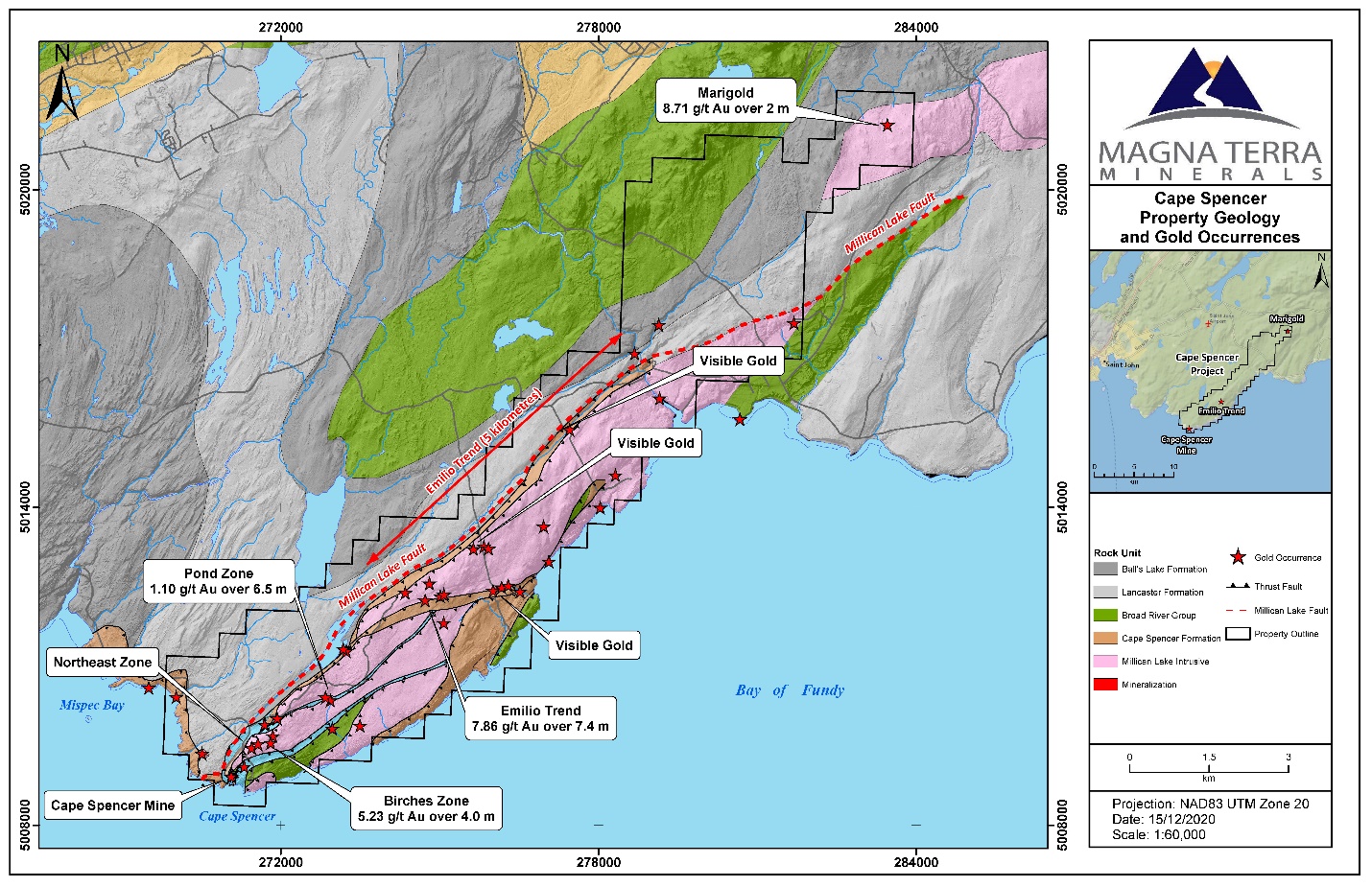

TORONTO, ON / ACCESSWIRE / March 4, 2021 / Magna Terra Minerals Inc. (the "Company" or "Magna Terra") (TSXV:MTT) is pleased to announce that it has started a Phase one, 2,000 metre drill program (the "Drill Program") designed to test the highly prospective Emilio Trend at the Cape Spencer Project ("Cape Spencer" or "Project"), located in southern New Brunswick (Exhibit A).

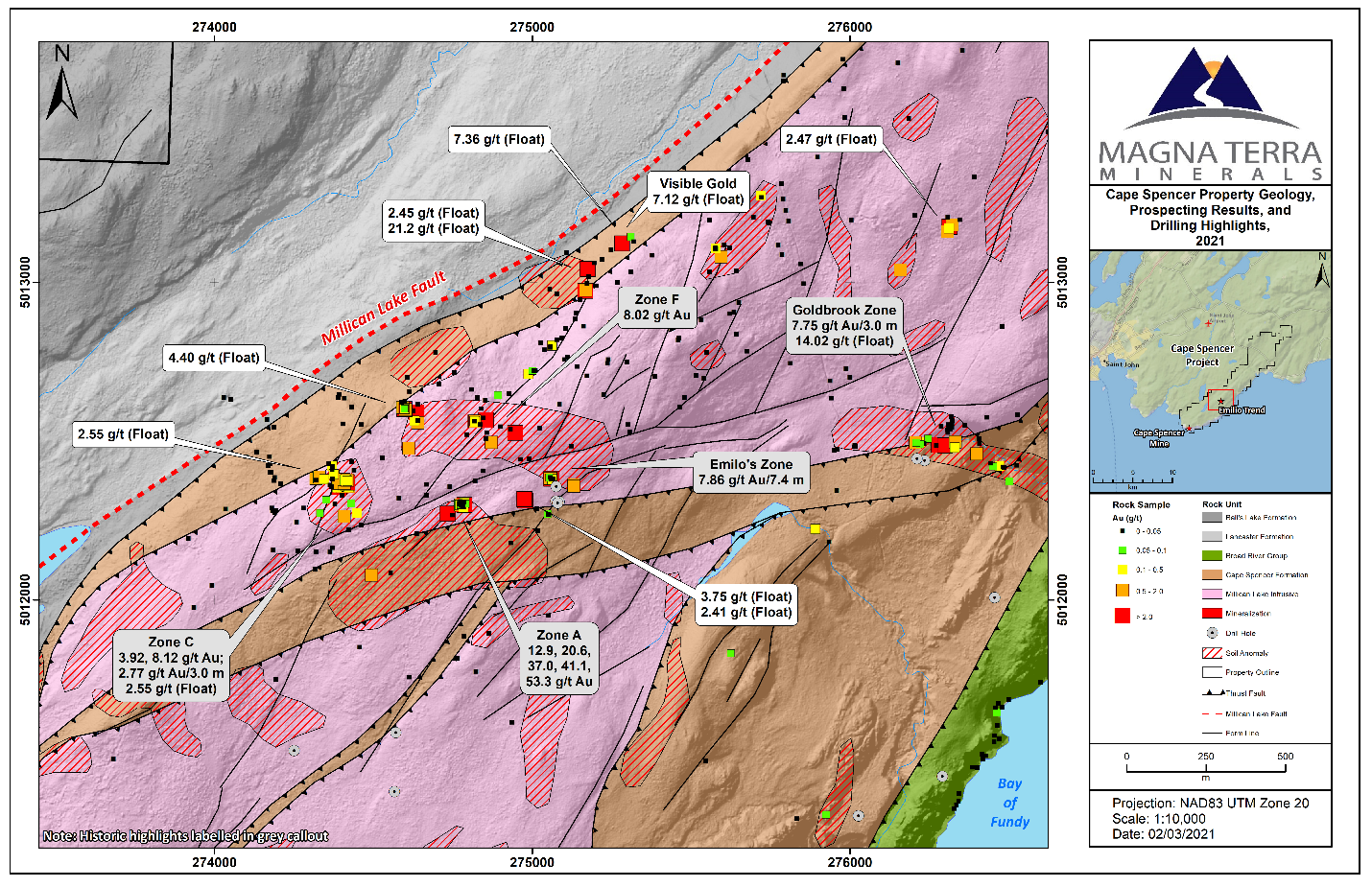

The Drill Program will test priority targets on the western half of the 5-kilometre Emilio Trend based on recent and historic exploration results that demonstrate a strong mineralization system, in multiple gold occurrences. The drill program will target surface gold occurrences, including recent sampling with assays up to 21.2 grams per tonne ("g/t") gold, that are hosted along faulted geological contacts and associated structures as announced in news releases on December 17, 2020 and February 23, 2021 (Exhibit B).

Highlights of the Emilio Trend include:

- 7.86 g/t gold over 7.4 metres in historic drill hole AB-04-06;

- 12.00 g/t gold over 1.4 metres and 2.77 g/t gold over 3.0 metres in historic outcrop chip samples;

- Recent and historic rock float and outcrop grab* samples up to 53.50 g/t gold;

- Numerous visible gold occurrences with 63 of 576 float and outcrop grab* samples assaying over 0.5 g/t gold;

- Emilio Trend footprint expanded to 5.0 kilometres - demonstrating the presence of a large-scale gold mineralizing system; and

- Recognition of multiple NNE striking faults, that are favourable hosts to gold mineralization.

*Grab and float samples are selected samples and are not necessarily representative of mineralization that may be hosted on the property.

"We are pleased to start our first drill program testing the Emilio Trend. This 2,000 metre drill program will test high priority targets that parallel major geological contacts as well as the recently identified structures off the Millican Lake Fault - a regional structure genetically linked to gold mineralization within the Emilio Trend. A cursory, 2004, six-hole program demonstrated the presence of gold mineralization in this area and included an intersection of 7.86 g/t gold over 7.4 metres. We have built on this and demonstrated the presence of a multi-kilometre, large-scale gold bearing system within the Emilio Trend that has the potential to host significant gold deposits. This phase-one program will be an initial test of the western half of this highly prospective part of the Emilio Trend, while we continue to generate new targets along the entire, currently identified 5.0 kilometre strike length."

- Lew Lawrick, President and CEO, Magna Terra Minerals Inc.

Drill Program Details

2,000 metres of diamond drilling will test the western half of the 5.0 kilometre long Emilio Trend. The Emilio Trend is defined by numerous gold occurrences, some with visible gold, soil geochemical anomalies with recent and historic rock float and grab assays up to 53.50 g/t gold; with 63 of 576 float and outcrop grab samples assaying over 0.5 g/t gold. The Emilio Trend has only been tested with cursory drilling (8 holes) to date with the majority of drilling (4 holes; 199 metres) testing one section of the Emilio Zone where drill core assays up to 7.86 g/t gold over 7.4 metres were intersected in near-surface drilling in hole AB-04-06 (Exhibit B).

Mineralization comprises specular hematite and pyrite bearing quartz veins that are hosted within pervasively illite, pyrite and iron-carbonate altered and strongly deformed Millican Lake granite and Cape Spencer formation sediments, the same geological environment hosting the nearby Pit and Northeast Zones. Gold mineralization is hosted both in pyrite-bearing wallrock as well as low-sulphide (pyrite), visible gold bearing, quartz veins as observed in rock float, outcrop and in hole AB-04-06 at the Emilio Trend.

Geological mapping has outlined the importance of two critical structural environments that host gold mineralization; 1) major faulted lithological contacts between the Millican Lake Granite and Cape Spencer formation sediments (hosts to the Northeast and Pit Zone Deposits) and; 2) a series secondary NNE striking fault splays off of the Millican Lake Fault. These fault zones, in certain cases, show strong coincidence with gold-bearing float and grab samples and wallrock alteration expanding the potential host structures for gold mineralization.

The Company has critically considered logistical matters given the ongoing COVID-19 pandemic, to ensure that this Exploration Program and all future programs are executed in a way that ensures the absolute health and safety of our personnel, contractors, and the communities where we operate.

The Company would like to thank the Government of New Brunswick for partial funding of the exploration program under the NBJMAP Program.

Cape Spencer Project Highlights

- 5,045 hectares along 15 kilometres of strike of a regional-scale gold bearing structure - the Millican Lake Fault and associated structures;

- Project is host to large untested gold bearing alteration systems including:

- 5.0 kilometre alteration and gold bearing Emilio Trend with drill intercepts up to 7.86 g/t gold over 7.4 metres;

- Marigold Prospect with drill intercepts up to 8.71 g/t gold over 2.0 metres;

- Birches Zone with drill intercepts up to 5.23 g/t gold over 4.0 metres;

- The Cape Spencer Deposit has an Inferred Mineral Resource Estimate of 1,720,000 tonnes at an average grade of 2.72 g/t gold for 151,000 contained ounces in two zones:

- Northeast Zone - Inferred Mineral Resource of 740,000 tonnes at an average grade of 4.07 g/t gold, for 96,000 contained ounces at a cut-off grade of 2.5 g/t gold in a conceptual underground development; and

- Pit Zone - Inferred Mineral Resource of 990,000 tonnes at an average grade of 1.71 g/t gold, for 54,000 contained ounces at a cut-off grade of 0.5 g/t gold.

**Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. All Mineral Resource Estimates were prepared in accordance with NI 43-101 and the CIM Standards (2014). Please refer to the NI 43-101 Technical Report with effective date January 23, 2019 by Harrington and Cullen (2019) as detailed below for the Cape Spencer Project. See further details on Technical Reports below.

Note: Analytical results in this press release section are sourced in the Cape Spencer Project Technical Report (2019) - see "Technical Reports and Documentation Notes" below; "grab samples" are selected samples and are not necessarily representative of mineralization that may be hosted on the property.

Qualified Person and Technical Reports

This news release has been reviewed and approved by David A. Copeland, P. Geo., Chief Geologist with Anaconda Mining Inc., a "Qualified Person", under National Instrument 43-101 - Standard for Disclosure for Mineral Projects. Widths from drill core intervals reported in this press release are presented as core lengths only. True widths are unknown. All quoted drill core sample intervals, grades and production statistics have been compiled from historic assessment reports obtained from the Government of New Brunswick.

All rock float and grab samples referred to in this release were analyzed for gold at ALS Global in North Vancouver, BC ("ALS"), using standard fire assay (30 g) pre-concentration and Atomic Absorption finish methods (method AU-AA23). Overlimit samples were analysed at ALS via gravimetric finish using method AU-GRA21 and select samples assaying >0.5 g/t gold were analysed via screen metallics method AU-SCR21. ALS is a fully accredited firm within the meaning of NI 43-101 for provision of this service.

The Mineral Resource Estimate quoted in this press release regarding the Cape Spencer Project refers to the technical report: "NI 43-101 Technical Report and Mineral Resource Estimate on The Cape Spencer Gold Deposit, Saint John County, New Brunswick, Canada", with an effective date of January 23, 2019, and authored by Michael Cullen, P.Geo. (Independent Qualified Person), and Matthew Harrington, P.Geo. (Independent Qualified Person).

About Magna Terra

Magna Terra Minerals Inc. is a precious metals focused exploration company, headquartered in Toronto, Canada. Magna Terra owns three district-scale, advanced gold exploration projects in the world class mining jurisdictions of New Brunswick and Newfoundland and Labrador. Further, the Company maintains a significant exploration portfolio in the province of Santa Cruz, Argentina which includes its precious metals discovery on its Luna Roja Project, as well as an extensive portfolio of district scale drill ready projects available for option or joint venture.

Forward Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

Some statements in this release may contain forward-looking information. All statements, other than of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding potential mineralization) are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "may", "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, without limitation, failure to establish estimated mineral resources, the possibility that future exploration results will not be consistent with the Company's expectations, changes in world gold markets or markets for other commodities, and other risks disclosed in the Company's public disclosure record on file with the relevant securities regulatory authorities. Any forward-looking statement speaks only as of the date on which it is made and except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement.

FOR FURTHER INFORMATION PLEASE CONTACT:

Magna Terra Minerals Inc.

Lewis Lawrick

President and CEO, Director

647-478-5307

Email: info@magnaterraminerals.com

Website: www.magnaterraminerals.com

Exhibit A: Cape Spencer Project Property Geology and Gold Occurrences

Exhibit B: Emilio Trend Geology and Rock Sample Locations and gold assays, including historic assay highlights

SOURCE: Magna Terra Minerals Inc.

View source version on accesswire.com:

https://www.accesswire.com/633352/Magna-Terra-Initiates-a-2000-Metre-Drill-Program-at-the-Emilio-Trend-Cape-Spencer-Project