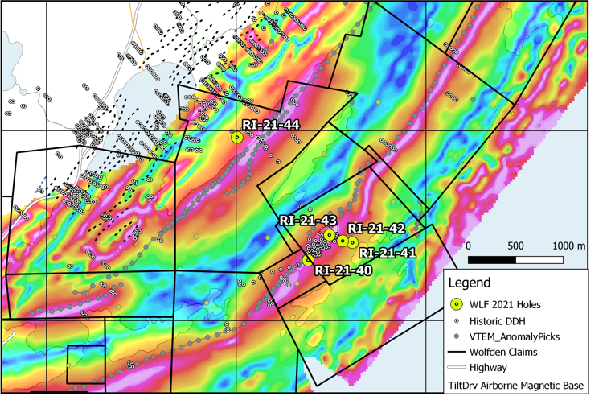

THUNDER BAY, ON / ACCESSWIRE / April 13, 2021 / Wolfden Resources Corporation (TSXV:WLF) ("Wolfden" or the "Company") is pleased to announce that it has completed a 5-hole, 2,300 metre winter diamond drilling program on is wholly owned Rice Island Nickel-Copper-Cobalt-Platinum Group Elements Project in Snow Lake, Manitoba and is waiting for assay results. Three of the four holes that targeted the nickel-rich Keel and Feeder Zones interested encouraging sulphide mineralization and the fourth hole passed below the east-plunging mineralization. The fifth hole, that tested a regional airborne conductor and magnetic target, yielded a 138 metre-long zone with approximately 40% sulphides (pyrite and pyrrhotite). The drill program was funded in part with the support of a $230,000 grant from the Manitoba Government Mineral Development Fund.

![]()

"The drilling was a success with respect to intersecting additional mineralization of the Keel and Feeder zones resulting in the potential to increase the known resources of the deposit (assays pending see Figure 2.), stated Don Dudek V.P Exploration for Wolfden. "The program would have continued with additional holes if the weather had not warmed so early. We will be keen to follow-up the pending assay results, new model insights and down-hole geophysical targets in the next round of drilling".

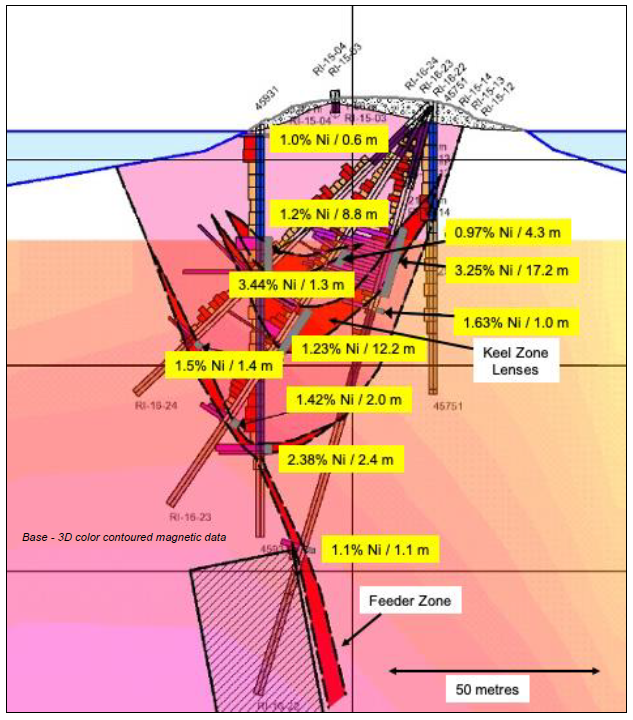

The Keel Zone -Principle Ni-rich mineralization

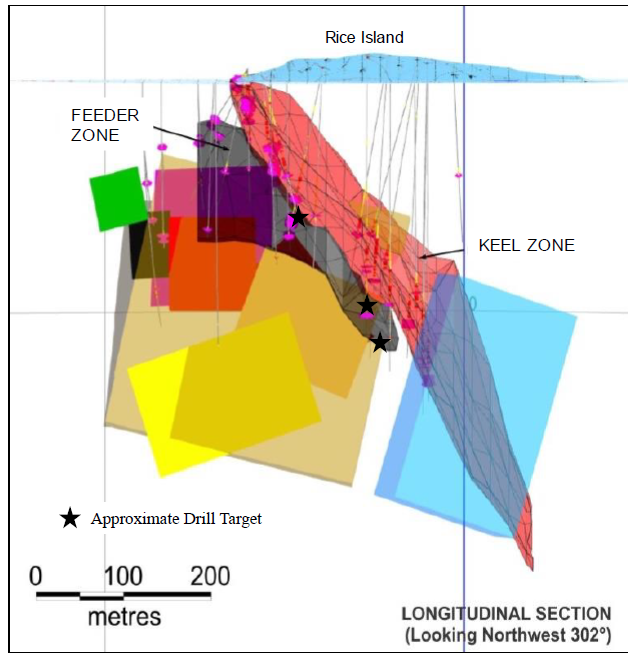

Holes RI-20-42 and RI-20-43 tested a 150-metre gap in the Keel Zone and intersected sulphide mineralization (20-25% sulphides including pyrrhotite/pentlandite with lesser amounts of chalcopyrite) over 22.2 and 24.2 metre intervals including narrower zones of semi-massive to massive sulphide This gap was bound between an up-plunge hole that returned 0.61% Ni and 0.39% Cu over 43.3 metres3 (no previous Co or PGE assays, ~20 m true width) and a down-plunge hole that returned 0.60% Ni and 0.45% Cu over 18.5 metres3 (no Co or PGE assays, ~10 m true width) (see Figure 2). Assays are expected within the next 8 weeks. True widths of the recent drill intersections are uncertain at this time.

The Feeder Zone - Feeder to the Keel Zone

Hole RI-21-40 was drilled to test the Feeder Zone, that occurs below the Keel and was the principal conduit of the Keel Zone mineralization (see model cross section Figure 4.), and intersected a 3-metre-wide zone estimated to contain 5-10% combined millerite (mineral containing approximately 65% nickel) and associated pyrrhotite/pentlandite (mineral containing 30-35% nickel). This hole also intersected thermal alteration zones beyond the Feeder Zone that may be indicative of additional mineralization nearby and will be followed-up with additional drilling depending on further review of the down-hole geophysical data and assay results.

Bore hole electromagnetic surveys (BHEM) were completed down holes RI-21-40, 41 and 42. Preliminary results indicate in-hole anomalies associated with the sulphide mineralization in holes RI-40 and 42. A complete interpretation is the BHEM survey data is pending.

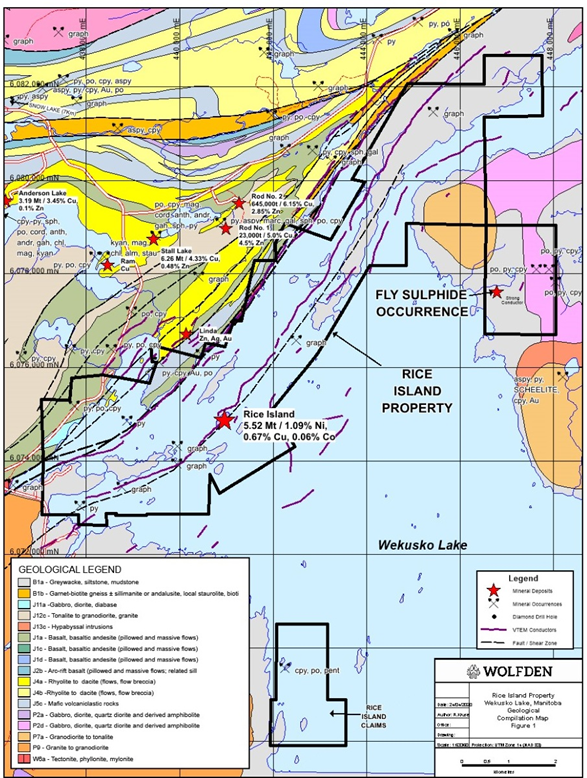

The Regional Target - Gold Potential

Hole RI-21-44 was drilled approximately 1 km west of the Rice Island deposit to test an airborne conductor and coincident magnetic target that occurs close to the main contact between the Wekusko Lake sediments and the Snow Lake volcanic belt. The hole intersected 138-metre long zone with approximately 40% sulphides (pyrite and pyrrhotite) within a quartz veined graphitic sedimentary host rock. Assays (more focused on precious metals) are pending and the true width is uncertain at this time.

A review of the historic data indicates several holes, along strike from the same magnetic feature related to the Rice Island Deposit (see Figure 1.), had intersected narrow ultramafic intervals and zones of interpreted thermal alteration. Untested geophysical anomalies are also noted in several areas along the trend of the Nickel Island mineralization. Further testing of these targets is warranted due to their potential for hosting additional nickel sulphide mineralization.

About the Rice Island Deposit

The Rice Island Ni-Cu-Co-PGE sulphide deposit is comprised of a 'keel' of higher-grade mineralization where previous drilling returned intercepts of up to 14.7 metres grading 3.63% nickel, 1.13% copper, 0.12% cobalt (March 22, 2016, true width approx. 5m) and a 'feeder-dyke-type' zone that returned intercepts of up to 21.1 metres of 2.4% nickel, 1.3% copper and 0.16 g/t PGE2 (April 12, 2016, true width approx. 10.6m). A historical inferred mineral resource (non 43-101 compliant) was reported as 5.5 million tonnes at a grade of 1.1% nickel, 0.7% copper and 0.07% cobalt1. The Keel Zone has been traced for 600 metres and remains open down-plunge while the Feeder Zone is open along strike and at depth. The Feeder Zone was not included in the historical inferred resource.

About Wolfden

Wolfden is an exploration and development company focused on high-margin metallic mineral deposits. Its wholly owned Pickett Mountain Project is one of the highest-grade polymetallic projects in North America (Zn, Pb, Cu, Ag, Au). This relatively advanced project in northern Maine is well-located near excellent infrastructure that will support near term development as detailed in a Preliminary Economic Assessment date September 14, 2020.

For further information please contact Ron Little, President & CEO, at (807) 624-1136 or Rahim Lakha, Corporate Development at (416) 414-9954.

The information in this news release has been reviewed and approved by Don Dudek, P. Geo., VP Exploration and Ron Little P.Eng., President and CEO, who are Qualified Persons' under National Instrument 43-101.

1The potential tonnage and grade of the historical resource is conceptual in nature. There has been insufficient exploration of this deposit to define a Mineral Resource and it is uncertain if further exploration will result in the historical resource being delineated as a Mineral Resource

2Wolfden Sample analyses includes holes with 15, 16 and 17 in central portion of hole designation. Wolfden adheres to strict Quality Assurance and Quality Control protocols, including routine insertion of blanks and certified reference standards in each sample batch, that is sent to the lab for analyses. Drill core was cut with a diamond saw on site, with one half retained by the Company and the other half shipped by Gardewine North, to Activation Laboratories in Dryden, Ontario. Samples were analyzed for Au, Pd and Pt by fire assay with ICP-OES finish (Code 1C-OES) and were also analyzed by multi-element assays using peroxide fusion and ICPOES finish (Code 8 Peroxide ICP-O.

3QAQC procedures for historic holes are unknown. During the 2015-2017, Wolfden completed a series of holes into the deposit, with holes returning Ni and Cu results similar to those obtained during the historic drilling programs. However, the reader must be cautioned that an independent review of the historic results and how they compare to the Wolfden results, has not been carried out.

Cautionary Statement Regarding Forward-Looking Information

This press release contains forward-looking information (within the meaning of applicable Canadian securities legislation) that involves various risks and uncertainties regarding future events. Such forward-looking information includes statements based on current expectations involving a number of risks and uncertainties and such forward-looking statements are not guarantees of future performance of the Company, and include, without limitation, metal price assumptions, cash flow forecasts, projected capital and operating costs, metal or mineral recoveries, mine life and production rates, and other assumptions used in Preliminary Economic Assessment dated September 14, 2020, information about future activities at the Pickett Mountain Project that include plans to complete additional drilling and pre-permitting (rezoning petition), the results of the Preliminary Economic Assessment dated September 14, 2020, the potential upside of the Pickett Mt. Project, and the timing and completion of drill programs in Maine, Manitoba and New Brunswick and the respective drill results. There are numerous risks and uncertainties that could cause actual results and the Company's plans and objectives to differ materially from those expressed in the forward-looking information in this news release, including without limitation, the following risks and uncertainties: (i) risks inherent in the mining industry; (ii) regulatory and environmental risks; (iii) results of exploration activities and development of mineral properties; (iv) risks relating to the estimation of mineral resources; (v) stock market volatility and capital market fluctuations; and (vi) general market and industry conditions. Actual results and future events could differ materially from those anticipated in such information. This forward-looking information is based on estimates and opinions of management on the date hereof and is expressly qualified by this notice. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada at www.sedar.com. The Company assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1. Rice Island Drill Hole Plan on Airborne Geophysics

Figure 2. Rice Lake Deposit Longitudinal Section (Keel Plunging to East)

Figure 3. Rice Lake Deposit Isometric Longitudinal Section

Figure 4. Rice Island Deposit Cross-section through Keel Zone showing Feeder Zone below

Figure 5. Rice Island Regional Geology Map and Wolfden Landing Holdings (black outline)

SOURCE: Wolfden Resources Corporation

View source version on accesswire.com:

https://www.accesswire.com/640099/Wolfden-Reports-on-Rice-Island-Drill-Program-Snow-Lake-Manitoba