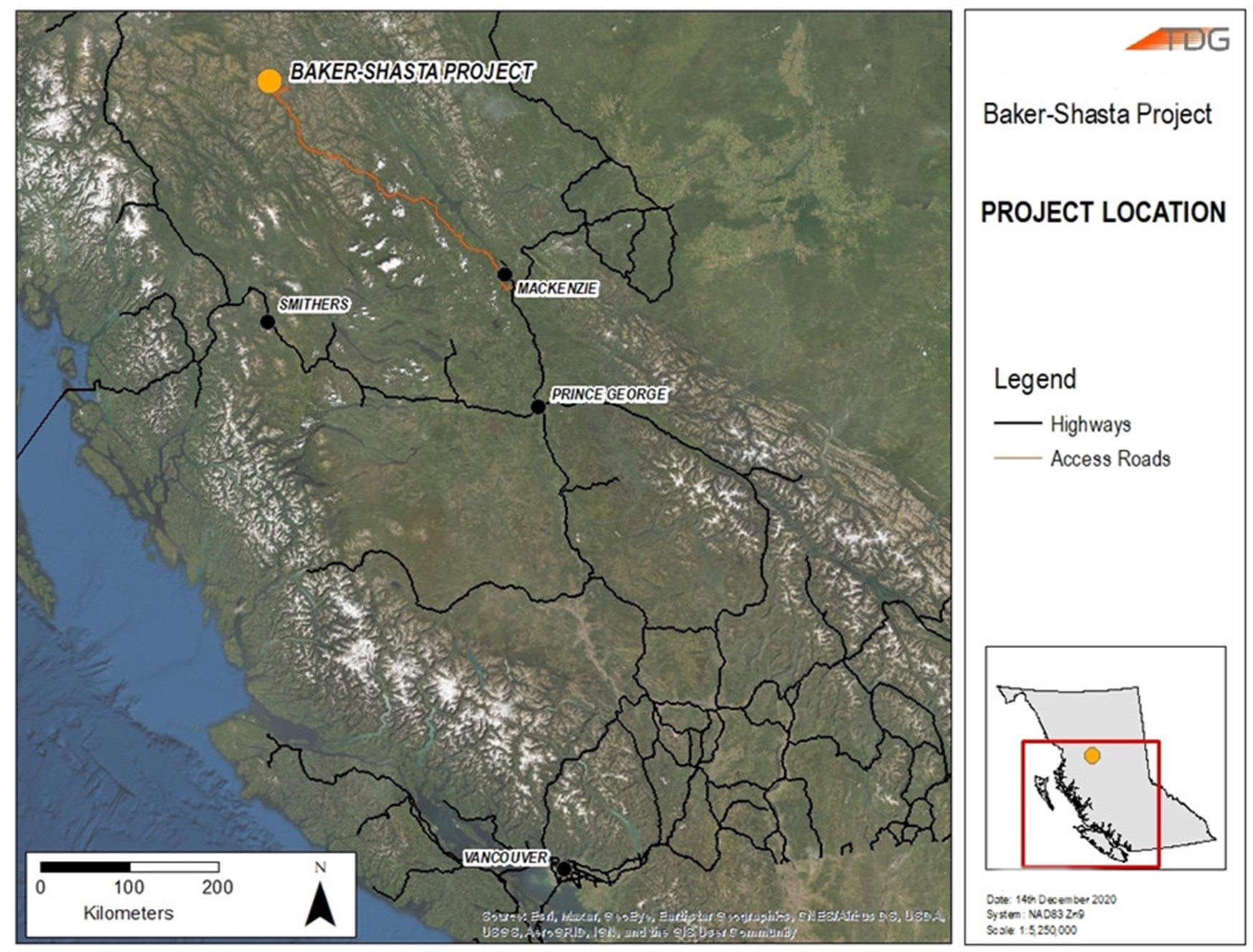

The Baker and Shasta Mines are former producing gold and silver operations accessible by road 430 km northwest of Prince George, via Mackenzie and the Omineca Resource access route past Centerra Gold Inc.'s Kemess Copper Gold Mine (Figure 1).

Figure 1. Location of the Baker and Shasta Mines.

The Baker and Shasta Mines operated on an intermittent basis in the period 1980 until 2012, focusing on the high-grade veins and structures, both through underground and small-scale open pit operations. In the period 1981-1983 and 1996-1997, 81,878 tonnes of Baker ore were milled recovering 765,565 ounces silver and 41,281 ounces gold. Production from the Shasta Mine in the years 1989-1991 and 2000, recovered 1,061,577 ounces silver and 19,381 ounces gold milled from 131,113 tonnes ore (Note 1).

TDG has been undertaking a detailed compilation of historic data from both Baker and Shasta mine sites and is pleased to present in this news release the first update of the Shasta area review and data analysis.

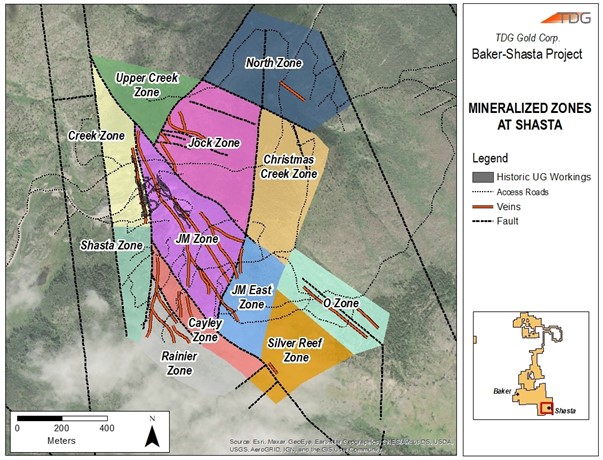

The Shasta exploration target covers an area approximately 800 metres by 1500 metres. Previous exploration at Shasta identified at least twelve mineralized zones of which the historic workings are contained within two structures, the JM and Creek Zones shown in Figure 2. Underground workings at Shasta extend 300 metres along strike at each of the JM and Creek Zones, with depths up to 100 metres from surface. Total tonnage extracted from underground and pits, including ore and waste is estimated at 420,000 tonnes (Note 2).

Figure 2. Mineralized zones at Shasta covering an area of approximately 800 metres by 1500 metres.

TDG has compiled 28,751 metres of drilling from 325 historic diamond drill holes at Shasta. Sample assays for gold and silver are reported from 10,716 metres of drilling of which 48% grade over 0.25 grams per tonne ("gpt") gold equivalent (gold to silver ratio of 1:78). Gold-silver mineralization is hosted in quartz veins, quartz-carbonate stockworks, breccias and fault zones.

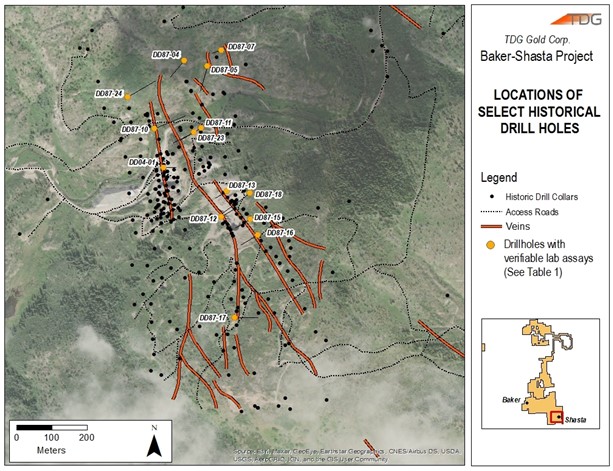

Shown below in Figure 3 and Table 1 are reported drill hole assay results within the Shasta exploration area. The data is from independent laboratories, with recorded assay certificates (Note 3). Additional information is included in TDG's updated corporate presentation available on the TDG website (www.tdggold.com).

Figure 3. Location at Shasta of historic drill holes with independent laboratory assay certificates.

Hole Id | From (m) | To (m) | Composite Width (m) | Au (gpt) | Ag (gpt) | Zone |

DD-04-01 | 23.53 | 37.77 | 14.24 | 7.34 | 343.67 | Creek Zone, within historic working |

including | 31.92 | 37.77 | 5.85 | 13.80 | 641.33 | |

DD87-04 | 61.3 | 94.8 | 33.5 | 0.70 | 34.59 | Upper Creek Zone, underexplored Area |

including | 84.2 | 94.8 | 10.6 | 1.34 | 90.17 | |

and | 104.2 | 111.2 | 7 | 0.64 | 20.31 | |

DD87-05 | 78.9 | 80.4 | 1.5 | 7.62 | 15.00 | Jock Zone, underexplored Area |

and | 91.8 | 101.2 | 9.4 | 0.65 | 23.50 | |

DD87-07 | 14.8 | 29.8 | 15 | 1.29 | 23.77 | Jock Zone, underexplored Area |

DD87-10 | 25.1 | 30 | 4.9 | 1.03 | 81.85 | Creek Zone, crossing into JM, within historic workings |

and | 36.1 | 44.3 | 8.2 | 2.09 | 90.37 | |

and | 55 | 84 | 29 | 0.80 | 37.82 | |

DD87-11 | 67.2 | 94.2 | 27 | 2.03 | 118.75 | JM Zone, within historic workings |

including | 80.2 | 84.6 | 4.4 | 8.20 | 497.06 | |

DD87-12 | 14.9 | 20.5 | 5.6 | 2.26 | 206.63 | JM Zone, within historic workings |

and | 24.5 | 52.5 | 28 | 2.34 | 154.72 | |

and | 58 | 66.8 | 8.8 | 1.02 | 19.97 | |

DD87-13 | 18 | 48.1 | 30.1 | 1.31 | 53.49 | JM Zone, within historic workings |

including | 24 | 33.9 | 9.9 | 2.04 | 71.78 | |

DD87-15 | 11.9 | 59 | 47.1 | 1.20 | 61.56 | JM Zone, above historic workings |

including | 48.6 | 50.6 | 2 | 3.61 | 139.00 | |

including | 46 | 53.6 | 7.6 | 4.09 | 223.76 | |

DD87-16 | 21.4 | 72 | 50.6 | 0.44 | 18.09 | JM Zone, step out along strike |

including | 48.7 | 51 | 2.3 | 3.89 | 132.50 | |

DD87-17 | 45.1 | 47.5 | 2.4 | 8.77 | 91.00 | JM Zone, step out along strike |

and | 59.6 | 79.7 | 20.1 | 0.19 | 3.66 | |

DD87-18 | 58.8 | 146.1 | 87.3 | 0.73 | 25.68 | JM Zone, partly within workings |

including | 69 | 86 | 17 | 1.38 | 67.46 | |

including | 122.8 | 135.4 | 12.6 | 2.04 | 65.58 | |

DD87-23 | 32.9 | 89.7 | 56.8 | 0.85 | 35.91 | JM Zone, within historic workings |

DD87-24 | 97 | 109 | 12 | 0.97 | 47.50 | Creek Zone, step out along strike |

NB. True width estimated at 60 to 90 percent of drill hole width.

Table 1. Historic drill holes at Shasta.

Historic production at Shasta targeted higher grades in the JM and Creek Zones. The drill hole assay results demonstrate that additional gold and silver mineralization, described as "halo mineralization" lies outside the higher grade zones within the hangingwall and footwall to the vein structures.

TDG proposes to undertake exploration in 2021 that will test for multiple gold and silver vein extensions and the associated halo mineralization in the vein hanging wall and footwall within the known 800 metres by 1500 metres exploration target area.

Drill Hole Details

Hole_ID | Easting | Northing (NAD83 ZN9) | Elevation (m) | Azimuth (o) | Dip (o) | EOH (m) |

DD04-01 | 620937 | 6347460 | 1278 | 90 | -41 | 47.56 |

DD87-04 | 620995 | 6347763 | 1299 | 220 | -60 | 127.7 |

DD87-05 | 621060 | 6347747 | 1287 | 195 | -45 | 106.4 |

DD87-07 | 621099 | 6347793 | 1302 | 250 | -45 | 39.3 |

DD87-10 | 620911 | 6347570 | 1257 | 68 | -45 | 130.8 |

DD87-11 | 621043 | 6347571 | 1268 | 240 | -40 | 94.2 |

DD87-12 | 621100 | 6347321 | 1346 | 60 | -45 | 66.8 |

DD87-13 | 621116 | 6347393 | 1327 | 240 | -45 | 63.7 |

DD87-15 | 621182 | 6347314 | 1358 | 240 | -45 | 72.8 |

DD87-16 | 621204 | 6347269 | 1372 | 240 | -45 | 78.9 |

DD87-17 | 621138 | 6347035 | 1403 | 90 | -45 | 91.7 |

DD87-18 | 621181 | 6347387 | 1337 | 234 | -45 | 146.1 |

DD87-23 | 621022 | 6347559 | 1270 | 243 | -45 | 91.1 |

DD87-24 | 620834 | 6347660 | 1286 | 60 | -45 | 127.7 |

Notes

Note 1. J.H. Montgomery Ph.D., P.Eng. November 12, 2003, Report on Toodoggone Gold project, Omineca mining Division, Northern British Columbia. Sable Resources Ltd.

Note 2. Tetra Tech (Consulting and Engineering Firm) Report for TDG Gold December 8th, 2020.

Note 3. ARIS Reports reference certified assay certificates aris.empr.gov.bc.ca, Report files 7653A and 16698.

Qualified Person

The technical content of this news release has been reviewed and approved by Duncan McBean, P.Geo., a qualified person as defined by National Instrument 43-101.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information:

TDG Gold Corp., please contact Fletcher Morgan

Telephone: +1.604.536.2711

Email: info@tdggold.com

Cautionary Note Regarding Forward-Looking Statements:

Certain statements made and information contained herein may constitute "forward looking information" and "forward looking statements" within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management's expectations. Forward-looking statements and information may be identified by such terms as "anticipates", "believes", "targets", "estimates", "plans", "expects", "may", "will", "could" or "would". Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: TDG Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/621262/TDG-Gold-Corp-Outlines-800-Metres-by-1500-Metres-Exploration-Target-Area-at-the-Former-Producing-Gold-Silver-Shasta-Mine