TORONTO, ON / ACCESSWIRE / June 1, 2021 / Tartisan Nickel Corp. (CSE:TN)(FSE:A2D)(OTC PINK:TTSRF) ("Tartisan", or the "Company") announces that the Company has filed on SEDAR (Amended) Technical Report and Updated Mineral Resource Estimate of the Kenbridge Nickel Project, Northwestern Ontario. The Company has Updated the Report to revise certain disclosure and to include the recent Kenbridge Property visit by representatives of P&E Mining Consultants Inc. which took place on May 18, 2021 as well as the recent Crone Geophysics winter work program. The Company has retracted at the request of the staff of the Ontario Securities Commission the "aged" Kenbridge Preliminary Economic Assessment "PEA" information (originally filed on SEDAR 2008 and amended 2010 by Canadian Arrow Mines Limited) from the Technical Report.

Kenbridge Nickel Project

As outlined in the (Amended) Technical Report and Updated Mineral Resource Estimate, resource estimates were done for pit constrained and out-of-pit nickel, copper, and cobalt Mineral Resources. Total Measured & Indicated Mineral Resources based on a Net Smelter Return ("NSR") cut-off value of CDN$15 per tonne for pit constrained Mineral Resources and CDN$60 per tonne "NSR" for out-of-pit Mineral Resources is 7.47 Mt at 0.6% Ni and 0.32% Cu for a total of 95 Mlb of contained nickel. An additional 0.99 Mt at 1.0% Ni and 0.62% Cu (22 Mlb contained nickel) were calculated as Inferred Mineral Resources. The pit constrained Measured & Indicated Mineral Resources total 5.24 Mt of 0.5% nickel; 0.26% copper; and 0.009% cobalt at an "NSR" cut-off value of CDN$15/tonne. The out-of-pit Measured & Indicated Mineral Resources total 2.23 Mt of 0.9% nickel; 0.45% copper; and 0.006% cobalt. Inferred Mineral Resources out-of-pit total 0.99 Mt at 1.00% nickel; 0.62% copper; and 0.003% cobalt, at an "NSR" cut-off value of CDN$60/tonne.

The Kenbridge Nickel Project is located in the Kenora Mining District - Fort Francis, Ontario area with good access to roads and power. Kenbridge has an existing shaft to a depth of 2,042 ft (622 m), with level stations at 150 ft. (45 m) intervals below the shaft collar and two levels developed at 350 ft (107 m) and 500 ft (152 m) below the shaft collar.

Mineral Resource Estimate is shown in Table 1.

Table 1 | |||||||||

Scenario | Classification | Cut-off | Tonnes | Ni | Ni | Cu | Cu | Co | Co |

Pit Constrained | Measured | 15 | 2.966 | 0.5 | 30.8 | 0.26 | 17.3 | 0.007 | 0.5 |

Indicated | 15 | 2.270 | 0.4 | 21.5 | 0.26 | 13.2 | 0.010 | 0.5 | |

Meas + Ind | 15 | 5.236 | 0.5 | 52.3 | 0.26 | 30.5 | 0.009 | 1.0 | |

Out-of-pit | Indicated | 60 | 2.232 | 0.9 | 42.5 | 0.45 | 22.4 | 0.006 | 0.3 |

Inferred | 60 | 0.985 | 1.00 | 21.8 | 0.62 | 13.5 | 0.003 | 0.1 | |

Total | Measured | 15 | 2.966 | 0.5 | 30.8 | 0.26 | 17.3 | 0.007 | 0.5 |

Indicated | 15+60 | 4.502 | 0.7 | 64.1 | 0.36 | 35.6 | 0.008 | 0.8 | |

Meas + Ind | 15+60 | 7.468 | 0.6 | 94.9 | 0.32 | 52.9 | 0.008 | 1.3 | |

Inferred | 60 | 0.985 | 1.0 | 21.8 | 0.62 | 13.5 | 0.003 | 0.1 | |

Note: Ni =Nickel Cu = Copper, Co = Cobalt, NSR = Net Smelter Return.

1. Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability.

2. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

3. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

4. The Mineral Resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM"), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

5. The Mineral Resource Estimate was based on US$ metal prices of $7.42/lb nickel, $3/lb copper and $25/lb cobalt.

6. The out-of-pit Mineral Resource grade blocks were quantified above the $60/t NSR cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Additionally, only groups of blocks that exhibited continuity and reasonable potential stope geometry were included. All orphaned blocks and narrow strings of blocks were excluded. The longhole stoping with backfill mining method was assumed for the out of pit Mineral Resource Estimate calculation.

The Kenbridge Deposit shows there is great potential to expand the Mineral Resource down- plunge of high- grade intersections such as hole KB07-180 (2.95% Ni, 0.82% Cu / 21.5m including 7.2% Ni, 0.67% Cu / 5.5m) and also at depth. The deepest hole (end of hole K2010 = 880 m below surface) intersected mineralization grading 4.25% nickel and 1.38% copper over 10.7 ft (3.3 m), indicating that the Deposit remains open at depth.

The Company recently performed a surface Time Domain Electromagnetic ("TDEM") survey at Kenbridge North, 2.5km to the north of the Kenbridge Deposit, as well as borehole geophysics at the known Kenbridge Deposit. The Kenbridge North target is interpreted to represent similar rock types that host the Kenbridge Deposit. (Press release May 5, 2021). Results of the borehole "TDEM" survey conducted on historic drill holes KB07-180 and KB07-194 at the Kenbridge Deposit, suggest that conductive material does in fact continue to depth and to the north of Kenbridge Deposit.

Tartisan Nickel Corp. plans to expand on these intersections, upgrade the Indicated and Inferred Mineral Resources and test high potential nickel exploration targets, such as the Kenbridge North Target.

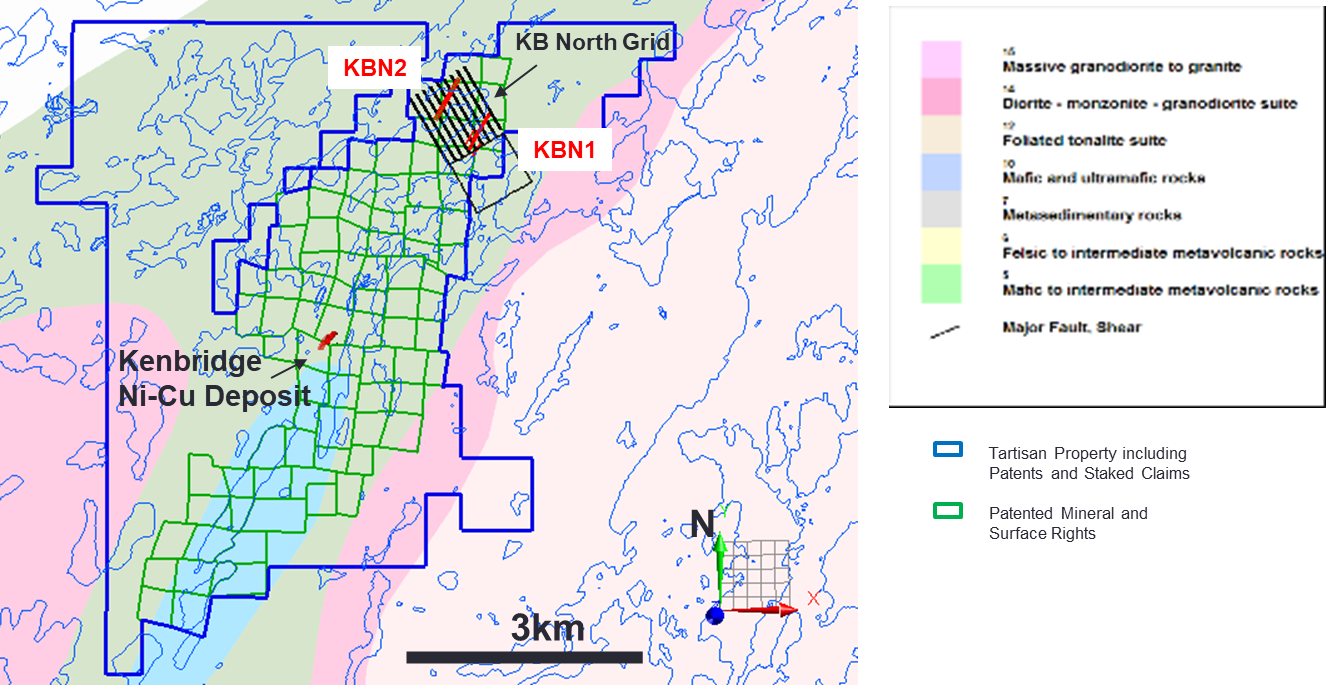

Figure 1: Regional Geology and Tartisan land position. KBN1 and KBN2 are electromagnetic conductors identified from a recent ground survey.

P&E Mining Consultants Inc. is in the process of completing a Preliminary Economic Assessment technical report ("PEA") on the Kenbridge Project (press released February 2, 2021). The "PEA" will identify the critical next steps the Company needs to take to move the Kenbridge Deposit towards a Feasibility Study including permitting, geotechnical, environmental, and geological considerations.

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian based mineral exploration and development company whose flag ship asset is the Kenbridge Nickel Deposit located in the Kenora Mining District, Ontario. Tartisan also owns; the Sill Lake Silver Property in Sault St. Marie, Ontario as well as the Don Pancho Manganese-Zinc-Lead-Silver Project in Peru.

Tartisan Nickel Corp. also owns an equity stake in; Eloro Resources Limited, Class 1 Nickel and Technologies Limited, Peruvian Metals Corp. and Silver Bullet Mines Inc.

Tartisan Nickel Corp. common shares are listed on the Canadian Securities Exchange (CSE:TN; US-OTC:TTSRF; FSE:A2D). Currently, there are 104,333,606 shares outstanding (110,358,714 fully diluted).

For further information, please contact Mark Appleby, President & CEO and a Director of the Company, at 416-804-0280 (info@tartisannickel.com). Additional information about Tartisan Nickel Corp. can be found at the Company's website at www.tartisannickel.com or on SEDAR at www.sedar.com.

Dean MacEachern P.Geo. and Eugene Puritch, P.Eng, FEC, CET are the respective Company and independent Qualified Persons under NI 43-101 and have read and approved the technical content of this News Release.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

SOURCE: Tartisan Nickel Corp.

View source version on accesswire.com:

https://www.accesswire.com/649830/Tartisan-Files-Enhanced-Disclosure-and-Amended-Technical-Report-and-Updated-Mineral-Resource-Estimate-of-the-Kenbridge-Nickel-Project-Kenora-Ontario