Not for distribution to U.S. news wire services or dissemination in the United States.

VANCOUVER, BC / ACCESSWIRE / October 7, 2021 / New Placer Dome Gold Corp. ("New Placer Dome" or the "Company") (TSXV:NGLD)(OTCQB:NPDCF)(FSE:BM5) is pleased to report the initial induced polarization (IP) / resistivity geophysical surveys results from its flagship Kinsley Mountain Gold Project ("Kinsley Mountain") in Nevada.

Kinsley Mountain is located 90 km south of the Long Canyon Mine1, operated by the Newmont/Barrick Joint Venture, Nevada Gold Mines. It hosts Carlin-style gold mineralization under and adjacent to a historical open-pit, run-of-mine heap leach operation, and hosts an Indicated Resource at the Western Flank Zone (WFZ) of 302,000 ounces of gold grading 6.11 g/t Au (1.54 million tonnes)1.

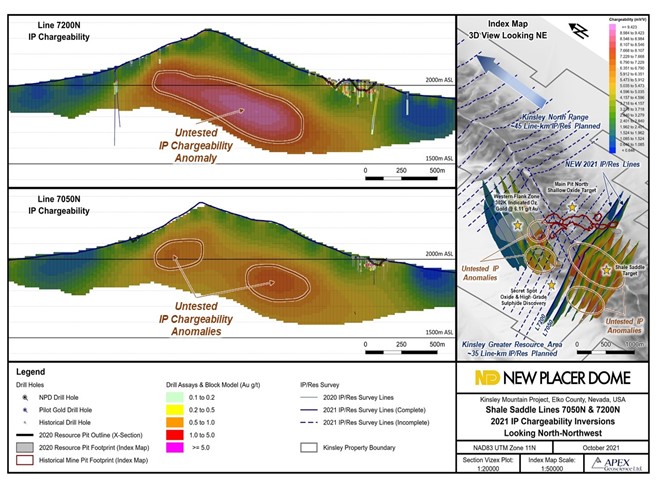

IP/Resistivity surveys are currently underway to infill between the WFZ and Shale Saddle survey grids completed during Q4 of 2020. The 2020 surveys revealed a correlation between enhanced chargeability and drill confirmed high grade gold sulphide mineralization at the WFZ. At Shale Saddle, drill hole KMR20-035, drilled prior to the 2020 survey, intersected anomalous gold values on the periphery of a large untested chargeability anomaly.

The 2021 geophysical surveys are progressing northwest from Shale Saddle towards the high-grade WFZ resource (Figure 1). Two northeast-southwest oriented infill lines have been completed to date. Both lines detected significant chargeability anomalies coincident with modelled Secret Canyon shale rocks, the main host of high-grade sulphide gold mineralization at the WFZ and Secret Spot. The Company's 2020 drilling yielded high-grade gold sulphide intercepts from the Secret Canyon shale including: 10.2 g/t gold (Au) over 6.1 metres within a broader zone averaging 2.63 g/t Au over 38.1 metres in KMR20-017 at the WFZ; and 11.3 g/t Au over 2.9 m within a broader zone grading 3.81 g/t Au over 11.6 m in KMD20-006 at Secret Spot2. Significantly, the two holes are separated by a 1.5-kilometer expanse of largely untested Secret Canyon stratigraphy.

The new chargeability anomalies occur within an area untested by previous drilling and represent at least three new potential drill targets. Together with anomalies identified by the 2020 survey, a broad north-south trending zone of elevated chargeability is emerging, increasing in both size and amplitude to the north. Only 10% of the 2021 IP/Resistivity survey is complete, totaling 8 line-km. An additional 72 line-km are planned, covering a total area of 25 square km of undrilled target host rocks.

Max Sali, CEO and founder of New Placer Dome commented, "The 2020 geophysical surveys successfully demonstrated that IP/Resistivity surveys are a powerful exploration tool capable of unlocking potential targets undetected by previous methods. The discovery of additional high quality chargeability targets on the first two lines of the 2021 survey further reinforces our belief that additional undiscovered zones of high-grade gold mineralization exist within underexplored areas at Kinsley. With the survey only 10% complete, we look forward to receiving additional results as we move forward with completing the financing and generating drill targets for the upcoming Kinsley core and RC drilling program. We continue to collect allocations on the private placement financing on a daily basis despite market conditions and continue to work on the Kinsley project and appreciate the support from insiders of Liberty Gold and funds that continue to support."

Figure 1. Kinsley Mountain IP/Resistivity Chargeability Inversions

Private Placement & Kinsley Option Agreement

Further to the Company's news release dated September 14, 2021, the Company intends to close the private placement and the amended Kinsley Option Agreement with Liberty Gold Corp. (TSXV: LGD) on or before October 22, 2021. The private placement and the amended Kinsley Option Agreement are subject to approval by the TSX Venture Exchange.

Upon the closing of a minimum of $4,000,000 pursuant to the private placement and the issuance of common shares pursuant to the amended Kinsley Option Agreement, Liberty Gold Corp. would own approximately 18% of the issued and outstanding common shares of New Placer Dome on an undiluted basis.

Methodology and QA/QC

Two IP/resistivity lines have been completed to date during 2021 infilling the area between the WFZ and Shale Saddle target. The lines are spaced 150 metres apart, each with a line length of 4 kilometres. Data were collected using the Direct Current Resistivity, Induced Polarization ("DCIP") method, on a 16-channel pole-dipole array with a dipole size (a-spacing) of 100 metres. A GDD GRx16 receiver and GDD 5000W-2400V-20A IP Tx model Tx4 transmitter was used. Raw data were loaded into GDD IP Post-Process software and Geosoft Oasis Montaj software for quality control and review. The reviewed data were used to produce pseudo section plots of apparent resistivity and apparent chargeability and were the input for the inversion. Inversions were completed using the UBC-GIF DCIP2D inversion codes. Each line of data was inverted independently. The resistivity and IP inversion is a two-step process. The resistivity inversion is run first, and this model is used in the chargeability inversion. Multiple inversions were completed for quality control.

About New Placer Dome Gold Corp.

New Placer Dome Gold Corp. is a gold exploration company focused on acquiring and advancing gold projects in Nevada. New Placer Dome's flagship Kinsley Mountain Gold Project located 90 km south of the Long Canyon Mine (currently in production under the Newmont/Barrick Joint Venture, Nevada Gold Mines), hosts Carlin-style gold mineralization, previous run of mine heap leach production, and NI 43-101 indicated resources containing 418,000 ounces of gold grading 2.63 g/t Au (4.95 million tonnes) and inferred resources containing 117,000 ounces of gold averaging 1.51 g/t Au (2.44 million tonnes)3. The Bolo Project, located 90 km northeast of Tonopah, Nevada, is another core asset, similarly hosting Carlin-style gold mineralization. New Placer Dome also owns 100% of the Troy Canyon Project, located 120 km south of Ely, Nevada. New Placer Dome is run by a strong management and technical team consisting of capital markets and mining professionals with the goal of maximizing value for shareholders through new mineral discoveries, committed long-term partnerships, and the advancement of exploration projects in geopolitically favourable jurisdictions.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Kristopher J. Raffle, P.Geo. (BC), Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, a Director of New Placer Dome and a "Qualified Person" as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Mr. Raffle has verified the data disclosed which includes a review of the sampling, analytical and test data underlying the information and opinions contained herein.

On behalf of the Board of Directors,

/s/ "Max Sali"

Max Sali, Chief Executive Officer

Contact Information:

Max Sali, Chief Executive Officer & Director

Tel: 604 620 8406

Email: msali@newplacerdome.com

Karl Mansour, Paradox IR

Tel: 514 341 0408

Email: karlmansour@paradox-pr.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This news release does not constitute an offer to sell or the solicitation of an offer to buy securities in the United States or in any jurisdiction where the offer, sale or solicitation would be unlawful. The Securities referred to in this press release may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Forward Looking Information

This news release includes certain statements that constitute "forward-looking information or statements" within the meaning of applicable securities law, including without limitation, the completion of the Private Placement, completion of the amendments of the Kinsley Option Agreement with Liberty Gold, completion of the geophysical survey program and subsequent drilling and the expected outcomes and results, other statements relating to the technical, financial and business prospects of the Company and its properties, and other matters.

Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved), and variations of such words, and similar expressions are not statements of historical fact and may be forward-looking statements. Forward-looking statements are necessarily based upon a number of factors that, if untrue, could cause the actual results, performances or achievements of the Company to be materially different from future results, performances or achievements express or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of metals, anticipated costs and the ability to achieve goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company's planned exploration activities will be available on reasonable terms and in a timely manner. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks. For further information concerning these and other risks and uncertainties, refer to the Company's filings on www.SEDAR.com including the annual information form for the year ended June 30, 2020, filed on May 26, 2021.

Forward-looking statements are subject to a variety of risks and uncertainties, which could cause actual events, level of activity, performance or results to differ materially from those reflected in the forward-looking statements, including, without limitation: (i) risks related to gold and other commodity price fluctuations; (ii) risks and uncertainties relating to the interpretation of exploration results; (iii) risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses; (iv) that resource exploration and development is a speculative business; (v) that the Company may lose or abandon its property interests or may fail to receive necessary licences and permits; (vi) that environmental laws and regulations may become more onerous; (vii) that the Company may not be able to raise additional funds when necessary; (viii) the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; (ix) exploration and development risks, including risks related to accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration and development; (x) competition; (xi) the potential for delays in exploration or development activities or the completion of geologic reports or studies; (xii) the uncertainty of profitability based upon the Company's history of losses; (xiii) risks related to environmental regulation and liability; (xiv) risks associated with failure to maintain community acceptance, agreements and permissions (generally referred to as "social licence"); (xv) risks relating to obtaining and maintaining all necessary government permits, approvals and authorizations relating to the continued exploration and development of the Company's projects; (xvi) risks related to the outcome of legal actions; (xvii) political and regulatory risks associated with mining and exploration; (xix) risks related to current global financial conditions; and (xx) other risks and uncertainties related to the Company's prospects, properties and business strategy. These risks, as well as others, could cause actual results and events to vary significantly.

Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, the loss of key directors, employees, advisors or consultants, adverse weather and climate conditions, increase in costs, equipment failures, government regulations and policies, litigation, exchange rate fluctuations, the impact of Covid-19 or other viruses and diseases on the Company's ability to operate, decrease in the price of gold and other metals, failure of counterparties to perform their contractual obligations and fees charged by service providers. Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. The forward-looking statements included in this news release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation.

1Technical Report on the Kinsley Project, Elko County, Nevada, U.S.A., dated June 21, 2021, with an effective date of May 5, 2021 and prepared by Michael M. Gustin, Ph.D., and Gary L. Simmons, MMSA and filed under New Placer Dome Gold Corp.'s Issuer Profile on SEDAR (www.sedar.com). Long Canyon Mine is not necessarily indicative of mineralization within New Placer Dome Properties.

2See New Placer Dome news releases dated January 11, and April 29, 2021. True width of mineralized intervals is interpreted to be between 60-90% of the reported lengths.

3Technical Report on the Kinsley Project, Elko County, Nevada, U.S.A., dated June 21, 2021 with an effective date of May 5, 2021 and prepared by Michael M. Gustin, Ph.D., and Gary L. Simmons, MMSA and filed under New Placer Dome Gold Corp.'s Issuer Profile on SEDAR (www.sedar.com). Long Canyon Mine is not necessarily indicative of mineralization within New Placer Dome Properties.

SOURCE: New Placer Dome Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/667287/New-Placer-Dome-Gold-Corp-Geophysical-Surveys-Yield-Additional-Chargeability-Anomalies-at-Kinsley-Mountain-Gold-Project-Updates-on-Private-Placement-Financing