VANCOUVER, BC / ACCESSWIRE / February 3, 2021 / Ximen Mining Corp. (TSXV:XIM)(FRA:1XMA)(OTCQB:XXMMF) (the "Company" or "Ximen") is pleased to announce that it has acquired the Running Wolf gold property located 20 kilometers west of Cranbrook in the Fort Steele Mining Division in southern British Columbia.

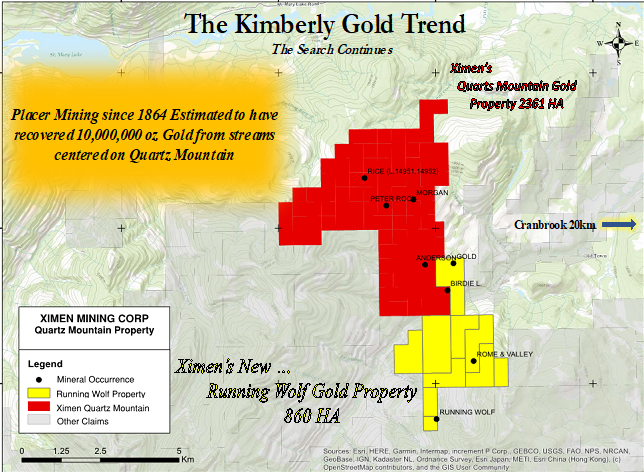

Claim map showing Running Wolf and Quartz Mountain properties at Kimberley, B.C.

The Running Wolf and Quartz Mountain properties lie within the Cranbrook Gold Belt (also known as the Kimberley Gold Trend), a zone that extends southwestward from the Northern Hughes Range, crossing the Rocky Mountain trench, into the western part of the Purcell Mountains. Alluvial gold placer mining is estimated to have recovered 10 million oz of gold from streams in the East Kootenay area centred on Quartz Mountain since discovery of gold in 1864, and mining has continued since. Exploration for lode gold sources to the alluvial placers has been ongoing for a century.

The Running Wolf claims cover three known mineral occurrences, including Rome & Valley, Running Wolf and Gold. Historic records indicate that at Rome & Valley, two or more large quartz veins occur in a fault zone and contain pyrite and galena. One vein has been traced 470 metres and varies in width from 0.6 to 7.6 metres. Samples of mineralized vein material are reported to have assayed from 1.08 to 19.55 grams per tonne gold. At the Running Wolf prospect, historic workings consist of five adits. The main adit exposes three veins, each about 10 metres wide. Surface grab samples of the vein are reported to assay up to 35.0 grams per tonne gold. DDH 1985-8 intersected the No.1 vein in a sheared quartzite and assayed 2.0 grams per tonne gold over 2.0 metres. At the Gold prospect, an alteration zone in quartz phyllite is reported to have assayed 0.24 grams per tonne gold over 3.5 m.

Ximen's Quartz Mountain property covers important historical placer deposits on Sawmill creek and five mineral occurrences: Rice, Anderson, Birdie L., Peter Rock and Morgan. At Rice (also known as Quartz Mountain), quartz veins 0.75 to 1 metre wide are mineralized with pyrite, chalcopyrite and native gold. In 1973 and 1974, 1,481 tonnes were mined from surface showings and shipped to Trail, B.C. for smelting. From this, 14,945 grams of gold, 13,405 grams of silver, 1,307 kilograms of copper, 3,286 kilograms of lead and 1,481 kilograms of zinc were recovered.

At Anderson (also known as Golden Egg), quartz veins contain specular hematite, pyrite, galena, sphalerite, chalcopyrite and native gold. Historic records indicate that from 1937 to 1940 (inclusive), 381 tonnes of ore were mined, from which 313 grams of gold, 5194 grams of silver and 200 kilograms of lead were recovered. In 1995, rock chip samples assayed up to 107.2 grams per tonne gold and 63.0 grams per tonne silver over 5 metres. Sampling of a tunnel located on the north side of the pit yielded up to 18.1 grams per tonne gold, 11.6 grams per tonne silver and 0.2 per cent lead over 0.36 metre. In 2003, diamond drilling intersected quartz vein material that assayed 16.53 grams per tonne gold over 0.49 metre. In 2013, two rock samples from a newly exposed road cut, located south west of the pit, yielded 1.12 and 2.28 grams per tonne gold, respectively.

At Birdie Load and Peter Rock, quartz veins containing minor amounts of pyrite locally contain gold. Quartz filled shears in trenches at Birdie L. assayed up to 3.4 grams per tonne gold, and a 1983 dump sample assayed 13.1 grams per tonne gold. A rock sample at Peter Rock assayed 3.9 grams per tonne gold, and a composite sample yielded 13.5 grams per tonne gold.

Ximen considers the Running Wolf acquisition as a significant addition to its holdings in the Cranbrook Gold Belt. Future work will focus on expanding the areas of known gold mineralization and related fault/shear structures, and exploration for additional lode or disseminated gold deposits.

Ximen recently signed a purchase agreement to acquire 100% interest in 10 mineral claims covering 860 hectares in the Cranbrook Gold Belt, referred to as the Running Wolf property. According to the terms of the Purchase Agreement, Ximen is required to pay a total of $30,000 split among the vendors and issue 200,000 shares also to be split among the vendors. The Running Wolf property adjoins Ximen's Quartz Mountain property (58 claims, 2,361 hectares), acquired in 2020.

Readers are cautioned that historical information including the assay and production results referred to in this News Release have been examined but not verified by a Qualified Person. Further work is required to verify that historical records referred to in this News Release are accurate.

Dr. Mathew Ball, P.Geo., VP Exploration for Ximen Mining Corp. and a Qualified Person as defined by NI 43-101, approved the technical information contained in this News Release.

On behalf of the Board of Directors,

"Christopher R. Anderson"

Christopher R. Anderson,

President, CEO and Director

604 488-3900

Investor Relations:

Sophy Cesar,

604-488-3900,

ir@XimenMiningCorp.com

About Ximen Mining Corp.

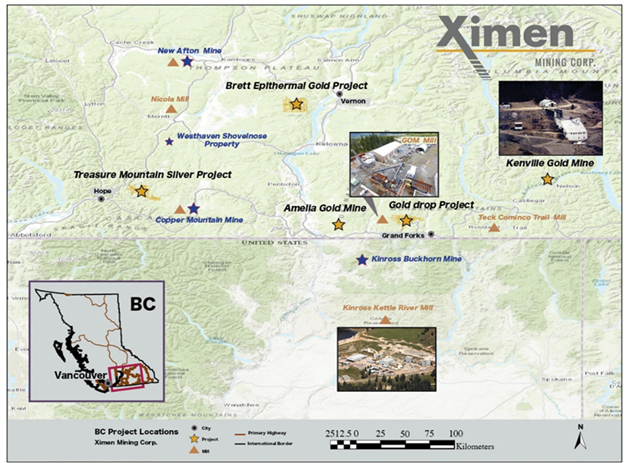

Ximen Mining Corp. owns 100% interest in three of its precious metal projects located in southern BC. Ximen's two Gold projects The Amelia Gold Mine and The Brett Epithermal Gold Project. Ximen also owns the Treasure Mountain Silver Project adjacent to the past producing Huldra Silver Mine. Currently, the Treasure Mountain Silver Project is under a option agreement. The option partner is making annual staged cash and stocks payments as well as funding the development of the project. The company has recently acquired control of the Kenville Gold mine near Nelson British Columbia which comes with surface and underground rights, buildings and equipment.

Ximen is a publicly listed company trading on the TSX Venture Exchange under the symbol XIM, in the USA under the symbol XXMMF, and in Frankfurt, Munich, and Berlin Stock Exchanges in Germany under the symbol 1XMA and WKN with the number as A2JBKL.

This press release contains certain "forward-looking statements" within the meaning of Canadian securities This press release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, including statements regarding the receipt of TSX Venture Exchange approval and the exercise of the Option by Ximen. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the possibility that the TSX Venture Exchange may not accept the proposed transaction in a timely manner, if at all. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Ximen Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/627555/Ximen-Acquires-Running-Wolf-Gold-Property-Cranbrook-BC