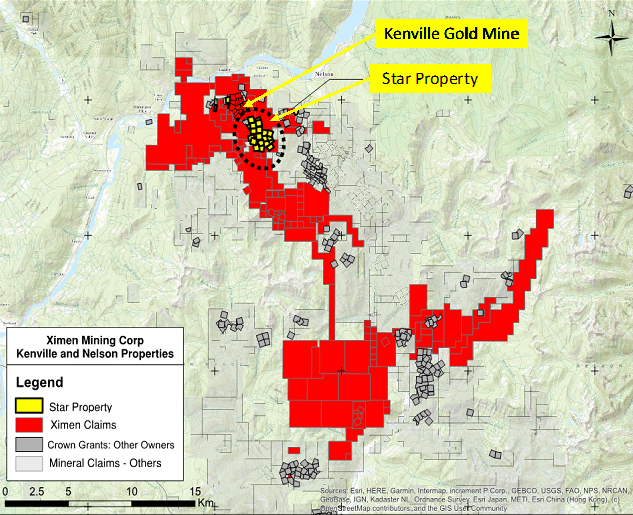

VANCOUVER, BC / ACCESSWIRE / January 28, 2021 / Ximen Mining Corp. (TSXV:XIM)(FRA:1XMA)(OTCQB:XXMMF) (the "Company" or "Ximen") is pleased to announce that it has acquired the Star properties in the Nelson mining camp in southern British Columbia.

https://www.ximenminingcorp.com/wp-content/uploads/2021/01/XimenStarProperties.png

Ximen recently signed an option agreement to acquire 100% interest in 25 Crown Granted mineral claims covering 363 hectares in the Nelson camp, collectively referred to as the Star Properties. The Star properties include a group of 22 contiguous Crown Grants situated south of the Kenville gold mine property, 2 Crown Grants that adjoin the Kenville Gold mine property on its west side, and one Crown Grant situated east of Kenville.

https://www.ximenminingcorp.com/wp-content/uploads/2021/01/NQ2DrillCoreGold.png

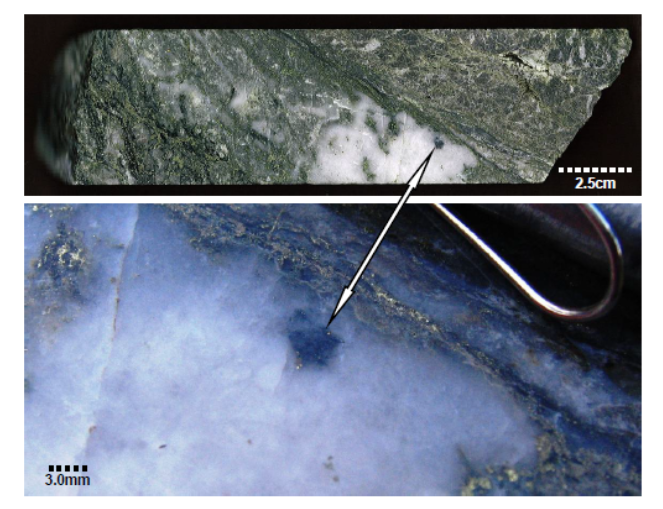

ALMA N ZONE VISIBLE GOLD- (top) VST09-009 Andesite;Quartz Vein photo of NQ2 drill core from 121.75 to 121.90m. There is approx. 10-15 very fine grained (<0.5mm) gold flecks at 121.86m (bottom). The one metre wide sample, # 103457 assayed: 14.45 g/t Au, 15.00 g/t Ag and 0.59% Cu.

Ximen believes the group of Star claims located south of the Kenville mine is one of the key properties in the Nelson camp. This claim group straddles the margin of the Eagle Creek pluton, which hosts the high-grade gold-quartz veins at Ximen's Kenville property. On the Star ground, widespread disseminated mineralization occurs over a south-southeast trending zone approximately two kilometres in strike length and one half to one kilometre wide. Mineralization includes fracture-controlled pyrite, chalcopyrite and other copper sulfides and oxides, specular hematite and local molybdenite. The best mineralized intercepts occur in steeply dipping zones that are 50 metres or more in width but in some areas, mineralization extends over entire hole lengths (100 metres or more). The gold-silver-copper mineralization is associated with potassic alteration (orthoclase and carbonate), which signifies genesis by a porphyry-type system. As such, this property has excellent potential for a large-tonnage, low-grade gold deposit.

https://www.ximenminingcorp.com/wp-content/uploads/2021/01/AlmaNZone3DModel.png

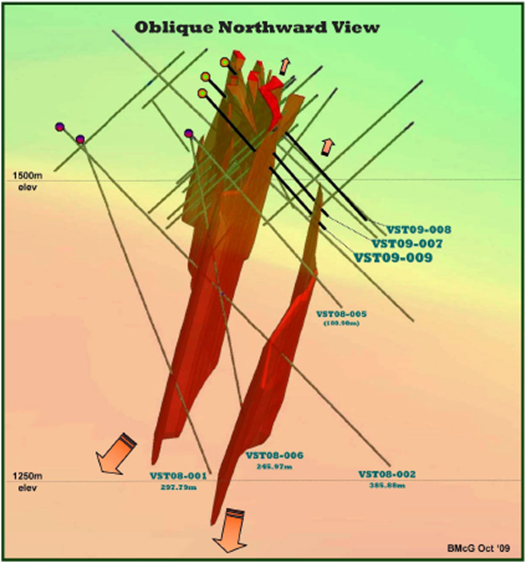

Alma N Zone Conceptual 3D Model

The Star Crown Grants cover the historic Eureka and Star mines. Historic production at the Eureka was 617 ounces gold, 36,161 ounces silver, 350, 910 pounds of copper and minor lead from 8,995 tonnes mined (3603 tonnes milled). Calculated grades for tonnage mined are 125 grams per tonne silver, 1.8 grams per tonne gold and 1.77% copper. The historic Star mine produced 180 ounces of gold and minor silver and copper from 1,163 tonnes mined. The calculated gold grade is 4.81 grams per tonne.

The property has been held since the 1950's when underground development was done at the historic Eureka mine to test high-grade copper-silver bearing fracture zones. Between 1984 and 1988, soil geochemical surveys, geophysical surveys (IP and magnetic) and drilling were done (rotary reverse circulation and core drilling). From 1989 through 1992 the property was further tested. In 1990, three zones were trenched at the Star claim and copper-gold mineralization was traced over an area of 800 by 200 metres, which was then tested by 26 diamond drill holes totalling 5880 metres. Between 2008 and 2011 aerial geophysical surveys and fifteen more holes were drilled. Significant drill intercepts from historic data are listed below.

Zone | Hole | Type | From | To | Length | Gold g/t | Silver g/t | Copper % |

Eureka | 89-5 | Diamond | 32.0 | 82.0 | 50.0 | 1.10 | 2.36 | 0.27 |

Eureka | VST10-11 | Diamond | 54.0 | 113.0 | 59.0 | 0.65 | 1.19 | 0.16 |

Eureka | VST10-11 | Diamond | 242.0 | 288.0 | 46.0 | 0.35 | 5.45 | 0.47 |

Star | S-1 | Rotary | 5.2 | 27.4 | 22.2 | 0.47 | 2.00 | 0.16 |

Star | S-1 | Rotary | 27.4 | 118.9 | 91.5 | 0.16 | N/A | 0.12 |

Star | S-8 | Rotary | 73.2 | 138.7 | 65.5 | 0.74 | 2.20 | 0.08 |

Star | S-9 | Rotary | 4.6 | 140.2 | 135.6 | 0.39 | 1.06 | 0.15 |

Star | S-10 | Rotary | 13.7 | 70.1 | 56.4 | 1.20 | 3.58 | 0.26 |

Star | " | 70.1 | 152.4 | 82.3 | 0.13 | 1.55 | 0.04 | |

Star | S-13 | Rotary | 83.8 | 120.4 | 36.6 | 0.98 | 6.00 | 0.12 |

Star | S-35 | Rotary | 2.1 | 136.2 | 134.1 | 0.66 | 3.04 | 0.15 |

Star | S-36 | Rotary | 3.0 | 74.7 | 71.7 | 0.60 | 2.37 | 0.17 |

Star | " | 74.7 | 136.2 | 61.5 | 0.25 | 1.60 | 0.08 | |

Star | S-37 | Rotary | 3.0 | 38.1 | 35.1 | 0.75 | 2.90 | 0.29 |

Star | DDH-51 | Diamond | 18.3 | 89.9 | 71.6 | 0.78 | 5.26 | 0.16 |

Star | " | 89.9 | 149.4 | 59.5 | 0.14 | 1.50 | 0.09 | |

Star | DDH-52 | Diamond | 12.2 | 114.3 | 102.1 | 0.25 | 1.04 | 0.21 |

Star | 89-4 | Diamond | 13.4 | 76.0 | 62.6 | 0.67 | 2.49 | 0.11 |

Star | " | 76.0 | 110.0 | 34.0 | 0.26 | 1.35 | 0.03 | |

Star | " | 110.0 | 188.0 | 78.0 | 0.41 | 2.32 | 0.19 | |

Star | VST08-004 | Diamond | N/A | N/A | 24.0 | 1.16 | 2.46 | 0.16 |

Star | VST10-010 | Diamond | 109.0 | 127.0 | 18.0 | 0.90 | 3.13 | 0.27 |

Alma N | S-3 | Rotary | 25.9 | 62.5 | 36.6 | 2.74 | 2.90 | 0.02 |

Alma N | S-5 | Rotary | 27.4 | 74.7 | 47.3 | 4.30 | 2.90 | 0.03 |

Alma N | S-33 | Rotary | 24.4 | 65.5 | 41.2 | 0.68 | N/A | N/A |

Alma N | 89-1 | Diamond | 17.0 | 96.0 | 79.0 | 1.48 | 1.95 | 0.03 |

Alma N | VST08-006 | Diamond | 76.0 | 88.0 | 12.0 | 1.32 | 0.54 | 0.01 |

Alma N | " | 233.0 | 245.7 | 12.7 | 5.94 | 3.78 | 0.01 | |

Alma N | VST09-007 | Diamond | 6.0 | 50.0 | 44.0 | 2.12 | 1.63 | N/A |

Alma N | VST11-013 | Diamond | 442.0 | 462.0 | 20.0 | 0.11 | N/A | 0.10 |

SE | S-29 | Rotary | 20.4 | 111.3 | 90.8 | 0.77 | 10.30 | 0.05 |

SE | S-38 | Rotary | 79.3 | 121.9 | 42.7 | 0.27 | 8.80 | 0.08 |

SE | S-41 | Rotary | 15.2 | 79.3 | 64.0 | 0.41 | 6.60 | 0.03 |

SE | S-42 | Rotary | 12.2 | 25.9 | 13.7 | 0.41 | 8.00 | 0.03 |

According to the terms of the Option Agreement, to acquire 100% interest in the properties Ximen is required to pay the vendors a total of $400,000 over nine years in scheduled varying payments and do work on the property for expenditures totalling $1,000,000 over 10 years in scheduled varying annual increments. The payments and work expenditures can be accelerated. The acquisition is subject to a 2.5% NSR royalty in favour of the vendors that can be reduced to 1.5% by payment of $2,000,000.

Readers are cautioned that historical information including the drill records referred to in this News Release have been examined but not verified by a Qualified Person. Further work is required to verify that historical records referred to in this News Release are accurate.

Dr. Mathew Ball, P.Geo., VP Exploration for Ximen Mining Corp. and a Qualified Person as defined by NI 43-101, approved the technical information contained in this News Release.

On behalf of the Board of Directors,

"Christopher R. Anderson"

Christopher R. Anderson,

President, CEO and Director

604 488-3900

Investor Relations:

Sophy Cesar,

604-488-3900,

ir@XimenMiningCorp.com

About Ximen Mining Corp.

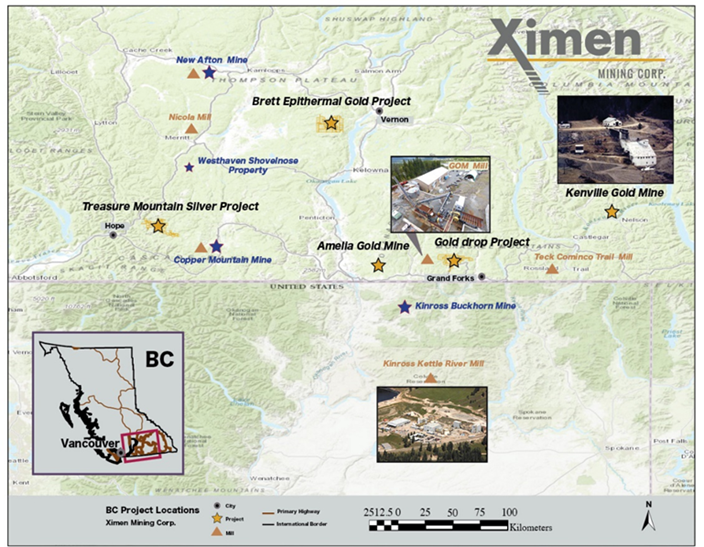

https://www.ximenminingcorp.com/wp-content/uploads/2020/06/x6.png

Ximen Mining Corp. owns 100% interest in three of its precious metal projects located in southern BC. Ximen's two Gold projects The Amelia Gold Mine and The Brett Epithermal Gold Project. Ximen also owns the Treasure Mountain Silver Project adjacent to the past producing Huldra Silver Mine. Currently, the Treasure Mountain Silver Project is under a option agreement. The option partner is making annual staged cash and stocks payments as well as funding the development of the project. The company has recently acquired control of the Kenville Gold mine near Nelson British Columbia which comes with surface and underground rights, buildings and equipment.

https://www.ximenminingcorp.com/wp-content/uploads/2020/06/x7.png

Ximen is a publicly listed company trading on the TSX Venture Exchange under the symbol XIM, in the USA under the symbol XXMMF, and in Frankfurt, Munich, and Berlin Stock Exchanges in Germany under the symbol 1XMA and WKN with the number as A2JBKL.

This press release contains certain "forward-looking statements" within the meaning of Canadian securities This press release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, including statements regarding the receipt of TSX Venture Exchange approval and the exercise of the Option by Ximen. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the possibility that the TSX Venture Exchange may not accept the proposed transaction in a timely manner, if at all. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Ximen Mining Corp

888 Dunsmuir Street - Suite 888, Vancouver, B.C., V6C 3K4 Tel: 604-488-3900

XIM images:

Pic 1: https://www.ximenminingcorp.com/wp-content/uploads/2021/01/XimenStarProperties.png

Pic 2: https://www.ximenminingcorp.com/wp-content/uploads/2021/01/NQ2DrillCoreGold.png

Pic 3: https://www.ximenminingcorp.com/wp-content/uploads/2021/01/AlmaNZone3DModel.png

Pic 4: https://www.ximenminingcorp.com/wp-content/uploads/2020/06/x6.png

Pic 5: https://www.ximenminingcorp.com/wp-content/uploads/2020/06/x7.png

SOURCE: Ximen Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/626452/Ximen-Acquires-25-Crown-Grants-Beside-Kenville-Gold-Mine--Nelson-Mining-Camp