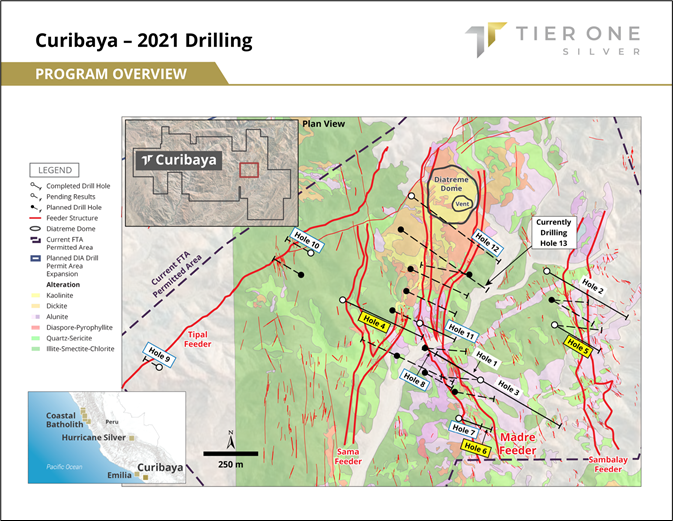

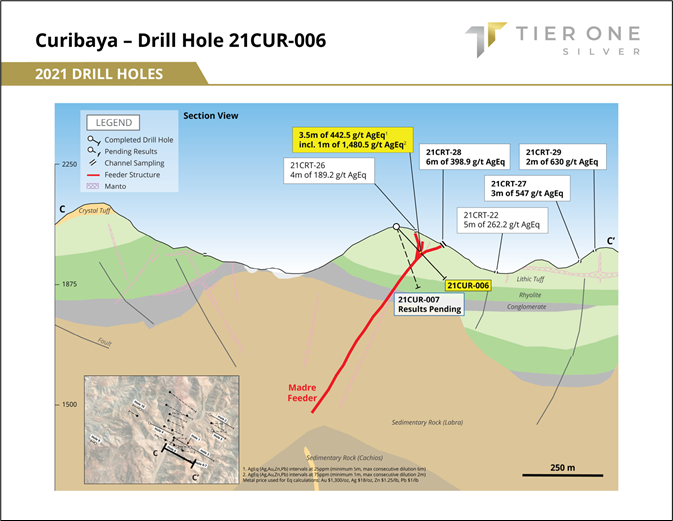

VANCOUVER, BC / ACCESSWIRE / November 18, 2021 / Tier One Silver (TSXV:TSLV, OTCQB:TSLVF) ("Tier One" or the "Company") is pleased to report results from drill holes 4 - 6 at the Curibaya project in southern Peru (Figure 1). Drill hole 6 targeted the Madre structure, which has emerged as the primary target structure on the project to-date, and intersected 1 metre (m) of 1,480.5 g/t silver equivalent (AgEq) within a broader interval of 3.5 m of 442.5 g/t AgEq at a drill depth of 107.5 m to 111 m (Figure 2). Tier One's technical team believes the result from hole 6 demonstrates the high-grade potential along the 1.4-kilometre (km) long Madre structure, as defined by mapping and remote sensing data. Currently, there are results from three drill holes along the Madre structure pending, including a first drill hole into the diatreme dome complex that the technical team believes is the potential source for precious metal mineralization across the property (Figure 1).

A Message from Peter Dembicki, President, CEO & Director:

"Hole 6 is the first plus-kilogram intercept at Curibaya on a feeder vein that may host the extensive high-grade silver on surface, which gives us the confidence that we are in the infancy of a new silver discovery. Drilling along structures that have yielded positive channel sample results is proving to be a sound strategy as the Company looks to realize the vast potential of the property indicated through high-grade silver mineralization on surface."

Drill Holes 4 - 5:

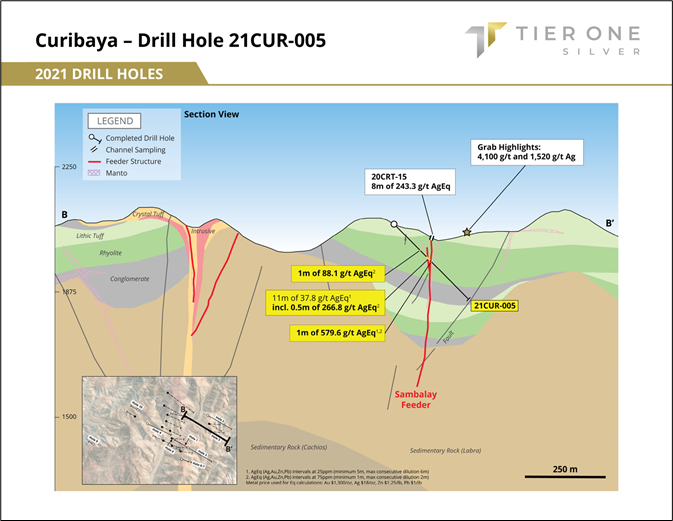

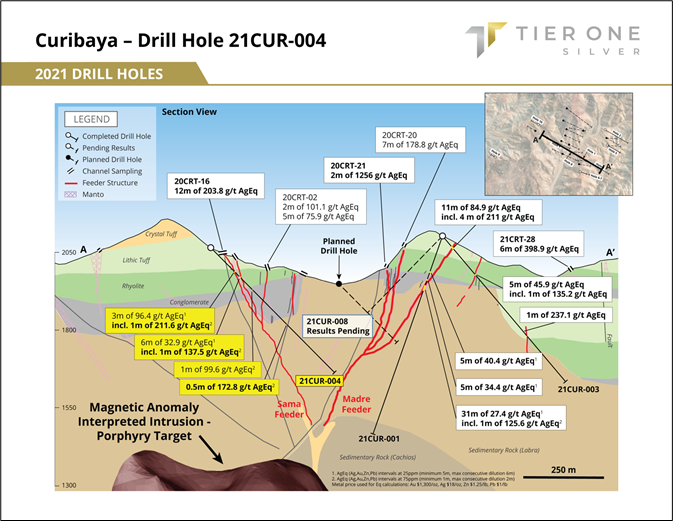

Drill holes 4 and 5 targeted the Sama and Sambalay structures, respectively, and both drill holes encountered significant silver mineralization in multiple parallel structures. Hole 5 is the second drill hole to test the 900 m long Sambalay structural corridor and intersected 1 m of 579.6 g/t AgEq, 0.5 m of 266.8 g/t AgEq, 1 m of 88.1 g/t AgEq and 11 m of 37.8 g/t AgEq (Figure 3). Hole 4 was the first drill hole to test the Sama structure and intersected 1 m of 211.6 g/t AgEq within a broader interval of 3 m of 96.4 g/t AgEq, 1m of 137.5 g/t AgEq, 1 m of 99.6 g/t AgEq and 0.5 m of 172.8 g/t AgEq (Figure 4). A summary of the results from drill holes 4 - 6 are provided below in Table 1.

Table 1: Summary of Significant Results from Drill Holes 4 - 6

Hole ID | From (m) | To (m) | Length (m) | AgEq (g/t) | Ag (g/t) | Au (g/t) | Zn % | Pb % | |

21CUR-004 | 1 | 105 | 108 | 3 | 96.4 | 78.4 | 0.24 | 0.005 | 0 |

Incl.2 | 105 | 106 | 1 | 211.6 | 175.0 | 0.50 | 0.005 | 0.01 | |

1 | 128 | 134 | 6 | 32.9 | 22.6 | 0.13 | 0.016 | 0 | |

Incl.2 | 133 | 134 | 1 | 137.5 | 93.5 | 0.60 | 0.010 | 0.005 | |

2 | 187 | 188 | 1 | 99.6 | 66.5 | 0.42 | 0.045 | 0.016 | |

2 | 336.5 | 337 | 0.5 | 172.8 | 23.3 | 0.05 | 2.450 | 0.766 | |

21CUR-005 | 2 | 114 | 115 | 1 | 88.1 | 81.2 | 0.08 | 0.014 | 0.013 |

1 | 143 | 154 | 11 | 37.8 | 29.5 | 0.08 | 0.046 | 0.01 | |

Incl.2 | 149 | 149.5 | 0.5 | 266.8 | 228.0 | 0.44 | 0.092 | 0.069 | |

1,2 | 161 | 162 | 1 | 579.6 | 446.0 | 1.83 | 0.026 | 0.01 | |

21CUR-006 | 1 | 107.5 | 111 | 3.5 | 442.5 | 418.7 | 0.12 | 0.184 | 0.16 |

Incl.2 | 108 | 109 | 1 | 1,480.5 | 1,431.0 | 0.39 | 0.182 | 0.343 | |

| |||||||||

Significance of Results and Program Update:

The results from drill holes 4 - 6 demonstrate that significant precious metal mineralization extends to depth below mineralization encountered in surface channel samples. In addition, hole 6 was the first drill hole to test the margin of the high chargeability anomaly that, in part, defines the Madre structural corridor. The positive correlation between high-grade mineralization in drill hole 6 and the margins of the chargeability anomaly further strengthens the Company's targeting efforts at depth.

To date, the Company has drilled a total of 12 holes into four of the five precious metal feeder structures for a total of 4,473 m, with results pending for six holes. The Company plans to drill an additional 1,000 m in three holes along the Madre structure, prior to a pause in drilling for the rainy season beginning in mid-December. The Company expects to resume drilling at Curibaya at the end of Q1 2022. In addition, a drill permit expansion is in progress to include the Cambaya structures, to the northeast of current drilling, which the Company plans to drill test in 2022.

A Message from Dave Smithson, SVP of Exploration:

"The positive results from hole 6 represent a major advancement in our understanding of the controls on high-grade mineralization within the project. The combination of alteration vectoring, targeting the margins of high chargeability anomalies and surface geochemical channel sampling is paying dividends with the drill. These results continue to support our view that Curibaya has the potential for a major discovery."

Figure 1: Illustrates the ongoing drill program, the location of the completed and planned holes and their proximity to interpreted feeder structures and the diatreme dome complex.

Figure 2: Illustrates the location and results from drill hole 6, as well as the location of drill hole 7, which also targets the Madre feeder and has results pending.

Figure 3: Illustrates the location and results from drill hole 5.

Figure 4: Illustrates the location and results from drill hole 4 as well as the location of drill hole 8, which also targets the Madre feeder and has results pending.

Michael Henrichsen (Chief Geologist), P.Geo is the QP who assumes responsibility for the technical contents of this press release.

ON BEHALF OF THE BOARD OF DIRECTORS OF TIER ONE SILVER INC.

Peter Dembicki

President, CEO and Director

For further information on Tier One Silver Inc., please contact Natasha Frakes, Vice President of Communications at (778) 729-0600 or info@tieronesilver.com.

About Tier One

Tier One Silver is an exploration company focused on creating value for shareholders and stakeholders through the discovery of world-class silver, gold and base metal deposits in Peru. The Company's management and technical teams have a strong track record in raising capital, discovery and monetization of exploration success. The Company's exploration assets in Peru include: Hurricane Silver, Emilia, Coastal Batholith, Corisur and the flagship project, Curibaya, which has commenced its first drill program. For more information, visit www.tieronesilver.com.

Curibaya Drilling

Analytical samples were taken by sawing HQ or NQ diameter core into equal halves on site and sent one of the halves to ALS Lab in Arequipa, Peru for preparation and then to Lima, Peru for analysis. All samples are assayed using 30 g nominal weight fire assay with atomic absorption finish (Au-AA25) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where MS61 results were greater or near 10,000 ppm Cu, 10,000 ppm Pb or 100 ppm Ag the assay were repeated with ore grade four acid digest method (Cu, Pb, Ag-OG62). Where OG62 results were greater or near 1,500 ppm Ag the assay were repeated with 30 g.

QA/QC programs for 2021 core samples using company and lab duplicates, standards and blanks indicate good accuracy and precision in a large majority of standards assayed.

Silver equivalent grades (AgEq) were calculated using silver price of US$18/oz, gold price of US$1,300/oz, zinc price of US$1.25/lb, and lead price of US$1.00/lb. Metallurgical recoveries were not applied to the silver equivalent calculation.

Intercepts were calculated with no less than 5 m of >= 25 g/t AgEq with maximum allowed consecutive dilution of 6 m.

True widths of mineralization are unknown based on current geometric understanding of the mineralized intervals.

Forward Looking Information and General Cautionary Language

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, "forward-looking statements") that relate to the Company's current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as "will likely result", "are expected to", "expects", "will continue", "is anticipated", "anticipates", "believes", "estimated", "intends", "plans", "forecast", "projection", "strategy", "objective" and "outlook") are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release. In particular and without limitation, this news release contains forward-looking statements regarding the Company's exploration plans.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Tier One Silver Inc.

View source version on accesswire.com:

https://www.accesswire.com/673563/Tier-One-Silver-Intersects-14805-gt-Silver-Equivalent-over-1-Metre-on-the-Madre-Structure-at-Curibaya