TORONTO, ON / ACCESSWIRE / February 3, 2021 / Avidian Gold Corp. ("Avidian" or the "Corporation") (TSXV:AVG)(OTCQB:AVGDF) is providing a summary of the major 2020 exploration accomplishments, 2020 corporate activity and its 2021 exploration/corporate plans. The 2020 exploration program focused primarily on the Amanita property, located 5 km southwest and adjacent to the Fort Knox gold mine situated within the Fairbanks Gold Mining District, Alaska. A small exploration program was also carried out on the Golden Zone property in preparation for a 2021 program. Both the Amanita and Golden Zone properties are situated within the prolific Tintina Mineral Belt, which is known to host numerous multi-million ounce gold deposits. Both properties are accessible on a year-round basis.

Avidian was able to successfully conduct its exploration programs during the COVID-19 Pandemic and operated with preventive COVID-19 protocols in place and is pleased to report that no COVID-19 related cases occurred.

Key exploration results from Avidian's 2020 exploration programs follow.

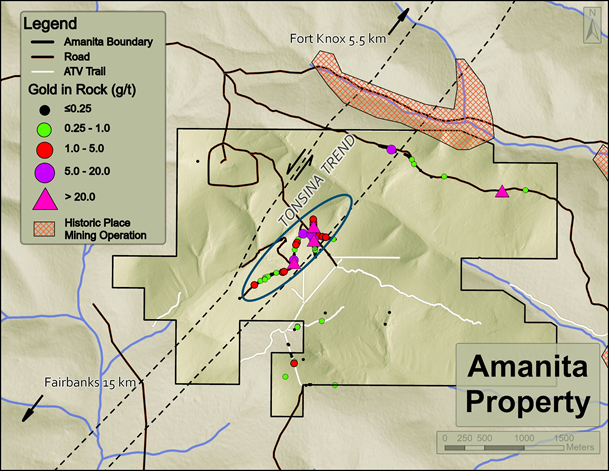

Amanita Property, Alaska (Figure 1)

Completed a high-resolution drone magnetic survey (443.6 line km) over the entire property at 50 m line spacing with selected areas flown at a 25 m line spacing in order to assist with ongoing drill targeting.

Completed a helicopter-borne LiDAR survey which also provided an orthophoto to aid its 2020 drill program and future drill programs.

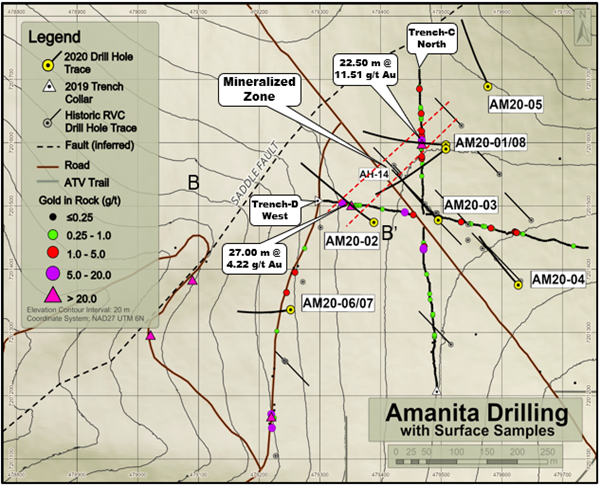

Completed nine HQ-diameter oriented core holes for a total of 1,945 m (see Figure 2) as follows:

Three core holes (AM20-1, 2, 8) were drilled in the vicinity of Trench C & D (completed in 2019) to test the NE-SW trending zone of gold mineralization;

Two core holes (AM20-3, 4) drilled to test for possible NE-SW trending parallel gold zones anywhere from 20 to 250 m southeast of the hole AM20-2;

Three core holes (AM20-5, 6, 7: note hole AM20-6 was abandoned at 54.25 m due to rock conditions and hole AM20-7 was drilled at the same collar location) drilled to test for a possible strike extension of mineralized trenches on trend with hole AM20-1 & 2) 140 m to the northeast and 230 m to the southeast, respectfully); and,

One hole (AM20-9) drilled 1.1 km southwest of the trenches to test possible SW extension of the mineralization coincident with geophysical targets.

Complete hole assay results have only been received for holes AM20-1 and AM20-2 with the remainder of the balance of the core hole results pending. Drill holes AM20-01 and AM20-02 were designed to test for the down-dip extent of the mineralization encountered in trenches C-North and D-West, respectively. The mineralization between these two trenches trends in a NE direction over a strike extent of at least 200 m. Highlights from these holes are listed below.

Gold mineralization was encountered in both holes, with the highlight being 22.72 m of 3.11 g/t Au from Hole AM20-02; this intersection occurs approximately 60 metres below Trench D-West, which returned 27.0 m of 4.22 g/t Au (Press Release dated January 7, 2020).

AM20-01 was designed to pass under the north-trending intersection of 22.5 m of 11.51 g/t Au in Trench C-North and intercept this zone at a vertical depth of approximately 50 m. The upper 75 m of AM20-01 is structurally complex and movement along these structures likely displaced the mineralization as no significant mineralization was intercepted in the upper part of the hole. Several thin anomalous (>0.25 g/t) gold values were encountered including 3.12 m of 1.39 g/t Au at a depth of 95 m. The structural complexity in the upper 75 meters of AM20-01 is also evident in the property wide magnetic survey that indicates multiple, major, structural trends intersecting in the area of AM20-01.

Hole AM20-02 was designed to test the down-dip extension of the Trench D-West intersection of 27.0 m of 4.22 g/t Au, interpreted to reflect the same mineralized zone targeted by Hole AM20-01. The upper parts of the hole contain intersections of 4.54 m of 0.68 g/t Au and 6.10 m of 1.49 g/t Au, but the highlight intersection is 33.89 m of 2.56 g/t Au, which includes 27.22 m of 3.11 g/t Au, which itself includes 12.87 m of 6.23 g/t Au. This intersection lies approximately 60 m below the Trench D-West intersection, demonstrating its down-dip extension. This mineralization remains open at depth and along strike.

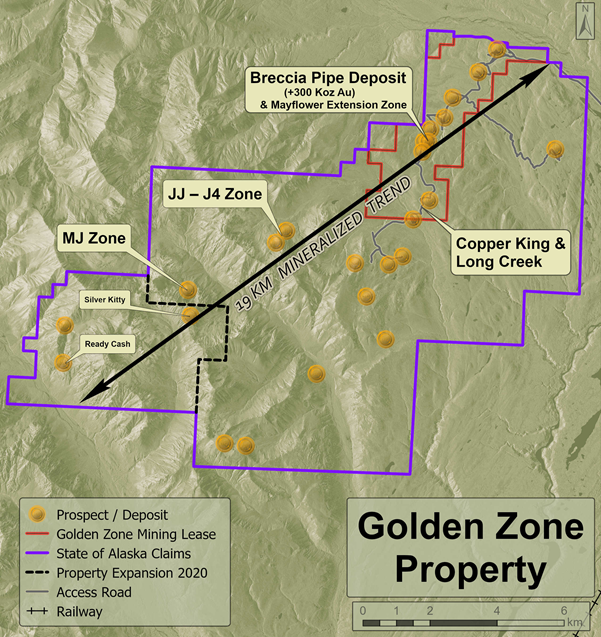

Golden Zone Property, Alaska

A helicopter LiDAR and Orthophoto survey was flown over the entire property.

A 588.7 line km Drone-Mag magnetometer survey was flown over the northern portion of the property covering the Breccia Pipe Deposit area.

Staked an additional 1,975 hectares (4,880 acres) of claims adjoining the southwestern portion of the property along the strike extension of the newly discovered MJ mineral occurrence (grab samples of 5.17 g/t Au and 4.2 g/t Au plus 2.77% Cu) extending the mineralized trend to 19 kilometres in strike length and overall property size to 125.3 sq km (see Figure 3). Three mineral occurrences are located on the newly staked area known as Silver Kitty, Ready Cash and Canyon Creek.

Immediately west of the Silver Kitty occurrence, described as a chalcopyrite and sphalerite bearing skarn adjacent to a porphyritic stock, a grab sample returned 12.5 g/t Au. This sample is located approximately 500 m southwest and on trend with the MJ discovery.

At the Ready Cash occurrence, a grab sample returned 0.4 g/t Au, 17.7 g/t Ag and 4.7% Cu (see press release dated September 30, 2020).

It should be noted that, due to their selective nature, assay results from grab samples noted may not be representative of the overall grade and extent of mineralization on the subject areas. All drill core assays and trench results noted above are presented in core/sample lengths as at this time there is insufficient data with respect to the orientation of the mineralized intersections to calculate true widths.

Jungo, Nevada

While no field work was conducted during 2020, work permits were approved and granted late in the year. The 1,960-hectare Jungo property, located within the prolific Humboldt trend in north-western Nevada and proximal to the 7 Moz Au Sleeper and 25 Moz Au Hycroft deposits, is now permitted for exploration work activities including drilling. The property has several immediately available drill targets situated within a 5 km long NE-SW trending zone of Au + Cu mineralization.

2020 Corporate Activity Highlights

Promoted Steve Roebuck, P. Geo to President.

Raised $3.7 million as a private placement between Eric Sprott and Crescat Capital LLC primarily for exploration activities on the Amanita project, Alaska and general corporate purposes.

Purchased the Amanita NE property, which is a 418 hectare Uplands Mining Lease, located 6.5 km east of Kinross Gold's Fort Knox Gold Mine and immediately west of Kinross Gold's Gil deposit in the Fairbanks Mining District. Upon completion of the purchase Avidian flew a high-resolution LiDAR and Orthophoto survey over the entire property, and a drone magnetic survey at 25 m line spacing (212.9 line km).

Converted 1,320 acres (5.3 sq km) of its 3,607 acre (14.6 sq km) Amanita property to an Uplands Mining Lease. The Amanita Mining Lease is valid for 20 years and conveys the exclusive right to explore for minerals within the leased area and the exclusive right to mine, extract and remove all minerals subject to obtaining all the required permits and approvals necessary to be able to mine and produce from the lease area.

On October 28, 2020, Avdian commenced trading on the OTCQB Venture marketplace ("OTCQB") under the ticker symbol "AVGDF". Listing on the OTCQB will increase exposure in the US and make trading in Avidian stock much more accessible to U.S. investors.

Avidian's majority controlled private subsidiary High Tide Resources Corp. completed a four hole, 999 m drilling program on its Labrador West Iron ore property, designed to test the lithological and grade continuity between several key and widely spaced historical Rio Tinto Exploration Canada Inc. drill holes completed on the property from 2010 to 2012. The property (2,475 hectares) is well located with respect to infrastructure and in close proximity to the Rio Tinto - Iron Ore Company of Canada's 23 MTPY Carol Lake iron ore mining operations. High Tide acquired the Property in August 2019 through an option agreement with Altius Resources Inc. ("Altius"). Highlight results include (see press release dated November 11, 2020 for further details):

Hole 20LB0056

35.3% Total Fe over 25.7 metres and 33.8% Total Fe over 60.0 metres

Hole 20LB0057

29.6% Total Fe over 314.7 metres

Hole 20LB0058

26.9% Total Fe over 115.7 metres and 31.0% Total Fe over 57.2 metres

Hole 20LB0059

26.8% Total Fe over 321.5 metres

Two of the four holes, 56 and 58, were stopped while still in high-grade iron oxide mineralization due to bad ground conditions.

2021 Activities Plan

Avidian currently holds three major property blocks, two in Alaska and one in Nevada. Each of these properties represent large land positions in recognized, prolific gold belts where historically multi-million ounce deposits have been discovered. All three properties are at an advanced exploration stage and either host a resource or have drill/trench intercepts of economic interest. They also have historical databases and multiple identified drill ready targets. In 2021, Avdian's focus will be dominantly on the Amanita and Golden Zone properties.

Amanita and Amanita NE, Alaska

Follow-up drilling to expand strike and depth of mineralized zones intersected in 2020 particularly in the vicinity of hole AM20-2

Scout drilling on targets not tested in 2020

Property-wide soil survey to identify new anomalies to drill test

Golden Zone, Alaska

Resource Expansion Drilling at Breccia Pipe Deposit and MEZ area

Scout drilling at Copper King area

Further mapping and sampling at new discovery areas to expand their footprint and produce drill targets

Expand existing drone magnetic survey to the southwest.

Additional soil sampling

Jungo, Nevada

- If warranted and appropriately funded, initial drilling of established targets.

Corporate - Additional Value Creation

Assist in High Tide's go public event in the first half of 2021and spin out the public shares of High Tide to Avidian shareholders in a tax efficient manner.

Continue to increase the visibility of Avidian especially in the U.S through Avidian's OTCQB listing where there is a high level of interest in domestic gold exploration projects.

Convert the balance of the State of Alaska claims at Amanita into the existing Uplands Mining Lease.

Background Information on the Golden Zone Property

The property is located 320 km north of Anchorage, Alaska and is conveniently accessed by a 16 km road west of the main highway between Anchorage and Fairbanks, which is also the main corridor for power and rail between the two cities. The property covers an area of 125.3 sq. km.

High grade gold ± base metal mineralization (> 4 g/t Au to > 25 g/t Au) spatially related to intrusions which are believed to be at shallow depths extends along a strike length of 19 km. Mineralization styles include quartz-arsenopyrite-base metal sulphide veins and stockworks, local semi-massive sulphide skarn mineralization and replacement style mineralization in conglomerate. The multitude of large footprint targets at Golden Zone indicates this property has district scale potential.

The property currently hosts a NI 43-101 resource Indicated gold resource of 267,400 ounces (4,187,000 tonnes at 1.99 g/t Au) plus an Inferred gold resource of 35,900 ounces (1,353,000 tonnes at 0.83 g/t Au).

Background Information on the Amanita Property

The Amanita property is comprised of an Uplands Mining Lease and State of Alaska claims totalling 1,460 hectares (14.6 sq. km) and is located 15 km northeast of Fairbanks, Alaska, and approximately 5 km southwest and contiguous to the Fort Knox open-pit gold mine.

The Amanita Property represents an opportunity to identify one or more oxide gold resources within the Tonsina Trend structural corridor that extends directly onto the adjacent Fort Knox gold mine property. Historical drilling along this corridor (referred to as the Tonsina Trend) indicates that oxide gold mineralization extends from surface to a depth of at least approximately 150 m.

Quality Control/Quality Assurance

For precious metal analysis, sampling included insertion of certified standards and blanks into the stream of samples for chemical analysis. Every twentieth surface sample was a standard or a blank. Samples were prepared at ALS Global's laboratory in Fairbanks, Alaska and shipped to their Vancouver facility for gold analysis by fire assay and other elements by ICP analysis. Selected samples were also analyzed by metallic screen analysis. ALS is a certified and accredited laboratory service. Gold results varied from below detection to a high of 22.3 g/t.

For Iron Ore analysis, sample shipments were securely delivered via courier to Activision Laboratories ("ActLabs") in Ancaster, Ontario for sample preparation and analytical testing. Sample preparation was through the laboratory's standard rock preparation protocol that begins with jaw crushing followed by pulverization of a sample split (250 g) to generate a pulp having 95% passing a 0.074 mm screen. Iron (Fe) content was measured using the XRF technique following Lithium Metaborate fusion. Prior to fusion, the loss on ignition (LOI), which includes H2O+, CO2, S and other volatiles, is determined from the weight loss after roasting the sample. The fusion disk is made by mixing the roasted sample with a combination of lithium metaborate and lithium tetraborate. Samples are fused in Pt crucibles using an automated crucible fluxer and automatically poured into Pt molds for casting. Samples are then analyzed on a Panalytical Axios Advanced wavelength dispersive XRF.

ALS and Actlabs are independent of Avidian Gold and High Tide Resources.

Qualified Person

The technical information contained in this news release has been approved by Dr. Tom Setterfield, P.Geo., Vice President Exploration of Avidian and Steve Roebuck, P.Geo, President of Avidian who are Qualified Persons as defined in "National Instrument 43-101, Standards of Disclosure for Mineral Projects."

About Avidian Gold Corp.

Avidian brings a disciplined and veteran team of project managers together with a focus on advanced stage gold exploration projects in Alaska. Avidian's Golden Zone project hosts a NI 43-101 Indicated gold resource of 267,400 ounces (4,187,000 tonnes at 1.99 g/t Au) plus an Inferred gold resource of 35,900 ounces (1,353,000 tonnes at 0.83 g/t Au)*. Additional projects include the Amanita and the Amanita NE gold properties which are both adjacent to Kinross Gold's Fort Knox gold mine in Alaska, and the Jungo gold/copper property in Nevada. *Technical Report on the Golden Zone Property, August 17, 2017, L. McGarry P.Geo & I. Trinder P.Geo, A.C.A Howe International Ltd.

Avidian is the majority owner of High Tide Resources, a private company with an option on the Labrador West iron ore property located in Newfoundland and Labrador, Canada. Avidian is focused on and committed to the development of advanced stage mineral projects throughout first world mining friendly jurisdictions using industry best practices combined with a strong social license from local communities. Further details on the Corporation and the individual projects, including the NI 43-101 Technical report on the Golden Zone property, can be found on the Corporation's website at www.avidiangold.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-looking information

This News Release includes certain "forward-looking statements". These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, project development, reclamation and capital costs of the Company's mineral properties, and the Company's financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws

Figure 1: Amanita Property, Alaska

Orientation Map

Figure 2: Amanita Property - 2020 Drill Hole Locations

Figure 3: Golden Zone Property

SOURCE: Avidian Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/627610/Avidian-Golds-Review-of-2020-Highlights-and-2021-Exploration-Plans