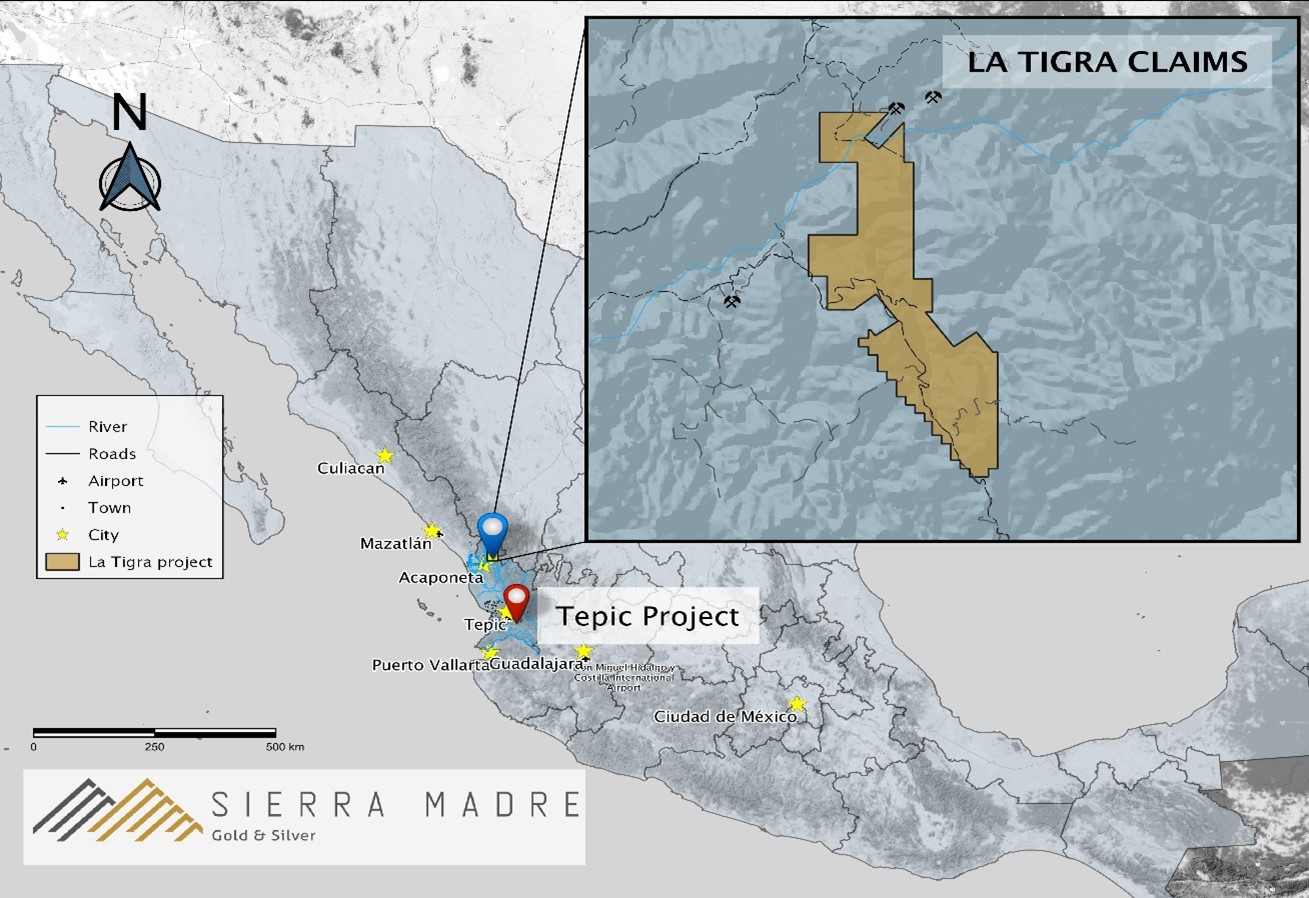

VANCOUVER, BC / ACCESSWIRE / July 20, 2021 / Sierra Madre Gold and Silver Ltd. ('Sierra Madre' or the 'Company') is pleased to announce that it has entered into a purchase agreement with an option to joint venture for the La Tigra Project ("the Project" or "La Tigra"), located 148 kilometres north of the Company's flagship Tepic Project in the state of Nayarit, Mexico. The La Tigra Project consists of seven Mining Concessions, totaling 357 hectares, covering most of the historical mines in the Distrito Minero Del Tigre. The agreement is with the property's owner, Industrial Minera Mexico S.A. de C.V. (IMMSA).

"We are thrilled to be able to acquire the La Tigra Project," said Alex Langer, CEO and President of Sierra Madre. "The location and infrastructure of La Tigra fits seamlessly with Sierra Madre's strategy of consolidating high value projects with production potential. With a history of past production and a significant amount of historical data, our technical team is very keen to apply modern exploration techniques to this highly prospective project."

"I'd also like to thank IMMSA for their professionalism and trust in Sierra Madre as we form this alliance focused on progressing La Tigra forward."

History of La Tigra

According to reports published by Servico Geológico Mexicano (SGM), a department of the Mexican Federal Secretaria de Economia, gold and silver were mined in the La Tigra area by the Cora Peoples and "villagers" prior to 1900. SGM reports state that between 2,500 and 5,000 people worked as "gold panners" in the area.

The SGM reports further state that in the early 1900's John Cleary acquired the mining rights and developed the La Tigra mine and associated workings. The La Tigra mine was exploited by an incline shaft on two principal levels with development begun on three lower levels. Production apparently ceased during the Mexican Revolution of 1910 to 1920. Beginning in 1927, Compañia Minera Unida Oriente S.A.de C.V. is reported to have invested US$500,000 in rehabilitating the mines and building new processing facilities. SGM reports that 13,110 tonnes of material grading 10 g/t gold and 358 g/t silver was processed at this time.

The most recent mining occurred between 1983 and 1991 when Compañia Minera Nayoro S.A. installed a 250 tpd flotation plant. SGM reports the grade of material derived from the La Tigra mine was 10 g/t gold and 300 g/t silver. Operations were said to be restricted to pillars and stopes above the water table. There has been little exploration work done in the district since Nayoro ceased operations and sold off its equipment. The information from the SGM reports is historical in nature and a qualified person has not verified this information and has not completed sufficient work to treat this data as current. The historical data should not be relied upon.

Currently there are a small number of families that are engaged in artisanal mining within the concession. The Company plans to immediately commence an exploration program on the La Tigra Project which will include compilation of historical data, surface mapping and sampling of the principal vein structures which have been exposed by previous mining, and trenching. This work is designed to prioritize drilling targets with Phase 1 drilling expected to commence within the next six months. The Project has excellent infrastructure and is road accessible, located 10 kilometres off of the paved highway.

Agreement Terms and Obligation

The purchase agreement calls for payments totaling US$1,500,000 over a period of three years. As part of the agreement, Sierra Madre is required to provide a NI 43-101 compliant technical report containing a resource estimation before the end of the three-year period. The company must also inform IMMSA at least 90 days before and not sooner than 180 days before the last payment is made of its intention to exercise its option to acquire the property.

Upon exercise of the option IMMSA is assigned a 2.5% NSR royalty. The Company can elect to purchase a 1.5% NSR portion of the royalty for US$1,500,000 at any point in the future. If IMMSA does not elect to exercise the Joint Venture clause the Company will acquire 100% of the Project subject to the NSR.

Potential Joint Venture

In the event that the NI 43-101 technical report has gold resources estimated at 1,000,000 ounces or more, IMMSA, at its sole discretion, can elect to form a Joint Venture for the purpose of placing the Project into production. The joint venture company will be 51% owned by IMMSA and 49% by the Company. IMMSA has 60 days from the time it receives the NI 43-101 technical report to notify the Company of its intent to form the joint venture.

Company Update Webinar

Management will be presenting on Thursday, July 22nd, at 4:15 PM (EST). Please register here to attend: https://bit.ly/3kGB1ma

Qualified Person

Mr. Gregory Smith, P. Geo, Director of Sierra Madre, is a Qualified Person as defined by NI 43-101, and has reviewed and approved the technical data and information contained in this news release. Mr. Smith has verified the technical and scientific data disclosed herein.

About the Company

Sierra Madre Gold and Silver Ltd. is a mineral exploration company, currently focused on the acquisition, exploration and development of the Tepic and La Tigra Properties in Nayarit, Mexico. The Company has an experienced management team with a proven track record of wealth creation in Mexico through project discovery, advancement, and monetization. Sierra Madre's key objective is to advance exploration on the Tepic and La Tigra Properties to determine whether it contains commercially exploitable deposits of precious or base metals.

On behalf of the board of directors of Sierra Madre Gold and Silver Ltd.,

"Alexander Langer"

Alexander Langer

President, Chief Executive Officer, and Director

Contact:

investor@sierramadregoldandsilver.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This press release contains 'forward-looking information' and 'forward-looking statements' within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this press release only, and the Company does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as 'plans', 'expects', 'is expected', 'budgets', 'scheduled', 'estimates', 'forecasts', 'predicts', 'projects', 'intends', 'targets', 'aims', 'anticipates' or 'believes' or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions 'may', 'could', 'should', 'would', 'might' or 'will' be taken, occur or be achieved. Forward-looking information in this press release includes, but is not limited to, statements with respect plans for the La Tigra property, including the prospect of preparing a technical report containing a mineral resource estimate. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of the Company to control or predict, that may cause the Company's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including, but not limited to, the risk that the La Tigra Property may not yield the results expected and the general risk factors related to exploration and development as are set out under the heading 'Risk Factors' in the Company's final long form non-offering prospectus dated March 31, 2021 available for review on the Company's profile at www.sedar.com. Such forward-looking information represents management's best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

SOURCE: Sierra Madre Gold and Silver

View source version on accesswire.com:

https://www.accesswire.com/655974/Sierra-Madre-Acquires-the-la-Tigra-Project-in-Nayarit-Mexico