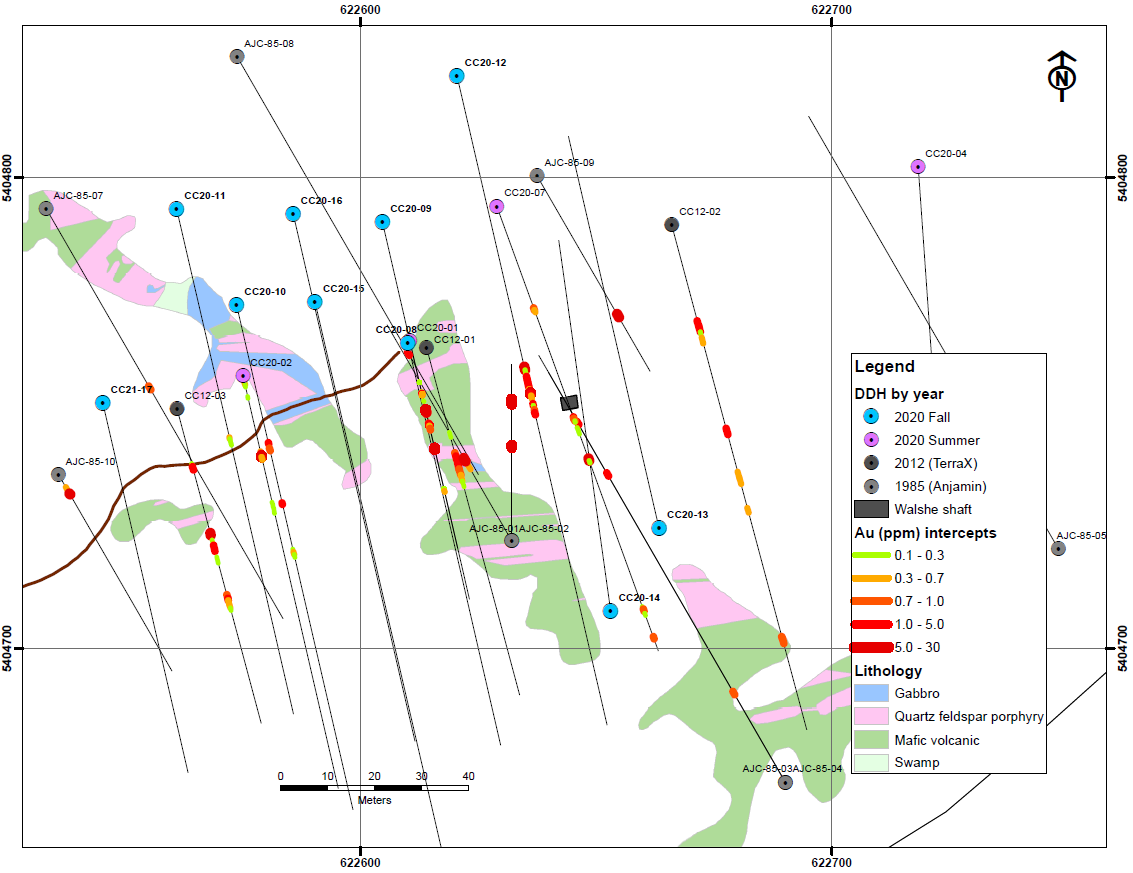

VANCOUVER, BC / ACCESSWIRE / February 18, 2021 / FALCON GOLD CORP. (TSXV:FG)(GR:3FA)(OTC PINK:FGLDF); ("Falcon" or the "Company") is pleased to provide an update on its fall 2020 drilling program at the Central Canada gold mine. The Company has received the preliminary analyses for holes, CC 20-10, CC20-11 and the upper half of CC20-12. There remains outstanding in addition to the balance of CC20-12, the analyses for the final 5 holes of the program. Falcon has presently 264 core samples submitted for analyses and anticipates in the order of 250 more samples to be taken from the last three drill holes core. A surface plan of Falcon's 2020 drilling and that of TerraX Minerals (2012) and Anjamin Mines (1966 & 1967) may be found below in Figure One.

Falcon is also pleased to report that each of the three drill holes of this release penetrated the Central Canada main mine trend with gold mineralized intersections including the visible gold core sample from CC20-12 (see Table One). Highlights of the drill intersections for CC20-12 are as follows:

- The Central Canada main gold zone occurred from 89.6m to 102.9m for 14.8m core length;

- The weighted average grade of the main gold zone is 1,570 ppb gold or 1.57 grams per tonne gold ("g/t Au");

- Within the main zone intersections, the first meter of core returned 5.68 g/t Au: and,

- Intersections from 97.4m to 98.6m (1.2m) averaged 6.06 g/t Au which includes the visible gold sample that assayed 20.5 g/t Au over 0.3m.

The Central Canada main gold zone as intersected in drill holes, CC20-10 and -11, was somewhat narrower being approximately 3.5m and mineralized with 0.5% to 2.0% pyrite in silicified and chloritic units and quartz veins. The host rock lithologies include metamorphosed quartz feldspar porphyries, felsic pyroclastic units and mafic volcanic flows and intrusive units, all of which may be intensely altered to such a degree as to obliterate most original features.

The Company's hole, CC20-12 was collared approximately 70m north-north-west of the shaft to target the main gold zone at a vertical depth of approximately 75m. This hole reported entering high-grade gold mineralization of 5.68 g/t Au in a 1m sample at 89.6m within altered porphyry. This intersection was the first of a 14.8m core length zone with an average grade of 1.57 g/t Au. In addition, visible gold was identified in a 0.3m vein at 97.6m that returned an assay of 20.5 g/t Au.

Mr. Karim Rayani, Falcon's Chief Executive Officer, commented, "Our drill program is continuing to expand the potential of the Central Canada gold mine. The results from Falcon's fall drilling gives us more than encouragement that the historic gold resources of this mine were as advertised back in 1934. We have a substantial number of samples pending analysis and look forward to reporting on our findings as soon as the results are available."

Table One. Summary of the of significant intersections of Falcon's 2020 drill holes, CC 20 - 08 & - 09 on the Central Canada gold mine.

Drill Hole | From | To | Length | Gold Analyses | |||||||||||||||||

(m) | (m) | (m) | Au (ppb) | Au (g/t) | Comments | ||||||||||||||||

CC20-10 | 60.0 | 63.5 | 3.5 | 506 | 0.51 | ||||||||||||||||

86.3 | 87.0 | 0.7 | 1,520 | 1.52 | |||||||||||||||||

106.6 | 110.2 | 3.6 | 340 | 0.34 | Central Canada main gold zone from 106.6m to 110.2m for 3.6m length | ||||||||||||||||

41.5 | 43.3 | 1.8 | 239 | 0.24 | |||||||||||||||||

CC20-11 | 99.4 | 102.9 | 3.5 | 228 | 0.23 | Central Canada main gold zone from 131.0m to 165.6m for 34.6m length | |||||||||||||||

41.5 | 43.3 | 1.8 | 239 | 0.24 | |||||||||||||||||

CC20-12 | 89.6 | 104.4 | 14.8 | 1,570 | 1.57 | Central Canada main gold zone from 89.6m to 102.9m for 14.8m length | |||||||||||||||

Incl. | 89.6 | 90.6 | 1.0 | >5,000 | 5.68 | ||||||||||||||||

Incl. | 97.4 | 98.6 | 1.2 | >5,000 | 6.06 | ||||||||||||||||

And | 97.6 | 97.9 | 0.3 | >5,000 | 20.50 | Visible gold in narrow quartz vein in the heart of the main gold zone | |||||||||||||||

Assays pending for samples from 105.0m to 201.0m (End of Hole) | |||||||||||||||||||||

17.0 | 18.1 | 1.0 | 273 | 0.27 | |||||||||||||||||

Color key: | Denotes Au grades better than 0.5 g/t and less than 1.0 g/t | ||||||||||||||||||||

Denotes Au grades better than 1.0 g/t | |||||||||||||||||||||

Qualified Person

The technical content of this news release has been reviewed and approved by Mike Kilbourne, P.Geo., who is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About Falcon Gold Corp., the Central Canada Gold Mine Project and Jack Lake Shear Zone

Falcon is a Canadian mineral exploration company focused on generating, acquiring, and exploring opportunities in the Americas. Falcon's flagship project, the Central Canada Gold Mine, is approximately 20 km south east of Agnico Eagle's Hammond Reef Gold Deposit which has Measured & Indicated estimated resources of 208 million tonnes containing 4.5 million ounces of gold. The Hammond Reef gold property lies on the Hammond fault which is a splay off of the Quetico Fault Zone ("QFZ") and may be the control for the gold deposit. The Central Gold property lies on a similar major splay of the QFZ named the Jack Lake Shear Zone.

History of Central Canada gold mine includes;

1901 to 1907 - Shaft constructed to a depth of 12 m and 27 oz of gold from 18 tons using a stamp mill.

1930 to 1934 - Central Canada Mines Ltd. installed a 75 ton per day gold mill. Development work included 1,829 m of drilling and a vertical shaft to a depth of 45 m with about 42 m of crosscuts and drifts on the 100-foot level. In December 1934 the mine had reportedly outlined approximately 230,000 ounces of gold with an average grade of 9.9 g/t Au.

1935 - With the on-going financial crisis of the Great Depression, the Central Canada Mines was unable to fund operations and the mine ceased operations.

1965 - Anjamin Mines completed diamond drilling and in hole S2 returned a 2 ft section of 37.0 g/t Au and hole S3 assayed 44.0 g/t Au across 7 ft.

1985 - Interquest Resources Corp. drilled 13 diamond holes totaling 1,840 m in which a 3.8 ft intersection showed 30.0 g/t Au.

2010 to 2012 - TerraX Minerals Inc. conducted programs that included line cutting, geological surveys and 363 m of drilling.

2020 - Falcon Gold Corp. completed its inaugural 17-hole program totaling 2,942.5m of core. In addition, the Company acquired by staking 7,477 ha of mineral claims consisting of 369 units immediately south and northwest of Agnico Eagle Mines Ltd.'s Hammond Reef property.

The Company also holds 4 additional projects. The Camping Lake Gold property in the world-renowned Red Lake mining camp; a 49% interest in the Burton Gold property with Iamgold near Sudbury Ontario; the Spitfire-Sunny Boy Gold Claims near Merritt, B.C.; and most recently, the Springpole West Property near Red Lake, Ontario.

Figure One: Plan of the 2020 drill program showing the Falcon, TerraX and Anjamin drill holes, project to surface. Note Falcon's holes CC20-13 to -17 results are pending the receipt of assays.

CONTACT INFORMATION:

Falcon Gold Corp.

"Karim Rayani"

Karim Rayani

Chief Executive Officer, Director

Telephone: (604) 716-0551

Email: info@falcongold.ca

Cautionary Language and Forward-Looking Statements

This news release may contain forward looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Falcon Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/630490/Falcon-Reports-on-Its-2020-Central-Canada-Drill-Program-Hitting-Grades-as-High-as-205-gt-from-the-Visible-Gold-Intercept