Orvana Announces 2nd Quarter Production of 14,197 AuEq Oz & Provides Exploration Update

PR Newswire

TORONTO, April 15, 2021

- On Track to Meet Annual Production Guidance

- Year-to-date Exploration Program at OroValle Confirming Upside & Potential Mine Life Increase

- 5,000m Drilling Program Underway to Expand Taguas Project Resources in Argentina

- Undergoing Final Quality Assurance Testing of Oxides Stockpile Project at EMIPA, Bolivia

TORONTO, April 15, 2021 /CNW/ - Orvana Minerals Corp. (TSX: ORV) (the "Company" or "Orvana") today announced production results for the second quarter of fiscal 2021 ("Q2 2021") and exploration results for the first half of fiscal 2021 ("H1 2021") at OroValle, Spain.

Juan Gavidia, CEO of Orvana Minerals stated: "While we are on track to deliver on our production guidance for fiscal 2021, we are also pleased to report that exploration at OroValle continues to produce positive results, enhancing our current 5-Year Life-of-Mine Plan. OroValle's future has never looked brighter than today. Completing Orvana's big picture, we look forward to updating shareholders with exploration results at our in-development Taguas Project in Argentina, and with metallurgical testing programs completion at EMIPA, Bolivia, over the next upcoming quarters."

Q2 FY2021 OPERATIONAL RESULTS

OroValle

- 10,785 gold ounces, and on track to meet fiscal year 2021 guidance

- 1.4 million pounds, and on track to meet fiscal year 2021 guidance

- 6,530m of exploration drilling at OroValle were undertaken pursuant to aggressive resources annual program

Taguas

- 3,000m of diamond drilling were undertaken in the quarter, with 2,000m more to be completed in Q3

- An updated Resource Estimate is expected in the next quarter

EMIPA

- The Oxides Stockpile Project quality assurance (metallurgical) testing is currently in progress, and a decision on the project is expected by the end of fiscal year 2021

Objectives for Remainder of FY2021

- OroValle: Strong cash flow generation. Deliver on production guidance, and go beyond replenishment of annual depletion thus, extending mine life

- Taguas: Issue expanded-resource PEA by end of 2021, and define the Infill Drilling Program required to develop a Pre-Feasibility Study during 2022

- EMIPA: Make final decision on Oxides Stockpile Project. Subject to final approval and access to required financing, it will be a one-year construction project in 2022, and a three-year production life between 2023 and 2025

Production Results

Q2 FY2021 | Q1 FY2021 | Q2 FY2020 | FY 2021 | |

Ore milled (tones) | 159,603 | 180,380 | 148,339 | |

Gold Equivalent (oz) | 14,197 | 18,398 | 14,843 | |

Gold | ||||

Grade (g/t) | 2.31 | 2.60 | 2.74 | |

Recovery (%) | 90.9 | 93.6 | 93.0 | |

Production (oz) | 10,785 | 14,127 | 12,139 | 50,000 - 55,000 |

Copper | ||||

Grade (%) | 0.47 | 0.63 | 0.52 | |

Recovery (%) | 82.3 | 81.6 | 83.1 | |

Production (K lbs) | 1,355 | 2,044 | 1,422 | 7,000 - 8,500 |

Orovalle H1 Exploration Update

El Valle Boinás

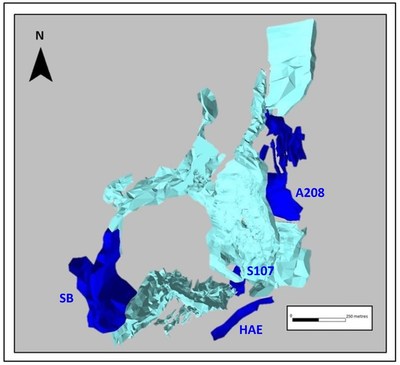

Fiscal year 2021 drilling program focus continues on the Oxides areas with a total of 13,743m drilled in H1 2021 (see Figure 1). Detail of areas and drilled metres are in Table 1 below and full detail of the drill program can be found in Table 2:

Infill (m) | Brownfield (m) | TOTAL (m) | |

A208 | 3,658 | - | 3,658 |

Boinas South | 2,167 | - | 2,167 |

S107 | 867 | - | 867 |

High Angle East | - | 4,648 | 4,648 |

Other Areas | 1,796 | 607 | 2,403 |

TOTAL | 8,488 | 5,255 | 13,743 |

Table 1. Orovalle H1 Drilling Fiscal Year 2021

Highlights per Area (see detailed assays in Table 2):

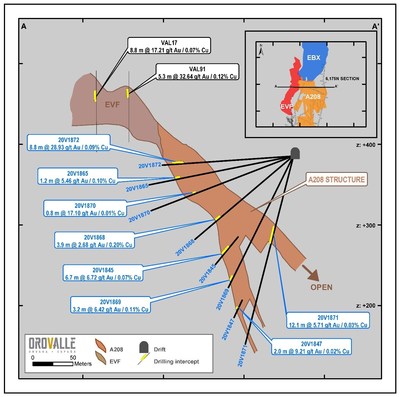

- A208:8.9m with 28.93 g/t Au. Drilling advancing to the North, next to East Breccia.

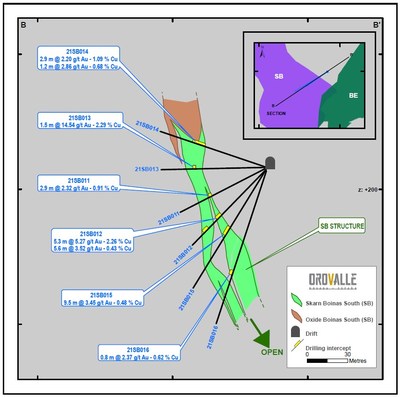

- Boinas South: 5.9m with 11.87 g/t Au and 1.31% Cu. Mineral expansion is open at depth and to the North. Drilling continues to the North, connecting the Black Skarn area, around the intrusive contour.

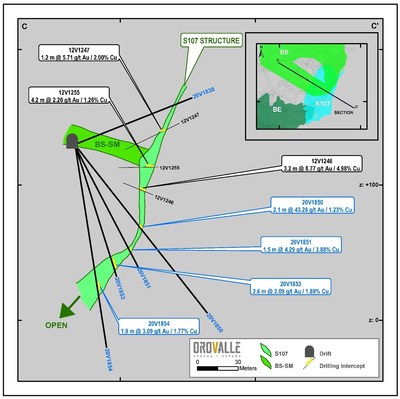

- S107:2.1m with 43.28 g/t Au and 1.23% Cu. Drilling focused on open mineralization at depth.

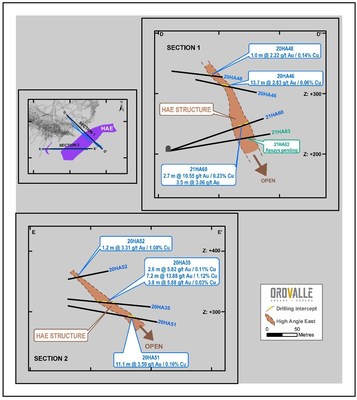

- High Angle East:4.3mwith38.38 g/t Au and 4.22% Cu. Structure growth remains open at depth and to the North.

Area 208 (A208)

Information obtained from 16,802m of infill drilling since 2019 allowed for better understanding of the structure, which remains open at depth. Zoning can be identified within the structure, where the highest gold grades are located at the footwall.

Boinas South (SB)

The drilling campaign was focused on the lower part, targeting skarn material with the highest gold and copper grades. The structure remains open at depth and to the North. An infill drilling campaign is being planned for the next few months.

S107

The infill drilling carried out in the deep zone has demonstrated a change in the inclination of the mineral layer, from a subvertical position to 45º Northwest, fitting the contact with the limestone. The skarn contains bands of massive copper sulphides.

High Angle East (HAE)

Drilling continues on the latest discovery at El Valle (see news release dated October 22, 2020). Zones within the structure contain Au and Au-Cu bands. The structure remains open at depth and to the North.

Greenfield exploration update

A total of 1,016.7m was completed at the Lidia Project in H1 FY2021. The second phase is anticipated for September 2021, once the results of the first phase have been completely evaluated.

Quality Control

The analytical work for the brownfield and infill drilling programs are being performed by the Orovalle laboratory, which is ISO 9001:2015 certified. Sample preparation was carried out at the El Valle facility. All diamond core samples have been prepared using the following procedure, once split:

The core samples are dried at a temperature of 105ºC and then crushed through a jaw crusher to 95%<6 mm. The coarse-crushed sample is further reduced to 95%<425 microns using an LM5 bowl-and-puck pulverizer. An Essa rotary splitter is used to take a 450 g to 550 g sub-sample of each split for pulverizing. The remaining reject portion is bagged and stored. The sample is reduced to a nominal -200 mesh using an LM2 bowl-and-puck pulverizer. 140 g sub-samples are split using a special vertical-sided scoop to cut channels through the sample which has been spread into a pancake on a sampling mat. Samples are then sent to the laboratory for gold and base metal analysis. Leftover pulp is bagged and stored.

After sample preparation, 30g samples are analyzed for Au by fire assay with an atomic absorption spectroscopy (AAS) finish and two-gram samples for Ag, As, Bi, Cu, Hg, Pb, Sb, Se, and Zn by ICP-optical emission spectroscopy (ICP-OES) after an aqua regia digestion.

The reported work has been completed using industry standard procedures, including a quality assurance/quality control ("QA/QC") program consisting of the insertion of certified reference material, blanks and duplicates samples into the sample stream.

The exploration update was prepared under the supervision of Guadalupe Collar Menéndez, a qualified person for the purposes of NI 43-101 and an employee of Orovalle Minerals S.L., a subsidiary of Orvana.

H1 2021 Intercepts from A208, S107, SB and HAE

Zone | DDH | From (m) | To (m) | Thick (m) | Au(gpt) | Ag(g/t) | Cu(%) |

A208 | 20V1836 | 9.00 | 10.55 | 1.22 | 15.59 | 1.8 | 0.26 |

A208 | 20V1836 | 19.60 | 20.90 | 0.90 | 3.31 | 0.5 | 0.08 |

A208 | 20V1836 | 23.90 | 25.50 | 1.10 | 6.34 | 1.2 | 0.05 |

A208 | 20V1836 | 62.30 | 63.75 | 0.89 | 4.78 | 0.5 | 0.02 |

A208 | 20V1836 | 87.45 | 88.50 | 0.64 | 4.54 | 0.5 | 0.03 |

A208 | 20V1840 | 10.40 | 12.70 | 2.17 | 4.21 | 3.6 | 0.24 |

A208 | 20V1840 | 35.80 | 37.00 | 0.81 | 8.03 | 0.5 | 0.02 |

A208 | 20V1840 | 102.00 | 105.00 | 2.67 | 13.01 | 0.5 | 0.04 |

A208 | Including | 102.00 | 103.50 | 1.33 | 20.33 | 0.5 | 0.04 |

A208 | 20V1843 | 16.10 | 18.90 | 1.99 | 2.75 | 1.9 | 0.23 |

A208 | 20V1843 | 31.50 | 32.70 | 1.00 | 12.95 | 0.5 | 0.06 |

A208 | 20V1843 | 37.50 | 41.85 | 3.63 | 5.43 | 0.5 | 0.03 |

A208 | 20V1843 | 124.50 | 130.35 | 5.13 | 2.32 | 6.1 | 0.31 |

A208 | 20V1843 | 134.75 | 137.55 | 2.46 | 2.64 | 1.9 | 0.25 |

A208 | 20V1845 | 8.50 | 9.80 | 1.10 | 5.13 | 1.0 | 0.32 |

A208 | 20V1845 | 17.65 | 20.50 | 2.44 | 2.72 | 3.3 | 0.10 |

A208 | 20V1845 | 25.90 | 27.50 | 1.37 | 3.19 | 0.5 | 0.03 |

A208 | 20V1845 | 90.20 | 91.70 | 1.43 | 13.67 | 5.0 | 0.36 |

A208 | 20V1845 | 152.35 | 161.70 | 6.75 | 6.72 | 1.1 | 0.07 |

A208 | 20V1847 | 22.90 | 23.90 | 0.73 | 11.37 | 1.5 | 0.02 |

A208 | 20V1847 | 34.70 | 46.10 | 7.98 | 5.26 | 0.5 | 0.05 |

A208 | Including | 38.20 | 39.00 | 0.56 | 21.63 | 0.5 | 0.03 |

A208 | Including | 43.80 | 44.90 | 0.77 | 12.83 | 0.5 | 0.03 |

A208 | 20V1847 | 90.70 | 131.00 | 26.87 | 6.41 | 0.5 | 0.03 |

A208 | Including | 92.70 | 102.70 | 6.67 | 11.67 | 0.5 | 0.01 |

A208 | Including | 106.70 | 108.70 | 1.33 | 13.89 | 0.5 | 0.01 |

A208 | Including | 117.00 | 119.00 | 1.33 | 20.87 | 0.5 | 0.03 |

A208 | 20V1847 | 171.00 | 173.00 | 0.96 | 3.64 | 0.5 | 0.01 |

A208 | 20V1847 | 186.55 | 187.60 | 0.63 | 6.05 | 0.5 | 0.02 |

A208 | 20V1847 | 198.00 | 201.30 | 1.98 | 9.21 | 0.5 | 0.02 |

A208 | 20V1849 | 8.30 | 9.00 | 0.53 | 9.39 | 1.80 | 0.58 |

A208 | 20V1849 | 25.10 | 36.30 | 6.84 | 2.45 | 1.15 | 0.09 |

A208 | 20V1849 | 94.60 | 103.10 | 4.91 | 10.16 | 0.10 | 0.04 |

A208 | Including | 94.60 | 96.60 | 1.16 | 13.65 | 0.10 | 0.02 |

A208 | Including | 101.85 | 103.10 | 0.72 | 39.80 | 0.10 | 0.06 |

A208 | 20V1849 | 156.70 | 158.70 | 0.82 | 5.16 | 0.10 | 0.02 |

A208 | 20V1849 | 166.70 | 168.70 | 0.82 | 3.22 | 0.10 | 0.02 |

A208 | 20V1852 | 9.70 | 11.15 | 1.16 | 3.82 | 1.10 | 0.12 |

A208 | 20V1852 | 26.05 | 45.50 | 15.13 | 2.65 | 0.50 | 0.07 |

A208 | Including | 44.20 | 45.50 | 1.01 | 18.45 | 0.20 | 0.02 |

A208 | 20V1852 | 187.70 | 188.90 | 1.20 | 2.31 | 0.80 | 0.12 |

A208 | 20V1858 | 8.60 | 9.70 | 0.86 | 6.88 | 2.00 | 0.62 |

A208 | 20V1858 | 24.75 | 26.20 | 0.64 | 11.14 | 2.10 | 0.07 |

A208 | 20V1858 | 37.20 | 40.20 | 1.07 | 6.08 | 0.85 | 0.06 |

A208 | 20V1858 | 46.35 | 47.90 | 0.55 | 3.12 | 0.50 | 0.04 |

A208 | 20V1861 | 10.40 | 11.45 | 0.69 | 2.93 | 29.70 | 2.23 |

A208 | 20V1861 | 43.65 | 60.00 | 4.18 | 8.89 | 0.75 | 0.11 |

A208 | Including | 49.45 | 51.00 | 0.40 | 41.46 | 0.50 | 0.05 |

A208 | Including | 55.25 | 57.55 | 0.59 | 21.07 | 0.50 | 0.05 |

A208 | 20V1861 | 66.60 | 69.25 | 1.38 | 3.22 | 5.71 | 0.10 |

A208 | 20V1861 | 73.60 | 77.80 | 2.19 | 18.20 | 0.50 | 0.03 |

A208 | Including | 76.40 | 77.80 | 0.73 | 28.99 | 0.50 | 0.02 |

A208 | 20V1861 | 163.90 | 165.15 | 0.65 | 3.13 | 0.50 | 0.01 |

A208 | 20V1861 | 170.40 | 171.45 | 0.55 | 7.85 | 0.50 | 0.01 |

A208 | 20V1865 | 95.90 | 97.40 | 1.37 | 6.24 | 0.50 | 0.04 |

A208 | 20V1865 | 114.80 | 116.30 | 1.37 | 2.74 | 0.50 | 0.02 |

A208 | 20V1865 | 148.15 | 149.55 | 1.24 | 5.46 | 1.90 | 0.10 |

A208 | 20V1868 | 80.20 | 81.40 | 1.11 | 2.32 | 0.5 | 0.09 |

A208 | 20V1868 | 115.40 | 119.85 | 3.91 | 2.68 | 0.8 | 0.20 |

A208 | 20V1868 | 122.75 | 125.30 | 2.24 | 1.94 | 5.1 | 0.12 |

A208 | 20V1869 | 78.50 | 79.90 | 1.12 | 5.08 | 0.5 | 0.02 |

A208 | 20V1869 | 135.55 | 137.30 | 0.64 | 6.24 | 0.5 | 0.02 |

A208 | 20V1869 | 161.30 | 167.30 | 3.20 | 6.42 | 0.5 | 0.11 |

A208 | 20V1869 | 164.30 | 167.30 | 1.60 | 12.02 | 0.5 | 0.08 |

A208 | 20V1870 | 112.90 | 114.50 | 1.05 | 2.29 | 1.3 | 0.40 |

A208 | 20V1870 | 130.75 | 132.00 | 0.82 | 17.10 | 0.5 | 0.01 |

A208 | 20V1870 | 146.00 | 147.30 | 0.85 | 8.89 | 2.4 | 0.09 |

A208 | 20V1871 | 84.90 | 108.60 | 12.11 | 5.71 | 0.5 | 0.03 |

A208 | Including | 98.05 | 99.80 | 0.89 | 26.61 | 0.5 | 0.01 |

A208 | Including | 101.55 | 103.30 | 0.89 | 13.09 | 0.5 | 0.01 |

A208 | 20V1872 | 117.90 | 119.15 | 1.07 | 31.27 | 0.5 | 0.03 |

A208 | 20V1872 | 137.30 | 148.70 | 8.87 | 28.93 | 0.6 | 0.09 |

A208 | Including | 137.30 | 139.95 | 2.06 | 81.31 | 0.5 | 0.02 |

A208 | Including | 144.05 | 145.60 | 1.21 | 15.49 | 0.5 | 0.00 |

A208 | Including | 147.15 | 148.70 | 1.21 | 57.01 | 0.5 | 0.02 |

A208 | 20V1872 | 154.75 | 156.30 | 1.21 | 2.62 | 1.8 | 0.13 |

A208 | 20V1873 | 89.90 | 91.55 | 1.52 | 2.15 | 0.5 | 0.01 |

A208 | 20V1873 | 101.85 | 104.65 | 2.49 | 7.83 | 0.5 | 0.10 |

A208 | 20V1873 | 101.85 | 103.25 | 1.24 | 14.03 | 0.5 | 0.10 |

A208 | 21V1874 | 106.35 | 110.15 | 3.67 | 11.75 | 0.5 | 0.01 |

A208 | Including | 108.25 | 110.15 | 1.84 | 20.62 | 0.5 | 0.01 |

A208 | 21V1875 | No intercepts >2g/t Au | |||||

A208 | 21V1876 | 72.00 | 74.00 | 1.82 | 5.55 | 0.5 | 0.01 |

A208 | 21V1876 | 120.10 | 121.85 | 1.59 | 31.59 | 0.5 | 0.03 |

A208 | 21V1876 | 128.85 | 130.60 | 1.59 | 8.72 | 0.5 | 0.03 |

A208 | 21V1877 | 132.00 | 133.50 | 1.25 | 8.01 | 0.5 | 0.02 |

A208 | 21V1878 | 91.90 | 93.90 | 1.89 | 4.67 | 0.5 | 0.04 |

A208 | 21V1879 | 92.90 | 100.75 | 6.45 | 5.58 | 1.3 | 0.09 |

A208 | Including | 95.50 | 96.80 | 1.07 | 11.67 | 0.5 | 0.05 |

A208 | 21V1880 | 60.90 | 62.40 | 1.50* | 4.91 | 0.5 | 0.15 |

A208 | 21V1880 | 97.75 | 98.85 | 0.94 | 11.73 | 0.5 | 0.06 |

A208 | 21V1882 | 62.20 | 63.80 | 1.60* | 2.15 | 0.5 | 0.11 |

A208 | 21V1882 | 94.85 | 97.85 | 2.63 | 21.52 | 0.5 | 0.03 |

A208 | Including | 96.35 | 97.85 | 1.32 | 40.86 | 0.5 | 0.03 |

A208 | 21V1882 | 101.85 | 103.35 | 1.32 | 2.04 | 0.5 | 0.08 |

A208 | 21V1882 | 106.35 | 107.85 | 1.32 | 2.57 | 0.5 | 0.01 |

A208 | 21V1883 | 51.75 | 53.75 | 2.00* | 5.70 | 0.5 | 0.11 |

A208 | 21V1883 | 56.65 | 59.50 | 2.85* | 38.04 | 0.5 | 0.27 |

S107 | 20V1838 | No intercepts >2g/t Au | |||||

S107 | 20V1839 | No intercepts >2g/t Au | |||||

S107 | 20V1842 | 88.90 | 90.10 | 1.11 | 9.78 | 94.20 | 7.65 |

S107 | 20V1841 | 8.90 | 10.65 | 1.75* | 2.22 | 0.50 | 0.00 |

S107 | 20V1844 | 88.00 | 94.10 | 3.39 | 3.26 | 21.99 | 1.98 |

S107 | 20V1844 | 225.20 | 226.60 | 1.40 | 2.39 | 4.30 | 0.26 |

S107 | 20V1846 | 85.70 | 87.30 | 1.26 | 2.73 | 12.90 | 1.09 |

S107 | 20V1848 | 89.05 | 90.20 | 1.15* | 2.78 | 4.20 | 0.03 |

S107 | 20V1850 | 41.35 | 42.80 | 1.45* | 4.01 | 24.00 | 0.36 |

S107 | 20V1850 | 78.85 | 82.15 | 2.09 | 43.28 | 30.76 | 1.23 |

S107 | Including | 80.80 | 82.15 | 0.85 | 94.90 | 69.70 | 2.86 |

S107 | 20V1851 | 87.15 | 88.80 | 1.47 | 4.29 | 48.06 | 3.88 |

S107 | 20V1853 | 89.00 | 96.20 | 5.52 | 1.52 | 14.98 | 1.30 |

S107 | 20V1854 | 102.00 | 102.65 | 0.40 | 10.91 | 112.10 | 7.15 |

S107 | 20V1855 | 45.85 | 48.30 | 2.45* | 13.06 | 17.72 | 1.38 |

S107 | 20V1855 | 58.55 | 59.90 | 1.35* | 2.91 | 7.20 | 0.21 |

S107 | 20V1855 | 96.50 | 97.45 | 0.84 | 5.80 | 2.60 | 6.38 |

S107 | 20V1856 | 62.60 | 63.55 | 0.95* | 5.58 | 25.30 | 0.42 |

S107 | 20V1856 | 85.80 | 90.85 | 4.21 | 1.18 | 14.77 | 0.77 |

S107 | 20V1857 | 61.20 | 62.50 | 1.30* | 3.96 | 13.50 | 0.32 |

S107 | 20V1859 | 63.95 | 65.10 | 1.15 | 10.79 | 4.00 | 0.06 |

S107 | 20V1859 | 95.35 | 98.40 | 2.88 | 3.49 | 28.78 | 0.95 |

SB | 20SB001 | 0.90 | 1.75 | 0.72 | 18.96 | 137.20 | 3.35 |

SB | 20SB001 | 66.45 | 67.85 | 1.09 | 2.39 | 6.90 | 0.24 |

SB | 20SB001 | 71.80 | 79.35 | 5.87 | 11.87 | 46.69 | 1.31 |

SB | including | 75.15 | 77.80 | 2.06 | 14.64 | 96.43 | 2.40 |

SB | 20SB001 | 85.80 | 90.00 | 3.97 | 4.59 | 0.70 | 0.04 |

SB | 20SB002 | 1.05 | 1.95 | 0.78 | 2.10 | 16.20 | 0.92 |

SB | 20SB002 | 72.00 | 74.50 | 2.50 | 2.10 | 52.34 | 4.50 |

SB | 20SB002 | 80.65 | 81.60 | 0.94 | 3.00 | 27.80 | 0.47 |

SB | 20SB003 | 65.75 | 93.00 | 23.62 | 3.39 | 36.21 | 1.71 |

SB | including | 66.75 | 67.85 | 0.95 | 7.95 | 98.40 | 9.68 |

SB | including | 69.80 | 72.20 | 2.08 | 3.95 | 53.45 | 1.48 |

SB | including | 79.60 | 85.95 | 5.50 | 6.94 | 71.93 | 3.00 |

SB | including | 91.40 | 93.00 | 1.39 | 5.64 | 1.90 | 0.01 |

SB | 20SB004 | No intercepts >2g/t Au | |||||

SB | 20SB005 | 0.00 | 0.60 | 0.55 | 2.74 | 24.70 | 0.80 |

SB | 20SB005 | 1.50 | 2.70 | 1.11 | 2.64 | 22.10 | 1.06 |

SB | 20SB005 | 4.60 | 5.90 | 1.20 | 5.93 | 55.60 | 1.52 |

SB | 20SB006 | 0.00 | 0.70 | 0.65 | 2.89 | 22.20 | 0.70 |

SB | 20SB006 | 2.20 | 3.65 | 1.35 | 2.89 | 19.30 | 0.65 |

SB | 21SB007 | 0.00 | 1.00 | 0.89 | 2.33 | 20.20 | 0.78 |

SB | 21SB007 | 60.15 | 74.70 | 13.90 | 2.77 | 12.92 | 0.50 |

SB | Including | 73.20 | 74.70 | 1.43 | 16.68 | 0.50 | 0.22 |

SB | 21SB008 | 0.00 | 2.20 | 2.13 | 3.72 | 33.10 | 2.70 |

SB | 21SB008 | 67.15 | 68.80 | 1.37 | 2.40 | 64.10 | 0.97 |

SB | 21SB008 | 78.30 | 79.55 | 0.99 | 3.96 | 0.50 | 0.07 |

SB | 21SB009 | 0.00 | 0.95 | 0.81 | 5.13 | 59.60 | 7.00 |

SB | 21SB011 | 53.00 | 56.10 | 2.86 | 2.32 | 20.94 | 0.91 |

SB | 21SB010 | 0.00 | 1.55 | 1.21 | 7.54 | 53.50 | 4.01 |

SB | 21SB012 | 51.50 | 57.25 | 5.30 | 5.27 | 77.67 | 2.26 |

SB | 21SB012 | 65.30 | 74.20 | 5.64 | 3.52 | 18.52 | 0.43 |

SB | 21SB013 | 62.40 | 64.10 | 1.53 | 14.54 | 144.30 | 2.29 |

SB | 21SB014 | 54.90 | 58.30 | 2.87 | 2.20 | 18.18 | 1.09 |

SB | 21SB014 | 62.65 | 64.10 | 1.22 | 2.86 | 19.10 | 0.68 |

SB | 21SB015 | 52.30 | 63.80 | 9.46 | 3.45 | 18.76 | 0.48 |

SB | 21SB016 | 84.95 | 86.45 | 0.75 | 2.37 | 27.90 | 0.62 |

SB | 21SB017 | 69.00 | 70.25 | 1.11 | 2.21 | 11.20 | 0.26 |

SB | 21SB017 | 78.40 | 79.55 | 0.83 | 2.85 | 1.10 | 0.02 |

SB | 21SB018 | 56.65 | 59.85 | 2.99 | 6.63 | 38.97 | 1.07 |

SB | Including | 58.70 | 59.85 | 1.07 | 15.63 | 97.10 | 2.64 |

SB | 21SB018 | 74.00 | 76.40 | 1.87 | 2.58 | 4.60 | 0.12 |

HAE | 20HA41 | 213.70 | 214.80 | 1.10* | 4.34 | 11.70 | 0.89 |

HAE | 20HA42 | No intercepts >2g/t Au | |||||

HAE | 20HA43 | 178.50 | 193.30 | 14.80* | 2.16 | 2.16 | 0.13 |

HAE | including | 178.50 | 184.75 | 6.25* | 3.46 | 1.95 | 0.04 |

HAE | 20HA43 | 188.95 | 190.40 | 1.45* | 2.62 | 5.50 | 0.28 |

HAE | 20HA43 | 191.85 | 193.30 | 1.45* | 2.04 | 0.50 | 0.05 |

HAE | 20HA44 | 202.50 | 209.75 | 7.25* | 1.39 | 0.80 | 0.03 |

HAE | 20HA44 | 221.10 | 222.10 | 1.00* | 1.64 | 17.10 | 0.94 |

HAE | 20HA45 | 186.20 | 200.45 | 14.25* | 2.09 | 7.29 | 0.25 |

HAE | including | 187.70 | 193.70 | 6.00* | 3.29 | 1.78 | 0.03 |

HAE | 20HA46 | 175.05 | 188.70 | 13.65* | 2.83 | 2.37 | 0.06 |

HAE | including | 175.05 | 176.55 | 1.50* | 16.39 | 0.50 | 0.05 |

HAE | including | 184.20 | 188.70 | 4.50* | 2.85 | 6.17 | 0.14 |

HAE | 20HA47 | 165.05 | 167.10 | 2.04* | 2.02 | 168.93 | 8.94 |

HAE | 20HA48 | 152.85 | 155.00 | 2.15* | 1.90 | 5.27 | 0.09 |

HAE | 20HA49 | 135.70 | 139.70 | 4.00* | 2.95 | 24.41 | 1.39 |

HAE | 20HA50 | No intercepts >2g/t Au | |||||

HAE | 20HA51 | 214.00 | 220.75 | 6.75* | 4.95 | 3.15 | 0.23 |

HAE | 20HA51 | 223.30 | 225.10 | 1.79* | 1.79 | 6.65 | 0.14 |

HAE | 20HA52 | 128.80 | 130.00 | 1.19* | 3.31 | 45.00 | 1.08 |

HAE | 20HA53 | 167.80 | 171.30 | 3.50* | 2.79 | 21.25 | 0.47 |

HAE | 20HA53 | 178.70 | 184.70 | 6.00* | 8.85 | 386.16 | 1.69 |

HAE | 20HA54 | 159.90 | 163.80 | 3.90* | 2.58 | 1.39 | 0.03 |

HAE | 21HA55 | 92.75 | 94.00 | 1.25* | 5.34 | 21.80 | 1.26 |

HAE | 21HA55 | 96.50 | 99.85 | 3.34* | 8.68 | 5.21 | 0.10 |

HAE | 21HA55 | 176.00 | 176.90 | 0.90* | 3.39 | 16.50 | 0.58 |

HAE | 21HA56 | 109.45 | 112.70 | 3.25* | 3.57 | 3.24 | 0.12 |

HAE | 21HA57 | 31.90 | 33.25 | 1.35* | 4.03 | 0.50 | 0.03 |

HAE | 21HA58 | 204.45 | 206.00 | 1.55* | 4.01 | 12.70 | 0.40 |

HAE | 21HA58 | 207.55 | 209.10 | 1.54* | 2.34 | 23.50 | 0.87 |

HAE | 21HA59 | No intercepts >2g/t Au | |||||

HAE | 21HA60 | 147.30 | 150.00 | 2.69* | 10.55 | 3.90 | 0.23 |

HAE | Including | 148.65 | 150.00 | 1.34* | 18.02 | 7.30 | 0.42 |

HAE | 21HA60 | 155.40 | 156.55 | 1.15* | 2.34 | 0.50 | 0.00 |

HAE | 21HA60 | 165.50 | 169.00 | 3.50* | 3.06 | 1.01 | 0.00 |

HAE | 21HA61 | 188.40 | 189.90 | 1.50* | 2.67 | 1.70 | 0.07 |

HAE | 21HA62 | 55.85 | 60.15 | 4.30* | 38.38 | 76.35 | 4.22 |

HAE | Including | 55.85 | 57.25 | 1.40* | 83.21 | 101.80 | 2.85 |

HAE | Including | 58.65 | 60.15 | 1.50* | 25.89 | 71.40 | 5.07 |

HAE | 21HA62 | 136.55 | 139.05 | 2.50* | 8.92 | 37.70 | 0.81 |

HAE | Including | 137.80 | 139.05 | 1.25* | 11.38 | 8.90 | 0.19 |

* Not true widths as there is currently insufficient data to calculate true orientation | |||||||

ABOUT ORVANA - Orvana is a multi-mine gold-copper-silver company. Orvana's assets consist of the El Valle operation in northern Spain, and the Don Mario gold-silver property in Bolivia, currently in care and maintenance. Orvana is in the process of closing the acquisition of Taguas, Argentina. Additional information is available at Orvana's website (www.orvana.com).

Cautionary Statements - Forward-Looking Information

Certain statements made herein constitute forward-looking statements or forward-looking information within the meaning of applicable securities laws ("forward-looking statements"). Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, potentials, future events or performance (often, but not always, using words or phrases such as "believes", "expects", "plans", "estimates", "intends" or "anticipates" or stating that certain actions, events or results "may", "could", "would", "might", "will" or "are projected to" be taken or achieved) are not statements of historical fact, but are forward-looking statements.

The forward-looking statements herein relate to, among other things: Orvana's ability to achieve improvement in free cash flow; the potential to extend the mine life of El Valle and Don Mario beyond their current life-of-mine estimates including specifically, but not limited to in the case of Don Mario, the processing of the mineral stockpiles and the reprocessing of the tailings material; Orvana's ability to optimize its assets to deliver shareholder value; the Company's ability to optimize productivity at Don Mario and El Valle; any measures taken by the Company to prevent and/or mitigate the impact of COVID-19 and other infectious diseases at or near the Company's mines and support the sustainability of its business including through the development of crisis management plans, increasing stock levels for key supplies, monitoring of guidance from the medical community, and engagement with local communities and authorities; estimates of future production, operating costs and capital expenditures; mineral resource and reserve estimates; statements and information regarding future feasibility studies and their results; future transactions (including the completion of the acquisition of Taguas); future metal prices; the ability to achieve additional growth and geographic diversification; future financial performance, including the ability to increase cash flow and profits; future financing requirements; mine development plans, Orvana's exploration activities and programs and its plan and expectations for its properties, as well as the timing and costs associated with same; . Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. The estimates and assumptions of the Company contained or incorporated by reference in this news release, which may prove to be incorrect, include, but are not limited to, the various assumptions set forth herein and in Orvana's most recently filed Management's Discussion & Analysis and Annual Information Form in respect of the Company's most recently completed fiscal year (the "Company Disclosures") or as otherwise expressly incorporated herein by reference as well as: there being no significant disruptions affecting operations, whether due to labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; permitting, development, operations, expansion and acquisitions at El Valle and Don Mario being consistent with the Company's current expectations; political developments in any jurisdiction in which the Company operates being consistent with its current expectations; certain price assumptions for gold, copper and silver; prices for key supplies being approximately consistent with current levels; production and cost of sales forecasts meeting expectations; the accuracy of the Company's current mineral reserve and mineral resource estimates; and labour and materials costs increasing on a basis consistent with Orvana's current expectations.

A variety of inherent risks, uncertainties and factors, many of which are beyond the Company's control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include the effect of COVID-19 and other infectious diseases on the Company's operations, workforce and supply chain, fluctuations in the price of gold, silver and copper; the need to recalculate estimates of resources based on actual production experience; the failure to achieve production estimates; variations in the grade of ore mined; variations in the cost of operations; the availability of qualified personnel; the Company's ability to obtain and maintain all necessary regulatory approvals and licenses; the Company's ability to use cyanide in its mining operations; risks generally associated with mineral exploration and development, including the interpretation and actual results of current exploration activities, changes in project parameters as plans continue to be refined as the exploration program advances, the success of exploration activities, the Company's ability to continue to operate the El Valle and/or Don Mario and/or ability to resume long-term operations at the Carlés Mine; the Company's ability to successfully implement a sulphidization circuit and ancillary facilities to process the current oxides stockpiles at Don Mario; the Company's ability to acquire and develop mineral properties and to successfully integrate such acquisitions; the Company's ability to execute on its strategy; the Company's ability to obtain financing when required on terms that are acceptable to the Company; challenges to the Company's interests in its property and mineral rights; current, pending and proposed legislative or regulatory developments or changes in political, social or economic conditions in the countries in which the Company operates; general economic conditions worldwide; and the risks identified in the Company's disclosures. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Company's Disclosures for a description of additional risk factors.

Any forward-looking statements made herein with respect to the anticipated development and exploration of the Company's mineral projects are intended to provide an overview of management's expectations with respect to certain future activities of the Company and may not be appropriate for other purposes.

Forward-looking statements are based on management's current plans, estimates, projections, beliefs and opinions and, except as required by law, the Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change. Readers are cautioned not to put undue reliance on forward-looking statements.

Photo - https://mma.prnewswire.com/media/1488423/Figure_1.jpg

Photo - https://mma.prnewswire.com/media/1488424/Figure_2.jpg

Photo - https://mma.prnewswire.com/media/1488425/Figure_3.jpg

Photo - https://mma.prnewswire.com/media/1488426/Figure_4.jpg

Photo - https://mma.prnewswire.com/media/1488427/Figure_5.jpg

Nuria Menéndez, Chief Financial Officer, E: nmenendez@orvana.com; Joanne Jobin, Investor Relations Officer, E: jjobin@orvana.com, T: 647 964 0292