VANCOUVER, BC / ACCESSWIRE / April 14, 2021 / BeMetals Corp. (TSXV:BMET)(OTCQB:BMTLF)(Frankfurt:1OI.F) (the "Company" or "BeMetals) is pleased to announce it has received encouraging exploration drilling results from its 2020 field program at the Pangeni Copper Project ("Pangeni" or the "Project" or the "Property") in Zambia. The laboratory results from the 2020 drilling campaign highlight both the compelling focused exploration potential at the D-Prospect and generated additional priority targets for testing during this year's field program.

The Pangeni Project is located on the prospective western extension of the Central African Copperbelt in Zambia (the "Zambian Copperbelt") where copper mineralization discovered on the Property is covered by a thin veneer of Kalahari sand.

HIGHLIGHTS:

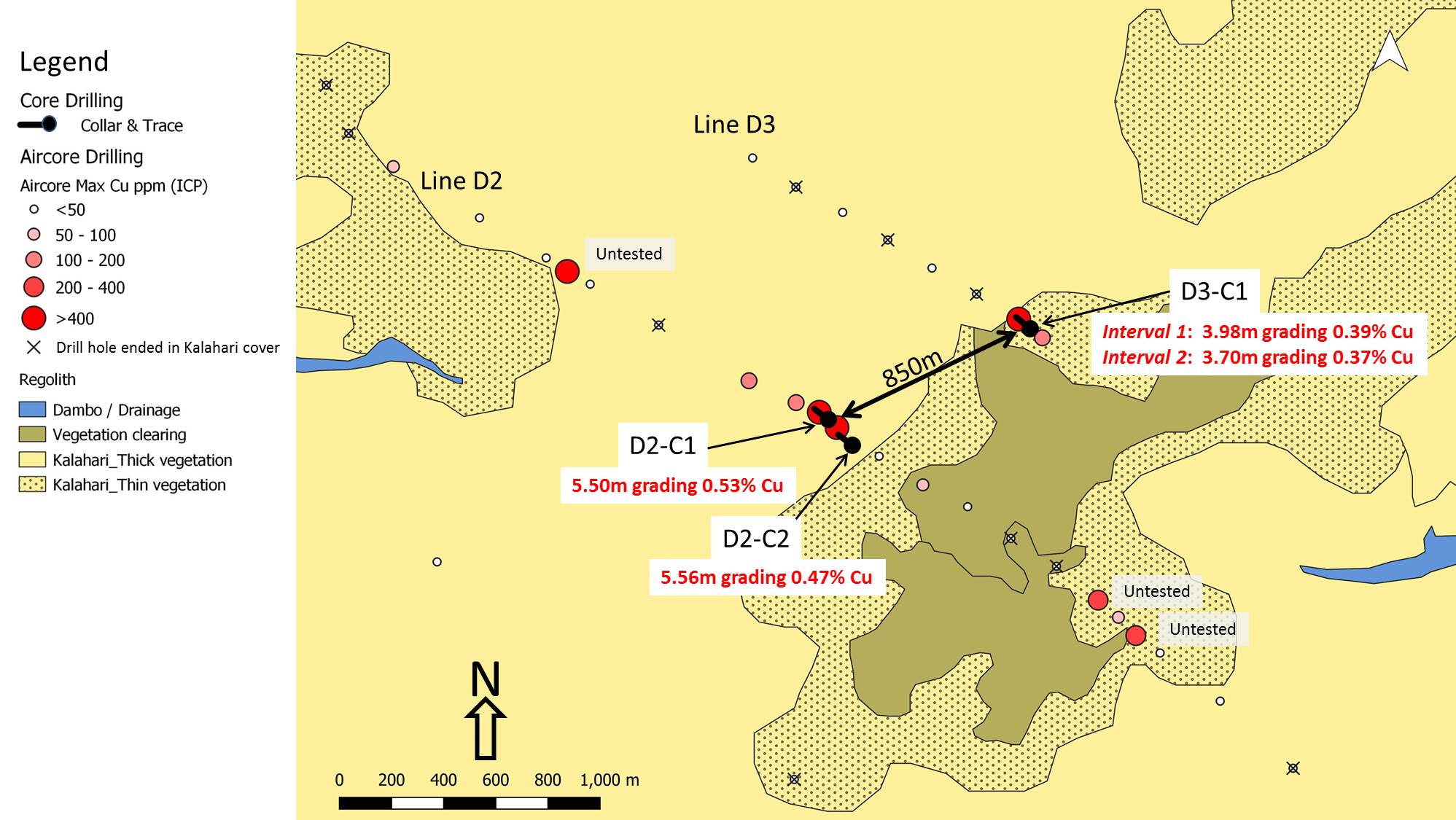

- Drill hole D3-C1: Interval 1: 3.98 metres grading 0.39% Copper ("Cu") from 71.45 metres

Interval 2: 3.70 metres grading 0.37% Cu from 153.36 metres

- Strong motivation for follow-up aircore and core drilling at the D-Prospect

- Newly identified priority G2 and Q3 targets from 2020 aircore program

- Aircore drilling and field operations to commence in H1 2021

Note: See Table 1 below for drill intersection details and QA/QC section

BeMetals President and CEO, John Wilton stated, "We are highly encouraged by the results from both our 2020 shallow aircore and follow-up core drilling programs. Core drill hole D3-C1 with intervals of 3.98 metres at 0.39% Cu and 3.70 metres at 0.37% Cu are of specific interest. These two shallow copper intersections are meaningful, as they occur some 850 metres along the same interpreted strike of mineralized zones intersected in holes D2-C1 and D2-C2 during the 2019 field season. D2-C1 intersected 5.50 metres grading 0.53% Cu, and D2-C2 intersected 5.56 metres grading 0.47% Cu. The combined results significantly expand the footprint and potential of the D-Prospect underneath the shallow sand cover in this area.

In addition to the successful D-Prospect results, the 2020 aircore program generated two new targets for priority exploration follow-up during the 2021 field season at the G2 and Q3 targets. The G2 target is located at an interpreted formation contact and the Q3 target is a new standalone anomaly associated with a structural target some four kilometres southeast of the SW-Prospect.

As recently reported, the Company has entered into a Joint Exploration and Option Agreement with Japan Oil, Gas and Metals National Corporation ("JOGMEC") that will allow for acceleration of planned 2021 exploration with funding from both BeMetals and JOGMEC. We are currently completing the detailed design of this year's expanded exploration program and are excited to commence the campaign."

2020 EXPLORATION DRILLING RESULTS

The 2020 exploration program included the completion of some 3,700 metres of shallow aircore drilling to test both significant step outs from copper intersections from the 2019 field work and to test other priority targets generated from the interpretation of the airborne magnetics. Also approximately 770 metres of core drilling was completed in five drill holes to test the copper anomalies below the Kalahari sand cover. The 2020 drilling program was completed in mid-December. Full laboratory results were received in late March 2021, and quality assessments of the data completed.

D-PROSPECT

Figure 1 below illustrates the location and intersected copper mineralization grades in the drill hole D3-C1 in relation to the regolith cover map for the area. It shows the new copper intersections in drill hole D3-C1 (See Table 1 below) are some 850 metres from the previously discovered copper zones intersected in D2-C1 and D2-C2 (See BeMetals' news release dated October 16, 2019). A number of aircore drilling anomalies on line D2 remain untested and there is currently no aircore drilling extending to the southeast on line D3. Within an approximate 500 metre radius of these copper intersections the average Kalahari sand cover is some 24 metres.

The Company intends to complete infill and step out lines of aircore drilling with the intention of generating more core drilling targets at this exciting D-Prospect.

FIGURE 1: LOCATION OF D3-C1 DRILL HOLE AT D-PROSPECT WITH AIRCORE DRILLING ANOMALIES AND REGOLITH COVER MAP

TABLE 1: 2020 CORE DRILLING PROGRAM SIGNIFICANT RESULTS

Borehole ID & Zone | From | To | Core Interval | Cu % |

D2 PROSPECT | ||||

D3-C1 | ||||

Interval 1: | 71.45 | 75.43 | 3.98* | 0.39 |

Interval 2: | 153.36 | 157.06 | 3.70‡ | 0.37 |

CT PROSPECT | ||||

B2-C2 | ||||

34.23 | 34.72 | 0.49† | 0.67 | |

136.09 | 136.59 | 0.50† | 0.47 | |

168.00 | 168.50 | 0.50† | 1.00 |

Note: Intertek Genalysis completed the analytical work with the core samples processed at their preparation facility in Kitwe, Zambia. All analytical procedures were conducted in an Intertek Genalysis laboratory in Australia. Reported widths are drilled core lengths as true widths are unknown at this time. Based upon current data it is estimated true widths range between 80 to 90% of the drilled intersections. *A nominal cut-off grade of 0.40% Cu has been used to determine the boundaries of the intersection with internal dilution at 0.30% Cu not exceeding 1 metre of the intercept. ‡ denotes intersection where a cut-off grade of 0.25% Cu has been used with no internal dilution. † denotes single sample.

C4, C5 TARGETS AND CT-PROSPECT

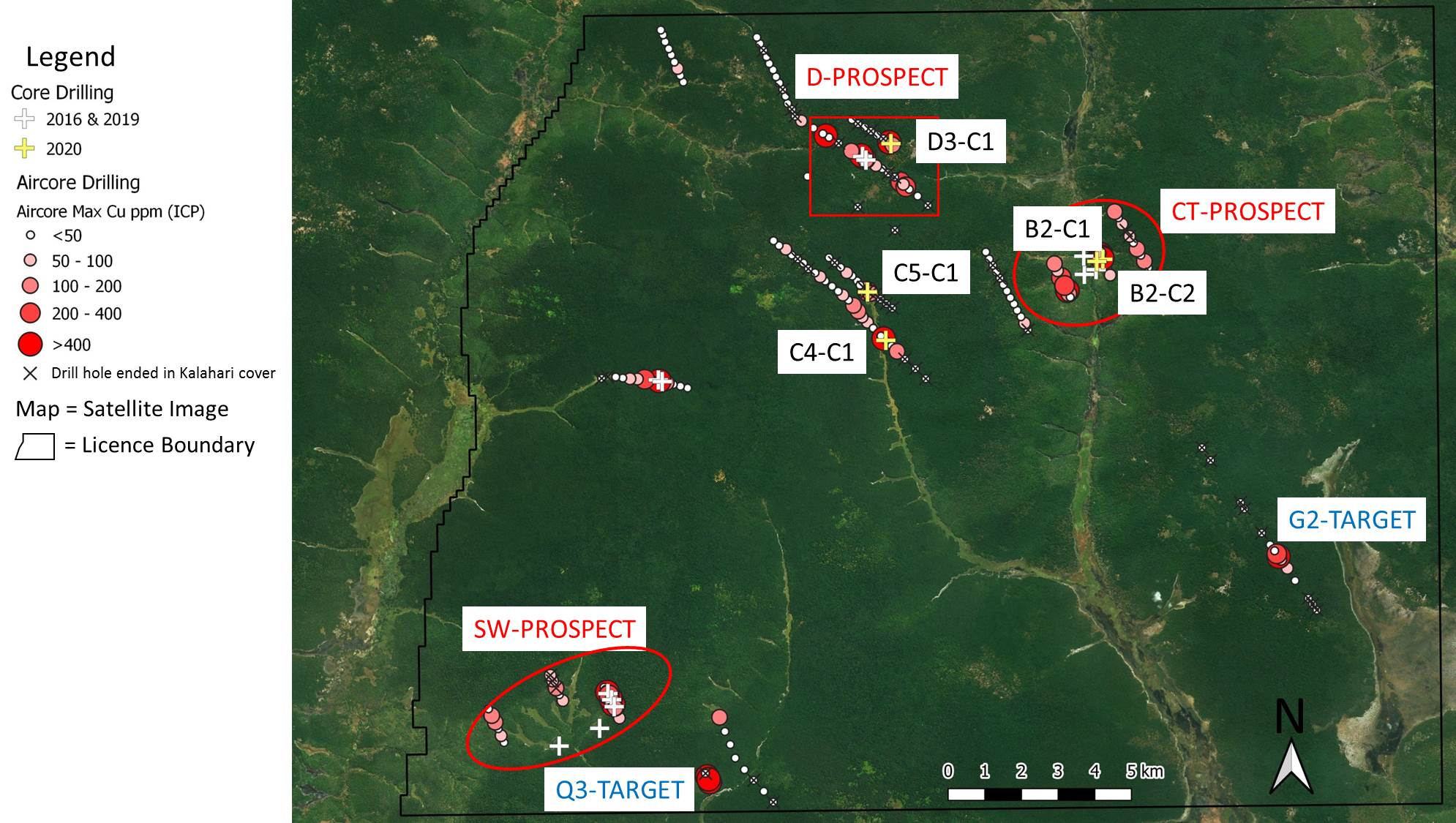

Figure 2 below shows the location of the five 2020 field program core drill hole collars plotted on a satellite image of the Property. Also indicated are the aircore anomalies for the Project to date based upon laboratory results. Drill holes C4-C1 and C5-C1 intersected interpreted basement units with no significant mineralization.

At the CT-Prospect drill hole B2-C2 returned three approximately 0.50 metres length samples with copper grades of 0.67, 0.47 and 1.00% Cu respectively. These mineralized zones are related to chalcopyrite and minor amounts of bornite copper sulphides and associated with observed kyanite, an alteration mineral. Kyanite has an important association with the mineralization at the Sentinel Copper Mine some 130 kilometres from the Pangeni Project. The thickness of Kalahari cover units at the CT-Prospect ranges from 1 to 7 metres. Detailed structural logging will be completed for the five core drill holes to allow for an updated interpretation of local controls on the mineralization and to revise targets where aircore anomalies were not fully explained.

NEWLY GENERATED G2 AND Q3 TARGETS

The location of the newly identified G2 and Q3 targets from the aircore drilling that will be followed up in the planned 2021 exploration program are also indicated on Figure 2. Table 2 below provides drill hole, azimuth, dip, end of hole depth, and collar co-ordinates for the 2020 core drilling.

FIGURE 2: LOCATION OF CORE DRILL HOLES D3-C1, B2-C1, B2-C2, C4-C1, C5-C1 AIRCORE DRILLING ANOMALIES AND SATELLITE IMAGE

TABLE 2: 2020 DRILL HOLE, AZIMUTH, DIP, EOH DEPTH, COLLAR CO-ORDINATES

Drill Hole ID | Azimuth Degree | Dip Degree | End of hole Depth | Easting (m) | Northing (m) | Elevation | Geological |

D3-C1 | 310 | -65 | 165.90 | 178056 | 8601638 | 1178 | See Table 1 |

B2-C1 | 340 | -60 | 141.60 | 183841 | 8598480 | 1197 | Did not intersect |

B2-C2 | 025 | -75 | 194.90 | 183677 | 8598423 | 1189 | See Table 1 |

C4-C1 | 310 | -75 | 100.70 | 177916 | 8596266 | 1229 | Did not intersect |

C5-C1 | 312 | -60 | 167.40 | 177416 | 8597587 | 1213 | Did not intersect |

QUALITY ASSURANCE AND QUALITY CONTROL

The results reported here for these core and aircore drilling programs were analyzed by Intertek Genalysis, an independent and accredited laboratory. Samples were prepared at their facility in Kitwe, Zambia and analytical work conducted in Australia. The results were determined using multi-acid, near total digest, and analyzed by Inductively Coupled Plasma ("ICP") Optical (Atomic) Emission Spectrometry ("OES"). The core and aircore sampling was conducted with a robust sampling protocol that included the appropriate insertion of standard reference material, duplicates, and blanks into the sample stream. The aircore ICP results compare consistently with the pXRF results conducted in the field and support the robust sampling protocol implemented for the field operations.

Field operations and management have been provided by Remote Exploration Services ("RES") an independent geological consulting and contracting company. The core and aircore drilling was conducted by Blurock Mining Services, of Kitwe, Zambia.

THE PANGENI COPPER PROJECT

The Pangeni Project is located on the western extension of the Zambian Copperbelt, within the Lufilian Arc, underlain by Katangan Supergroup metasediments situated unconformably on basement schists and gneisses, which are covered by a thin veneer of Kalahari sands. The open pit Sentinel Copper Mine is operated by First Quantum Minerals Ltd. some 130 kilometres to the northeast of the Pangeni Project. A number of major international mining companies have identified this region of the Zambian Copperbelt to be prospective for the discovery of tier one copper mines and are also conducting extensive exploration work in this area.

The Pangeni property is geologically prospective for the following deposit types; Basement-hosted Cu (analogues: the Lumwana Deposit, Nyungu Prospect), Sediment-hosted stratiform Cu-Co (analogues: Nchanga, Konkola, Nkana, and Mufulira Deposits), other Domes Region Deposits e.g. Sentinel, and Kansanshi and DRC Copperbelt Deposits e.g. Lonshi, Frontier, Kamoa-Kakula).

UPDATE ON THE COMPANY'S ENTRY INTO THE GOLD SECTOR WITH ACQUISITIONS IN JAPAN

On February 17, 2021, the Company reported the proposed transaction to acquire privately owned Kronk Resources Inc. ("Kronk") and its wholly owned subsidiary Kazan Resources, which holds the rights to a highly prospective portfolio of gold exploration projects in Japan (the "Transaction").

BeMetals is pleased to report that at its Special General Meeting of shareholders held on March 31, 2021, shareholders of the Company approved the Transaction with 100% of shareholders that cast their vote having voted in favour of the Transaction. The Company has further been advised that shareholders of Kronk have also approved the Transaction with 100% of shareholders that cast their vote having voted in favour. Additionally, BeMetals received conditional approval for the Transaction from the TSX Venture Exchange ("TSXV") on March 11, 2021 and now waits final approval to proceed with closing. The Company intends to close the transaction and concurrent private placement from B2Gold Corp., of C$7,500,000 as soon as possible following final approval from TSXV.

ABOUT BEMETALS CORP.

BeMetals is a precious and base metals exploration and development company focused on becoming a leading metal producer through the acquisition of quality exploration, development and potentially production stage projects. The Company is establishing itself in the gold sector with the acquisition of certain exploration projects in Japan, subject to final TSXV approval to close the transaction. BeMetals is also progressing both its advanced high-grade, zinc-silver-gold-copper polymetallic underground exploration at the South Mountain Project in Idaho through a preliminary economic assessment, and its tier-one targeted, Pangeni Copper Exploration Project in Zambia. Leading BeMetals' growth strategy is a strong board and management team, founders and significant shareholders of the Company, who have an extensive proven record of delivering considerable value in the mining sector through the discovery, construction and operation of mines around the world.

QUALIFIED PERSON

The technical information in this news release for BeMetals has been reviewed and approved by John Wilton, CGeol FGS, CEO and President of BeMetals, and a "Qualified Person" as defined under National Instrument 43-101.

ON BEHALF OF BEMETALS CORP.

"John Wilton"

John Wilton

President, CEO and Director

For further information about BeMetals please visit our website at www.bemetalscorp.com and sign-up to our email list to receive timely updates, or contact:

Derek Iwanaka

Vice President, Investor Relations & Corporate Development

Telephone: 604-609-6141

Email: diwanaka@bemetalscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" and "forward looking information" (as defined under applicable securities laws), based on management's best estimates, assumptions and current expectations. Such statements include but are not limited to, statements with respect to plans for completion of the Transaction and private placement; plans for an accelerated exploration program in 2021 at the Pangeni Project; future exploration and development of the South Mountain Project, the Pangeni project and the Japan properties; and the acquisition of additional base and/or precious metal projects. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", "anticipates", "plans", "anticipates", "believes", "intends", "estimates", "projects", "aims", "potential", "goal", "objective", "prospective", and similar expressions, or that events or conditions "will", "would", "may", "can", "could" or "should" occur. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those expressed or implied by such statements, including but not limited to: receipt of required TSXV approval for the Transaction and fulfilment of all conditions precedent to completion of the Transaction including closing of the private placement, JOGMEC funding its pro-rata portion of exploration programs at the Pangeni Project, the actual results of exploration activities, the availability of financing and/or cash flow to fund the current and future plans and expenditures, the ability of the Company to satisfy the conditions of the option agreements for the South Mountain Project and/or the Pangeni Project, and changes in the world commodity markets or equity markets. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward-looking statements and forward looking information are made as of the date hereof and are qualified in their entirety by this cautionary statement. The Company disclaims any obligation to revise or update any such factors or to publicly announce the result of any revisions to any forward-looking statements or forward looking information contained herein to reflect future results, events or developments, except as require by law. Accordingly, readers should not place undue reliance on forward-looking statements and information. Please refer to the Company's most recent filings under its profile at www.sedar.com for further information respecting the risks affecting the Company and its business.

SOURCE: BeMetals Corp.

View source version on accesswire.com:

https://www.accesswire.com/640322/BeMetals-Returns-Further-Positive-Drilling-Results-from-Pangeni-Copper-Project