TORONTO, ON / ACCESSWIRE / October 13, 2021 / Pelangio Exploration Inc. (TSXV:PX)(OTC PINK:PGXPF) ("Pelangio" or the "Company") is pleased to provide an update on recent exploration activities on its projects in Ghana and Canada.

Highlights of Recent Exploration Activities

- A diamond drilling program to test for extensions to the Pokukrom gold resource mineralization has commenced on the Manfo project in Ghana.

- One-meter re-assays of significant mineralized intervals from the maiden Dankran project RC drilling program returned an intercept of 14.17 g/t Au over 3 meters, including 39.20 g/t Au over 1 meter.

- Ground Induced Polarization Survey completed at Gowan Cu Zn Ag Au polymetallic project, to refine drill targets.

- Drill contract secured for Dome West project; drilling to commence in late October.

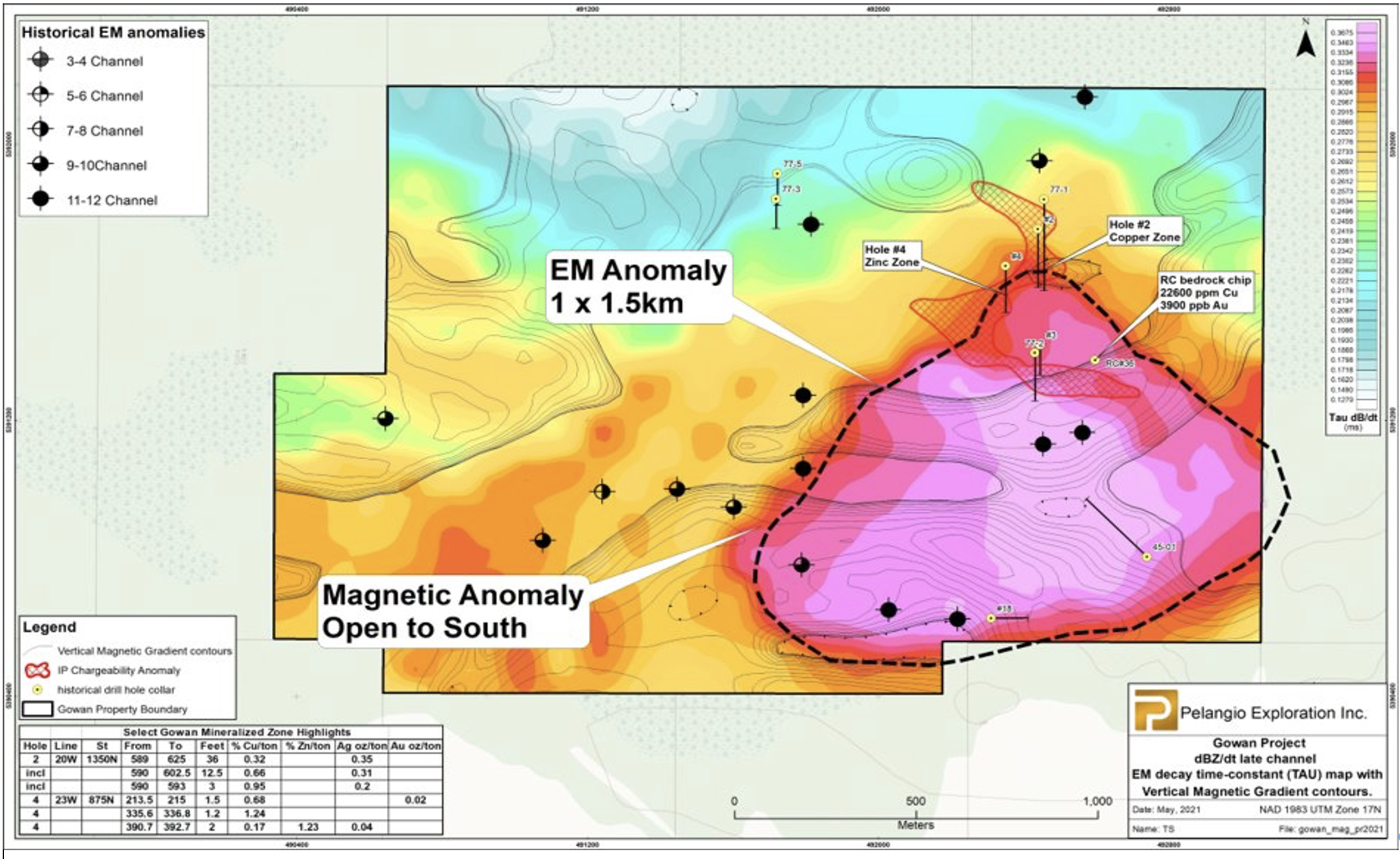

Ingrid Hibbard, President and CEO commented, " We are anticipating three very exciting drill programs at our Manfo, Dome West and Gowan projects over the next several months. These programs follow our maiden drilling at Dankran that returned significant results over 2.7 km and intercepted 14.17 g/t Au over 3 meters, including 39.20 g/t Au over 1 m; as well as the Gowan airborne VTEM survey that identified the large, 1.5 km X 1 km moderate VTEM anomaly on the flank of large magnetic anomaly. Further, we look forward to seeing the exploration work commence at Birch Lake with our option partner First Mining."

GHANA

Manfo Project

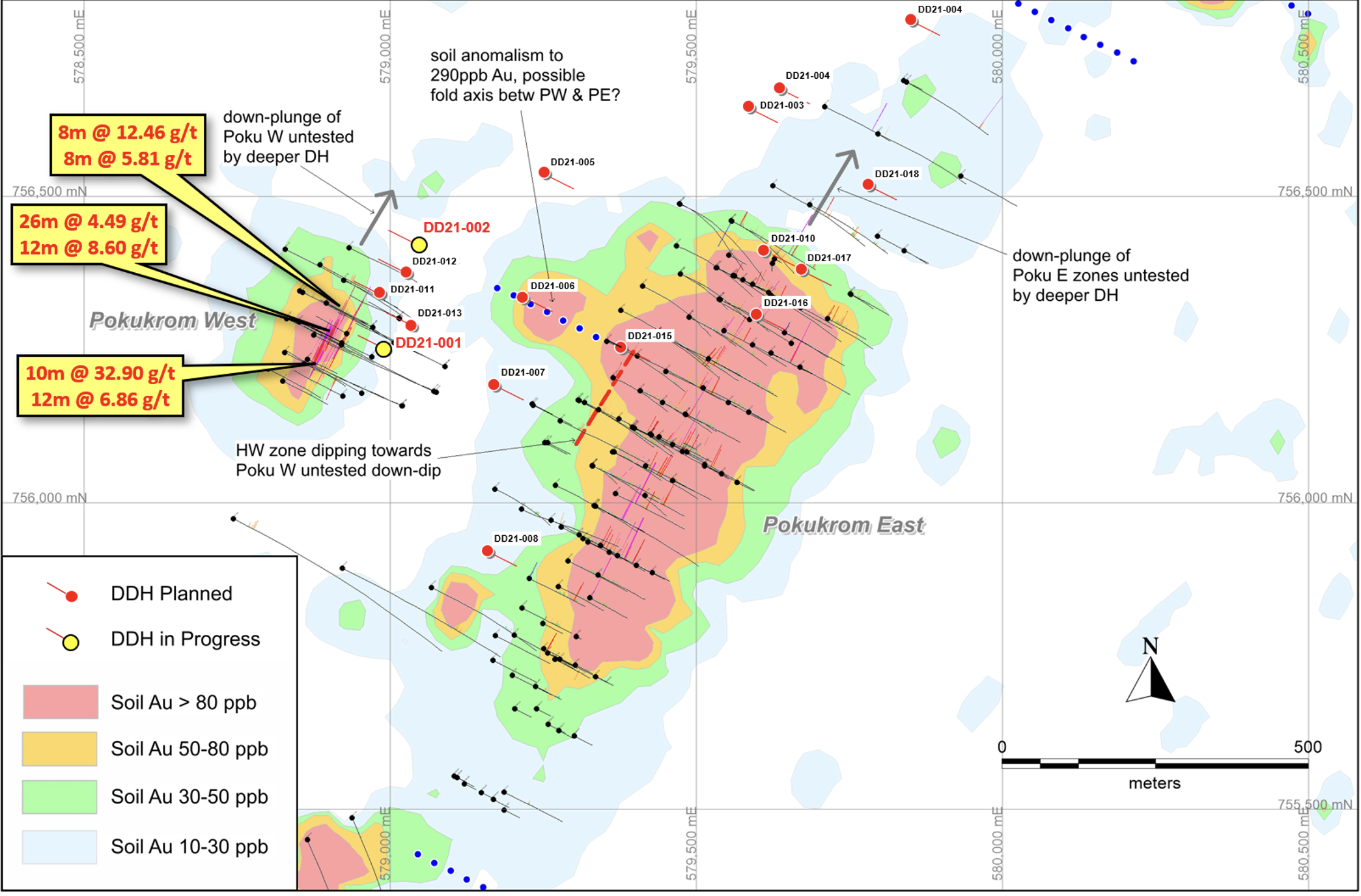

A diamond drilling program commenced on the Manfo Project designed to test for extensions to the known mineralization in the Pokukrom East and Pokukrom West deposits. Pokukrom East and West contain the majority of the gold resource at Manfo, estimated to be 195,000 oz (at 1.52 g/t Au) Indicated and 298,000 oz (at 0.96 g/t Au) Inferred by SRK in June of 2013. Refer to the Mineral Resource Evaluation Technical Report, Manfo Gold Project, Ghana, authored by SRK and released by Pelangio on June 21, 2013.

A 3,700-meter diamond drilling program has been engineered to test for down-dip and down-plunge extensions to the mineralization in these two deposits in addition to evaluating exploration targets in the immediate vicinity. The drilling program commenced in September with two holes in progress on the smaller, higher-grade Pokukrom West deposit, where historic drilling by Pelangio returned a number of high-grade intercepts including 32.90 g/t Au over 10 meters (hole SPDD-090), 8.60 g/t Au over 12 meters (hole SPDD-084) and 4.49 g/t Au over 26 meters including 8.08 g/t Au over 12 meters (hole SPDD-083), with all Au intercepts reported "un-cut".

The first hole at Pokukrom West was completed to a final depth of 151.5 meters and was designed to provide an improved structural understanding of the mineralization from oriented drill core with the hole drilled in the midst of previous high-grade drill holes. Assays are pending. The second hole is in progress, planned for 230 meters depth, and is designed to test for the down-plunge continuation of the high-grade mineralization at Pokukrom West approximately 175 meters down-plunge (to the north) of previous drilling. Refer to Figure 1.

The drilling program will pause after completion of these initial two holes to allow for sampling to be completed and assays received as the results could alter the planned drill hole priorities if exceptional results are returned.

Figure 1: Planned Diamond Drilling at Pokukrom, Manfo Project

Dankran Project

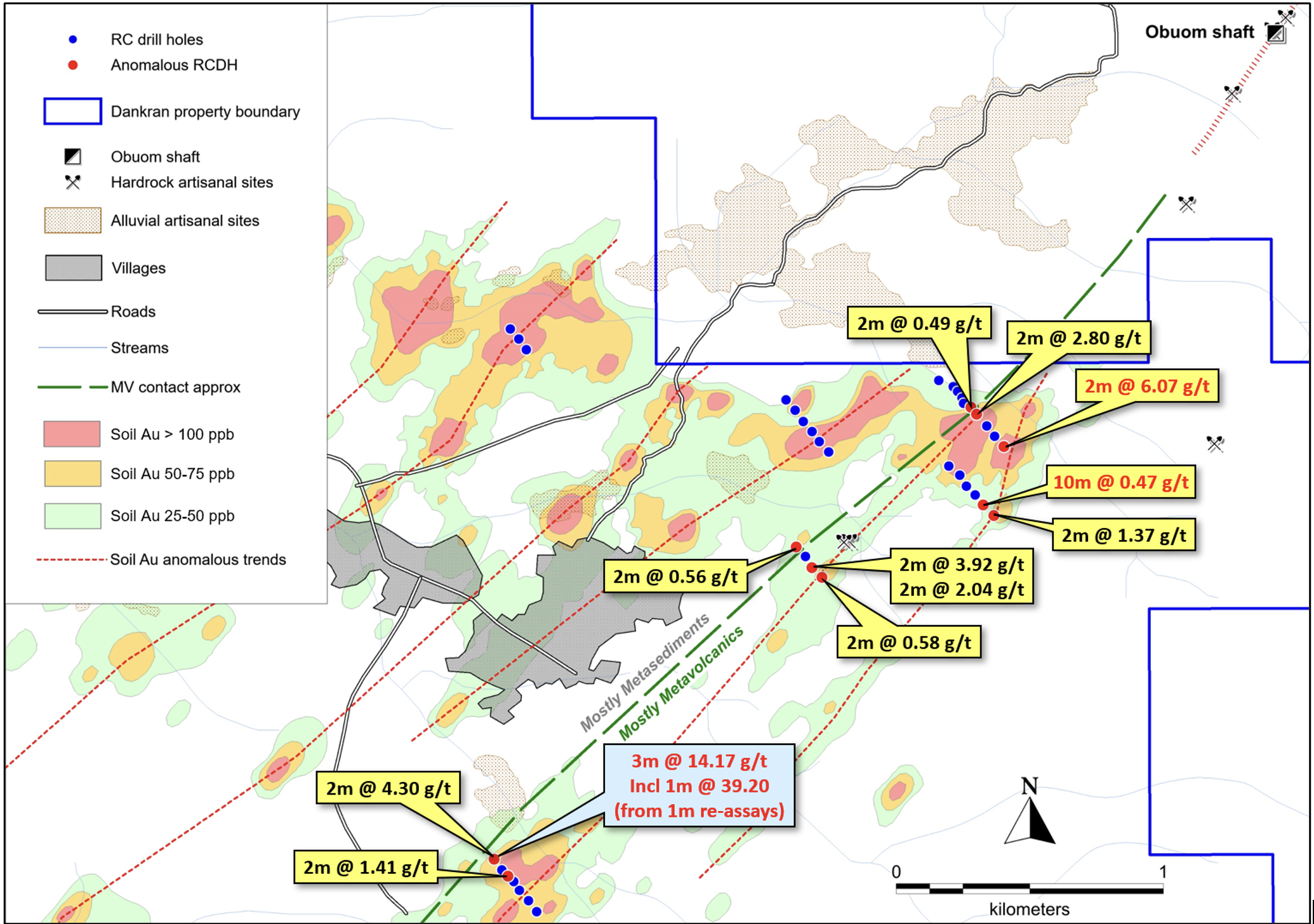

A maiden RC exploration drilling program consisting of 2,491 meters drilled in 36 RC holes was completed on the Dankran Project in June with the results reported by Pelangio on July 21, 2021. Sampling was conducted at 1 meter drill intervals and were composited to 2 meters for analysis by Fire Assay. The 1-meter samples from all significant drill intercepts plus "shoulder' samples were recently submitted to the Intertek Minerals Limited laboratory in Tarkwa Ghana for 50g Fire Assay for a check of the results and in order to provide a more accurate measure of gold mineralized widths. Results returned varied considerably from the initial 2-meter composited results with several mineralized intervals being diminished while several others were significantly improved in the 1-meter analyses. For example, hole DKRC036, which reported 4.30 g/t Au over 2 meters from the 2-meter composite samples returned a significantly higher grade 14.17 g/t Au over 3 meters (uncut) including 39.20 g/t Au over 1 meter from the recent 1-meter assay exercise. This suggests the possibility of a nugget component to the gold mineralization at Dankran, not unusual for high-grade vein-hosted gold mineralization, and also indicates the potential for higher grades than was returned from the initial 2-meter analyses of the Dankran drilling. Future drilling will consider 2 kg bottle roll (BLEG) analysis and/or screened metallics fire assay to check for and counter a gold nugget issue. Refer to Figure 2.

The Dankran RC drilling program has returned significant results over 2.7 kilometers of strike along a regional metavolcanic-metasedimentary contact 28 kilometers northeast of AngloGold Ashanti's giant Obuasi gold mine, with minimal and shallow drill testing performed to date. Further drilling will be planned to infill the limited drilling conducted as well as to investigate the potential at depth with several deeper core holes.

Figure 2: Dankran RC Drilling Results and Soil Geochemistry

CANADA

Dome West Project

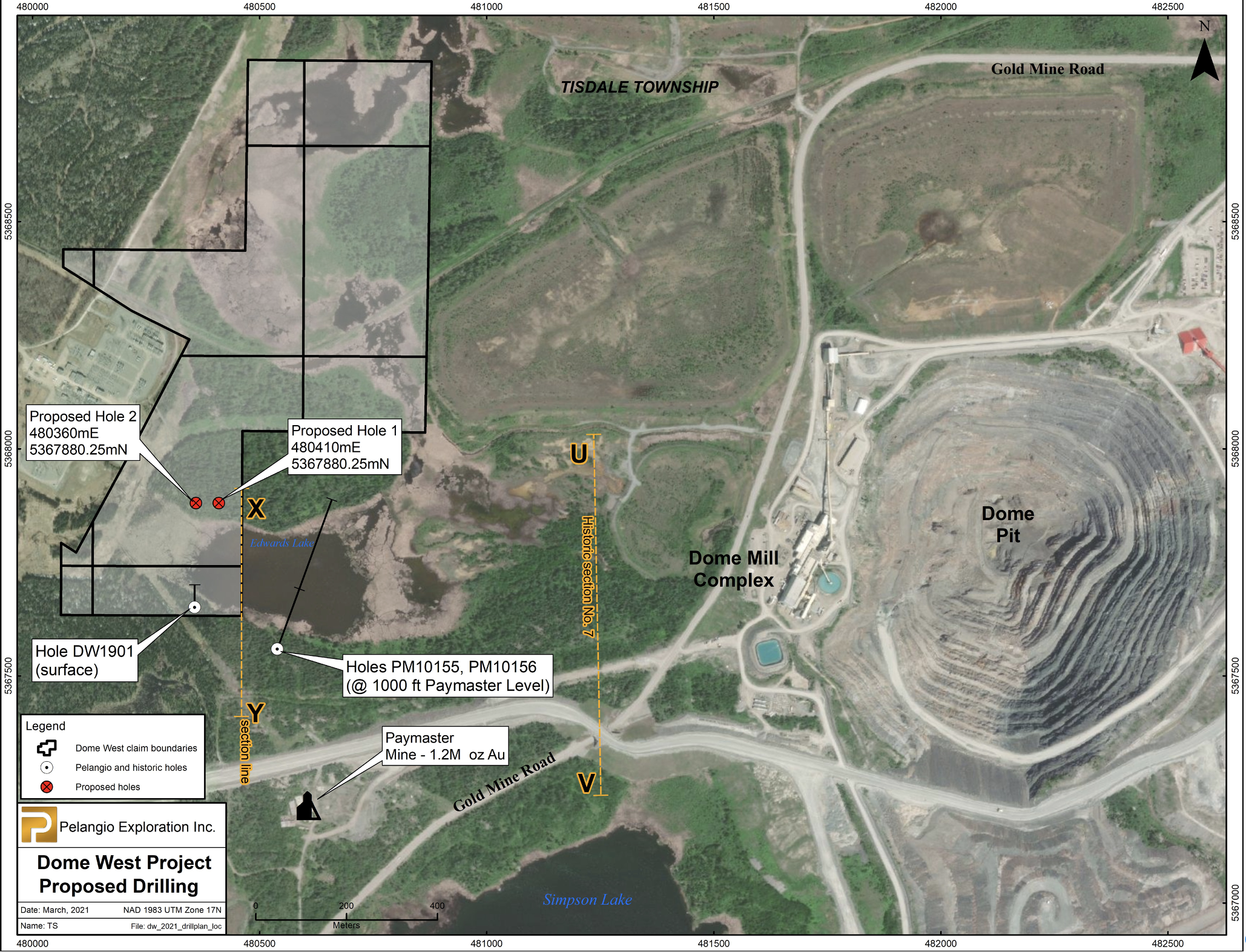

The Dome West Property is located in main portion of the Timmins mining camp, more specifically the property is comprised of 10 mining cells or 56 hectares of mineral rights located approximately 800 meters west of Newmont's Dome Mine and 450 meters northwest of the former Paymaster Mine (see Figure 3). A recent review compiled from historical level plan data from government reports and limited underground drill hole data from the adjoining former Paymaster Mine has allowed for the planning of the final proposed program. The following salient points from this review are as follows:

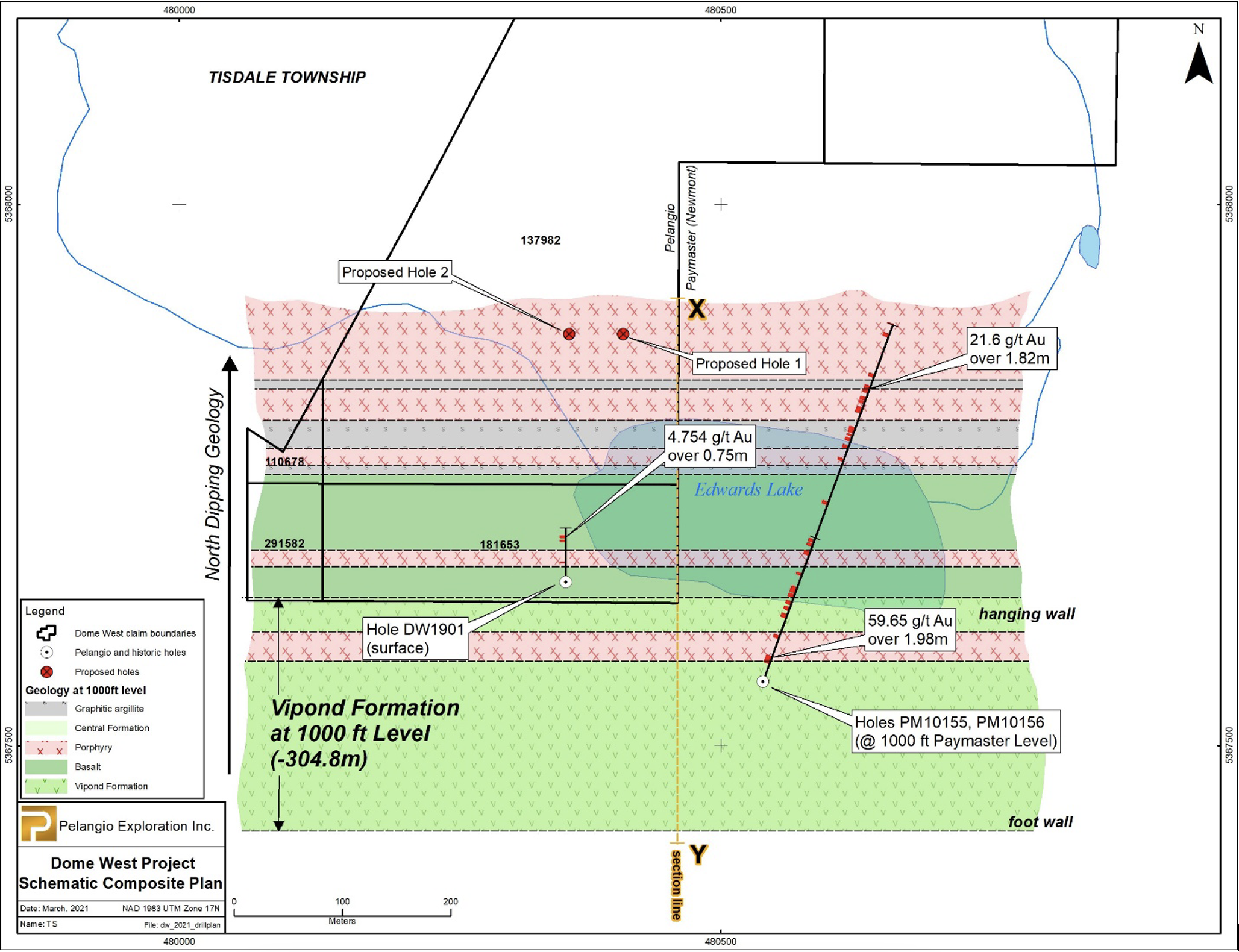

- Underground Paymaster Mine drill holes collared at the 1000-foot level (304.8 m) of the mine to the east of the Dome West property boundary (see Figures 3 and 4) demonstrated the existence of a series of gold bearing felsic porphyritic (FP) intrusive bodies and sills. The better gold values from these FP intrusives returned 21.6 g/t gold over 1.82 meter and 59.6 g/t gold over 1.98 meters. The FP intrusives also contained numerous anomalous intercepts ranging from 0.342 to 1.03 g/t gold. Due to the proximity of these intrusives to the Dome West property boundary, interpretation suggests that the strike and dip projections of the FP intrusives will cross the Dome West boundary. These FP intrusives are representative of very high-quality targets which are untested on the Dome West Property. It can be noted that substantial amounts of gold and copper ore have been mined from FP intrusives in the various mines in Timmins such as the former McIntyre Mine and Preston East Dome. (References: Historical Paymaster Drill Holes PM10155 & PM10156; and Gold 86 International Symposium Proceedings, A.J. Macdonald,1986)

- The review of composite level plan data from OGS Report 58 (Furguson, S.1968) and a recent Pelangio drill hole DW1901 demonstrated that the prospective Vipond stratigraphy which hosts a substantial portion of the ore at the Dome and Paymaster mines crosses the Dome West boundary from the Paymaster Mine at the 1000-foot level (304.8 m). (See Figure 4) This significant target horizon is virtually untested on the Dome West Property for 400 meters of strike length and no drilling below 300 meters, the depth at which the Vipond stratigraphy crosses the Dome West boundary line.

Figure 3: Area Location Map with Proposed Hole Locations

Pelangio has signed a drill contract and anticipates commencing a first phase drill program of 1200 meters in late October. This is the first test of both the feldspar porphyry target extension and the prospective Vipond stratigraphy in the history of the property.

Figure 4: Composite Level Plan

Gowan Property

The Gowan polymetallic property is a 4.3 square kilometer property located in Gowan Township, 27 kilometers ("km") northeast of the City of Timmins, Ontario and approximately 16 km due east of Glencore's Kidd Mine Site. The property is prospective for both copper-zinc-VMS deposits with associated precious metals, and nickel-copper-sulphide deposits.

The northeastern portion of the Gowan property is underlain by a prospective felsic volcanic package of rocks. Limited exploration efforts in the early to mid 1970's focused on evaluating the northern portion of the property for a Kidd style copper-zinc volcanogenic massive sulphide ("VMS") deposit. These early exploration programs were successful in demonstrating the potential for this type of mineralization. The highlight of these early exploration efforts was a broad semi-massive sulphide intercept grading 0.32% Cu and 0.35 oz/ton Ag over 36 feet. A shorter interval within this broad section returned 0.66% Cu and 0.31 oz/ton Ag over 12.5 feet including an interval of 0.95% Cu and 0.20 oz/ton Ag across 3 feet. Also of note is a bedrock sample from the bottom of a reverse circulation (RC) drill hole returned 2.26% Cu and 0.11 oz/ton Au . Very limited follow up was conducted on the massive sulphide intercepts and no drill follow up was completed on the copper gold occurrence detected in the bottom of the RC hole. The southern portion of the property is interpreted to be underlain by ultramafic volcanics from limited drilling and magnetic data; this area of the property is thought to be a prospective for nickel-copper sulphides. (Reference: Alamo Petroleum Assessment File, R.S. Middleton P.Eng. 1975)

In late March of 2021, Pelangio received preliminary results from an airborne VTEM Plus electromagnetic survey and magnetic survey. The survey outlined a large (1 km by 1.5 km) moderate VTEM response on the flank of a large magnetic anomaly (see Figure 5). In October of 2021, Pelangio completed an induced polarization survey over the central portion of anomaly to define priority drill targets within the broad anomaly. The field data has just been received and processing of the data and interpretation is under way. A drill program for this project is fully funded and will be initiated after a review of the data.

Figure 5: Gowan VTEM Response and Compilation Map

Qualified Persons

Mr. Kevin Thomson, P.Geo. (Ontario, #0191), is a qualified person within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Thomson approved the technical data disclosed in the Ghana section of this release.

Mr. Kevin Filo, P.Geo. (Ontario, #0221), is a qualified person within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Filo approved the technical data disclosed in the Canada section of this release.

About Pelangio

Pelangio acquires and explores world-class land packages on strategic gold belts in Ghana, West Africa and Canada. In Ghana, the Company is exploring its two 100% owned camp-sized properties: the 100 km 2 Manfo property, the site of seven near-surface gold discoveries, and the 284 km 2 Obuasi property, located four km on strike and adjacent to AngloGold Ashanti's prolific high-grade Obuasi Mine, as well as its Dankran property located adjacent to its Obuasi property. In Canada, the Company is currently focused in Ontario on its Grenfell property, located 10 km from Kirkland Lake, at its Dome West property, situated some 800 meters from the Dome Mine in Timmins and is advancing its Hailstone property in Saskatchewan. See www.pelangio.com for further detail.

For additional information, please visit our website at www.pelangio.com, or contact:

Ingrid Hibbard, President and CEO

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email: info@pelangio.com

Forward Looking Statements

Certain statements herein may contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Forward-looking statements or information appear in a number of places and can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate" or "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements and information include statements regarding the Company's strategy of acquiring large land packages in areas of sizeable gold mineralization, and the Company's ability to complete the planned exploration programs. With respect to forward-looking statements and information contained herein, we have made numerous assumptions, including assumptions about the state of the equity markets. Such forward-looking statements and information are subject to risks, uncertainties and other factors which may cause the Company's actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks include the changes in equity markets, share price volatility, volatility of global and local economic climate, gold price volatility, political developments in Ghana, and Canada, increases in costs, exchange rate fluctuations, speculative nature of gold exploration, including the risk that favourable exploration results may not be obtained, delays due to COVID-19 safety protocols, and other risks involved in the gold exploration industry. See the Company's annual and quarterly financial statements and management's discussion and analysis for additional information on risks and uncertainties relating to the forward-looking statement and information. There can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward- looking statements or information. We undertake no obligation to reissue or update any forward-looking statements or information except as required by law. All forward-looking statements and information herein are qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Pelangio Exploration Inc.

View source version on accesswire.com:

https://www.accesswire.com/667829/Pelangio-Exploration-Provides-Update-On-Exploration-Activities-in-Ghana-and-Canada