GOLDEN, CO / ACCESSWIRE / October 10, 2021 / Vitro Biopharma, Inc. dba Vitro Biopharma, announced its 3rd quarter, ended July 31st 2021, financial results of operations.

Vitro Biopharma recorded increased 3rd quarter revenues of $331,687 vs $132,267 an increase of 251% over the comparative quarter last year. Revenues were up slightly from the prior quarter which were $326,535. The increase in revenue is directly attributed to the COVID 19 pandemic wind down. The opening back up of the economy and resumption of air travel has started the recovery and expansion of Vitro's revenue streams for the rest of 2021 and into 2022. Feedback from our international AlloRx customers report a resurgence in medical tourism travel. The cosmetic clinics www.Infinivive.com have also started to open up with variations by state mandates, resulting in increased revenue expectations into the 4th quarter and continued momentum into 2022.

Gross profit increased 6% from the comparative quarter last year primarily due to the increased higher margin AlloRx® stem cell therapies and cosmetic sales versus the mid margin stem cell research and development products that were the majority of sales in the prior comparative quarter.

Overall operating expenses increased in the quarter ended July 31st 2020 by $368,949 to $772,852 from $403,903 in the prior year's comparative quarter. The increase in expenses reflects the increased costs of manufacturing expansion, external clinical trial testing, FDA regulatory, legal, audit and accounting consulting costs.

The company added extra resources to continue its efforts in the world-wide challenge of finding therapies to fight COVID-19. Vitro continues to provide Covid-19 AlloRx® stem cell therapies to critically ill Covid-19 patients under its eIND for compassionate use. To date, Vitro has treated 15 critically ill patients who have failed with other therapeutic treatment options. Dr. Jack Zamora, CEO of Vitro was recently interviewed with local press coverage of our efforts in successfully treating COVID 19 patients.

https://www.youtube.com/watch?v=V058g5FsUVU

https://www.vitrobiopharma.com/blogs/news/vitro-biopharma-names-world-renown-physician- entrepreneur-as-its-ceo

During and subsequent to the quarter the company achieved and pursued the following objectives:

- Established Pathway to Gain FDA Approval of AlloRx Stem Cells® .

As a part of our overall strategy to target both global and US stem cell regenerative medicine markets, Vitro Biopharma submitted a Phase I IND application to the FDA to assess the safety of AlloRx Stem Cells® in the treatment of COVID-19. We have established strong communication channels with FDA officials that facilitated our IND review and FDA authorization to enroll patients. Several clinical centers have expressed interest in our stem cell therapy, and we continue to enlist multi-center sites to conduct our Phase 1 trial. No adverse events were reported in our patients treated through Emergency INDs, and one patient who had various comorbidities (diabetes, obesity and cardiovascular disease) stabilized and exhibited enhanced pulmonary, liver and renal function during the six weeks following AlloRx Stem Cell® Therapy. The patient has now recovered and is at home from the hospital after 3 months of intensive care. We have now completed fifteen eIND treatments without adverse events and resolution of COVID-19 symptoms. MSCs have been shown to block the cytokine storm that occurs in COVID-19 patients in acute respiratory distress through their powerful anti-inflammatory effectiveness. The cytokine storm leads to the need for assisted breathing by ventilators, patient transfer to ICU and related burdens on the global health and systems as the pandemic continues. It is important to note that AlloRx Stem Cells® are a possible therapy for other viral attacks including influenza. Stem cells block acute respiratory distress and repair damage to other major organs including cardiovascular, pulmonary, hepatic, and renal systems. During the quarter the company moved forward by obtaining hospital partners to enroll patients in its phase I-IIa, randomized, double-blinded, placebo controlled study of the safety and efficacy of therapeutic treatment with AlloRx Stem Cells® in adults with COVID-19.

AlloRx Stem Cells® have been shown to assist in recovery from failure of various organ systems in COVID-19 survivors, as our results and several other labs are demonstrating. It is thus likely that AlloRx Stem Cells® may be effective in treating long COVID-19. We look to submit filings to the FDA requesting expansion of the COVID-19 indication to include patients with adverse symptoms following COVID-19, so called "long haul COVID" (PASC) that is emerging as a major global health issue. As variants of COVID-19 evolve and threaten global pandemic expansion, AlloRx Stem Cell® therapy may be effective without regard to the viral sequence enhancing its therapeutic utility and compliment to vaccine therapy.

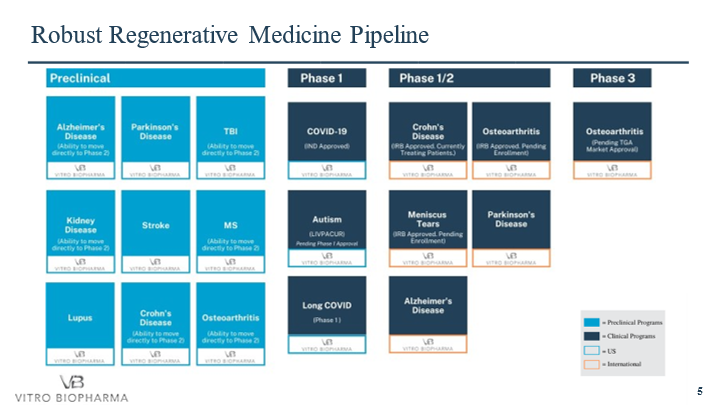

- Expansion of Vitro Biopharma's clinical FDA pipeline strategy

Vitro is in Phase I/IIa for safety of its AlloRx® stem cell therapy for treatment of Acute Covid-19 with a planned expansion to long-COVID-19 patient. Upon successful completion of the Phase I clinical trial, Vitro may be able to advance directly to Phase II for multiple indications and diseases such as; Osteoarthritis and other musculoskeletal conditions, Alzheimer's, Parkinson's, Crohn's Disease, Autism, Long Covid, Covid-19, Kidney Disease, Lupus, Multiple Sclerosis, Stroke and Traumatic Brain Injury, amongst many other debilitating diseases. Once the AlloRx stem cells® are proven safe from the Phase I Covid-19 clinical trial, Vitro will submit phase II clinical trial applications for the various indications listed above. The company has supplied its AlloRx Stem Cells® for over 200 treatments internationally in various indications, eINDs within COVID, and has the pre-liminary clinical data as to both safety and effectiveness of its AlloRx Stem Cells®. The offshore therapies not only provide revenue to the company but critical data as to safety and effectiveness in various indications to support our future FDA submissions.. This greatly enhances our belief in the likelihood of an FDA Phase II authorization and the ability to move forward with a Phase III trial either by the company or in partnership with major pharmaceutical partners or licensees.

The Company is also pursuing Orphan Drug Designation for AlloRx Stem Cells. We are targeting a rare genetic form of autism, Pitt Hopkins Syndrome (PTHS), in collaboration with the PTHS Center of Excellence at the Children's Hospital at CU Anschutz Medical Center in Denver CO. Orphan Drug Designation provides a fast track approval for AlloRx Stem Cells® with the potential to gain accelerated FDA pre-market authorization hence opening up US markets sooner than completion of other Phase II/III studies. Autism Spectrum Disorder (ASD) has been treated with safety and evidence of efficacy by MSC therapies supporting the use of AlloRx Stem Cells® for successful treatment of ASD. We estimate this market in the US to be over 6 million potential patients.

- Expansion of our manufacturing capacity

The company commenced the expansion of its laboratory and manufacturing facilities to expand its manufacturing output. This expanded facility is being constructed in the first and second quarter of 2022. During the quarter we have initiated technical upgrades to our AlloRx Stem Cell® manufacturing procedures that will increase cellular yields and further automate manufacturing.

Our increased capacity is rigorously controlled by our Quality Management System that was recently re-certified to the ISO9001 Quality Standard and the ISO13485 Medical Device Standard as well. This provides cGMP-compliant manufacturing of the highest quality stem cells/medical devices for clinical trial testing to provide further evidence of safety and efficacy for treatment of a wide variety of indications. Highly regulated cGMP biologics manufacturing within a BLA-compliant facility provides numerous opportunities for the Company to drive strong revenue growth. The recent FDA authorization of our COVID-19 clinical trial further validates our cGMP compliance as our manufacturing and quality procedures were rigorously reviewed and approved. We continue to support Magellan Stem Cells in Australia as they approach finalization of their Phase III study and explore emerging opportunities in the Medical Pavilion of the Bahamas and possible realtionships in the Middle East Our future plans include the establishment of a separate facility for the manufacture of FDA-approved AlloRx Stem Cells®

During and subsequent to the quarter the company has added new regenerative medicine clinics in Cabo San Lucas Mexico and Antigua. The company is in discussions with additional offshore clinics who want to utilize the companies AlloRx Stem Cells® in their regenerative therapies. Subsequent to the quarter the company has now provided AlloRx® stem cells for regenerative medicine therapies to the Antigua clinic and the Cabo clinic.

STEMulize and SPECTRUM + update

Subsequent to the quarter the company announced the acquisition of its nutraceutical distributor Fitore Inc. Vitro acquired Fitore Nutrition for $2,300,000 in a combination of notes and stock. https://www.vitrobiopharma.com/blogs/news and https://fitorenutrition.com/ Fitore will be contributing 100% of its revenues to Vitro in the fourth quarter of 2021. Additionally, Fitore's expertise in digital marketing and E- commerce will help support and expand Vitro and InfiniVive sales.

"The integration of Fitore's direct to consumer (D2C) technology platform will accelerate Vitro's nutraceutical product penetration and brand recognition into the marketplace for all its products. To date we have had an incredibly successful partnership with Vitro with the joint development of Stemulife formerly known as STEMulize®, and Spectrum +. Partnering with Vitro Biopharma only accelerates our mission as we continue to develop more life-changing products based on Vitro's scientific capabilities and the expanding market demands for natural health products." said Tanner Haas C.E.O. of Fitore Inc."

Fitore also has two other products Easy Sleep and Thought Calmer. The Company and Fitore will continue to expand the product line centered around the research capabilities of Vitro Biopharma.

- Supporting Revenue from Infinivive MD Stem Cell Serum comes back on line as various states open back up for full time business.

Subsequent to the quarter the company acquired its exclusive distributor Infinivive-MD from its C.E.O. Jack Zamora MD. The company acquired Infinivive MD for $5,750,000 in an all-stock transaction.

Infinivive MD will be contributing 100% of its revenues in the fourth quarter of 2021.

https://www.vitrobiopharma.com/blogs/news www.infinivivemd.com www.jackzamoramd.com

InfiniVive MD has created the highest quality cGMP-grade cosmetic stem cell, exosome, and conditioned media serums. InfiniVive MD cosmetic stem cell products contain ultra-pure mesenchymal stem cells and exosomes to be used topically by plastic surgeons, cosmetic surgeons, and aestheticians throughout the United States and internationally. Infinivive is looking to disrupt the cosmetic industry through next level skin care product line.

"The acquisition of Fitore & Infinivive gives us the opportunity to leverage the revenues of both companies, increase market awareness for Vitro, and make serious advances in the areas of customer acquisition strategy and overall brand awareness" said Jack Zamora C.E.O. of Vitro Biopharma.

The company obtained two separate valuations from independent valuation experts for both Fitore and Infinvive MD to ensure a fair valuation in this related party transaction. The consolidation of this family of companies moves Vitro forward with no conflicts of interest with its C.E.O. who previously owned a minority position in Fitore and was the sole owner and exclusive distributor for Vitro of the topical stem cell product and the new jointly developed exosome product and daily serum product. The two companies are now wholly owned subsidiaries of Vitro and the results of operations of Fitore Inc. and Infinivive-MD will be 100% consolidated with the results of operations of Vitro Biopharma Inc. starting in the fourth quarter of 2021.

InfiniVive MD Cosmetic Serum is revolutionizing the cosmetic industry. Patients are experiencing unparalleled improvements in the appearance of fine lines and wrinkles. This is one of the fastest growing revenue streams for Vitro Biopharma. We work with a variety of regulatory experts to assist us in the appropriate regulatory pathways. Vitro Biopharma's cosmetic topical serums are being distributed into cosmetic clinics that are providing the highest tier skin care products. To date, the company's products are being offered in a number of clinics throughout the United States and international clinics are in line to be added shortly. https://infinivivemd.com/pages/find-a-specialist

- Update on the Clinical Trial of Musculoskeletal Conditions in the Bahamas

This initiative broadens Vitro Biopharma's expansion into highly regulated stem cell trials in collaboration with the Nassau-based Medical Pavilion of the Bahamas (TMPB).

http://www.tmp-bahamas.com

Pandemic related travel restrictions have delayed patient enrollment in our IRB-approved clinical trial to treat musculoskeletal conditions with AlloRx Stem Cells®. These include OA of any joint, ACL/MCL tear, Achilles tendon rupture, rotator cuff injury, tennis elbow and herniated disc that are highly prevalent and have few disease-modifying options. The company is partnered with Dr. Conville Brown, MD, MBBS, FACC, FESC, PhD, the founder and CEO of the Medical Pavilion of the Bahamas who is the Principal Investigator of this trial and director of its clinical administration. Dr. Brown was instrumental in the establishment of the NSCEC in the Bahamas.

About the Medical Pavilion of the Bahamas: TMPB operates within a 40,000 square foot building as a partnered care specialty medical facility with 10 different centers in various areas including cardiology, cancer, clinical research, and kidney disease. One of the centers is the Partners Stem Cell Centre, where the present trial will be conducted. The Partners Stem Cell Centre provides an environment to conduct stem cell research and clinical trials under the model of 'FDA rigor in a Non-FDA Jurisdiction' TMPB employs 20 medical specialists in various fields. See www.tmp-bahamas.com for additional information.

The company has entered into an operating agreement with the Partner's Stem Cell Centre and the pandemic has delayed patient enrollment for the clinical trial, revenue expectations are on hold until into 2022.

- Cayman Islands starts treating patients again as restrictions are relaxed but not yet all clear.

During and subsequent to the quarter DVC Stem has started to treat some patients who are willing to quarantine for the 4-7 days depending on Covid-19 test results and the patients vaccination status, these therapies will start to contribute to revenue more substantially into 2022. www.dvcstem.com

- New clinic in Antigua treats its first patients with AlloRx®

The Antigua clinic is run by Dr. Chad C. Prodromos M.D.; Medical Director and CEO the Prodromos Stem Cell Institute Medical Director, The Foundation for Orthopedics and Regenerative Medicine

https://www.thepsci.com/video-stem-cell-glenview-chicago-il.html

- New clinic in Cabo Mexico treats its first patients with AlloRx®

The company is in discussions for the further distribution of its AlloRx® stem cells, exosomes, topical stem cell products of Infinivive MD and its Fitore nutraceuticals. The Cabo clinic serves primarily the west coast - in particular California and Canada

- European Wellness Biomedical Group $2m 2Year Contract

Subsequent to the quarter; Vitro Biopharma, Inc. announced the signing of a $2M contract with European Wellness Biomedical Group headquartered in Kuala Lumpur, Malaysia and it's start-up subsidiary BioPep being registered in Delaware, USA to develop FDA-approval of biological products derived from existing mitochondrial peptide extracts now used globally as treatment of various conditions including aesthetic dermatology and skin revitalization, autism spectrum disorders, cardiovascular, metabolic and degenerative disorders, CKD and fertility through its global network of 12 (twelve) biomedical regenerative centers located throughout Europe and Asia Pacific. The contract provides for direct payments to Vitro Biopharma, Inc. of $2 million over 2-years for its services to gain FDA approval. The contract specifies distinct stages to gain FDA-approval including the steps needed to produce a research product for extensive preclinical and clinical testing to support an FDA IND filing, biomanufacturing infrastructure to support BLA-compliant upstream and downstream operations, development of a certified Quality Management System to support FDA-approval of target products and technology transfer to BioPep.

The companies CSO Jim Musick will be spearheading the project with the support to the companies Director (Chief) of Regulatory affairs Caroline Mosessian and the CMO Tiana States. The project has commenced in the fourth quarter and will contribute to revenues over that quarter and the next two years.

- Expanded our Patent & Intellectual Property Portfolio

The Company has 6 patent applications pending in the US and foreign jurisdictions. These patents cover our line and various aspects of our STEMulize® stem cell activation products for treatment of a wide variety of medical indications. During the quarter, the Company has responded to office actions and continues to vigorously prosecute & expand its patent filings. During prosecution, some previously pending applications that were expanded due to restriction actions by the US patent office were abandoned without altering the Company's ability to achieve patent protection of its key IP related to AlloRx Stem Cells®, STEMulize® for treatment of a wide variety of medical conditions and its novel stem cell therapy based on the combination of AlloRx Stem Cells® and STEMulize®. Also, our pending applications have opportunities for subsequent filings in other jurisdictions and we have filed a new application related to the engineering of vaccine properties into AlloRx Stem Cells®.

- Series A Convertible Preferred Stock Offering

During the quarter, the company continued with its Series A Convertible Preferred Stock offering to the accredited investors under the SEC Regulation D exemption. The preferred Stock is priced at $25 per share which is convertible at $0.25 cents per share for a total of 100 shares. The minimum investment is $50,000 per unit. The company had sold $1.0 million of the Series A Convertible Preferred Stock in 2020. The offering was sold out at $1.0 million and the company has expanded it to a total of up to $3.5 million to ensure sufficient working capital during the Coronavirus pandemic and to start the regulatory process of current reporting audits and funding for its expanded clinical trial activities with the FDA. The Series A Convertible Preferred offering has been funded to $1,080,000 during the nine months ended July 31st 2021 with a number of accredited investors including C.E.O. Jack Zamora. Subsequent to the quarter the Series A Convertible Preferred had been funded in 2021 to a total of $1,940,000. The offering is currently being closed out. As at October 3, 2021 the company had approximately $1,361,000 in cash and liquid assets.

The company has commenced discussions with various investors and investment banks on the prospects of going public with an institutional sponsored IPO on the NASDQ or New York stock exchange. See the company's corporate presentation here:

https://www.vitrobiopharma.com/pages/events-presentations

- Organizational expansion

The companies CFO and Chairman of the Board has brought in an experienced banker and finance executive as its new CFO. Nathan Haas, previously CFO of the recently acquired Fitore Inc. and Infinivive MD has become Vitro's CFO as of Oct 1st 2021. Nathan has investment banking experience with Bank of New York Mellon, working with the company's largest most complex clients. Nathan brings a wealth of financial background in the biotech and pharmaceutical industry. He will be leading the discussions with the investment banks about a Vitro IPO and listing on the NASDQ or New York Stock Exchange.

John R. Evans will remain as the Chairman of the Board and will be expanding to a seven person board to meet the increasing governance requirements of public companies. John has extensive executive public company management experience, including raising over a Billion dollars in capital over his career, and filling a variety of executive roles as CEO, CFO, Director and Chairman of the Board.

Our umbilical cord stem cells yield one of the highest viabilities in the world (above 90%) and have more potency, ATP expression, viability, and greater clinical efficacy than other stem cell products. See a comparative analysis of adult mesenchymal stem cells below.

https://www.vitrobiopharma.com/blogs/white-papers/comparative-analysis-of-adult-mesenchymal-stem-cells-derived-from-adipose-bone-marrow-placenta-and-umbilical-cord-tissue

We believe our stem cell products are distinctly superior to stem cell treatments offered in the USA. The latter usually involve use of impure products lacking validation as stem cells and containing insufficient numbers of stem cells to achieve therapeutic benefits. These are produced without regulatory oversight and have been known to cause serious adverse effects. Hence the use of highly purified and well characterized stem cells (AlloRx Stem Cells®) is needed to provide safety and efficacy in regenerative medicine therapies.

In summary, Vitro Biopharma is advancing as a key player in regenerative medicine with 10+ years' experience in the development and commercialization of stem cell products for research, recognized by a Best in Practice Technology Innovation Leadership award for Stem Cell Tools and Technology and a growing track record of successful translation to therapy. We plan to leverage our proprietary technology platform to the establishment of international Stem Cell Centers of Excellence and regulatory approvals in the US and worldwide.

Vitro Biopharma has supplied major biopharmaceutical firms, elite university laboratories and clinical trials worldwide with its Umbilical Cord Mesenchymal Stem Cells (AlloRx Stem Cells®), and it's MSC-Grow Brand of cell culture media along with advanced stem cell diagnostic services.

www.vitrobiopharma.com"

Sincerely yours,

Jack Zamora M.D.

C.E.O.

www.vitrobiopharma.com

1-866-848-7627

Forward-Looking Statements

Statements herein regarding financial performance have not yet been reported to the SEC nor reviewed by the Company's auditors. Certain statements contained herein and subsequent statements made by and on behalf of the Company, whether oral or written may contain "forward-looking statements". Such forward looking statements are identified by words such as "intends,"

"anticipates," "believes," "expects" and "hopes" and include, without limitation, statements regarding the Company's plan of business operations, product research and development activities, potential contractual arrangements, receipt of working capital, anticipated revenues and related expenditures.

Factors that could cause actual results to differ materially include, among others, acceptability of the Company's products in the market place, general economic conditions, receipt of additional working capital, the overall state of the biotechnology industry and other factors set forth in the Company's filings with the Securities and Exchange Commission. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking statements.

Except as otherwise required by applicable securities statutes or regulations, the Company disclaims any intent or obligation to update publicly these forward-looking statements, whether as a result of new information, future events or otherwise.

CONTACT:

Jack Zamora M.D,

4621 Technology Drive

Golden, CO 80403

1-866-848-7627

www.vitrobiopharma.com

| Vitro BioPharma, Inc. | |||||||||

| Balance Sheets | |||||||||

| Unaudited | |||||||||

| July 31, 2021 | October 31, 2020 | ||||||||

ASSETS | |||||||||

Cash | 450,133 | 297,212 | |||||||

Accounts receivable, net of allowance | 81,816 | 93,660 | |||||||

Accounts receivable - related parties | 124,536 | 58,250 | |||||||

Inventory | 86,371 | 35,000 | |||||||

Total Current Assets | 742,856 | 484,122 | |||||||

Fixed assets, net of depreciation | 126,125 | 146,440 | |||||||

Patents, net of amortization | 3,200 | - | |||||||

Right of use asset - operating lease | 347,841 | 394,793 | |||||||

Total Assets | 1,220,022 | 1,025,355 | |||||||

LIABILITIES | |||||||||

Accounts payable | 69,457 | 46,392 | |||||||

Accounts payable - related parties | 1,976 | 32,212 | |||||||

Other accrued liabilities | 511,109 | 165,923 | |||||||

Other accrued liabilities - related party | 211,000 | - | |||||||

Current maturities of capital lease obligations | 52,362 | 44,735 | |||||||

Current maturities of operating lease obligations | 58,625 | 61,797 | |||||||

Accrued interest payable | - | 83,251 | |||||||

Accrued interest payable, related parties | - | 118,890 | |||||||

Total Current Liabilities | 904,529 | 553,200 | |||||||

Capital lease obligations, net of current portion | 87,781 | 98,464 | |||||||

Operating lease obligation, net of current portion | 289,216 | 332,996 | |||||||

Convertible promissory notes - 10% | 300,515 | 260,257 | |||||||

Convertible promissory notes - 10% - related parties | 506,174 | 416,838 | |||||||

Accrued interest payable | 103,888 | - | |||||||

Accrued interest payable, related parties | 163,401 | - | |||||||

Unsecured 6% note payable - related party | 767,288 | 767,288 | |||||||

Unsecured 4% note payable - related party | 1,221,958 | 1,221,958 | |||||||

Long term accrued interest payable, related party | 70,992 | - | |||||||

Total Long Term Liabilities | 3,511,213 | 3,097,801 | |||||||

Total Liabilities | 4,415,742 | 3,651,001 | |||||||

SHAREHOLDERS' DEFICIT | |||||||||

Series A convertible preferred stock, 5,000,000 shares authorized, | |||||||||

58,200 and 41,000 outstanding, respectively | 84 | 41 | |||||||

Common stock, 500,000,000 shares authorized, | |||||||||

46,130,200 and 46,130,200 outstanding, respectively | 46,410 | 46,410 | |||||||

Paid in capital | 10,866,425 | 8,749,607 | |||||||

Less Treasury stock | (84,000 | ) | (84,000 | ) | |||||

Accumulated deficit | (14,024,639 | ) | (11,337,704 | ) | |||||

Total Stockholders' Deficit | (3,195,720 | ) | (2,625,646 | ) | |||||

Total Liabilities and Stockholders' Deficit | 1,220,022 | 1,025,355 | |||||||

| Vitro BioPharma, Inc. | |||||||||

| Statements of Operations | |||||||||

| Unaudited | |||||||||

| Three months ended | Three months ended | ||||||||

| July 31, 2021 | July 31, 2020 | ||||||||

Product sales | $ | 201,537 | $ | 88,517 | |||||

Product sales, related parties | 130,150 | 43,750 | |||||||

Total revenue | 331,687 | 132,267 | |||||||

Less cost of goods sold | (99,506 | ) | (48,274 | ) | |||||

Gross profit | 232,181 | 83,993 | |||||||

Operating costs and expenses: | |||||||||

Selling, general and administrative | 772,852 | 403,903 | |||||||

Research and development | 52,160 | 333 | |||||||

Loss from operations | (592,831 | ) | (320,243 | ) | |||||

Other expense: | |||||||||

Interest expense | (73,996 | ) | (73,810 | ) | |||||

Net loss | (666,827 | ) | (394,053 | ) | |||||

Deemed dividend on Series A Convertible preferred stock | (31,230 | ) | (10,201 | ) | |||||

Cumulative Series A Convertible preferred stock dividend | |||||||||

requirement | (24,183 | ) | (16,867 | ) | |||||

Net loss available to common stockholders | $ | (722,240 | ) | $ | (421,121 | ) | |||

Net loss per common share, basic and diluted | $ | (0.02 | ) | $ | (0.01 | ) | |||

Shares used in computing net loss per common share, | |||||||||

Basic and diluted | 46,130,200 | 46,010,200 | |||||||

| Vitro BioPharma Inc. | |||||||||

| Statements of Operations | |||||||||

| Unaudited | |||||||||

| Nine months ended | Nine months ended | ||||||||

| July 31, 2021 | July 31, 2020 | ||||||||

Product sales | $ | 422,914 | $ | 266,770 | |||||

Product sales, related parties | 362,800 | 220,050 | |||||||

Total revenue | 785,714 | 486,820 | |||||||

Less cost of goods sold | (180,005 | ) | (151,344 | ) | |||||

Gross profit | 605,709 | 335,476 | |||||||

Operating costs and expenses: | |||||||||

Selling, general and administrative | 2,964,133 | 1,110,047 | |||||||

Research and development | 52,473 | 919 | |||||||

Loss from operations | (2,410,897 | ) | (775,490 | ) | |||||

Other expense: | |||||||||

Interest expense | (276,038 | ) | (221,089 | ) | |||||

Net loss | (2,686,935 | ) | (996,579 | ) | |||||

Deemed dividend on Series A Convertible preferred stock | (75,625 | ) | (10,248 | ) | |||||

Cumulative Series A Convertible preferred stock dividend | |||||||||

requirement | (81,683 | ) | (27,720 | ) | |||||

Net loss available to common stockholders | $ | (2,844,243 | ) | $ | (1,034,547 | ) | |||

Net loss per common share, basic and diluted | $ | (0.06 | ) | $ | (0.02 | ) | |||

Shares used in computing net loss per common share, | |||||||||

Basic and diluted | 46,130,200 | 46,010,200 | |||||||

| Vitro BioPharma, Inc. | |||||||||||||||||||||||||||||||||

| Statement of Changes in Stockholders' Deficit | |||||||||||||||||||||||||||||||||

| Unaudited | |||||||||||||||||||||||||||||||||

| Preferred Stock | Common Stock | Treasury | Accumulated | ||||||||||||||||||||||||||||||

| Shares | Par Value | Shares | Par Value | Paid in Capital | Stock | Deficit | Total | ||||||||||||||||||||||||||

Balance at October 31, 2020 | 41,000 | $ | 41 | 46,130,200 | $ | 46,410 | $ | 8,749,607 | $ | (84,000 | ) | $ | (11,337,704 | ) | $ | (2,625,646 | ) | ||||||||||||||||

Sale of preferred stock | 12,000 | 12 | - | - | 299,988 | - | - | 300,000 | |||||||||||||||||||||||||

Stock based compensation | - | - | - | - | 62,673 | - | - | 62,673 | |||||||||||||||||||||||||

Beneficial conversion feature | |||||||||||||||||||||||||||||||||

on convertible preferred stock | - | - | - | - | 18,039 | - | - | 18,039 | |||||||||||||||||||||||||

Deemed dividend on convertible | |||||||||||||||||||||||||||||||||

preferred stock | - | - | - | - | (18,039 | ) | - | - | (18,039 | ) | |||||||||||||||||||||||

Net loss | - | - | - | - | - | - | (1,030,145 | ) | (1,030,145 | ) | |||||||||||||||||||||||

Balance at January 31, 2021 | 53,000 | 53 | 46,130,200 | 46,410 | 9,112,268 | (84,000 | ) | (12,367,849 | ) | (3,293,118 | ) | ||||||||||||||||||||||

Sale of preferred stock | 5,200 | 5 | 129,995 | 130,000 | |||||||||||||||||||||||||||||

Stock based compensation | - | - | - | - | 677,080 | - | - | 677,080 | |||||||||||||||||||||||||

Beneficial conversion feature | |||||||||||||||||||||||||||||||||

on convertible preferred stock | - | - | - | - | 26,356 | - | - | 26,356 | |||||||||||||||||||||||||

Deemed dividend on convertible | |||||||||||||||||||||||||||||||||

preferred stock | - | - | - | - | (26,356 | ) | - | - | (26,356 | ) | |||||||||||||||||||||||

Net loss | - | - | - | - | - | - | (989,963 | ) | (989,963 | ) | |||||||||||||||||||||||

Balance at April 30, 2021 | 58,200 | $ | 58 | 46,130,200 | $ | 46,410 | $ | 9,919,343 | $ | (84,000 | ) | $ | (13,357,812 | ) | $ | (3,476,001 | ) | ||||||||||||||||

Sale of preferred stock | 26,000 | 26 | - | - | 649,974 | 650,000 | |||||||||||||||||||||||||||

Stock based compensation | - | - | - | - | 297,108 | - | - | 297,108 | |||||||||||||||||||||||||

Beneficial conversion feature | |||||||||||||||||||||||||||||||||

on convertible preferred stock | - | - | - | - | 31,230 | - | - | 31,230 | |||||||||||||||||||||||||

Deemed dividend on convertible | |||||||||||||||||||||||||||||||||

preferred stock | - | - | - | - | (31,230 | ) | - | - | (31,230 | ) | |||||||||||||||||||||||

Net loss | - | - | - | - | - | - | (666,827 | ) | (666,827 | ) | |||||||||||||||||||||||

Balance at July 31, 2021 | 84,200 | $ | 84 | 46,130,200 | $ | 46,410 | $ | 10,866,425 | $ | (84,000 | ) | $ | (14,024,639 | ) | $ | (3,195,720 | ) | ||||||||||||||||

| Vitro BioPharma, Inc. | |||||||||||||||||||||||||||||||||

| Statement of Changes in Stockholders' Deficit | |||||||||||||||||||||||||||||||||

| Unaudited | |||||||||||||||||||||||||||||||||

| Preferred Stock | Common Stock | Treasury | Accumulated | ||||||||||||||||||||||||||||||

| Shares | Par Value | Shares | Par Value | Paid in Capital | Stock | Deficit | Total | ||||||||||||||||||||||||||

Balance at October 31, 2019 | - | $ | - | 46,010,200 | $ | 46,290 | $ | 7,407,220 | $ | (84,000 | ) | $ | (9,775,157 | ) | $ | (2,405,647 | ) | ||||||||||||||||

Sale of preferred stock | 18,000 | 18 | - | - | 449,982 | - | - | 450,000 | |||||||||||||||||||||||||

Stock based compensation | - | - | - | - | 138,869 | - | - | 138,869 | |||||||||||||||||||||||||

Beneficial conversion feature | |||||||||||||||||||||||||||||||||

on convertible preferred stock | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||

Deemed dividend on convertible | |||||||||||||||||||||||||||||||||

preferred stock | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||

Net loss | - | - | - | - | - | - | (268,074 | ) | (268,074 | ) | |||||||||||||||||||||||

Balance at January 31, 2020 | 18,000 | 18 | 46,010,200 | 46,290 | 7,996,071 | (84,000 | ) | (10,043,231 | ) | (2,084,852 | ) | ||||||||||||||||||||||

Sale of preferred stock | 5,800 | 6 | - | - | 144,994 | 145,000 | |||||||||||||||||||||||||||

Stock based compensation | - | - | - | - | 42,739 | - | - | 42,739 | |||||||||||||||||||||||||

Beneficial conversion feature | |||||||||||||||||||||||||||||||||

on convertible preferred stock | - | - | - | - | 47 | - | - | 47 | |||||||||||||||||||||||||

Deemed dividend on convertible | |||||||||||||||||||||||||||||||||

preferred stock | - | - | - | - | (47 | ) | - | - | (47 | ) | |||||||||||||||||||||||

Net loss | - | - | - | - | - | - | (334,452 | ) | (334,452 | ) | |||||||||||||||||||||||

Balance at April 30, 2020 | 23,800 | $ | 24 | 46,010,200 | $ | 46,290 | $ | 8,183,804 | $ | (84,000 | ) | $ | (10,377,683 | ) | $ | (2,231,565 | ) | ||||||||||||||||

Sale of preferred stock | - | 15 | - | - | 374,985 | 375,000 | |||||||||||||||||||||||||||

Stock based compensation | - | - | - | - | 42,739 | - | - | 42,739 | |||||||||||||||||||||||||

Beneficial conversion feature | |||||||||||||||||||||||||||||||||

on convertible preferred stock | - | - | - | - | 10,201 | - | - | 10,201 | |||||||||||||||||||||||||

Deemed dividend on convertible | |||||||||||||||||||||||||||||||||

preferred stock | - | - | - | - | (10,201 | ) | - | - | (10,201 | ) | |||||||||||||||||||||||

Net loss | - | - | - | - | - | - | (394,053 | ) | (394,053 | ) | |||||||||||||||||||||||

Balance at July 31, 2020 | 23,800 | $ | 39 | 46,010,200 | $ | 46,290 | $ | 8,601,528 | $ | (84,000 | ) | $ | (10,771,736 | ) | $ | (2,207,879 | ) | ||||||||||||||||

| Vitro BioPharma, Inc. | |||||||||

| Statements of Cash Flows | |||||||||

| Unaudited | |||||||||

| Nine months ended | Nine months ended | ||||||||

| July 31, 2021 | July 31, 2020 | ||||||||

Operating Activities | |||||||||

Net Loss | $ | (2,686,935 | ) | $ | (996,579 | ) | |||

Adjustment to reconcile net loss: | |||||||||

Depreciation expense | 66,067 | 36,173 | |||||||

Amortization of operating lease - ROU asset | 46,952 | 62,155 | |||||||

Accretion of debt discount | 129,594 | 112,974 | |||||||

Stock based compensation | 1,036,861 | 224,347 | |||||||

Changes in assets and liabilities | |||||||||

Accounts receivable | 11,844 | 105,621 | |||||||

Accounts receivable, related parties | (66,286 | ) | (174,650 | ) | |||||

Inventory | (51,371 | ) | (82,282 | ) | |||||

Prepaid expenses | - | (8,250 | ) | ||||||

Patent costs | (3,200 | ) | - | ||||||

Accounts payable | 23,065 | 10,861 | |||||||

Accounts payable, related parties | (30,236 | ) | (14,812 | ) | |||||

Operating lease obligation | (46,952 | ) | (62,155 | ) | |||||

Other accrued liabilities | 345,186 | (3,794 | ) | ||||||

Other accrued liabilities - related party | 211,000 | - | |||||||

Accrued interest | 20,637 | 54,558 | |||||||

Accrued interest, related parties | 115,503 | 38,661 | |||||||

Net cash used in operating activities | (878,271 | ) | (697,172 | ) | |||||

Investing Activities | |||||||||

Acquisition of property and equipment | (13,107 | ) | (1,716 | ) | |||||

Net cash used in investing activities | (13,107 | ) | (1,716 | ) | |||||

Financing Activities | |||||||||

Preferred stock issued for cash | 1,080,000 | 970,000 | |||||||

Capital lease principal payments | (35,701 | ) | (30,575 | ) | |||||

Net cash provided by financing activities | 1,044,299 | 939,425 | |||||||

Total cash provided (used) during the fiscal period | 152,921 | 240,537 | |||||||

Beginning cash balance | 297,212 | 118,624 | |||||||

Ending cash balance | $ | 450,133 | $ | 359,161 | |||||

Cash paid for interest | $ | 9,733 | $ | 14,895 | |||||

Cash paid for income taxes | $ | - | $ | - | |||||

Supplemental schedule of non cash financing activities: | |||||||||

Beneficial conversion feature and deemed dividend on convertible preferred stock | $ | 75,625 | $ | 10,248 | |||||

Capital lease for property and equipment | $ | 32,645 | $ | - | |||||

Right of use asset | $ | - | $ | 411,287 | |||||

These financial statements should be read in connection with the notes to the unaudited financial statements.

SOURCE: Vitro Diagnostics/DBA Vitro Biopharma

View source version on accesswire.com:

https://www.accesswire.com/667501/Vitro-Biopharma-Inc-July-31st-2021-3rd-Quarter-ended-Financial-Results-of-Operations-and-Shareholder-Letter