Asset managers need to better plan and prepare for expected ESG funds growth, according to Broadridge research

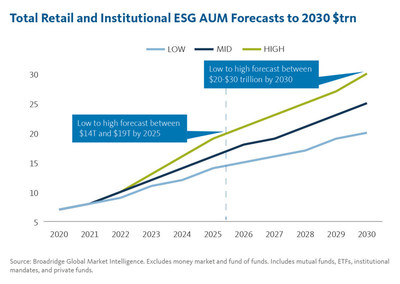

LONDON and NEW YORK, Dec. 2, 2021 /PRNewswire/ -- A new report from Broadridge Financial Solutions, Inc. (NYSE: BR), a global Fintech leader, reveals assets in dedicated environmental, social, and governance (ESG) mutual funds, ETFs, institutional mandates, and private funds are on track to grow from $8 trillion today to as much as $30 trillion by the end of this decade. Asset managers stand to win up to $9 trillion of net new flows, with expanding opportunities through thematic strategies, climate transition and net zero solutions, and investments offering measurable sustainability impacts.

Net flows into ESG mutual funds and ETFs have risen dramatically this year to $577 billion in the nine months through September 2021, far surpassing the full-year total of $355 billion for 2020. The center of gravity in ESG investing continues to evolve from value and risk considerations towards sustainability impacts, putting greater demands on asset managers to show evidence of the results achieved.

"ESG strategies accounted for just 11% of overall mutual fund and ETF assets but captured 30% of inflows during the twelve months through September 2021" says Jag Alexeyev, Head of ESG Insights at Broadridge Financial Solutions. "While growth remains strong, the complexities and costs of ESG implementation have risen, and fund selectors have begun to ask harder questions, In addition, greenwashing has emerged as a key reputational risk that firms must address. Improving a manager's sustainable investment capabilities, enhancing transparency, and amplifying communication of results can help establish credibility and strengthen client relationships."

ESG driving impact and other key findings from the report show:

- Among actively managed strategies, ESG drove more than 100% of flows in local European funds and 62% of flows in cross-border European and International markets.

- The EU's Sustainable Finance Disclosure Regulation (SFDR) has reshaped the business. In response to SFDR, firms identified more than 5,700 funds as Article 8 ESG or Article 9 sustainable investment products with combined assets of $4.1 trillion (€3.6 trillion) as of September 2021.

- Demand for thematic strategies has reinforced the ESG trend. Thematic equity funds captured $303 billion in net inflows worldwide in the twelve months through September 2021, ten times greater than the amount in 2019. Dedicated ESG products represented 65% of that total.

Visit this link to download Broadridge's ESG and Sustainable Investment Outlook Report.

Methodology

This report was conducted using Broadridge's Global Market Intelligence platform. Broadridge's proprietary Global Market Intelligence platform provides an integrated analytics solution for the asset management market tracking institutional and retail products globally. Broadridge provides insights into more than $100 trillion of tracked assets, covering every market in every region, and 80,000 globally tracked funds.

About Broadridge

Broadridge Financial Solutions (NYSE: BR), a global Fintech leader with $5 billion in revenues, provides the critical infrastructure that powers investing, corporate governance, and communications to enable better financial lives. We deliver technology-driven solutions that drive business transformation for banks, broker-dealers, asset and wealth managers and public companies. Broadridge's infrastructure serves as a global communications hub enabling corporate governance by linking thousands of public companies and mutual funds to tens of millions of individual and institutional investors around the world. Our technology and operations platforms underpin the daily trading of more than U.S. $9 trillion of equities, fixed income and other securities globally. A certified Great Place to Work, Broadridge is part of the S&P 500 Index, employing over 13,000 associates in 21 countries. For more information about us please visit broadridge.com.

Media Contacts:

Europe

Hannah Polson

Cognito

+44 (0) 7974244217

BroadridgeEMEA@cognitomedia.com

North America

Matthew Luongo

Prosek Partners

+1 646-818-9279

mluongo@prosek.com

Asia Pacific

Kainoa Blaisdell

Teneo

+65 6955 8874

ASIA-broadridge@teneostrategy.com

Photo - https://mma.prnewswire.com/media/1700475/Total_Retail_and_Institutional_ESG_AUM_Forecasts__2.jpg