- Inferred zinc-equivalent ("Zn-Eq") sulfide resource up 105% from 2017 estimate.

- Inferred Zn-Eq sulfide-mixed-oxide resource estimate up 64% from 2017 estimate.

- Total contained metal - Measured and Indicated: 0.65 billion pounds Zn-Eq.

- Total contained metal - Inferred: 3.39 billion pounds Zn-Eq at 10.9% Zn-Eq.

- Total contained silver - Inferred: 5.39 million oz.; Meas. & Ind: 1.2 million oz.

DENVER, CO / ACCESSWIRE / February 23, 2021 / Solitario Zinc Corp. ("Solitario") (NYSE American:XPL)(TSX:SLR) is pleased to report a significant Mineral Resource increase for its high-grade Florida Canyon zinc project in northern Peru. Solitario's joint venture partner, Nexa Resources S.A. (NYSE: NEXA; TSX: NEXA) ("Nexa"), completed a new resource estimate incorporating the results of the 2018/2019 drilling program and reinterpreting portions of the previous resource model. Solitario, through the work of an independent third-party consultant, has verified Nexa's resource estimate. Solitario will issue a new NI-43-101 compliant resource report before the end of March. Nexa is the world's fourth largest zinc miner and operates three underground zinc mines and a major zinc smelter in Peru and two zinc mines and two zinc smelters in Brazil.

The 2021 Mineral Resource Estimate is a mine plan constrained resource that takes into consideration various NSR cutoff grades, depending on mining method. All 2021 additions to the resource were in the Inferred Resource Category. The table below provides summary estimates for all resource categories.

2021 Florida Canyon Mineral Resource Estimate

Category | Tonnes Millions | Zinc % | Lead % | Silver g/t | ZnEq % | Contained Metal Zinc-Equivalent Billion Lbs. | Contained Silver Million Ozs. |

Measured | 0.81 | 11.32 | 1.40 | 15.4 | 12.78 | 0.29 | 0.40 |

Indicated | 1.63 | 10.28 | 1.31 | 14.9 | 11.66 | 0.42 | 0.78 |

M + I | 2.44 | 10.63 | 1.34 | 15.05 | 12.04 | 0.65 | 1.18 |

Inferred | 14.86 | 9.63 | 1.26 | 11.3 | 10.89 | 3.57 | 5.39 |

Notes to Mineral Resource Table:

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources have an effective date as of February 2, 2021.

- Mineral Resources are reported using mining cut off values of US$41.40/t NSR for Sub-Level Stoping, US$42.93/t for Cut and Fill and US$40.61/t for Room and Pillar mining methods.

- Forecast long term metal prices used for the NSR and Zn-Eq calculations are: Zn: US$2,816/t (US$1.27/lb); Pb: US$ 2,249/t (US$1.02/lb) and Ag: US$19.40/oz. Zn-Eq calculations do not take into account metallurgical recoveries.

- Minimum mining thickness is 3 meters for Sub-Level Stoping and Cut and Fill, and 4 meters for Room and Pillar mining methods.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Project Resources are reported on a 100% ownership basis.

- Numbers may not add due to rounding.

Overall Inferred Resource Increase, 2021

Mineralization at Florida Canyon consists of zinc, lead and silver contained in sulfide minerals, oxide minerals and mixed sulfide-oxide mineralization. Overall, contained Zn-Eq metal in the 2021 Inferred Resource, including all ore types, increased 64% compared to the 2017 resource estimate - from 8.8 million ore tonnes at 11.8% Zinc Equivalent ("Zn-Eq") to 14.9 million tonnes at 10.9% Zn-Eq, with an expansion of more than 6.0 million tonnes.

Inferred Sulfide Resource Doubles

The 2018/2019 drilling program was specifically designed to identify new NI-43-101 compliant sulfide resources at Florida Canyon. This objective was achieved with an overall 105% gain in Inferred Zn-Eq contained metal in sulfide resources compared to the 2017 Inferred Zn-Eq sulfide resource estimate. A comparison of the contained Zn-Eq metal in the inferred sulfide resource in the 2017 estimate versus the 2021 estimate, results in the following increase:

- In the 2017 Inferred Resource Estimate, 59% of the Zn-Eq resources were sulfide

- In the 2021 Inferred Resource Estimate, 78% of the Zn-Eq resources are sulfide

Why is Sulfide Mineralization Important?

The 2017 Preliminary Economic Assessment ("PEA" see SEDAR Filing dated August 8, 2017) demonstrated that mining and processing of Florida Canyon sulfide resources are much more profitable than for oxide and mixed resources. Cash flow estimates in the PEA for its 12.5-year mine life, based on the 2017 resource, illustrated that years 2-7 (mostly sulfide ore) generated approximately $75 million in annual free cash flow, while years 8-12 (mostly oxide+mixed ore) averaged approximately $30 million in annual free cash flow.

In addition to an increased mine life and cash flow, the current, larger resource will also provide the opportunity to assess increasing the production rate from the 2,500 tonnes per day assumed in the PEA, further improving project profitability.

Chris Herald, President and Chief Executive Officer of Solitario, commented:

"The new 2021 Resource Estimate exceeded our most optimistic expectations. With strong zinc demand, a robust $1.30 per pound current zinc price, and future world-wide stimulus infrastructure spending, we view this significant resource addition as providing further underlying asset value to our shareholders.

Exceptional potential to significantly expand the Florida Canyon mineralized system still exists, particularly immediately to the south and east of the current drilling footprint, where several new surface prospects have been recently discovered, demonstrating two parallel north-south corridors in excess of four-kilometers in length, with virtually no drilling. Additionally, mineralization is open to the North and potentially to the West where no drill tests have been conducted beyond an offsetting fault. Other important undrilled prospects, defined by geochemistry and geologic setting, are located even further north on the property.

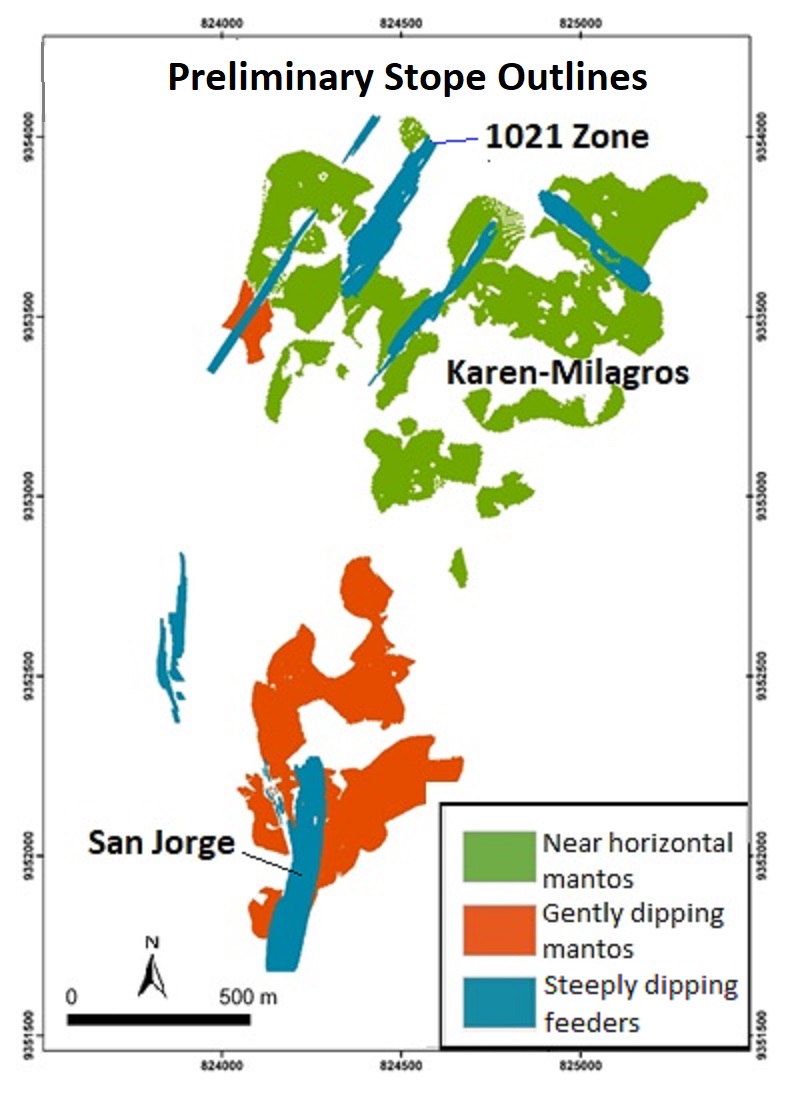

The results of the 2018/2019 Florida Canyon drilling program were very successful in achieving our three most important near-term objectives: 1) expanding the steeply dipping San Jorge deposit to the south of previously reported resources and expanding its associated high-grade horizontal mantos to the east; 2) discovering and partially defining the new 1021 Zone in the north central part of the previously drilled footprint over a minimum strike length of 800 meters; and 3) extending a number of horizontal mantos throughout the drilling footprint.

We want to congratulate Nexa for their hard work and commitment in advancing the Florida Canyon project. We are impressed with Nexa's strong social commitment to the communities surrounding the property, including a significant program of local employment and ongoing road-building efforts to better connect communities to each other and the greater regional transportation network."

Exploration Potential | Planned Activities

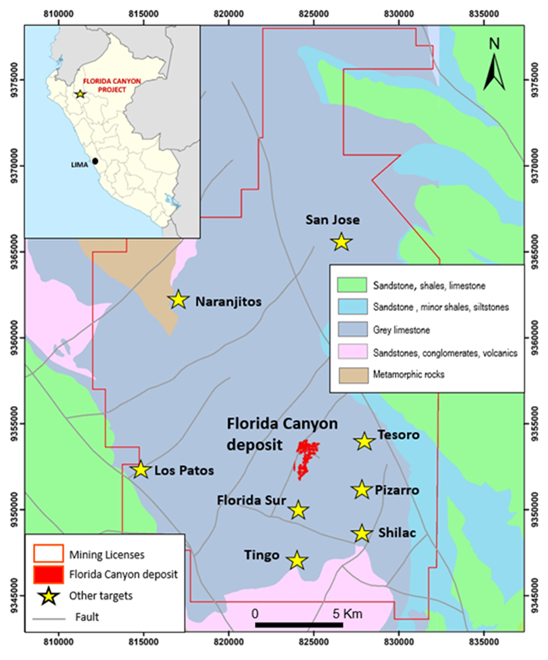

Several exploratory targets have been identified immediately south, north, east and west of the Florida Canyon deposit with mineralized outcrops, as shown in Figure 1. The targets to the south appear to be extensions to the Florida Canyon mineralized corridor. Drill testing some of these satellite targets is planned as they have the potential to significantly increase the mineral resource at the Florida Canyon Project.

Figure 1. Regional Exploration Prospects, Florida Canyon Property

All technical information which is included in this statement has been reviewed and approved by Donald E. Hulse, VP Mining of Gustavson Associates LLC. Mr. Hulse is independent of the Company and a qualified person, pursuant to the meaning of such terms in National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Information contained within this release is reported under Nexa's quality control program reviewed by Mr. Walt Hunt, COO for Solitario Zinc Corp., who is a qualified person as defined by National Instrument 43-101.

Background Information on Florida Canyon

The Florida Canyon resource is located within 16 contiguous mining concessions covering approximately 12,600 ha (31,100 acres). All of these concessions are currently titled. Surrounding the Florida Canyon resource area concessions are an additional 37 contiguous concessions covering approximately 27,900 hectares (68,940 acres) that are held within the Chambara joint venture with Nexa.

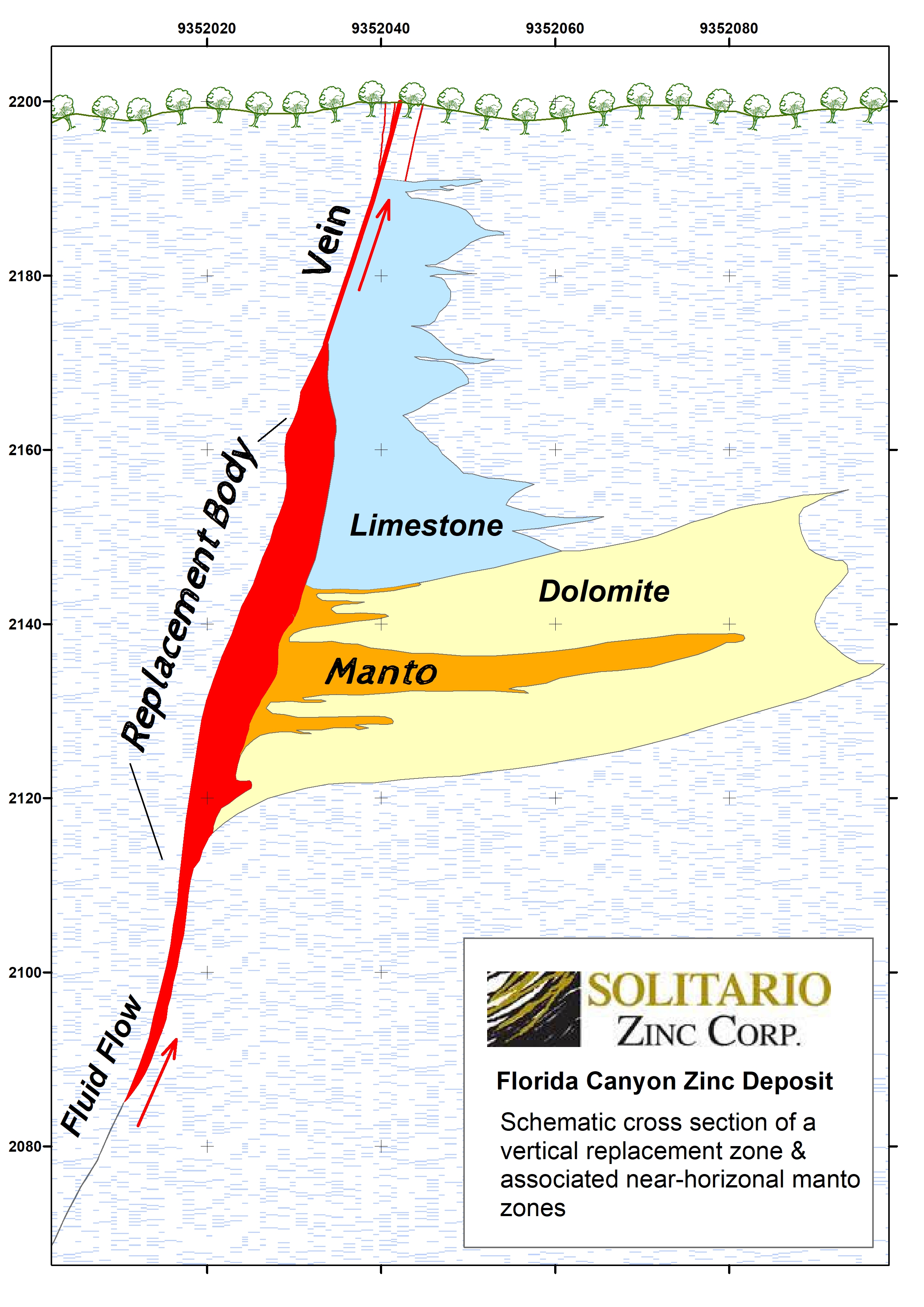

The Florida Canyon deposits are "Mississippi Valley" type where the zinc, lead, silver mineralization is associated with hydrothermal dolomitized zones. High energy facies of the original limestones belonging to the Chambara Formation of Upper Triassic-Lower Jurassic age, are characterized by high porosity and permeability. These lithologies were subsequently altered by dolomitization, further enhancing porosity and permeability, providing a favorable environment for the deposition of zinc mineralization within these preferred stratigraphic horizons (Manto style ore).

A second, and potentially more important style of mineralization, are near-vertical ore bodies such as the San Jorge and 1021 zones. These larger zones are controlled by structures and can be high-grade. Figure 2 is a schematic cross section of a vertical replacement zone and associated near-horizonal manto zones. Figure 3 is a simplified map of the Florida Canyon deposits illustrating the distribution of mantos and steeply dipping feeders (replacement deposits).

Figure 2. Schematic Cross Section

Figure 3. Distribution of Ore Zones

Terms of the Florida Canyon Joint Venture

Solitario owns a 39% interest and Nexa owns a 61% indirect interest in the Florida Canyon project. Nexa can earn a 70% interest in the Florida Canyon project by continuing to fund all project expenditures and committing to place the project into production based upon a positive feasibility study. After earning 70%, and at the request of Solitario, Nexa has further agreed to finance Solitario's 30% participating interest for construction through a project loan. Solitario will repay the loan facility through 50% of its net cash flow distributions from production.

About Solitario

Solitario is an emerging zinc exploration and development company traded on the NYSE American ("XPL") and on the Toronto Stock Exchange ("SLR"). Solitario holds 50% joint venture interest in the high-grade, open-pittable Lik zinc deposit in Alaska and a 39% joint venture interest (Nexa Resources holds the remaining 61% interest) on the high-grade Florida Canyon zinc project in Peru. Solitario recently acquired the early stage Gold Coin property in Arizona that has potential to host gold mineralization. Solitario's Management and Directors hold approximately 9.6% (excluding options) of the Company's 58.2 million shares outstanding. Solitario's cash balance and marketable securities stand at approximately US$7.9 million. Additional information about Solitario is available online at www.solitariozinc.com

FOR MORE INFORMATION ABOUT SOLITARIO, CONTACT:

Valerie Kimball

Director - Investor Relations

(720) 933-1150

(800) 229-6827

Christopher E. Herald

President & CEO

(303) 534-1030, Ext. 14

Cautionary Statement Regarding Forward Looking Information

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933 and the U.S. Securities Exchange Act of 1934, and as defined in the United States Private Securities Litigation Reform Act of 1995 (and the equivalent under Canadian securities laws), that are intended to be covered by the safe harbor created by such sections. Forward-looking statements are statements that are not historical fact. They are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and address activities, events or developments that Solitario expects or anticipates will or may occur in the future, and are based on current expectations and assumptions. Forward-looking statements involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Such forward-looking statements include, without limitation, statements regarding the Company's expectation of the projected timing and outcome of engineering studies; expectations regarding the receipt of all necessary permits and approvals to implement a mining plan, if any, at Lik or Florida Canyon; the potential for confirming, upgrading and expanding zinc, lead and silver mineralized material; future operating and capital cost estimates may indicate that the stated resources may not be economic; estimates of zinc, lead and silver grades of resources provided are predicted and actual mining grade could be substantially lower; estimates of recovery rates for could be lower than estimated for establishing the cutoff grade; and other statements that are not historical facts could vary significantly from assumptions made in the Resources Estimate. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. Although Solitario management believes that its expectations are based on reasonable assumptions, it can give no assurance that these expectations will prove correct. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among others, risks relating to risks that Solitario's and its joint venture partners' exploration and property advancement efforts will not be successful; risks relating to fluctuations in the price of zinc, lead and silver; the inherently hazardous nature of mining-related activities; uncertainties concerning reserve and resource estimates; availability of outside contractors, and other activities; uncertainties relating to obtaining approvals and permits from governmental regulatory authorities; the possibility that environmental laws and regulations will change over time and become even more restrictive; and availability and timing of capital for financing the Company's exploration and development activities, including uncertainty of being able to raise capital on favorable terms or at all; as well as those factors discussed in Solitario's filings with the U.S. Securities and Exchange Commission (the "SEC") including Solitario's latest Annual Report on Form 10-K and its other SEC filings (and Canadian filings) including, without limitation, its latest Quarterly Report on Form 10-Q. The Company does not intend to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities laws.

SOURCE: Solitario Zinc Corp.

View source version on accesswire.com:

https://www.accesswire.com/631202/Solitario-Reports-Significant-Increase-in-Inferred-Sulfide-Resources-For-Its-Florida-Canyon-Zinc-Project