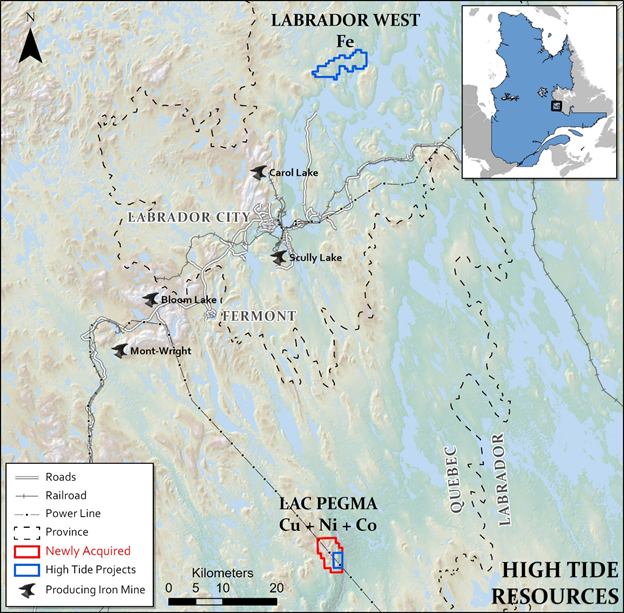

TORONTO, ON / ACCESSWIRE / February 25, 2021 / Avidian Gold Corp (TSXV:AVG)(OTCQB:AVGDF) is pleased to announce that its majority controlled private subsidiary High Tide Resources Corp. ("High Tide or the "Company") has increased its land position by acquiring 35 additional mineral exploration claims adjacent to its Lac Pegma Copper-Nickel-Cobalt sulphide deposit 50 km southeast of Fermont, Quebec in the southern Labrador Trough (see Figure 1). The claims have either been granted or are pending. High Tide now holds a total land package of approximately 2249 hectares.

High Tide's President and VP of Exploration, Steve Roebuck, states: "The demand for EV battery minerals is skyrocketing as we move toward a low-carbon economy. High Tide are currently conducting a desk-top study and preliminary modelling based on a review of the historical exploration data from the Lac Pegma area. The potential for copper-nickel-cobalt resource expansion is very apparent and remains the priority, but we are also seeing high potential for additional mineral discoveries beyond the immediate core area and claim staking secures that for the Company's investors."

High Tide's data review is currently focused on its copper-nickel-cobalt sulphide deposit and the exploration and resource expansion potential. Diadem Resources' 1996 drilling was focused on near surface mineralization with the average hole depth of approximately 100 metres. Presented below is a table of selected drill holes with copper and nickel percentages.

Hole ID | Azimuth (°) | Dip (°) | From (m) | To (m) | Width (m) | Cu (%) | Ni (%) |

96-3 | 270 | 50 | 64.0 | 91.8 | 27.8 | 0.53 | 0.26 |

96-22 | 0 | 90 | 94.5 | 123.0 | 28.5 | 0.44 | 0.34 |

Including | 108.0 | 118.5 | 10.5 | 0.56 | 0.52 | ||

96-24 | 0 | 90 | 70.5 | 123.5 | 53.0 | 0.63 | 0.25 |

96-26 | 0 | 90 | 43.4 | 105.9 | 62.5 | 0.87 | 0.48 |

96-27 | 0 | 90 | 36.4 | 101.3 | 64.9 | 0.63 | 0.57 |

Including | 76.4 | 94.4 | 18.0 | 0.73 | 1.19 | ||

96-28 | 0 | 90 | 63.0 | 83.0 | 20.0 | 0.94 | 0.54 |

Table 1 - 1996 Lac Pegma select results - intercept width is drilled width.

Previous Exploration and 2021 Resource Expansion

Prior to Diadem Resources' 1996 drilling, the first exploration program carried out at Lac Pegma was done by Bellechase Mining circa 1955. A report filed on Quebec's MERN website (GM03714B) provides details of a program that consisted of mapping, sampling and scout drilling using a man-portable back-pack drill.

Twenty-seven holes were drilled to average depth of 70 feet (33 metres) due to reported poor ground conditions and drill limitations. Results were encouraging with Hole 11 reporting 11 metres of 0.49% Cu and 0.30% Ni from 3 metres downhole. Despite the geology being logged as favourable gabbroic sills, dipping moderate to steeply east, most of the holes were not sampled. The logs noted consistent sulphide mineralization including pyrrhotite, chalcopyrite and pentlandite with sulphide percentages ranging from 1 % to 20% over multi-metre intervals while several holes were terminated in highly mineralized zones. No assays were completed for cobalt, platinum or palladium.

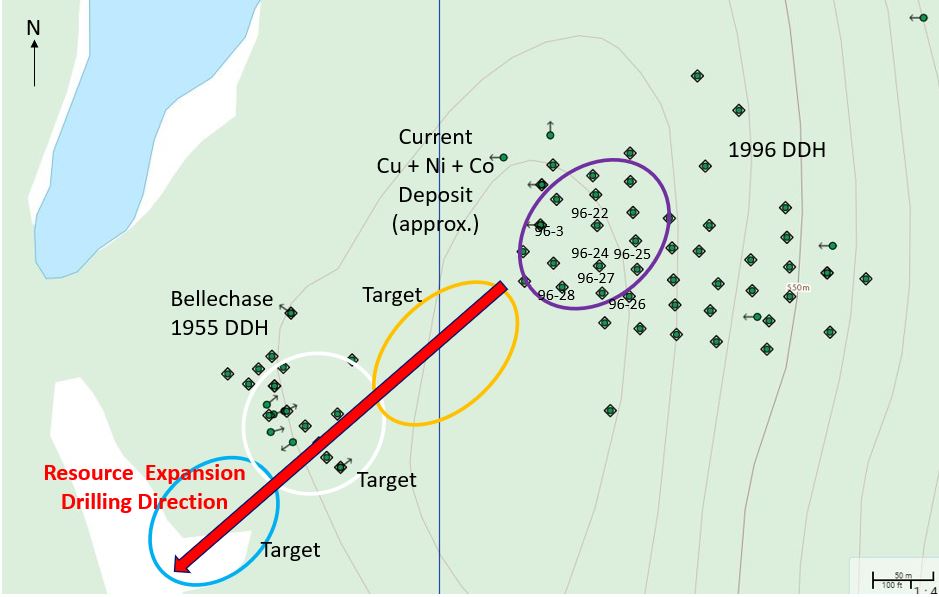

The focus of the 1955 Bellechase program was 250 metres to the southwest of the current copper-nickel-sulphide deposit creating a number of high-priority exploration targets for potential resource expansion drilling in 2021. Prior to drilling, a drone-magnetic geophysical survey will be conducted to further refine targets - see Figure 2.

Figure 2 - Plan map showing location of 1996 and 1955 drill holes and potential resource expansion toward the southwest

Project Geology

The orthomagmatic sulphide deposit at the Lac Pegma property is hosted within a gabbro to gabbro-ultramafic sill, intruded along the contacts of the Katsao Formation of Mesoproterozoic age. Based on drilling to date, the deposit presents as disseminated to net-textured, with local massive copper, iron and nickel sulphides. Greater accumulations of sulphide content and grades are associated with the basal portion of the intrusion.

These rocks are the equivalent of the Knob Lake District extension south from Labrador, NL. The bedrock geology at the prospect area consists of metamorphosed allochthonous sediments and volcanics that are intruded upon by the Shabogamo Intrusive Suite. The rock types consist of a north trending packages of quartz-biotite gneiss, kyanite gneiss and dolomitic marble represent the original quartzite, siliceous shales and limestone lithologies. Mafic to ultramafic dykes and sills host the mineralization. The Lac Pegma Deposit has undergone amphibolite facies metamorphism and has been complexly folded during the Grenville Orogeny (ca 1.0 Ga).

Figure 1 - Project area showing both Lac Pegma with new claims and the Labrador West Iron Project

Qualified Person Statement

All scientific and technical information disclosed in this news release was prepared and approved by Steve Roebuck, P.Geo., President & VP Exploration of High Tide Resources Corp. who is a Qualified Person as defined by NI 43-101 and has reviewed and approved this news release.

About High Tide Resources Corp.

High Tide is a private corporation that is advancing its Labrador West iron property located in Newfoundland & Labrador and its Lac Pegma copper nickel cobalt property located in Quebec. High Tide is majority owned by Avidian Gold Corp with plans to go public in mid 2021.

The last exploration program completed on Lac Pegma was by Diadem Resources in 1996 drilling 84 short BQ-diameter diamond drill holes totalling a reported 7678 metres. In a report filed on Quebec's MERN website (GM54771) in May 1997, Diadem Resources reported a non NI 43-101 compliant "indicated reserve of 2 million tons of 0.62% Cu, 0.35% Ni and 0.03% Co." * The Lac Pegma deposit was not assayed for platinum or palladium which are elements commonly found in this type of sulphide deposit.

DISCLAIMER: *Please note a Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves.

High Tide Resources has entered into a purchase agreement with Globex Mining Enterprises Inc. ("Globex")(GMX)(GLBXF)(G1MN) to purchase 100% of the Lac Pegma Copper-Nickel-Cobalt sulphide deposit. Please see PR dated February 8, 2021 for more details.

About Avidian Gold Corp.

Avidian brings a disciplined and veteran team of project managers together with a focus on advanced stage gold exploration projects in Alaska. Avidian's Golden Zone project hosts a NI 43-101 Indicated gold resource of 267,400 ounces (4,187,000 tonnes at 1.99 g/t Au) plus an Inferred gold resource of 35,900 ounces (1,353,000 tonnes at 0.83 g/t Au)*. Additional projects include the Amanita and the Amanita NE gold properties which are both adjacent to Kinross Gold's Fort Knox gold mine in Alaska, and the Jungo gold/copper property in Nevada. *Technical Report on the Golden Zone Property, August 17, 2017, L. McGarry P.Geo & I. Trinder P.Geo, A.C.A Howe International Ltd.

For further information, please contact:

Steve Roebuck

High Tide President & VP Exploration

Mobile: (905) 741-5458

Email: sroebuck@avidiangold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

This News Release includes certain "forward-looking statements". These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, project development, reclamation and capital costs of the Company's mineral properties, and the Company's financial condition and prospects, could differ materially from

those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

SOURCE: Avidian Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/631748/High-Tide-Advances-Its-Lac-Pegma-Copper-Nickel-Cobalt-Deposit