TORONTO, ON / ACCESSWIRE / November 9, 2021 / Talisker Resources Ltd. ("Talisker" or the "Company") (TSX:TSK) (OTCQX:TSKFF) is pleased to announce high-grade results from the brownfields BRX Project in drill hole SB-2021-068 highlighted by 407 g/t Au over 0.5 metre within 90.71 g/t Au over 2.25 metres at its 100% owned flagship Bralorne Gold Project.

Talisker is also pleased to announce that it has increased the number of drills from five to seven including one RC drill focused on infill drilling at the Pioneer zone.

Key Points:

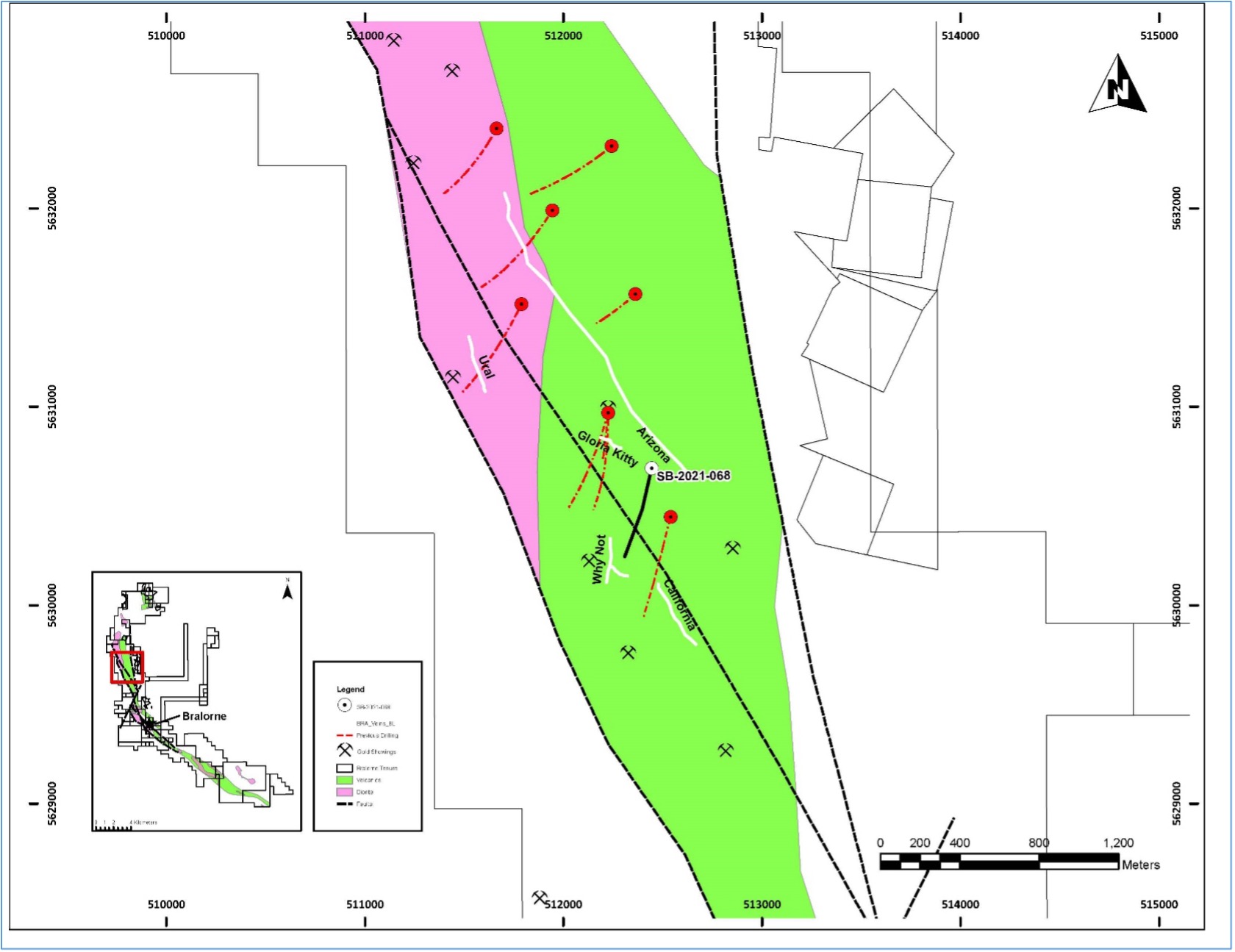

Hole SB-2021-068 intersected high-grade mineralization on the brownfields BRX Project 5.5 kilometres northwest of the historic Bralorne Mine.

Successful intersection of a new vein at the BRX Project highlighted by 407 g/t Au over 0.5m within 90.71 g/t Au over 2.25m.

A broader zone of lower grade mineralization around the Why Not vein intercepted between 184.75 and 236.60 metres grading 0.44 g/t Au over 51.85m.

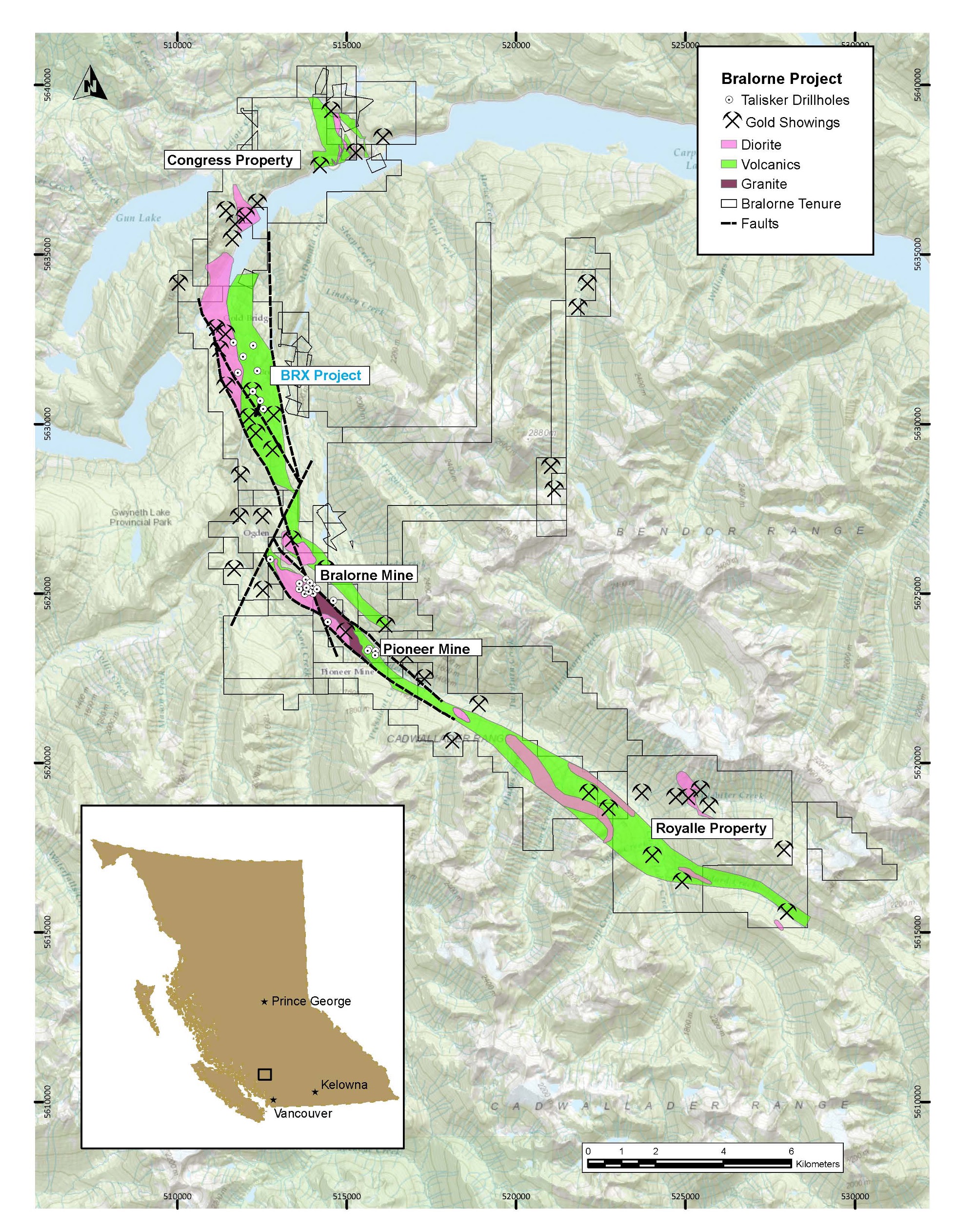

The BRX Project is Talisker's first brownfields drill program along the 33 kilometre Bralorne trend. Historically, 10 veins have been defined on the BRX property. The most extensively developed vein, the California Vein, was mined to a depth of 600 metres and is described as a 2 metre wide quartz-carbonate vein very similar in nature to the classical Bralorne crack and seal orogenic veins. Historic drilling at the BRX Project is highlighted by 5.65 g/t Au over 5.39m. Limited modern exploration has been conducted on the BRX Project.

Terry Harbort, Talisker's President and CEO, stated, "We are very pleased with our first high-grade brownfields results for the Bralorne trend. These encouraging results confirm the district nature of Bralorne and the significant upside potential outside of our current resource drill-out area."

The Bralorne Gold Project has a total of 47 gold showings over 33 kilometres. Talisker plans to expand its brownfield exploration in 2022 to focus on the Congress Project and Royalle Project.

The Congress Project sits 16 kilometres north of the historic Bralorne Mine and consists of three defined veins, mined to a depth of 200 metres. Several highly prospective exploration targets are present on the ground including the Lou zone with historic drilling intersecting zones ranging from 1.4 to 4 metres with grades between 5 and 11 g/t Au. Eight separate vein zones have been identified away from the Congress and Lou zones. A non-compliant resource consists of 46,151 ounces in the indicated and 148,091 ounces in the inferred categories. The Company notes that a qualified person has not verified the data disclosed in respect of the property, including sampling, analytical, and test data underlying this information.

The Royalle Project sits directly south of the historic Bralorne-Pioneer Mine along strike of the Cadwaller Break and hosts eight exploration targets including mesothermal gold and silver veins and skarn style mineralization. The main target is the Piebiter zone with historic adit sampling returning gold grades of 4.3 g/t over 21 metres and selective grab samples of up to 227 g/t Au. The Chopper silver vein has been delineated for 2,400 metres and with selective grab samples up to 1,585 g/t Ag. The Company notes that these selected samples are not necessarily representative of the mineralization hosted on the property and limited drilling has been completed on the property. A qualified person has not verified the data disclosed in respect of the Property, including sampling, analytical, and test data underlying this information.

Seven diamond drill rigs are currently drilling at the Bralorne Gold Project. A total of 73,321 metres consisting of 135 holes of a planned and fully funded 100,000 metres drill program has been drilled at the project this year with a total of 96,027 metres (171 holes) since Talisker initiated drilling at the project in February 2020. 32 holes consisting of 14,611 samples are currently at the assay laboratory and are expected to be received by the Company shortly.

SB-2021-068 Hole Description:

Complete results have been received for this hole.

Hole targeted the down-dip extension of veins developed in the Why Not mine and the large untested prospective block proximal to the Cadwaller Break.

Intersected mafic volcanics cross-cut by a suite of intermediate to mafic dikes similar to those observed at the Bralorne Gold Project from surface down to 560.0m.

Why Not Vein intersected as a broad mineralized zone of quartz-carbonate veining with strong silica-sericite alteration from 184.75 to 236.6m.

New Vein intersected with coarse visible gold hosted in a quartz-carbonate vein with banded sulphide septae, 2% arsenopyrite and pyrite mineralization and strong silica-sericite-mariposite alteration halos from 382.70 to 384.95m.

This gold-bearing New Vein discovery in the BRX Block is considered analogous to the classic Bralorne crack-seal quartz-carbonate veins.

Table 1: Bralorne Gold Project - Drill Hole SB-2021-068 | |||||||

|---|---|---|---|---|---|---|---|

Diamond Drill Hole Name | From (m) | To (m) | Interval (m) | Au (g/t) | Zone | Method Reported | |

| SB-2021-068 | 184.75 | 185.25 | 0.5 | 0.42 | BRX Bulk Zone | Au-AA26 | |

| SB-2021-068 | 185.25 | 186 | 0.75 | 0.26 | Au-AA26 | ||

| SB-2021-068 | 186 | 187 | 1 | 0.10 | Au-AA26 | ||

| SB-2021-068 | 187 | 188 | 1 | 0.10 | Au-AA26 | ||

| SB-2021-068 | 188 | 189 | 1 | 0.11 | Au-AA26 | ||

| SB-2021-068 | 189 | 189.6 | 0.6 | 0.15 | Au-AA26 | ||

| SB-2021-068 | 189.6 | 191 | 1.4 | 0.08 | Au-AA26 | ||

| SB-2021-068 | 191 | 192.5 | 1.5 | 0.28 | Au-AA26 | ||

| SB-2021-068 | 192.5 | 194 | 1.5 | 0.44 | Au-AA26 | ||

| SB-2021-068 | 194 | 195.5 | 1.5 | 0.28 | Au-AA26 | ||

| SB-2021-068 | 195.5 | 197 | 1.5 | 0.39 | Au-AA26 | ||

| SB-2021-068 | 197 | 198.5 | 1.5 | 0.27 | Au-AA26 | ||

| SB-2021-068 | 198.5 | 200 | 1.5 | 0.34 | Au-AA26 | ||

| SB-2021-068 | 200 | 200.8 | 0.8 | 0.43 | Au-AA26 | ||

| SB-2021-068 | 200.8 | 201.3 | 0.5 | 0.46 | Au-AA26 | ||

| SB-2021-068 | 201.3 | 202.5 | 1.2 | 0.24 | Au-AA26 | ||

| SB-2021-068 | 202.5 | 204 | 1.5 | 0.23 | Au-AA26 | ||

| SB-2021-068 | 204 | 204.7 | 0.7 | 0.15 | Au-AA26 | ||

| SB-2021-068 | 204.7 | 205.5 | 0.8 | 0.10 | Au-AA26 | ||

| SB-2021-068 | 205.5 | 206 | 0.5 | 0.15 | Au-AA26 | ||

| SB-2021-068 | 206 | 206.75 | 0.75 | 1.26 | Au-AA26 | ||

| SB-2021-068 | 206.75 | 207.25 | 0.5 | 0.21 | Au-AA26 | ||

| SB-2021-068 | 207.25 | 207.8 | 0.55 | 0.06 | Au-AA26 | ||

| SB-2021-068 | 207.8 | 208.3 | 0.5 | 0.02 | Au-AA26 | ||

| SB-2021-068 | 208.3 | 208.8 | 0.5 | 0.05 | Au-AA26 | ||

| SB-2021-068 | 208.8 | 209.3 | 0.5 | 0.04 | Au-AA26 | ||

| SB-2021-068 | 209.3 | 209.8 | 0.5 | 0.10 | Au-AA26 | ||

| SB-2021-068 | 209.8 | 210.3 | 0.5 | 2.91 | Au-AA26 | ||

| SB-2021-068 | 210.3 | 211 | 0.7 | 0.79 | Au-AA26 | ||

| SB-2021-068 | 211 | 211.5 | 0.5 | 0.18 | Au-AA26 | ||

| SB-2021-068 | 211.5 | 213 | 1.5 | 0.02 | Au-AA26 | ||

| SB-2021-068 | 213 | 214 | 1 | 0.01 | Au-AA26 | ||

| SB-2021-068 | 214 | 215 | 1 | 0.19 | Au-AA26 | ||

| SB-2021-068 | 215 | 216 | 1 | 0.32 | Au-AA26 | ||

| SB-2021-068 | 216 | 217 | 1 | 0.15 | Au-AA26 | ||

| SB-2021-068 | 217 | 218 | 1 | 0.02 | Au-AA26 | ||

| SB-2021-068 | 218 | 218.5 | 0.5 | 2.33 | BRX Bulk Zone | Au-AA26 | |

| SB-2021-068 | 218.5 | 219 | 0.5 | 0.01 | Au-AA26 | ||

| SB-2021-068 | 219 | 220 | 1 | 0.01 | Au-AA26 | ||

| SB-2021-068 | 220 | 221 | 1 | 0.05 | Au-AA26 | ||

| SB-2021-068 | 221 | 222 | 1 | 0.95 | Au-AA26 | ||

| SB-2021-068 | 222 | 222.8 | 0.8 | 2.27 | Au-AA26 | ||

| SB-2021-068 | 222.8 | 223.7 | 0.9 | 2.16 | Au-AA26 | ||

| SB-2021-068 | 223.7 | 224.6 | 0.9 | 1.80 | Au-AA26 | ||

| SB-2021-068 | 224.6 | 226 | 1.4 | 0.02 | Au-AA26 | ||

| SB-2021-068 | 226 | 226.55 | 0.55 | 0.02 | Au-AA26 | ||

| SB-2021-068 | 226.55 | 227.05 | 0.5 | 0.42 | Au-AA26 | ||

| SB-2021-068 | 227.05 | 227.75 | 0.7 | 0.19 | Au-AA26 | ||

| SB-2021-068 | 227.75 | 228.25 | 0.5 | 0.64 | Au-AA26 | ||

| SB-2021-068 | 228.25 | 229.25 | 1 | 0.28 | Au-AA26 | ||

| SB-2021-068 | 229.25 | 230.1 | 0.85 | 0.42 | Au-AA26 | ||

| SB-2021-068 | 230.1 | 231.1 | 1 | 1.91 | Au-AA26 | ||

| SB-2021-068 | 231.1 | 232.15 | 1.05 | 0.02 | Au-AA26 | ||

| SB-2021-068 | 232.15 | 233 | 0.85 | 0.57 | Au-AA26 | ||

| SB-2021-068 | 233 | 233.55 | 0.55 | 0.50 | Au-AA26 | ||

| SB-2021-068 | 233.55 | 234.05 | 0.5 | 1.05 | Au-AA26 | ||

| SB-2021-068 | 234.05 | 234.9 | 0.85 | 0.35 | Au-AA26 | ||

| SB-2021-068 | 234.9 | 235.4 | 0.5 | 0.31 | Au-AA26 | ||

| SB-2021-068 | 235.4 | 236.1 | 0.7 | 0.75 | Au-AA26 | ||

| SB-2021-068 | 236.1 | 236.6 | 0.5 | 0.40 | Au-AA26 | ||

| SB-2021-068 | 382.7 | 383.2 | 0.5 | 407.0 | New Vein | Au-GRA22 | |

| SB-2021-068 | 383.2 | 383.7 | 0.5 | 0.07 | Au-AA26 | ||

| SB-2021-068 | 383.7 | 384.2 | 0.5 | 0.02 | Au-AA26 | ||

| SB-2021-068 | 384.2 | 384.95 | 0.75 | 0.30 | Au-AA26 | ||

| Notes: Diamond drill hole SB-2021-023 has collar orientation of Azimuth 234; Dip -45. True widths are estimated at 40 - 90% of intercept lengths and are based on oriented core measurements where available. Method Reported includes the most up to date information as of the date of this press release. | |||||||

Qualified Person

The technical information contained in this news release relating to the drill results at the Bralorne Gold Project has been approved by Leonardo de Souza (BSc, AusIMM (CP) Membership 224827), Talisker's Vice President, Exploration and Resource Development, who is a "qualified person" within the meaning of National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About Talisker Resources Ltd.

Talisker (taliskerresources.com) is a junior resource company involved in the exploration of gold projects in British Columbia, Canada. Talisker's projects include two advanced-stage projects, the Bralorne Gold Complex and the Ladner Gold Project, both advanced-stage projects with significant exploration potential from historical high-grade producing gold mines, as well as its Spences Bridge Project where the Company holds ~85% of the emerging Spences Bridge Gold Belt and several other early-stage Greenfields projects. With its properties comprising 296,983 hectares over 346 claims, three leases and 198 crown grant claims, Talisker is a dominant exploration player in south-central British Columbia. The Company is well funded to advance its aggressive systematic exploration program at its projects.

For further information, please contact:

Terry Harbort

President and CEO

Terry.harbort@taliskerresources.com

+1 416 361 2808

Sample Preparation and QAQC

Drill core at the Bralorne project is drilled in HQ to NQ size ranges (63.5mm and 47.6mm respectively). Drill core samples are minimum 50 cm and maximum 160 cm long along the core axis. Samples are focused on an interval of interest such as a vein or zone of mineralization. Shoulder samples bracket the interval of interest such that a total sampled core length of not less than 3m both above and below the interval of interest must be assigned. Sample QAQC measures of unmarked certified reference materials (CRMs), blanks, and duplicates are inserted into the sample sequence and make up 9% of the samples submitted to the lab for holes reported in this release. Sample preparation and analyses is carried out by ALS Global in North Vancouver, British Columbia, Canada and SGS Canada in Burnaby, British Columbia, Canada. Drill core sample preparation includes drying in an oven at a maximum temperature of 60°C, fine crushing of the sample to at least 70% passing less than 2 mm, sample splitting using a riffle splitter, and pulverizing a 250 g split to at least 85% passing 75 microns (ALS code PREP-31 / SGS code PRP89). Gold in diamond drill core is analysed by fire assay and atomic absorption spectroscopy (AAS) of a 50g sample (ALS code Au-AA26 / SGS code GO_FAA50V10), while multi-element chemistry is analysed by 4- Acid digestion of a 0.25 g sample split with detection by inductively coupled plasma mass spectrometer (ICP-MS) for 48 elements (Ag, Al, As, Ba, Be, Bi, Ca, Cd, Ce, Co, Cr, Cs, Cu, Fe, Ga, Ge, Hf, In, K, La, Li, Mg, Mn, Mo, Na, Nb, Ni, P, Pb, Rb, Re, S, Sb, Sc, Se, Sn, Sr, Ta, Te, Th, Ti, Tl, U, V, W, Y, Zn, Zr). Gold assay technique (ALS code Au-AA26 / SGS code FAA50V10) has an upper detection limit of 100 ppm. Any sample that produces an over-limit gold value via the gold assay technique is sent for gravimetric finish (ALS method Au-GRA22 / SGS method GO_FAG50V) which has an upper detection limit of 1,000 ppm Au. Samples, where visible gold was observed, are sent directly to screen metallics analysis and all samples that fire assay above 1 ppm Au are re-analysed with method (ALS code Au-SCR24 / SGS code - 6 - GO_FAS50M) which employs a 1kg pulp screened to 100 microns with assay of the entire oversize fraction and duplicate 50g assays on the undersize fraction. Where possible all samples initially sent to screen metallics processing will also be re-run through the fire assay with gravimetric finish provided there is enough material left for further processing.

Caution Regarding Forward-Looking Information

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on Talisker's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. Those assumptions and factors are based on information currently available to Talisker. Although such statements are based on reasonable assumptions of Talisker's management, there can be no assurance that any conclusions or forecasts will prove to be accurate.

While Talisker considers these statements to be reasonable based on information currently available, they may prove to be incorrect. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include market risks and the demand for securities of the Company, risks inherent in the exploration and development of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined, risks relating to variations in grade or recovery rates, risks relating to changes in mineral prices and the worldwide demand for and supply of minerals, risks related to increased competition and current global financial conditions and the COVID-19 pandemic, access and supply risks, reliance on key personnel, operational risks, and regulatory risks, including risks relating to the acquisition of the necessary licenses and permits, financing, capitalization and liquidity risks.

The forward-looking information contained in this news release is made as of the date hereof, and Talisker is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

Figure 1: Location of the BRX Project within the Bralorne Gold Project.

Figure 2: SB-2021-068 drill hole location with the BRX Project.

SOURCE: Talisker Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/671816/Talisker-Intercepts-High-Grade-Gold-at-BRX-Brownfields-Drill-Program-North-of-Bralorne-and-Increases-to-Seven-Drill-Rigs