TORONTO, ON / ACCESSWIRE / September 28, 2021 / Talisker Resources Ltd. ("Talisker" or the "Company") (TSX:TSK)(OTCQX:TSKFF) is pleased to announce high grade results from drill hole SB-2021-043 at its 100% owned flagship Bralorne Gold Project. Five diamond drill rigs are currently drilling at Bralorne. A total of 58,950 metres consisting of 101 holes of a planned and fully funded 100,000 metres has been drilled at the project this year with a total of 81,130 m (137 holes) since Talisker initiated drilling at the project in February 2020. There are currently 26 holes consisting of 11,987 samples at the assay laboratory and are expected to be received by the Company shortly.

Key Points:

- Successful intercept targeting the 55HW Vein returning 19.73 g/t gold over 1.0m within 6.29 g/t gold over 4.65m, including 28.70 g/t over 0.5m.

- Previous intercepts in the 55HW Vein are highlighted by hole SB-2020-012 (15.11g/t over 1.0m) and SB-2021-020 (14.66g/t over 1.5m).

- This hole increases the number of intercepts for the 55HW Vein to 27 with a remaining 11 yet to be drilled this year to complete the resource drillout for this vein.

- Hole SB-2021-023, SB-2021-046 and SB-2021-058 also intersected the 55HW vein and results are expected shortly.

SB-2021-043 Hole Description:

- Bralorne West Block

- Complete preliminary results have been received for this hole.

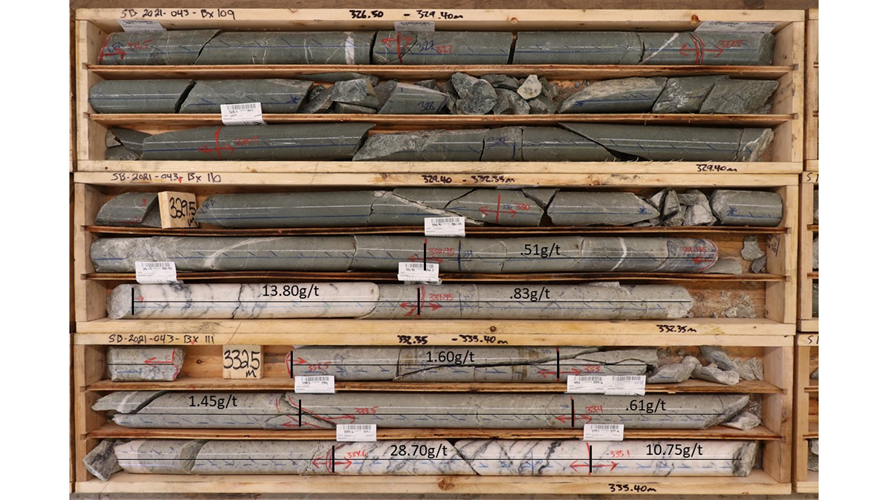

- The 55 Hanging Wall Vein intercept is hosted within a Felsic Dyke intruding the Bralorne Diorite. The 55 Hanging Wall Vein exhibits the classic crack and seal textures seen throughout the Bralorne deposit hosting high grade gold. Crack and seal fractures within this intercept contain parallel bands of fine-grained pyrite, arsenopyrite and visible gold.

- Disseminated pyrite and arsenopyrite are also hosted within the wall rock as vein halo mineralization proximal to the 55 hanging wall. Hydrothermal alteration proximal to the vein intercept includes pervasive silica and moderate sericite.

- This hole drilled to a final depth of 449.50m on May 24, 2021.

Table 1: Bralorne Gold Project - Drill Hole SB-2021-043 | ||||||

Diamond Drill Hole Name | From | To | Interval | Au | Zone | Method Reported |

| SB-2021-043 | 330.95 | 331.45 | 0.5 | 0.51 | 55 HW | Au-SCR24 |

| SB-2021-043 | 331.45 | 331.95 | 0.5 | 13.80 | Au-SCR24 | |

| SB-2021-043 | 331.95 | 332.5 | 0.55 | 0.83 | Au-AA26 | |

| SB-2021-043 | 332.5 | 333 | 0.5 | 1.60 | Au-SCR24 | |

| SB-2021-043 | 333 | 333.5 | 0.5 | 1.45 | Au-SCR24 | |

| SB-2021-043 | 333.5 | 334 | 0.5 | 0.05 | Au-AA26 | |

| SB-2021-043 | 334 | 334.6 | 0.6 | 0.61 | Au-AA26 | |

| SB-2021-043 | 334.6 | 335.1 | 0.5 | 28.70 | Au-SCR24 | |

| SB-2021-043 | 335.1 | 335.6 | 0.5 | 10.75 | Au-SCR24 | |

| Notes: Diamond drill hole SB-2021-043 has collar orientation of Azimuth 202; Dip -56. True widths are estimated at 40 - 90% of intercept lengths and are based on oriented core measurements where available. Method Reported includes the most up to date information as of the date of this press release. | ||||||

Qualified Person

The technical information contained in this news release relating to the drill results at the Bralorne Gold Project has been approved by Leonardo de Souza (BSc, AusIMM (CP) Membership 224827), Talisker's Vice President, Exploration and Resource Development, who is a "qualified person" within the meaning of National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About Talisker Resources Ltd.

Talisker (taliskerresources.com) is a junior resource company involved in the exploration of gold projects in British Columbia, Canada. Talisker's projects include two advanced stage projects, the Bralorne Gold Complex and the Ladner Gold Project, both advanced stage projects with significant exploration potential from historical high-grade producing gold mines, as well as its Spences Bridge Project where the Company holds ~85% of the emerging Spences Bridge Gold Belt and several other early-stage Greenfields projects. With its properties comprising 296,983 hectares over 346 claims, three leases and 198 crown grant claims, Talisker is a dominant exploration player in the south-central British Columbia. The Company is well funded to advance its aggressive systematic exploration program at its projects.

For further information, please contact:

Terry Harbort

President & CEO

Terry.harbort@talliskerresources.com

+1 416 361 2808

Related Links

https://taliskerresources.com/

Sample Preparation and QAQC

Drill core at the Bralorne project is drilled in HQ to NQ size ranges (63.5mm and 47.6mm respectively). Drill core samples are minimum 50 cm and maximum 160 cm long along the core axis. Samples are focused on an interval of interest such as a vein or zone of mineralization. Shoulder samples bracket the interval of interest such that a total sampled core length of not less than 3m both above and below the interval of interest must be assigned. Sample QAQC measures of unmarked certified reference materials (CRMs), blanks, and duplicates are inserted into the sample sequence and make up 9% of the samples submitted to the lab for holes reported in this release. Sample preparation and analyses is carried out by ALS Global in North Vancouver, British Columbia, Canada and SGS Canada in Burnaby, British Columbia, Canada. Drill core sample preparation includes drying in an oven at a maximum temperature of 60°C, fine crushing of the sample to at least 70% passing less than 2 mm, sample splitting using a riffle splitter, and pulverizing a 250 g split to at least 85% passing 75 microns (ALS code PREP-31 / SGS code PRP89). Gold in diamond drill core is analysed by fire assay and atomic absorption spectroscopy (AAS) of a 50g sample (ALS code Au-AA26 / SGS code GO_FAA50V10), while multi-element chemistry is analysed by 4- Acid digestion of a 0.25 g sample split with detection by inductively coupled plasma mass spectrometer (ICP-MS) for 48 elements (Ag, Al, As, Ba, Be, Bi, Ca, Cd, Ce, Co, Cr, Cs, Cu, Fe, Ga, Ge, Hf, In, K, La, Li, Mg, Mn, Mo, Na, Nb, Ni, P, Pb, Rb, Re, S, Sb, Sc, Se, Sn, Sr, Ta, Te, Th, Ti, Tl, U, V, W, Y, Zn, Zr). Gold assay technique (ALS code Au-AA26 / SGS code FAA50V10) has an upper detection limit of 100 ppm. Any sample that produces an over-limit gold value via the gold assay technique is sent for gravimetric finish (ALS method Au-GRA22 / SGS method GO_FAG50V) which has an upper detection limit of 1,000 ppm Au. Samples where visible gold was observed are sent directly to screen metallics analysis and all samples that fire assay above 1 ppm Au are re-analysed with method (ALS code Au-SCR24 / SGS code - 6 - GO_FAS50M) which employs a 1kg pulp screened to 100 microns with assay of the entire oversize fraction and duplicate 50g assays on the undersize fraction. Where possible all samples initially sent to screen metallics processing will also be re-run through the fire assay with gravimetric finish provided there is enough material left for further processing

Caution Regarding Forward-Looking Information

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on Talisker's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to, among other things, effective time of the rights provided to New Gold under the Investor Rights Agreement, the completion of New Gold's strategic investment; the completion of the Offering, the use of proceeds, the operations of the Company and the timing which could be affected by the current global COVID-19 pandemic. Those assumptions and factors are based on information currently available to Talisker. Although such statements are based on reasonable assumptions of Talisker's management, there can be no assurance that any conclusions or forecasts will prove to be accurate.

While Talisker considers these statements to be reasonable based on information currently available, they may prove to be incorrect. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include market risks and the demand for securities of the Company, risks inherent in the exploration and development of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined, risks relating to variations in grade or recovery rates, risks relating to changes in mineral prices and the worldwide demand for and supply of minerals, risks related to increased competition and current global financial conditions and the COVID-19 pandemic, access and supply risks, reliance on key personnel, operational risks, and regulatory risks, including risks relating to the acquisition of the necessary licenses and permits, financing, capitalization and liquidity risks.

The forward-looking information contained in this news release is made as of the date hereof, and Talisker is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

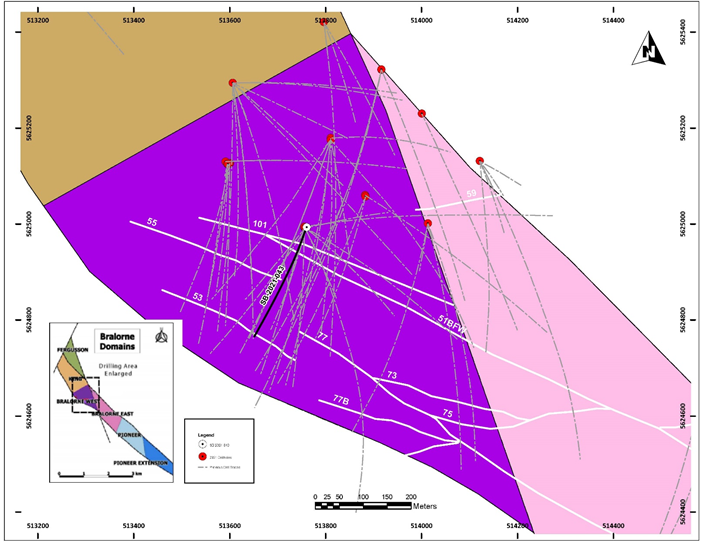

Figure 1: SB-2021-043 hole location within the Bralorne West Block.

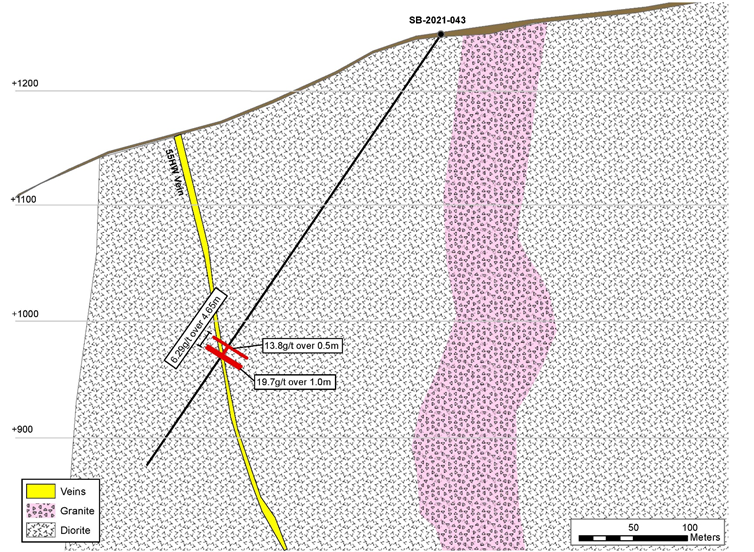

Figure 2: SB-2021-043 cross section intersecting the 55HW vein hosted within Diorite.

Figure 3: -2021-043 core photo showing the 55HW vein with typical crack seal vein textures and strong sericite/silica alteration. The interval of 330.95m-335.6m (4.65m) averages 6.29g/t Au.

SOURCE: Talisker Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/665841/Talisker-Intersects-1973-gt-Au-Over-10-Metre-Within-629-gt-Au-Over-465-Metres-at-Bralorne