TORONTO, ON / ACCESSWIRE / July 21, 2021 / Pelangio Exploration Inc. (TSXV:PX)(OTC PINK:PGXPF) ("Pelangio" or the "Company") is pleased to announce the completion of a maiden reverse circulation ("RC") exploration drilling program on its Dankran project in Ghana, with a number of significant drill intercepts returned. The program was designed as an initial test of several gold ("Au")-in-soil anomalies identified on the Dankran project plus test for the strike extension of the Obuom Mine structure immediately to the northeast of Dankran. The drilling program confirmed the Obuom Mine trend as the most promising target at Dankran, intercepting multiple generally narrow zones of mineralization with indications of higher-grade potential in one hole and width potential in another hole.

Highlights of the Dankran RC Drilling Program:

- 2,491 meters of RC drilling in 36 holes completed on 6 drill fences,

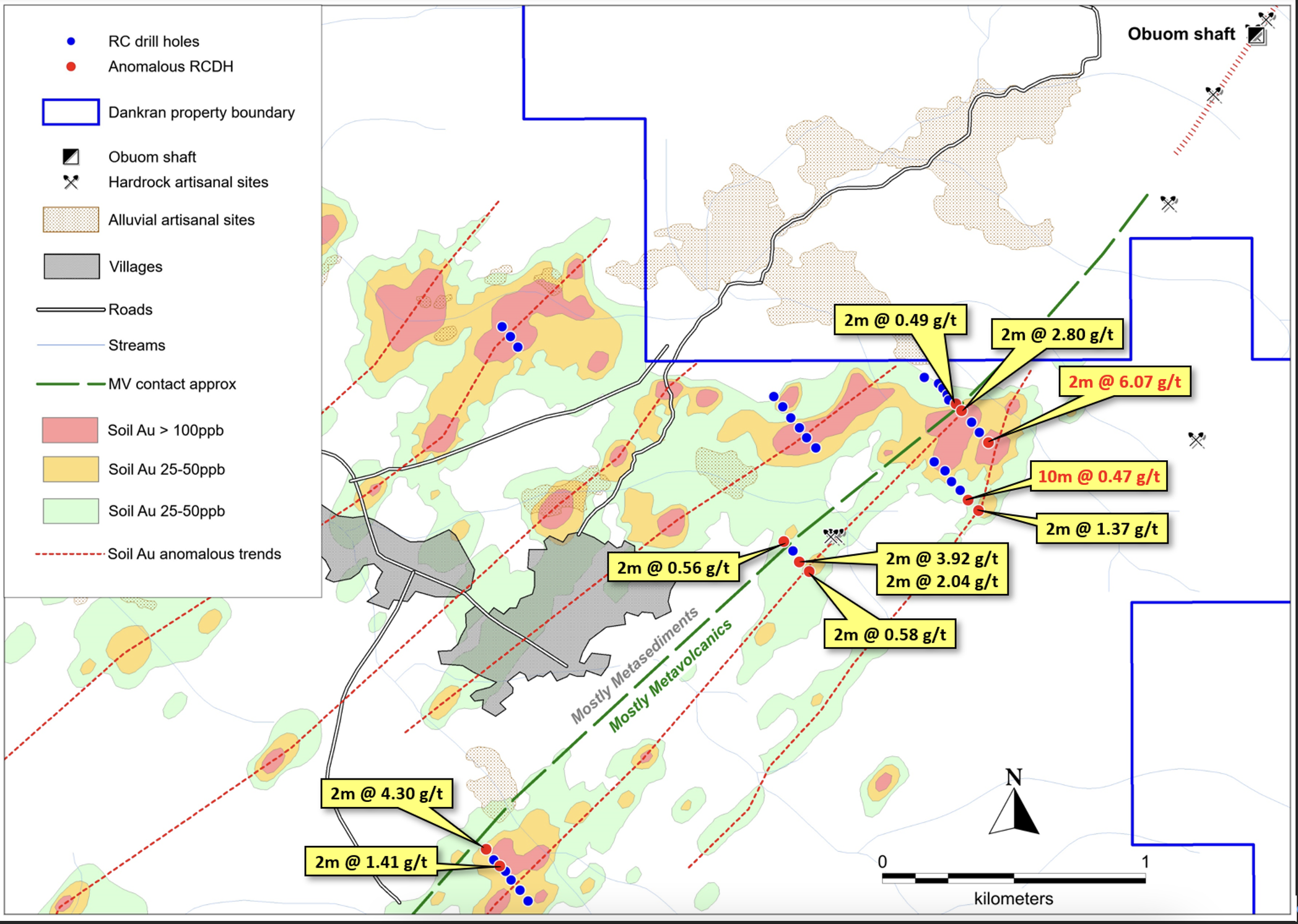

- Ten holes returned significant results (at a cut-off of 0.40 g/t Au) with grades up to 6.07 g/t Au over 2.0 meters and mineralized widths up 0.47 g/t Au over 10.0 meters, along a strike length of 2.5 kilometers,

- Several significant Au-in-soil anomalies remain to be tested, however future work will principally focus on the extension of the Obuom Mine trend where this program returned significant intercepts.

Ingrid Hibbard, President and CEO commented, "We are pleased to complete our maiden exploration RC drill test of targets on our Dankran property and receive a number of noteworthy drill intercepts. The results provide encouragement to conducting further work at Dankran. Our focus will now switch over to our Manfo Project where a sizeable drilling program is planned, after which we will consider further work programs to be planned for Dankran."

Details of the Dankran RC Drilling Program

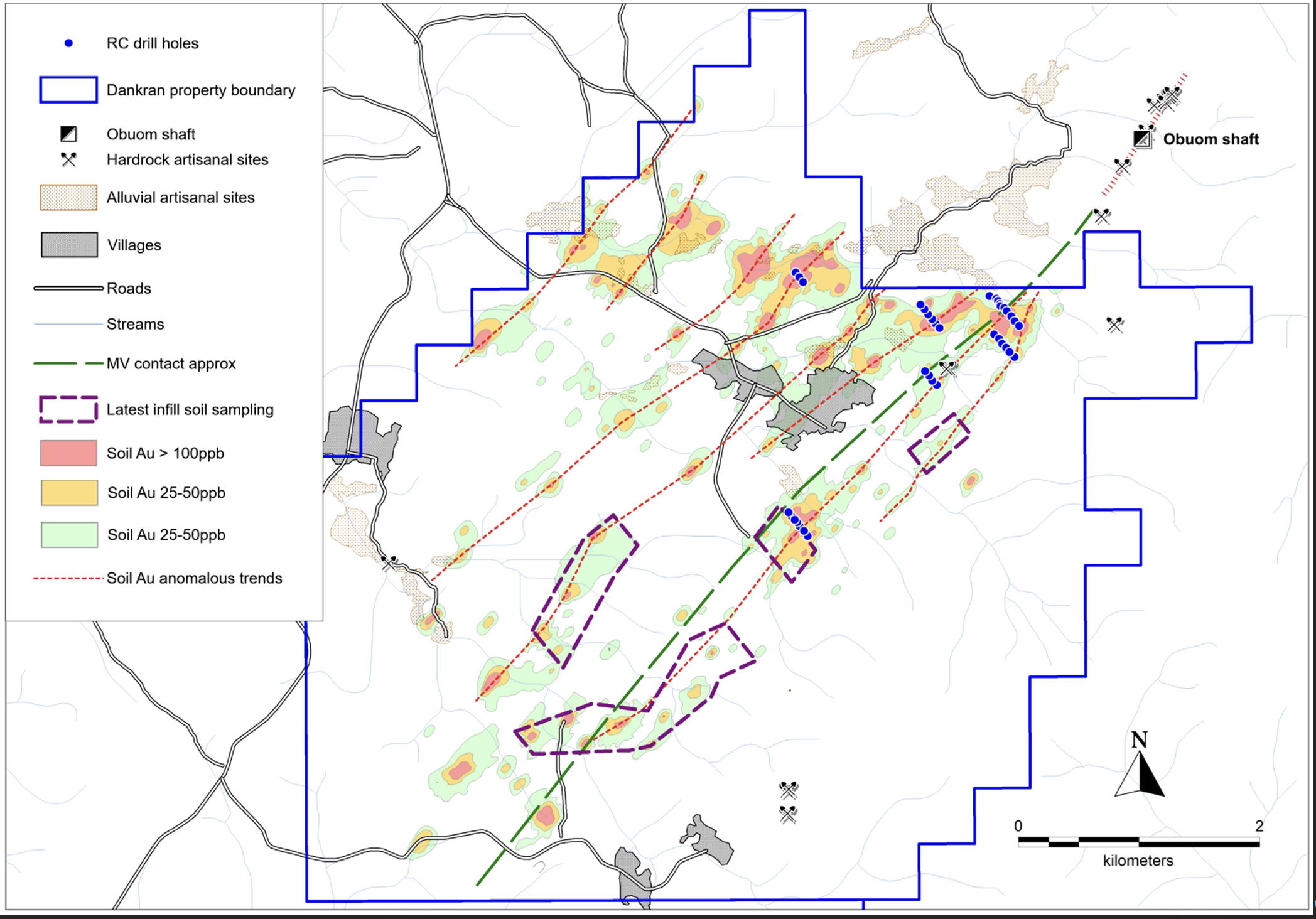

The Dankran property is a 34.65 square kilometer ("km²") Prospecting License optioned by Pelangio Exploration from BNT Resources Ghana Ltd. in November 2020 and is contiguous to the northeastern corner of Pelangio's Obuasi project. The Dankran property is adjacent to and on strike with the historic Obuom Mine which produced 29,000 ounces of gold at an average grade of 16 g/t Au from underground workings in the 1930's. The property covers nearly seven km of strike of highly prospective geology and regional structures along the western flank of the Ashanti Belt, which hosts AngloGold Ashanti's giant Obuasi Mine 20 km to the southwest. Pelangio conducted several programs of soil sampling on Dankran between December 2020 and March 2021 identifying multiple gold-in-soil anomalies worthy of drill testing. In addition, prospecting and geological mapping, which identified a number of artisanal workings and hand-dug shafts, traced the Obuom mineralized structure to the northeastern boundary of the Dankran property.

A maiden RC drilling program was conducted during May and June 2021 to test the most favourable soil anomalism and the strike extension of the Obuom structure in the northeastern end of Dankran. A total of 2,491 meters of RC drilling in 36 holes along 6 fences of drilling was completed. Sampling was conducted at 1-meter drill intervals and composited into 2-meters samples for Au fire-assay. Ten of the holes drilled returned generally narrow gold intercepts with one hole illustrating potential for high grades (DKRC014: 6.07 g/t Au over 2.0 meters) and one hole demonstrating potential for broader widths of mineralization (DKRC020: 0.47 g/t Au over 10.0 meters). Gold mineralization is associated with quartz veining focused along narrow shears at geological contacts, along and near to the main metasedimentary-metavolcanic contact on which the Obuom mine sits. The drilling has illustrated multiple, generally narrow, zones of mineralization along and near this regional contact over a strike length of 2.5 kilometers. The one-meter samples from the significant (> 0.40 g/t Au cut-off) 2-meter composited intercepts reported have been pulled for assay to better define the widths and grades present. Refer to Table 1 and Figures 1 and 2.

In addition to the maiden RC drilling test at Dankran, further infill soil sampling was completed in March to better define several Au-in-soil anomalies in the south to southwest areas of the Dankran property with a further 142 soil samples collected. The soil sampling did not add significantly to the soil anomalism but refined several anomalies for possible drill testing. Refer to Figure 1.

Future Plans for Dankran

The Dankran RC drilling program was successful in demonstrating multiple zones of mineralization along 2.5 kilometers of strike and highlighted the regional metasedimentary-metavolcanic contact on which the Obuom Mine sits as being the principal target. Although several significant untested Au-soil-anomalies remain which may be drill tested in future programs, the Obuom Mine trend in the northeastern part of the Dankran property will be the focus of any future work. Future plans may include additional mapping and prospecting plus possible limited ground geophysics and trenching to improve targeting, possibly followed by another small program of RC drill testing plus limited core drilling to better understand the geology and structural controls of the mineralization identified in the maiden RC drill program as well as to investigate the mineralization potential at depth.

The Company is now preparing to move to its Manfo Project on the Sefwi gold belt in Ghana, for a Fall 2021 drill program. Approximately 10,000 meters of combined exploration air-core plus resource extension diamond drilling is planned for the Manfo Project.

Table 1. Significant Assay Intercepts from the Dankran RC Drilling Program (0.40 g/t Au cut-off)

DHID | E_UTM | N_UTM | AZIM(°) | DIP(°) | EOH(m) | FROM(m) | TO(m) | LENGTH(m) | AU(g/t) |

DKRC001 | 671135 | 704579 | 140 | -50 | 57 | 10 | 12 | 2 | 0.58 |

DKRC002 | 671098 | 704615 | 140 | -50 | 80 | 50 | 52 | 2 | 2.04 |

68 | 70 | 2 | 3.92 | ||||||

DKRC004 | 671039 | 704692 | 140 | -50 | 75 | 54 | 56 | 2 | 0.56 |

DKRC010 | 671694 | 705215 | 140 | -50 | 60 | 16 | 18 | 2 | 0.49 |

DKRC011 | 671715 | 705190 | 140 | -50 | 79 | 4 | 6 | 2 | 2.80 |

DKRC014 | 671817 | 705069 | 140 | -50 | 72 | 64 | 66 | 2 | 6.07 |

DKRC019 | 671779 | 704810 | 140 | -50 | 57 | 32 | 34 | 2 | 1.37 |

DKRC020 | 671739 | 704850 | 140 | -50 | 60 | 16 | 26 | 10 | 0.47 |

DKRC035 | 669960 | 703460 | 140 | -50 | 50 | 6 | 8 | 2 | 1.41 |

DKRC036 | 669908 | 703523 | 140 | -50 | 80 | 62 | 64 | 2 | 4.30 |

Methodology, Quality Assurance/Quality Control

RC drilling was conducted with an Austex 300 track-mounted RC drill rig. All holes were drilled at an azimuth of 140° and a dip of -50°. Drill holes were planned for 80 meters depth each, however if wet drilling conditions were encountered the drill hole was stopped to avoid potential grade smearing. Drill holes were nominally spaced at 50 meters apart on each drill fence, however where drill holes were shorter than 80 meters the spacing was shortened to allow for adequate heel-to-toe drill coverage. Holes were positioned with a hand-held GPS (accuracy +/- 5 meters) but have not been surveyed in more accurately. Sampling was conducted from the drill rig cyclone at 1 meter drill intervals. Each 1-meter sample was riffle split to approximately 2 kilograms and subsequently combined into 2-meter composite samples for assay. The 1-meter samples were retained in a secure location for follow up assaying if required. Samples were analyzed by 50g Fire Assay at the Intertek Minerals Limited laboratory in Tarkwa Ghana. QA/QC samples, including certified standards, blanks and duplicate samples, were inserted into the RC drill sample stream at a rate of one in eight samples. The QA/QC results were within acceptable limits. The laboratory also performed their own internal QA/QC checks, which were also acceptable. The true thicknesses of the mineralized drill intercepts are unknown at this time given the limited structural information to date.

Methodology and QA/QC details for the final phase of infill soil sampling completed at Dankran in March are the same as reported in Pelangio's January 28, 2021, news release on Dankran soil sampling results.

Director Resignation

Further, the Company regrets to announce that Dr. Joyce Aryee has resigned from Pelangio's Board of Directors effective immediately, as a result of other board commitments in the same jurisdiction, which could potentially represent a perceived conflict regarding Pelangio's Ghanaian exploration projects. The Company thanks her for her service.

Qualified Person

Mr. Kevin Thomson, P.Geo. (Ontario), is a qualified person within the meaning of National Instrument 43-101. Mr. Thomson approved the technical data disclosed in this release.

About Pelangio

Pelangio acquires and explores world-class land packages on prolific gold belts in Ghana, West Africa and in Canada. In Ghana, the Company is exploring its two 100% owned camp-sized properties: the 100 km2 Manfo property, the site of eight near-surface gold discoveries, and the 284 km2 Obuasi property, located 4 km on strike and adjacent to AngloGold Ashanti's prolific high-grade Obuasi Mine, as well as the newly optioned Dankran property located adjacent to its Obuasi property. In Canada, the Company is currently focused in Ontario on its Dome West project, situated some 800 meters from the Dome Mine in Timmins, the Gowan project 16 km east of the Kidd Mine, and its Hailstone property in Saskatchewan. See www.pelangio.com for further detail on all of Pelangio's projects.

For additional information, please visit our website at www.pelangio.com, or contact:

Ingrid Hibbard, President and CEO

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email:info@pelangio.com

Figure 1: Dankran Soil Sampling Results and RC Drill Hole Locations

Figure 2: Dankran RC Drilling Results

Forward Looking Statements

Certain statements herein may contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Forward-looking statements or information appear in a number of places and can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate" or "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements and information include statements regarding the Company's strategy of acquiring large land packages in areas of sizeable gold mineralization, and the Company's ability to complete the planned exploration programs. With respect to forward-looking statements and information contained herein, we have made numerous assumptions, including assumptions about the state of the equity markets. Such forward-looking statements and information are subject to risks, uncertainties and other factors which may cause the Company's actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks include the changes in equity markets, share price volatility, volatility of global and local economic climate, gold price volatility, political developments in Ghana, and Canada, increases in costs, exchange rate fluctuations, speculative nature of gold exploration, including the risk that favourable exploration results may not be obtained, delays due to COVID-19 safety protocols, and other risks involved in the gold exploration industry. See the Company's annual and quarterly financial statements and management's discussion and analysis for additional information on risks and uncertainties relating to the forward-looking statement and information. There can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward- looking statements or information. We undertake no obligation to reissue or update any forward-looking statements or information except as required by law. All forward-looking statements and information herein are qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Pelangio Exploration Inc.

View source version on accesswire.com:

https://www.accesswire.com/656388/Pelangio-Reports-Results-From-Maiden-RC-Drill-Program-At-Dankran-Project-Ghana