VANCOUVER, BC / ACCESSWIRE / June 16, 2021 / Blackwolf Copper and Gold Ltd. ("Blackwolf" or the "Company") (TSXV:BWCG) is pleased to announce that assays from four drill holes have been received from the spring 2021 underground resource expansion and exploration drilling program from the Lookout Deposit at its 100%-owned Niblack copper-gold-silver-zinc VMS project, located adjacent to tidewater in southeast Alaska. This drilling is over 1,000 meters to the south of the historic Niblack Mine area where the Company recently reported high-grade, copper-massive sulphide mineralization (see Blackwolf Copper and Gold News Release, May 03, 2021).

Resource expansion drilling intersected much wider intervals than expected from previous modelling, with remarkably consistent polymetallic grades within the Lookout Zone. Exploration drilling down-dip of the deposit encountered encouraging base and precious metal intervals within the prospective massive sulphide horizon. Highlights of the drilling at the Lookout and Lookout Extension zones include:

- U21-226: 27.00 meters averaging 1.06% Cu, 1.87 g/t Au, 32.83 g/t Ag, 1.04% Zn or 3.08% Cu equiv.

including: 4.00 meters averaging 2.61% Cu, 4.93g/t Au, 76.58 g/t Ag, 2.34% Zn or 7.69% Cu equiv.

- U21-227: 32.60 meters averaging 1.03% Cu, 1.49 g/t Au, 26.54 g/t Ag,0.92% Zn or 2.67% Cu equiv.

including: 3.00 meters averaging 2.37% Cu, 3.29 g/t Au, 58.97 g/t Ag, 1.42% Zn or 5.78% Cu equiv.

Metal equivalency value is based on the following prices: US$3.25/lb Cu, US$1,600/oz Au, US$1.15/lb Zn and US$20.75/oz Ag; it is noted that no adjustments were made in the metal equivalency calculation for metal recovery. Prices taken as an average of research analyst's long-term metal prices forecasts, April 2021.

"Two drill holes were completed to test our revised geological model relating to the expansion of current Mineral Resources at the Lookout Zone and encountered substantially thicker intervals of mineralization than expected, with remarkable continuity between the drill holes. The consistent high-grade mineralization with excellent metallurgy and hosted in good ground conditions suggests that this area is potentially amenable to low-cost bulk underground mining," said Rob McLeod, President and CEO of Blackwolf Copper and Gold. "Additionally, the discovery of the Lookout mineralized horizon on the west side of the Bluebell fault is highly encouraging, greatly increasing the size potential of the deposit. Based on these results that have exceeded our expectations, Blackwolf has decided to initiate a significant upgrade of site facilities including camp, fuel storage, underground support and core processing that can accommodate greatly expanded programs at Niblack."

Assays have been received for four of five holes drilled during April's 1,810 meter program that targeted extensions to the current Mineral Resources from the Lookout Zone. Primary objectives of this program were: 1) resource expansion drill holes targeting massive sulphide mineralization approximately 300 meters away from the underground ramp; 2) exploration drill holes to test for the down dip extension of the Lookout mineralized horizon and exploration to the west of the Bluebell strike-slip fault, which runs shallowly oblique to the Lookout Zone. All drill holes successfully encountered mineralization. A fifth drill hole testing up dip of the Mineral Resource was stopped short of the mineralized horizon and will be completed during the next round of underground drilling.

Lookout Zone

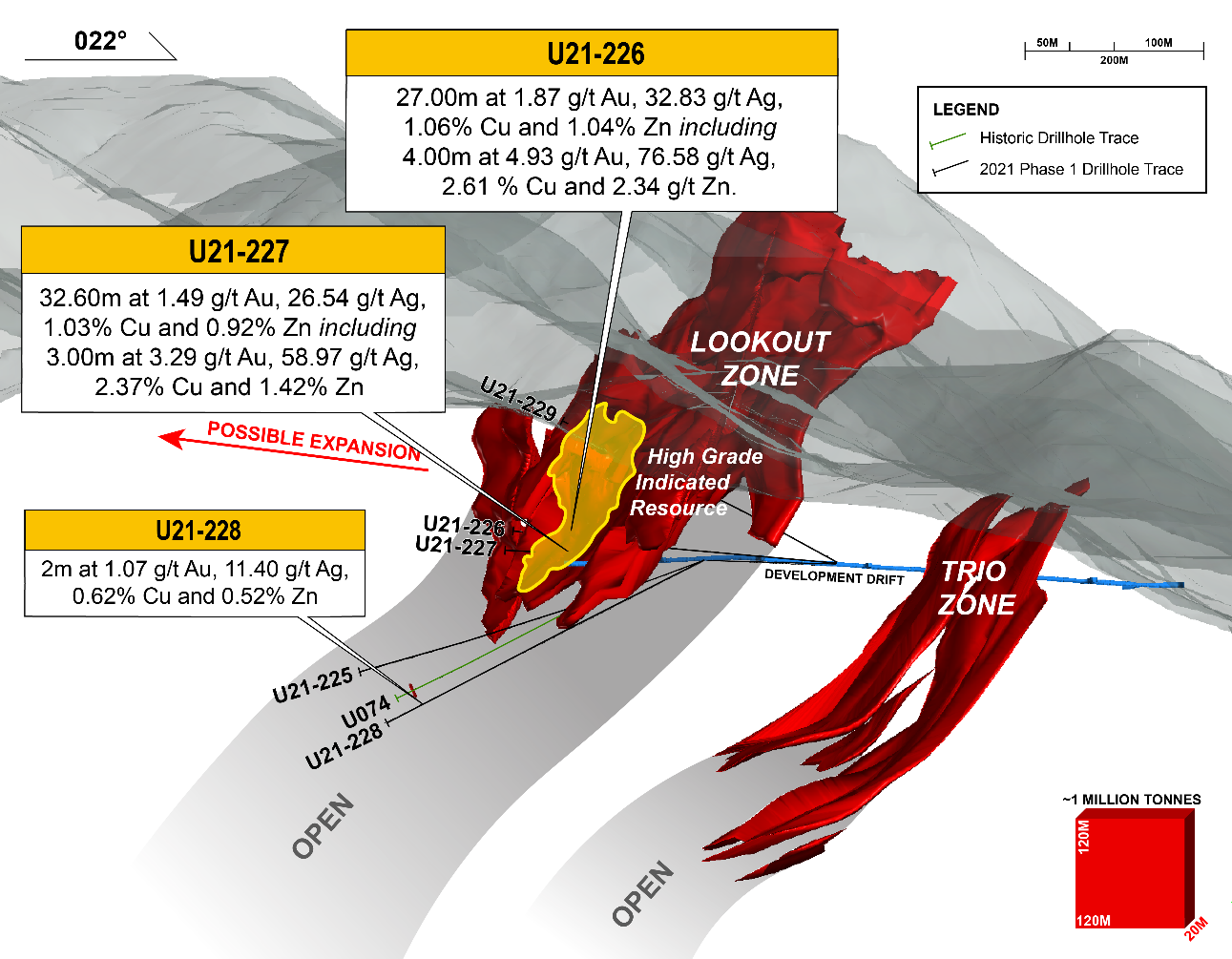

The largest deposit on the Niblack Property, the Lookout Zone hosts a large trough of polymetallic semi-massive to massive sulphide mineralization. Hosting consistent copper-gold-silver-zinc mineralization throughout, this deposit is over 120 meters thick at its widest, potentially amenable to bulk-underground mining techniques. Current NI 43-101 Mineral Resources are 5.6 million tonnes of Indicated Resources averaging 0.95% Cu, 1.75 g/t Au, 29.52 g/t Ag and 1.73% Zn, with additional Inferred Resources of 2.4 million tonnes of 0.73% Cu, 1.42 g/t Ag, 21.63 g/t Ag and 1.17% Zn. A higher-grade core of Indicated Resources hosts 1.2 million tonnes averaging 1.7% Cu, 3.2 g/t Au, 62.6 g/t Ag and 3.8% Zn. Refer to disclosure below for further details on the company's NI 43-101 Mineral Resources Estimate. The deposit is open to expansion to the west and at depth.

High-grade Neoproterozoic VMS-style mineralization is hosted within a series of felsic volcanic flows and breccias, typically as stringer, semi-massive to massive chalcopyrite and sphalerite-rich replacement-style mineralization, commonly with additional pyrite. Metamorphic and structural deformation events have overturned the volcanic sequence and recrystalized the sulphide mineralization, resulting in good metallurgical recoveries. First-pass, unoptimized metallurgical test results from the Lookout deposit yielded recoveries, including: copper (94.3 to 94.9%) and zinc (90.2 to 93.3%) with very clean concentrates. Current test work that is underway is focused on boosting the reasonable initial precious metal recoveries of 72.6 and 76% for gold and silver, respectively (see Blackwolf News Release, February 24, 2021).

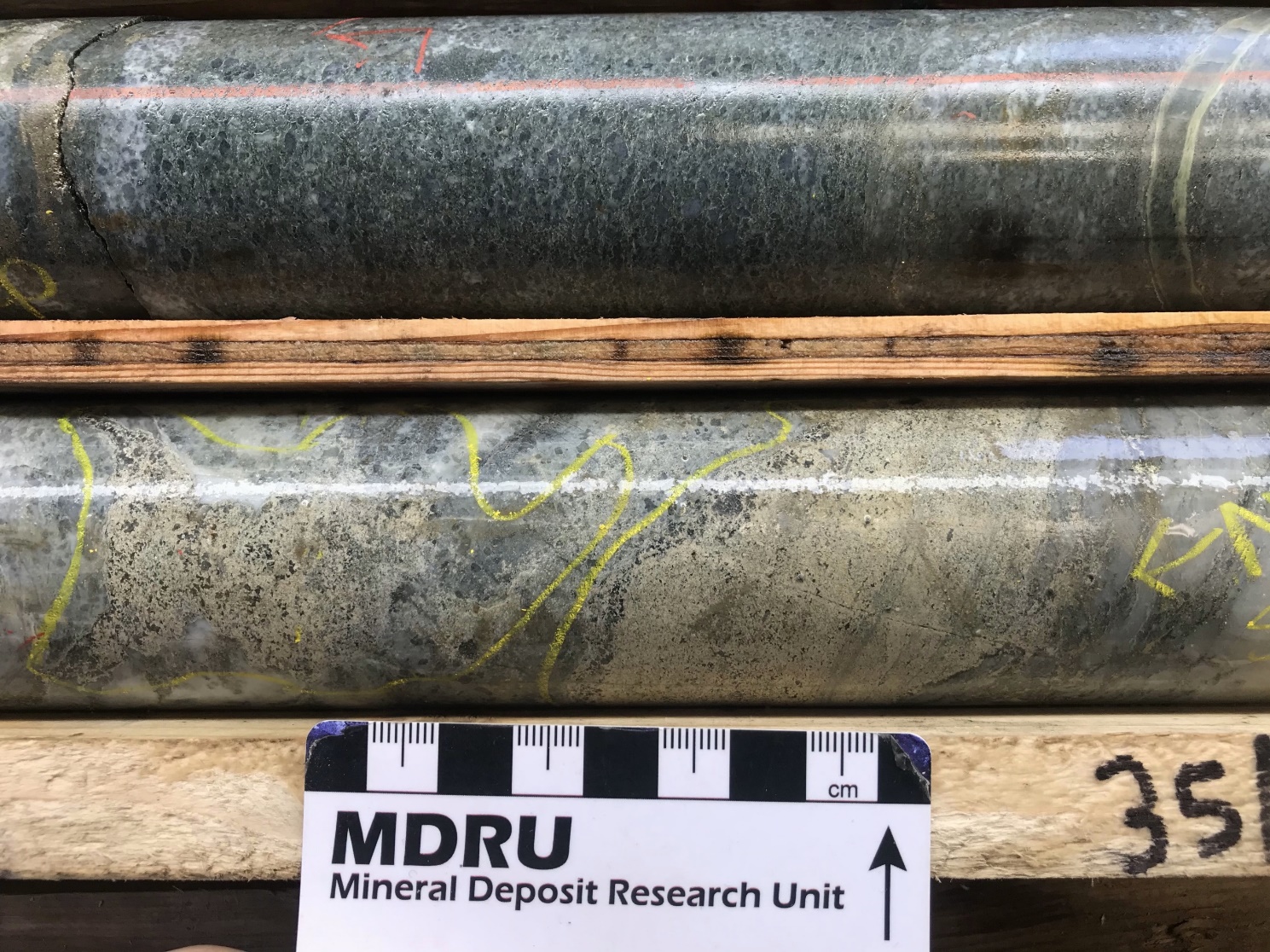

Figure 1. Lookout Zone 'honey sphalerite' massive zinc sulphides from drill holeU21-227

2021 Drill Results

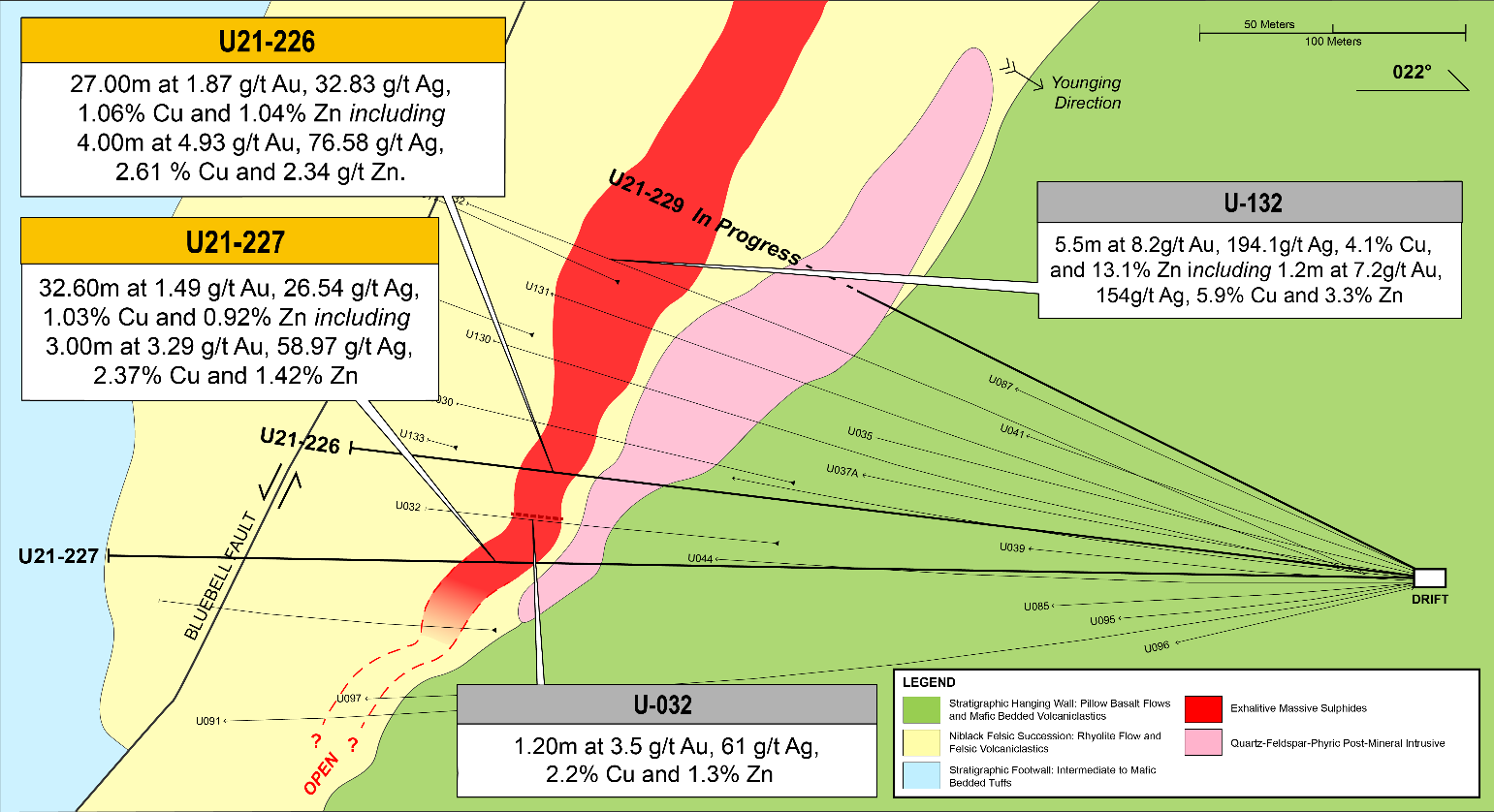

During March and April 2021, five holes totaling 1,810 meters of NQ2 core were completed using underground diamond drills operated by Morecore Drilling of Stewart, BC. Two resource expansion holes were completed, U21-226 encountered 27.00 meters of 1.06% Cu, 1.87 g/t Au, 32.83 g/t Ag and 1.04% Zn or 3.08% Cu-equivalent, including a higher-grade interval of 4.0 meters averaging 2.61% Cu, 4.93 g/t Au, 76.58 g/t Ag and 2.34% Zn or 7.69% Cu-equivalent. U21-227 intersected a very similar interval in thickness and grade, encountering 32.6 meters of 1.03% Cu, 1.49 g/t Au, 26.54 g/t Ag and 0.92% Zn with a higher-grade interval of 3.00 meters averaging 2.37% Cu, 3.29 g/t Au, 58.97 g/t Ag and 1.42% Zn or 5.78% Cu-equivalent. This area was previously interpreted to host mineralization three to five meters in width. The mineralized intervals in U21-226 and 227 are approximately 35 meters apart.

Figure 2. April 2021 Resource Expansion Drilling section

Drill holes U21-225 and 228 are exploration holes drilled up and down-dip, respectively, as step-outs from an isolated massive sulphide interval in historical hole U-074, which intersected 1.5 meters averaging 2.0% Cu, 3.3 g/t Au, 90 g/t Ag and 23% Zn. Blackwolf's drilling encountered broad intervals of disseminated and stringer sulphide mineralization, primarily pyrite which is suggestive of proximity to the mineralized horizon. Drill hole U21-225 intersected 2.66 meters averaging 0.11% Cu, 0.36 g/t Au, 13.47 g/t Ag and 1.34% Zn. Deeper hole U21-228 intersected a broader interval of 12.0 meters averaging 0.13% Cu, 0.45 g/t Au 5.0 g/t Ag and 0.25% Zn, including 2.0 meters averaging 0.62% Cu, 1.07 g/t Au, 11.4 g/t Ag and 0.52% Zn, with a second zone of sphalerite (zinc sulphide) stringers to the west of the Bluebell fault. Blackwolf is highly encouraged that the mineralization is continuing to depth, with these holes projected between 75 and 100 meters below the current mineral resource. The Company will perform additional follow-up drilling with down-hole geophysics to located where the wide trough of massive sulphide mineralization may project. Additional success will warrant extension of the underground ramp to permit drilling the Lookout Extension with shorter holes at a better orientation.

Complete 2021 drill results are as follows:

| Hole-ID | Zone | From (meters) | To (meters) | Length (meters)2 | Cu (%) | Gold (gpt) | Silver (gpt) | Zn (%) | Cu equiv1 |

| U21-225 | Lookout Ext. | 301.00 | 303.66 | 2.66 | 0.11 | 0.36 | 13.47 | 1.34 | 0.97 |

| U21-226 | Lookout | 326.00 | 353.00 | 27.00 | 1.06 | 1.87 | 32.83 | 1.04 | 3.08 |

| including | 327.00 | 331.00 | 4.00 | 2.61 | 4.93 | 76.58 | 2.34 | 7.69 | |

| U21-227 | Lookout | 321.90 | 354.50 | 32.60 | 1.03 | 1.49 | 26.54 | 0.92 | 2.67 |

| including | 325.00 | 328.00 | 3.00 | 2.37 | 3.29 | 58.97 | 1.42 | 5.78 | |

| U21-228 | Lookout Ext. | 298.75 | 310.75 | 12.00 | 0.13 | 0.45 | 4.66 | 0.25 | 0.59 |

| including | 304.75 | 305.75 | 1.00 | 0.14 | 1.18 | 11.50 | 0.33 | 1.21 | |

| And | 308.75 | 310.75 | 2.00 | 0.62 | 1.07 | 11.40 | 0.52 | 1.68 | |

| 350.75 | 366.50 | 15.75 | 0.01 | 0.02 | 5.39 | 0.21 | 0.15 | ||

| U21-229 | Lookout | In Progress | |||||||

- Metal equivalency value is based on the following prices: US$3.25/lb Cu, US$1,600/oz Au, US$1.15/lb Zn and US$20.75/oz Ag; it is noted that no adjustments were made in the metal equivalency calculation for metal recovery. Prices taken as an average of research analyst's long-term metal price forecast, April 2021

- Drilled intervals are reported. True widths are estimated to be between 85 and 100% of drilled intervals for the Lookout Zone and unknown for the Lookout Extension

Drill hole Collar Locations are as follows:

Hole-ID | Zone | Azimuth (Degree) | Dip (Degree) | Length (m) |

| U21-225 | Lookout Ext. | 200 | -22 | 413.30 |

| U21-226 | Lookout | 200 | 7 | 377.77 |

| U21-227 | Lookout | 200 | 1 | 379.47 |

| U21-228 | Lookout Ext. | 200 | -27 | 406.00 |

| U21-229 | Lookout | 200 | 30 | 231.00 |

Niblack Project Upgrades

Blackwolf's Board of Directors has approved a plan to significantly upgrade the Niblack Camp and infrastructure, phasing out of the old barge camp. The new camp will allow significant more capacity for work crews to support the Company's vision for the Project. This work will include all-season Weatherhaven tents, new fuel storage, improved core handling and processing facilities and better underground equipment maintenance and water management. Located on tidewater, the Niblack facilities support an 800 meter-long, production-sized underground ramp that provides a platform for diamond grilling for exploration, resource expansion and upgrading.

Figure 3. Lookout Zone Isometric; 2021 drill holes traces

QA/QC and Qualified Persons

The Qualified Person under NI 43-101 for the 2021 exploration program at the Niblack Project is Marilyne Lacasse, P.Geo, Vice-President of Exploration for Blackwolf Copper and Gold. Drill core was cut in-half with a diamond saw, with one-half placed in sealed bags and shipped with chain of custody controls to ALS Labs in Vancouver, BC, for sample preparation and analysis. A rigorous Quality Control/Quality Assurance program, including the insertion of Standards and Blanks, duplicate analysis and third-party labs checks has been implemented. Robert McLeod, P.Geo, President and CEO of Blackwolf Copper and Gold Ltd., a Qualified Person under NI 43-101, has reviewed and approved the technical content of this release, in addition to Ms. Lacasse.

About Blackwolf Copper and Gold

Blackwolf's founding vision is to be an industry leader in transparency, inclusion and innovation. Guided by our Vision and through collaboration with local and Indigenous communities and stakeholders, Blackwolf builds shareholder value through our technical expertise in mineral exploration, engineering and permitting. The Company holds a 100% interest in the high-grade Niblack copper-gold-zinc-silver VMS project, located adjacent to tidewater, as well as the Cantoo and Texas Creek Gold-Silver Properties in southeast Alaska. For more information on Blackwolf, please visit the Company's website at www.blackwolfcopperandgold.com.

On behalf of the Board of Directors

"Robert McLeod"

Robert McLeod, P.Geo

President, CEO and Director

For more information, contact:

Rob McLeod

604-617-0616 (Mobile)

604-343-2997 (Office)

rm@bwcg.ca

Thomas Kenney

587-777-4333 (Mobile)

604-343-2997 (Office)

tk@bwcg.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements:

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward-looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements relating to the historic Niblack mine's potential to be a new resource area and the Company's future objectives and plans. Forward-looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company's securities; fluctuations in commodity prices and changes in the Company's business plans. In making the forward looking statements in this news release, the Company has applied several material assumptions that the Company believes are reasonable, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. The Company seeks safe harbor.

The Company's "Mineral Resource Estimate" refers to a November 2011 NI 43-101 Report authored by SRK Consulting Independent of the Company and Deon Van Der Heever, Pr. Sci. Nat., Hunter Dickinson Inc., a Qualified Person who was not independent of the Company. Net Smelter Return (NSR) cutoff uses long-term metal forecasts: gold US$1,150/oz, silver US$20.00/oz, copper US$2.50/lb, and zinc US$1.00/lb; Recoveries (used for all NSR calculations) to Cu concentrate of 95% Cu, 56% Au and 53% Ag with payable metal factors of 96.5% for Cu, 90.7% for Au, and 89.5% for Ag; to Zn concentrate of 93% Zn, 16% Au, and 24% Ag with payable metal factors of 85% for Zn, 80% for Au and 20% for Ag. Detailed engineering studies will determine the best cutoff.

For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedar.com.

SOURCE: Blackwolf Copper and Gold Ltd

View source version on accesswire.com:

https://www.accesswire.com/651894/Blackwolf-Intersects-270-Meters-Averaging-11-Copper-19-gt-Gold-328-gt-Silver-and-10-Zinc-or-31-Copper-Equivalent-from-Lookout-Deposit-at-Niblack