Toronto, Ontario--(Newsfile Corp. - October 22, 2021) - Marret Asset Management Inc. is pleased to announce that two of their funds have received a total of three awards at the 2021 Canadian Hedge Fund Awards held on October 19, 2021.

The Annual Canadian Hedge Fund Awards, organized by Alternative IQ, help investors identify the best performing hedge funds by recognizing winners in five performance measures within specific hedge fund categories. The awards are based solely on quantitative performance data to June 30th, with Fundata Canada collecting and tabulating the data to determine the winners.

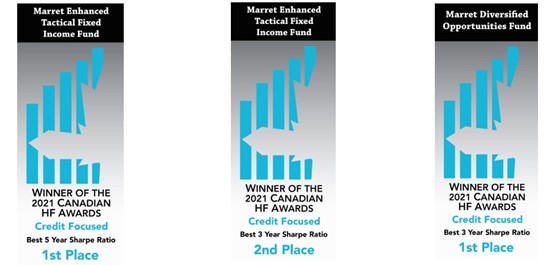

In the Credit Focused category, Marret's Enhanced Tactical Fixed Income Fund was awarded 1st place in 5-year Sharpe ratio and 2nd place in 3-year Sharpe ratio. Marret Diversified Opportunities Fund was awarded 1st place in 3-year Sharpe ratio. This follows on last year's 5 awards received by Marret Enhanced Tactical Fixed Income, Marret Investment Grade Hedged Strategies Fund, and Marret Diversified Opportunities Fund.

| 2021 Canadian Hedge Fund Awards | Credit Focused Category | |

| Marret Enhanced Tactical Fixed Income Fund | 1st place 5-year Sharp ratio 2nd place 3-year Sharpe |

| Marret Diversified Opportunities Fund[1] | 1st place 3-year Sharpe ratio |

"These awards reflect the dedication of our staff to our goals. What is really important to us at Marret is trying to achieve the best risk-adjusted returns over the long term, and receiving these awards is very much in line with this objective," said Paul Sandhu, President and CEO of Marret Asset Management Inc.

Image 1

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7474/100474_marret2_550.jpg

Marret Asset Management Inc. is a specialist fixed income manager that utilizes dynamic investment processes which aim to deliver favorable risk return outcomes across its strategies. Founded in 2001, the firm is led by Paul Sandhu, who has over 30 years of domestic and international fixed-income experience. Marret offers a full spectrum of corporate credit investing strategies covering government securities, investment grade, high yield, short term cash alternatives, and opportunistic fixed income strategies for both core and alternative allocations. In 2013, Marret Became a 65% owned subsidiary of CI Financial Corporation.

Mark Culver

President, Marret Private Wealth

E: mculver@marret.com | T: (514) 224-7795

Roberto Katigbak

Institutional Strategist, Head of Sales & Marketing

E: rkatigbak@marret.com | T: (514) 868-2191

Important Disclaimers

Past Performance:

Investment funds are not guaranteed. Their values change frequently, and past performance may not be repeated.

The Sharpe Ratio is a risk adjusted return measure. It is calculated by using standard deviation and excess return to determine reward per unit of risk. The higher the Sharpe Ratio, the better the portfolio's historical risk adjusted performance.

The rates of return in the Sharpe Ratio are the historical annual compound total returns net of fees including changes in security value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

Standard Deviation is widely used to measure risk in terms of the volatility of returns. It represents the historical level of volatility in returns over set periods. A lower standard deviation means the returns have historically been less volatile and vice versa. Historical volatility may not be indicative of future volatility.

Eligibility Of Award:

The Marret Enhanced Tactical Fixed Income Fund, the Marret Investment Grade Hedged Strategies Fund, and the Marret Diversified Opportunities Fund represent all Marret Funds which would have been under consideration for these awards. For further information please visit the Alternative IQ website at http://alternativeiq.com/canadian-hedge-fund-awards/categories/.

General Disclaimer:

This information is being provided to you solely for your information. The information does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in the Funds, and is not to be considered as a recommendation by the Fund or Marret Asset Management Inc. that any person make an investment in the Fund. An investment in units of the Fund is speculative and involves a number of risks that should be considered by a prospective investor. Investors should consult their own professional advisor for specific investment advice tailored to their needs and based on the latest available information. Nothing in this document is or should be relied upon as a promise or representation as to the future.

Marret Asset Management Inc. is a partly owned subsidiary of CI Financial Corp. and an affiliate of CI Investments Inc.

Published 10/19/2021.

[1] Effective August 6, 2021, Marret Diversified Opportunities Fund was renamed CI Alternative Diversified Opportunities Fund and is now publicly available as an alternatives mutual fund offering mutual fund series units as well as ETF C$ Series (CMDO) and ETF US$ Series (CMDO.U) units.

Not for distribution to U.S. news wire services or dissemination in the United States.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/100474