HALIFAX, NS / ACCESWIRE / May 20, 2021 / Namibia Critical Metals Inc. ("Namibia Critical Metals" or the "Company" or "NMI") (TSXV:NMI) is pleased to announce an updated NI 43-101 mineral resource estimate for the Lofdal Heavy Rare Earths Project ("Lofdal") in northwestern Namibia.

Highlights of the mineral resource update include:

1454% increase in total Measured and Indicated Mineral Resource tonnage from 2.88 Mt at 0.32% TREO to 44.76 million tonnes at 0.17% TREO for combined Area 4 (including the first Measured Resource for Lofdal) and Area 2B based on the same cut-off of 0.1 % TREO as in the previous PEA filed on October 1, 2014;

Term 1 objectives with JV partner JOGMEC of doubling the mineral resource far exceeded;

164% increase in total Inferred Mineral Resource tonnage to 8.67 million tonnes at a grade of 0.17% TREO for combined Area 4 and Area 2B based on 0.1 % TREO cut-off;

6 times increase in contained TREO in Measured & Indicated categories to 76,950 tonnes;

Compared to previous mineral resource estimate, contained dysprosium oxide (4,060 tonnes) and terbium oxide (620 tonnes) in the Measured and Indicated categories increased 6.1 times and 6.7 times, respectively;

Dysprosium oxide price in the "moderate down case scenario" for 2021 at 420 USD per kilogram and terbium oxide price at 1,125 USD per kilogram (Adamas Intelligence, 2021)

Darrin Campbell, President of NMI stated "We are extremely pleased to see this significant increase to the size and potential of our Lofdal Project. Our first year in partnership with JOGMEC has been a great success in advancing Lofdal forward to being one of the premier heavy rare earth projects in the world. It is a great pleasure to see that our geological team has cracked the code of the deposit to establish a first significant mineral resource outside Area 4 at Area 2B with several tens of kilometers of additional strike length of potentially mineralised structural zones to be drilled in Area 2 and Area 5 that could result in additional mineral resources. The main value drivers of the Lofdal deposit are dysprosium and terbium which are critical components to produce high-strength permanent magnets used in electric vehicle motors and wind turbines. The permanent magnet sector is expected to be the fastest-growing end-use category of rare earths for the next decade."

Background and summary

The Lofdal deposit is being developed by a joint venture of Namibia Critical Metals and the Japanese Oil, Gas and Metals Corporation (JOGMEC). The joint venture aimed at doubling the Mineral Resource of 2.88 Mt at a grade of 0.32% TREO in the Indicated category and 3.28 Mt at a grade of 0.27% TREO in the Inferred category (as reported in the PEA 2014[1]) with its 9 months drilling campaign in 2020.

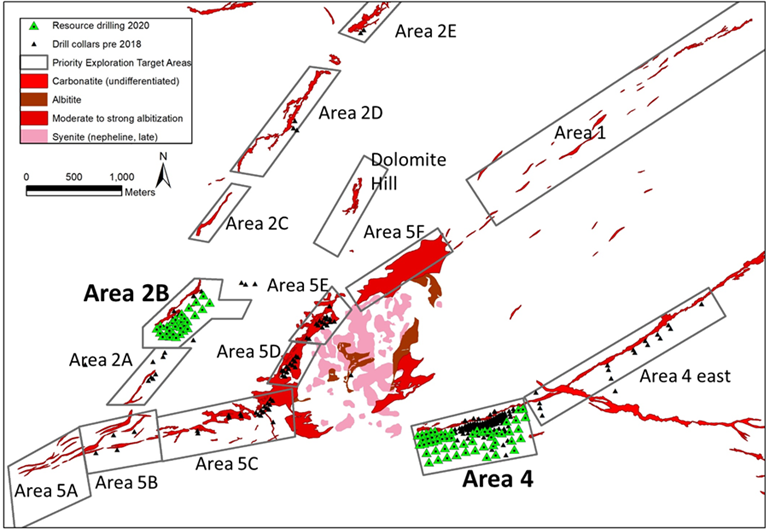

Figure 1 - Structural zones of the central Lofdal deposit with the first two areas with resource drilling: Area 2B and Area 4 (drill collars as green triangles).

As a result, drilling in 2020 increased the mineral resources of the project to 44.76 Mt at a grade of 0.17% TREO Measured and Indicated categories and 8.67 Mt at a grade of 0.17% TREO in Inferred category in combined Area 4 and Area 2B (see Figure 1), applying the same cut-off of 0.1% total rare earth oxides (TREO) as in the previous PEA of 2014.

[1] Preliminary Economic Assessment on the Lofdal Rare Earths Project Namibia dated October 1, 2014 authored by David S. Dodd, B. Sc (Hon) FSAIMM - The MDM Group, South Africa, Patrick J.F. Hannon, M.A.Sc., P.Eng. and William Douglas Roy, M.A.Sc., P.Eng. - MineTech International Limited, Canada, Peter Roy Siegfried, MAusIMM (CP Geology) and Michael R. Hall, B.Sc (Hons), MBA, MAusIMM, Pr.Sci.Nat, MGSSA - The MSA Group, South Africa. The PEA should not be considered to be a pre-feasibility or feasibility study, as the economics and technical viability of the Project has not been demonstrated at this time. The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. Furthermore, there is no certainty that the PEA will be realized.

On April 1, 2021 the Company announced that JOGMEC had officially elected to move to Term 2 of the JV Agreement and provide additional funding of $2,063,000 for further exploration and development programs at Lofdal through to July 31, 2021.

The terms of the JOGMEC JV Agreement contemplate that JOGMEC provides $3,000,000 in Term 1 and $7,000,000 in Term 2 to earn a 40% interest in the Lofdal project. Term 3 calls for a further $10,000,000 of expenditures to earn an additional 10% interest. The total approved expenditures to date for Terms 1 and 2 are $6,163,000. The JV Agreement is structured such that no NMI equity will be issued and it is totally non-dilutive to NMI shareholders.

Mineral Resource Estimates

The in-situ Mineral Resource estimate was independently prepared by The MSA Group of South Africa ("MSA") and was based on geochemical analyses and density measurements of core samples obtained by diamond drilling undertaken by Namibia Critical Metals from 2010 to 2012, 2015 and more recently in 2020.

A total of 172 drill holes have been drilled at Area 4, of which 13 were collared outside the defined Mineral Resource. In Area 2B, 46 drill holes were used to estimate the Mineral Resource. Extensive trenching and trench sampling were conducted in the earlier years of exploration, which was useful in defining the extents of the mineralisation but was excluded from the grade estimates due to potential biases from sampling in the near surface environment.

From the assumed parameters a 0.1% TREO cut-off grade was calculated, which together with the Whittle optimised pit shell demonstrates reasonable prospects for eventual economic extraction (RPEEE) for the Mineral Resource. The Mineral Resource is classified into the Measured, Indicated and Inferred categories and is reported at a cut-off grade of 0.1% TREO (TREO and *TREO in tables below refers to Total Rare Earth Oxides including Y2O3).

The mineral resource was estimated by MSA as follows:

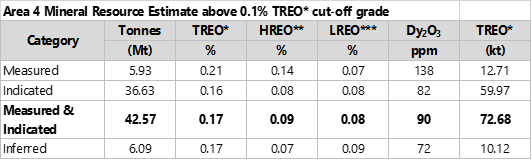

Table 1: Area 4 Mineral Resources Estimate for 0.1% TREO cut-off

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

- **HREO = Total Heavy Rare Earth Oxides and includes Y2O3

- ***LREO = Total Light Rare Earth Oxides

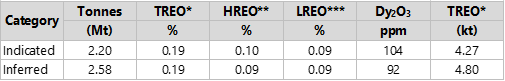

Table 2: Area 2B Mineral Resources Estimate for 0.1% TREO cut-off

Table 3: Area 4 Grade and Tonnages in Measured and Indicated categories

Cut-off TREO % | Tonnes (Mt) | TREO* | HREO** | LREO** | Dy2O3 ppm | TREO |

% | % | % | (kt) | |||

0.10 | 42.57 | 0.17 | 0.09 | 0.08 | 90 | 72.7 |

0.15 | 17.50 | 0.24 | 0.15 | 0.09 | 141 | 42.1 |

0.20 | 7.63 | 0.33 | 0.23 | 0.10 | 216 | 25.2 |

0.25 | 4.05 | 0.43 | 0.33 | 0.10 | 305 | 17.3 |

0.30 | 2.67 | 0.51 | 0.40 | 0.10 | 371 | 13.5 |

0.35 | 1.93 | 0.58 | 0.47 | 0.11 | 428 | 11.2 |

0.40 | 1.46 | 0.64 | 0.53 | 0.11 | 484 | 9.3 |

Table 4: Area 4 Grade and Tonnages in Inferred category

Cut-off TREO % | Tonnes (Mt) | TREO* | HREO** | LREO** | Dy2O3 ppm | TREO |

% | % | % | (kt) | |||

0.10 | 6.09 | 0.17 | 0.07 | 0.09 | 72 | 10.1 |

0.15 | 2.97 | 0.21 | 0.10 | 0.12 | 94 | 6.3 |

0.20 | 1.35 | 0.26 | 0.13 | 0.13 | 123 | 3.5 |

0.25 | 0.59 | 0.31 | 0.21 | 0.10 | 198 | 1.9 |

0.30 | 0.22 | 0.36 | 0.27 | 0.09 | 252 | 0.8 |

0.35 | 0.09 | 0.42 | 0.33 | 0.09 | 305 | 0.4 |

0.40 | 0.05 | 0.45 | 0.37 | 0.08 | 345 | 0.2 |

Table 5: Area 2B Grade and Tonnages in Indicated category

Cut-off TREO % | Tonnes (Mt) | TREO* | HREO** | LREO** | Dy2O3 ppm | TREO |

% | % | % | (kt) | |||

0.10 | 2.20 | 0.19 | 0.10 | 0.09 | 104 | 4.3 |

0.15 | 1.24 | 0.25 | 0.12 | 0.13 | 125 | 3.1 |

0.20 | 0.76 | 0.30 | 0.14 | 0.16 | 143 | 2.3 |

0.25 | 0.47 | 0.35 | 0.15 | 0.20 | 158 | 1.6 |

0.30 | 0.29 | 0.39 | 0.16 | 0.23 | 172 | 1.1 |

0.35 | 0.18 | 0.43 | 0.18 | 0.26 | 189 | 0.8 |

0.40 | 0.11 | 0.47 | 0.19 | 0.28 | 205 | 0.5 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

- **HREO = Total Heavy Rare Earth Oxides and includes Y2O3

- ***LREO = Total Light Rare Earth Oxides

Table 6: Area 2B Grade and Tonnages in Inferred category

Cut-off TREO % | Tonnes (Mt) | TREO* | HREO** | LREO** | Dy2O3 ppm | TREO |

% | % | % | (kt) | |||

0.10 | 2.58 | 0.19 | 0.09 | 0.09 | 92 | 4.8 |

0.15 | 1.37 | 0.24 | 0.13 | 0.11 | 123 | 3.3 |

0.20 | 0.67 | 0.31 | 0.17 | 0.14 | 168 | 2.1 |

0.25 | 0.45 | 0.36 | 0.20 | 0.16 | 196 | 1.6 |

0.30 | 0.31 | 0.39 | 0.23 | 0.16 | 226 | 1.2 |

0.35 | 0.20 | 0.43 | 0.29 | 0.14 | 274 | 0.9 |

0.40 | 0.11 | 0.47 | 0.34 | 0.13 | 324 | 0.5 |

Table 7: Area 4 Mineral Resources estimate by individual REO - Grades at a cut-off of 0.1% TREO

Class | Tonnes | TREO* | La2O3 | Ce2O3 | Pr2O3 | Nd2O3 | Sm2O3 | Eu2O3 | Gd2O3 | Tb2O3 | Dy2O3 | Ho2O3 | Er2O3 | Tm2O3 | Yb2O3 | Lu2O3 | Y2O3 |

Mt | % | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | |

Measured | 5.93 | 0.21 | 177 | 320 | 34 | 127 | 44 | 19 | 85 | 20 | 138 | 30 | 86 | 13 | 78 | 11 | 960 |

Indicated | 36.63 | 0.16 | 208 | 371 | 39 | 139 | 40 | 15 | 62 | 13 | 82 | 17 | 49 | 7 | 44 | 6 | 546 |

M&I | 42.57 | 0.17 | 204 | 364 | 38 | 137 | 41 | 16 | 65 | 14 | 90 | 19 | 54 | 8 | 48 | 7 | 603 |

Inferred | 6.09 | 0.17 | 247 | 436 | 45 | 158 | 41 | 14 | 54 | 11 | 72 | 15 | 45 | 7 | 41 | 6 | 470 |

Table 8: Area 4 Mineral Resources estimate by individual REO - Tonnes at a cut-off of 0.1% TREO

Class | Tonnes | TREO* | La2O3 | Ce2O3 | Pr2O3 | Nd2O3 | Sm2O3 | Eu2O3 | Gd2O3 | Tb2O3 | Dy2O3 | Ho2O3 | Er2O3 | Tm2O3 | Yb2O3 | Lu2O3 | Y2O3 |

Mt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | |

Measured | 5.93 | 12.71 | 1.05 | 1.90 | 0.20 | 0.75 | 0.26 | 0.11 | 0.51 | 0.12 | 0.82 | 0.18 | 0.51 | 0.08 | 0.46 | 0.07 | 5.69 |

Indicated | 36.63 | 59.97 | 7.62 | 13.58 | 1.42 | 5.09 | 1.48 | 0.56 | 2.26 | 0.46 | 3.01 | 0.62 | 1.78 | 0.26 | 1.60 | 0.23 | 19.99 |

M&I | 42.57 | 72.68 | 8.67 | 15.48 | 1.62 | 5.84 | 1.74 | 0.67 | 2.76 | 0.58 | 3.83 | 0.80 | 2.30 | 0.34 | 2.06 | 0.30 | 25.68 |

Inferred | 6.09 | 10.12 | 1.50 | 2.65 | 0.28 | 0.96 | 0.25 | 0.08 | 0.33 | 0.07 | 0.44 | 0.09 | 0.27 | 0.04 | 0.25 | 0.04 | 2.86 |

Table 9: Area 2B Mineral Resource estimate by individual REO - Grades at a cut-off of 0.1% TREO

Class | Tonnes | TREO* | La2O3 | Ce2O3 | Pr2O3 | Nd2O3 | Sm2O3 | Eu2O3 | Gd2O3 | Tb2O3 | Dy2O3 | Ho2O3 | Er2O3 | Tm2O3 | Yb2O3 | Lu2O3 | Y2O3 |

Mt | % | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | |

Indicated | 2.20 | 0.19 | 255 | 398 | 41 | 161 | 64 | 25 | 87 | 17 | 104 | 20 | 58 | 8 | 54 | 8 | 638 |

Inferred | 2.58 | 0.19 | 243 | 385 | 41 | 178 | 85 | 29 | 94 | 16 | 92 | 17 | 49 | 7 | 45 | 7 | 575 |

Table 10: Area 2B Mineral Resource estimate by individual REO - Tonnes at a cut-off of 0.1% TREO

Class | Tonnes | TREO* | La2O3 | Ce2O3 | Pr2O3 | Nd2O3 | Sm2O3 | Eu2O3 | Gd2O3 | Tb2O3 | Dy2O3 | Ho2O3 | Er2O3 | Tm2O3 | Yb2O3 | Lu2O3 | Y2O3 |

Mt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | kt | |

Indicated | 2.20 | 4.27 | 0.56 | 0.88 | 0.09 | 0.35 | 0.14 | 0.05 | 0.19 | 0.04 | 0.23 | 0.04 | 0.13 | 0.02 | 0.12 | 0.02 | 1.41 |

Inferred | 2.58 | 4.80 | 0.63 | 0.99 | 0.11 | 0.46 | 0.22 | 0.08 | 0.24 | 0.04 | 0.24 | 0.04 | 0.13 | 0.02 | 0.12 | 0.02 | 1.48 |

Notes:

- All tabulated data have been rounded and as a result minor computational errors may occur.

- Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

- *TREO = Total Rare Earth Oxides and includes Y2O3

Interpretation of the Mineral Resource estimates

The Mineral Resource at Area 4 was increased more than 7 fold using a cut-off of 0.1% TREO as in the maiden resource of 2012. In addition to Area 4, drilling in 2020 also demonstrated the potential of other mineralised structures to form part of the Lofdal deposit. Mineral resources at Area 2B amount to 2.2 Mt in the Indicated category and 2.58 Mt in the Inferred category at a cut-off of 0.1% TREO, or 1.24 Mt and 1.37 Mt, respectively, at a cut-off of 0.15% TREO. The exploration target for Area 2B was originally estimated at 1.5-2.5 Mt, and thus, was significantly exceeded.

Table 11: Comparison of Lofdal Mineral Resource Estimates of 2012 and 2021

Year of Mineral Resource Estimate | 2012 | 2012 | 2021 | 2021 |

Cut-off grade | 0.1% TREO | 0.1% TREO | 0.1% TREO | 0.1% TREO |

Million tonnes (Mt) | Grade %TREO | Million tonnes (Mt) | Grade %TREO | |

Measured Resource Area 4 | 0 | - | 5.93 | 0.21 |

Indicated Resource Area 4 | 2.88 | 0.32 | 36.63 | 0.16 |

Indicated Resource Area 2B | 0 | - | 2.20 | 0.19 |

Total Measured & Indicated Resources | 2.88 | 0.32 | 44.76 | 0.17 |

Inferred Resource Area 4 | 3.28 | 0.27 | 6.09 | 0.17 |

Inferred Resource Area 2B | 0 | - | 2.58 | 0.19 |

Total Inferred Resources | 3.28 | 0.27 | 8.67 | 0.17 |

The Mineral Resource estimates underline the potential of the Lofdal deposit to be developed in large-scale. Initial XRT and XRF sorting test work demonstrated an increase in the grade of the run of mine material by a factor of 1.5 to 3.0 (press release December 3rd, 2020) without any optimization. The Company plans substantial additional test work on sorting technologies to allow for a low cut-off grade in the range of 0.1% TREO.

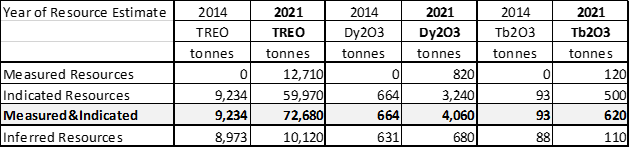

Compared to the previous Mineral Resource estimate, the contained dysprosium oxide (4,060 tonnes) and terbium oxide (620 tonnes) in the Measured and Indicated categories increased 6.1 times and 6.7 times, respectively (table 12).

Table 12: Comparison of contained dysprosium oxide and terbium oxide in Mineral Resources of 2012 and 2021

Geological background

The rare earth element ("REE") mineralisation at Lofdal comprises multiple zones of hydrothermal alteration, predominantly albitization and carbonatization, associated with narrow carbonatite dykes of variable thickness. Multiple zones of REE mineralisation occur at Lofdal, with the two locations that have been evaluated by recent drilling being known as Area 4 and Area 2B.

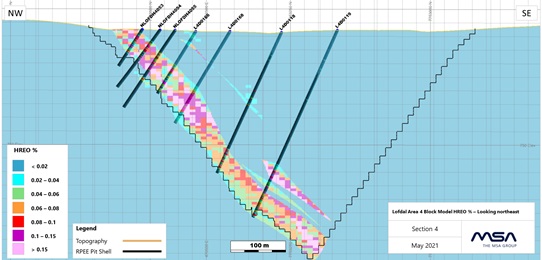

At Area 4, the zone of alteration has been traced for over more than 1,100 m at surface (figure 1), where it is characterised by an intensely altered zone of 15 m to 30 m thickness with a less altered halo of 50 m to 60 m that can extend up to 100 m in thickness (figure 2).

Figure 2: Section through block model of central part of Area 4displaying HREO block grades

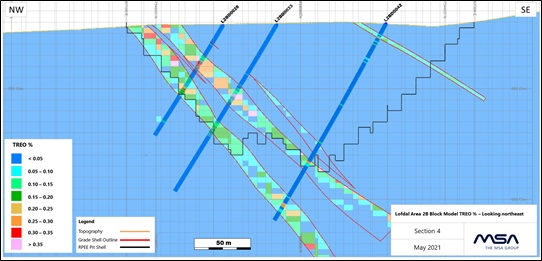

The alteration zone at Area 2B has been traced along a strike length of 600 m and its thickness ranges from 20 m to 35 m, thinning to less than 10 m in the central part of the deposit (figure 3). Regional sampling and mapping suggest that the mineralisation for both deposits may extend for several kilometers along strike.

Figure 3: Section through block model of western part of Area 2B displaying TREO block grades

Sampling and Mineral Resource estimation techniques

The Mineral Resource estimate was based on geochemical analyses and density measurements of core samples obtained by diamond drilling undertaken by Namibia Rare Earths from 2010 to 2012, 2015 and more recently by Namibia Critical Metals from 2020 to 2021.

A total of 172 drill holes have been drilled at Area 4, of which 13 were collared outside the defined Mineral Resource. In Area 2B, 46 drill holes were used to estimate the Mineral Resource.

Half core samples of one meter lengths intervals were taken for analysis. The bagged core samples were given a unique sample reference number and dispatched for preparation at Activation Labs (Actlabs) sample preparation facility in Windhoek. The core samples were crushed to 2 mm, split using a riffle splitter and pulverised to 105 microns. Pulverised sub-samples were homogenised in a stainless-steel riffle splitter and a 15 g sample and duplicate were drawn for analysis. The pulverised sample aliquots were shipped to the ISO/IEC 17025 accredited Actlabs analytical facility in Ancaster, Ontario, Canada. The REE's were assayed using lithium metaborate-tetraborate fusion and Inductively Coupled Plasma Mass Spectrometry (ICP-MS).

The samples were subjected to a quality assurance and control (QAQC) program consisting of the insertion of blank samples and certified reference materials at Lofdal and the preparation of a laboratory duplicate at the sample preparation facility in Windhoek. The primary laboratory assay values were confirmed by duplicate samples assayed by a second laboratory (ALS, North Vancouver, Canada). The Qualified Person is satisfied that the assay results are of sufficient accuracy and precision for use in Mineral Resource estimation.

A three-dimensional geological model of the REE mineralisation and weathering surface was constructed using the drill hole and trench data. A mineralised envelope was defined using a 10 ppm Dy2O3 threshold for Area 4 and 12 ppm Dy2O3 for Area 2B. The grades of the individual light rare earth oxides (LREO) and individual heavy rare earth oxides (HREO) were estimated using ordinary kriging into a block model for each deposit. Density was estimated using inverse distance weighting.

Filing of Report

The NI 43-101 compliant technical report ("Report") will be filed on SEDAR within the next 45 days.

The Qualified Person for the Mineral Resource estimate is Mr. Jeremy C. Witley (BSc Hons, MSc (Eng.)) who is a geologist with more than 30 years' experience in base and precious metals exploration and mining as well as in Mineral Resource evaluation and reporting. He is a Principal Resource Consultant for The MSA Group (an independent consulting company), is registered with the South African Council for Natural Scientific Professions (SACNASP) and is a Fellow of the Geological Society of South Africa (GSSA). Mr. Witley has the appropriate relevant qualifications and experience to be considered a "Qualified Person" for the style and type of mineralization and activity being undertaken as defined in National Instrument 43-101 Standards of Disclosure of Mineral Projects.

Geological services were provided by Gecko Exploration (Pty) Ltd. under the supervision of Dr Rainer Ellmies, VP Exploration for Namibia Critical Metals. Drilling services were provided by Günzel Drilling, a Namibian contract drilling company, and downhole geophysical measurements were carried out by Gregory Symons Geophysics of Windhoek. Sample preparation and analytical services were provided by Activation Laboratories Ltd. (Windhoek, Namibia and Ancaster, Ontario) as the primary laboratory employing ICP-MS techniques suitable for rare earth element analyses and following strict internal QAQC procedures inserting blanks, standards and duplicates. Check analyses were carried out by ALS Minerals (North Vancouver) as the umpire laboratory on approximately 5% of the resource database.

Neither Mr. Witley nor any associates employed in the preparation of the Mineral Resource report ("Consultants") have any beneficial interest in Namibia Critical Metals. These Consultants are not insiders, associates, or affiliates of Namibia Critical Metals. The results of the report are not dependent upon any prior agreements concerning the conclusions to be reached, nor are there any undisclosed understandings concerning any future business dealings between Namibia Critical Metals and the Consultants. The Consultants are to be paid a fee for their work in accordance with normal professional consulting practices.

About Namibia Critical Metals Inc.

Namibia Critical Metals Inc. holds a diversified portfolio of exploration and advanced stage projects in the country of Namibia focused on the development of sustainable and ethical sources of metals for the battery, electric vehicle and associated industries. The two advanced stage projects in the portfolio are Lofdal and Epembe. The Company also holds significant land positions in areas favourable for gold mineralization.

Heavy Rare Earths: The Lofdal Project is the Company's most advanced project having completed a Preliminary Economic Assessment in 2014 and full Environmental Clearance for a first mining area in 2016. The Company has received Notice of Preparedness to Grant the Mining Licence for Lofdal from the Ministry of Mines and Energy. The Company has lodged its acceptance of the mining licence and awaits finalization of the process from the Ministry. The project is developed in joint venture with Japan Oil, Gas and Metals National Corporation ("JOGMEC") who are funding the current CD$10,000,000 drilling and metallurgical program with the objective of doubling the resource size and optimization of the process flow sheet.

Gold: The Company's Exclusive Prospecting Licenses ("EPLs") prospective for gold are located in the Central Namibian Gold Belt which hosts a number of significant orogenic gold deposits including the Navachab Gold Mine, the Otjikoto Gold Mine and more recently the discovery of the Twin Hills deposit. At the Erongo Gold Project, stratigraphic equivalents to the meta-sediments hosting the Osino's gold discovery at Twin Hills have been identified and soil surveys are progressing over this highly prospective area.

The Grootfontein Base Metal and Gold Project has potential for magmatic copper-nickel mineralization, Mississippi Valley-type zinc-lead-vanadium mineralization and orogenic gold mineralization. Detailed interpretation of geophysical data and regional geochemical soil sampling have identified first gold targets. A regional helicopter-borne SkyTEM EM and magnetic survey is planned for May 2021.

Figure 4: Project areas of Namibia Critical Metals in Namibia

Tantalum-Niobium: The Epembe Tantalum-Niobium-Uranium Project is at an advanced stage with a well-defined, 10 km long carbonatite dyke that has been delineated by detailed mapping and radiometric surveys with over 11,000 meters of drilling. Preliminary mineralogical and metallurgical studies including sorting tests (XRT), indicate the potential for significant physical upgrading. Further work will be undertaken to advance the project to a preliminary economic assessment stage.

Copper-Cobalt: The Kunene Copper-Cobalt Project comprises a very large area of favorable stratigraphy along strike of the Opuwo cobalt-copper-zinc deposit. Secondary copper mineralization over a wide area points to preliminary evidence of a regional-scale hydrothermal system. Exploration targets on EPLs held in the Kunene project comprise direct extensions of the cobalt-copper mineralization to the west, sediment-hosted copper, orogenic copper, and stratabound manganese and zinc-lead mineralization.

The common shares of Namibia Critical Metals Inc. trade on the TSX Venture Exchange under the symbol "NMI".

Mr. Jeremy C. Witley, Pr. Sci Nat., is the Qualified Person and has reviewed and approved this press release. The information in this press release that relates to the estimate of Mineral Resources for the Lofdal Project is based upon, and fairly represents, information and supporting documentation compiled by Mr. Witley.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information please contact -

Namibia Critical Metals Inc.

Darrin Campbell, President

Tel: +01 (902) 835-8760

Fax: +01 (902) 835-8761

Email: Info@NamibiaCMI.com

Web site: www.NamibiaCriticalMetals.com

The foregoing information may contain forward-looking information relating to the future performance of Namibia Critical Metals Inc. forward-looking information, specifically, that concerning future performance, is subject to certain risks and uncertainties, and actual results may differ materially. These risks and uncertainties are detailed from time to time in the Company's filings with the appropriate securities commissions.

SOURCE: Namibia Critical Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/648349/Mineral-Resource-Update-More-than-650-Percent-Increase-in-Measured-and-Indicated-TREO-Mineral-Resources-for-the-Lofdal-Heavy-Rare-Earths-Project