VANCOUVER, BC / ACCESSWIRE / August 10, 2021 / Golden Dawn Minerals Inc., (TSXV:GOM)(FRA:3G8C)(OTC PINK:GDMRD), ("Golden Dawn" or the "Company"), announces that it is moving ahead with surface exploration plans at the Greenwood Precious Metals project in southeastern British Columbia.

"We also want to express our concerns and condolences to all the local communities, whom are dealing with the hard ships and extra stress due to the fire season. It's a time for all to be extra cautious with our recreational and work activities in and around our forests. We all are blessed to share the natural beautiful of BC. It's important that we continue to do our best to keep it that way for generations to come," states Chris Anderson CEO Golden Dawn Minerals.

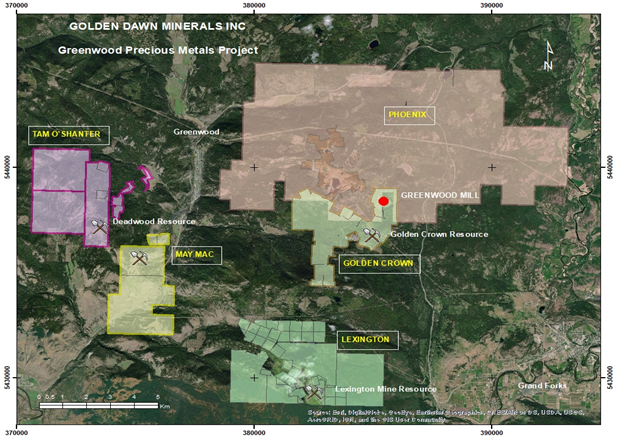

Map of the Greenwood Precious Metal Project areas.

The 2021 exploration season has been hampered by unusually hot and dry forest conditions leading to wildfires. As such, the Company has continued to work on updates to permits, as requested from the Ministry of Energy, Mines and Low Carbon Innovation (EMLI), for surface exploration at its Greenwood Precious Metal Project.

Permitting work is underway for the Golden Crown, Phoenix, Lexington, May Mac and Tam O'Shanter properties. A total of 97 drill sites are currently permitted or are being permitted on these properties, with multiple holes to be drilled from each of the sites, sufficient for up to 50,000 metres. Initially, 71 sites are proposed that are sufficient for up to 256 holes or 30,900 metres. Details are provided below.

At Golden Crown, the Company is permitting 35 drill sites, including 26 sites for drilling this year at the JD prospect and the Golden Crown mine. The purpose of the drilling is to add new mineral resources to the current inventory. Ten priority drill sites (up to 40 holes, 1,200 m) are planned for close-spaced to follow-up surface sampling results at the JD. The JD mineralized gold zone was previously exposed by trenching over a strike length of 200 meters. Seven drill sites (up to 28 holes, 1400m) are also planned at the Golden Crown mine to in-fill and extend the known resources defined in the Company's PEA technical report. An additional 9 sites (up to 27 holes, 1,350 m) are planned to test geophysical and geochemical anomalies between the Golden Crown and JD prospects.

Photo of geologist documenting historic drill site at Lexington property.

The Phoenix permit is for a total of 25 drill sites, of which 12 are planned for an initial phase (up to 48 holes, 7,200 m). The permit is being updated to include the re-activation of existing non-status roads. Targets for this year include the Minnie Moore and Summit epithermal gold and silver prospects, and the Gilt Edge and Sylvester K gold-copper porphyry/skarn prospects.

The Lexington exploration permit is for surface drilling (25 sites), access tracks and geophysical grids in areas surrounding the permitted underground gold mine. Phase 1 includes 14 drill sites (up to 56 holes, 11,200m) designed to follow-up historic intercepts that indicate potential strike extensions of the resource zone to the southeast and northwest, and to test for parallel zones northeast of the mine.

GOLD Mineralized rock with pyrite-chalcopyrite from Lexington mine.

The Company is now working on a summary report and data requested by EMLI to document disturbance created by the previous permittee. A survey to establish whether American Badgers are present is also planned.

The May Mac property is currently permitted for 10 drill sites, which are situated to enable drilling the northeast strike extension of polymetallic silver-gold veins exposed in the mine.

A new permit for 19 surface drill sites (up to 57 holes, 8,550 m) and access tracks was submitted for the Tam O'Shanter property, located west of Greenwood, where previous work outlined an inferred mineral resource and targets for epithermal gold mineralization.

Technical disclosure in this news release has been approved by Dr. Mathew Ball, P.Geo., President of the Company and a Qualified Person as defined by National Instrument 43-101,

For more details, please see the most recent National Instrument 43-101 Technical Report on the Company's website at www.goldendawnminerals.com.

On behalf of the Board of Directors:

GOLDEN DAWN MINERALS INC.

Per: "Christopher R. Anderson"

Christopher R. Anderson

Chief Executive Officer

For further information, please contact:

Golden Dawn Minerals Inc. - Corporate Communications:

Tel: 604-221-8936

Email: Office@goldendawnminerals.com

Forward-Looking Statement Cautions: This news release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, relating to, among other things, preliminary plans for a consolidation of the Company's Shares. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the possibility that the TSX Venture Exchange will not approve the proposed share consolidation, and that the Company may not be able to raise sufficient additional capital to continue its business. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effects. This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of securities of the Company in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The Company's securities have not been and will not be registered under the United States Securities Act of 1933 (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL, OR THE SOLICITATION OF AN OFFER TO BUY, NOR SHALL THERE BE ANY SALE OF SECURITIES OF THE COMPANY IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH JURISDICTION.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

SOURCE: Golden Dawn Minerals Inc.

View source version on accesswire.com:

https://www.accesswire.com/659039/Golden-Dawn-Plans-Drilling-97-Drill-Sites-Being-Permitted-on-Five-Properties-Up-To-50000-Meters