VANCOUVER, BC / ACCESSWIRE / November 9, 2021 / Lucky Minerals Inc. (TSXV:LKY)(OTC PINK:LKMNF)(FRA:LKY) ("Lucky" or the "Company") is pleased to announce it has received sample assay results from its ongoing work at the Wayka epithermal gold discovery at its 100% owned Fortuna Property ("Fortuna") in southern Ecuador.

This news release reflects the results of the north-south oriented trenches T-5 and T-6. These two trenches when combined into one trench has a total length of more than 70 metres.

Combined Trenches T-5 and T-6 average 1.67 g/t gold over 61 metres

Trenching highlights

One-meter systematic channel samples taken along the trench resulted in 75 one-metre samples with an average weight of 8 kilograms. These samples were taken with a rock saw to improve the quality of the samples.

Lucky Minerals' Country Manager, Santiago Yepez

at Trench T-6 showing continuous channel sampling done with a rock saw;

on the left are early exploration panel samples.

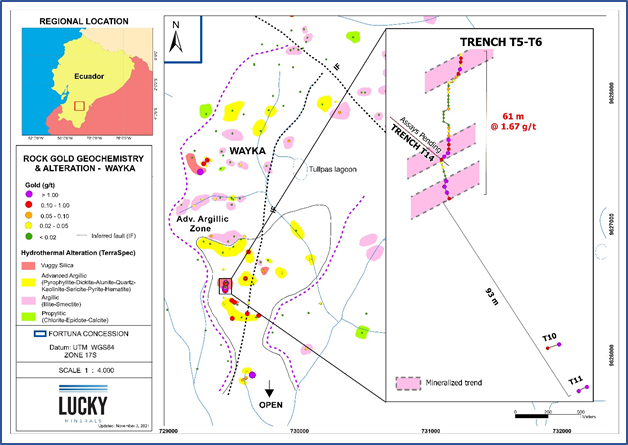

The combination of trenches T-5 and T-6 in a north-south direction shows three distinct strongly silicified structurally controlled mineralized trends, which are interpreted to be feeder zones. See map below.

Trench Location Map

The northernmost trend (feeder) averages 0.46 g/t gold across 9 metres and mineralization is interpreted to be structurally controlled along a trend that is strongly silicified and hosted in meta-granites. This mineralized trend is interpreted to strike east northeast.

The middle-mineralized trend (feeder) averages 6.68 g/t gold across 12 metres and mineralization is also interpreted to be structurally controlled along a trend that is hosted in strongly silicified meta-granites. At present this mineralized trend is interpreted to strike east northeast and appears to be parallel to the northernmost mineralized trend.

The southernmost mineralized trend averages 2.40 g/t gold across 7 metres and mineralization is interpreted also to be structurally controlled. This mineralized trend appears to also strike east northeast, and mineralization remains open to the south.

François Perron President and CEO states "By extending trenches T-5 and T-6 we have established that some mineralization at Wayka appears to be hosted in parallel mineralized trends or feeders. What is even more exciting is that these feeders are fairly high grade and are in proximity to each other. Establishing mineralization over 61 metres at surface is a significant step in advancing Wayka. Adding to this exciting development is the fact that we have identified further mineralization in trenches T-10 and T-11 which are only 70 metres from the area that we are reporting on today. Although these two trenches have yet to intersect their associated feeders, the potential for discovering additional parallel feeders is enticing. The team continues to advance trenching and I wish to thank them for their extraordinary hard work. In addition to the current trenching, we have mobilized crews to complete a detailed soil sampling program which will be combined with geophysics in order to refine our targeting and drilling which is expected in the coming months."

Fortuna - Next Steps

Wayka

Exploration teams are focused on trenching, soil sampling and geophysical survey This work will be followed by a detailed compilation of all geologic data which will subsequently lead to scout drilling in the coming months.

Trench T-5 & T-6 Sample Intervals &Assays

QA/QC Protocols

All exploration work is completed following QA/QC protocols and include the insertion of a coarse blank, a standard and duplicate sample on every batch of 25 samples.

Samples are being submitted approximately every two weeks to ALS Chemex Labs in Quito for preparation work, and the analytical work is completed at their lab facility in Lima, Peru. ALS Chemex is an ISO certified and accredited laboratory. Results will be released as they are received.

ON BEHALF OF THE BOARD

"François Perron"

President & Chief Executive Officer

About Lucky

Lucky is an exploration and development company targeting large-scale mineral systems in proven districts with the potential to host world class deposits. Lucky owns a 100% interest in the Fortuna Property.

The Company's Fortuna Project is comprised of twelve contiguous, 550 km2 (55,000 Hectares, or 136,000 Acres) exploration concessions. Fortuna is located in a highly prospective, yet underexplored, gold belt in southern Ecuador.

Covid-19 Safety Protocols

The company has put strict COVID protocols in place for all visitors, service providers and personnel arriving to and from field sites. All personnel are tested upon arriving and leaving and are again tested every two weeks. All personnel are following COVID protocols with permanent disinfection procedures in place and are following correspondent social distancing while being isolated from the surrounding communities.

Qualified Person

Victor Jaramillo, M.Sc.A., P.Geo., Lucky's Exploration Manager and a qualified person in accordance with National Instrument 43-101, is responsible for supervising the exploration program at the Fortuna Project for Lucky Minerals and has reviewed and approved the technical information contained in this news release.

Further information on Lucky can be found on the Company's website at www.luckyminerals.com and at www.sedar.com, or by contacting Francois Perron, President and CEO, by email at investors@luckyminerals.com or by telephone at (866) 924 6484.

Or by contacting:

Renmark Financial Communications Inc.

Daniel Gordon: dgordon@renmarkfinancial.com

Tel: (416) 644-2020 or (212) 812-7680

www.renmarkfinancial.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Adjacent Properties and Forward-Looking Information

This news release contains forward-looking statements relating to the future operations of the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the future plans and objectives of the Company are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Such factors include, but are not limited to: uncertainties related to exploration and development; the ability to raise sufficient capital to fund exploration and development; changes in economic conditions or financial markets; increases in input costs; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological or operational difficulties or inability to obtain permits encountered in connection with exploration activities; and labor relations matters. This list is not exhaustive of the factors that may affect the Company's forward-looking information. Important factors that could cause actual results to differ materially from the Company's expectations also include risks detailed from time to time in the filings made by the Company with securities regulators.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will not update or revise publicly any of the included forward-looking statements unless required by Canadian securities law.

SOURCE: Lucky Minerals Inc.

View source version on accesswire.com:

https://www.accesswire.com/671744/Systematic-Sampling-Along-Trenches-T-5-and-T-6-Averages-167-GT-Gold-Over-61-Metres-at-Wayka