VANCOUVER, BC / ACCESSWIRE / December 8, 2021 / GGL Resources Corp. (TSXV:GGL) ("GGL" or the "Company") is pleased to announce positive results from recent exploration at its Gold Point Project in the Walker Lane district of western Nevada. The results include promising intercepts from a maiden drill program that successfully targeted veins in and around the past-producing Great Western Mine as well as high-grade assays from new exposures in various parts of the project. These strong results prompted the Company to further consolidate and significantly expand its land holdings at the project.

Highlights of recent activities include:

- 2.22 g/t gold and 13.6 g/t silver over 12.19 m, including 5.17 g/t gold and 24.8 g/t silver over 4.57 m, hole GP-21-012;

- 2.40 g/t gold and 80 g/t silver over 9.15 m, including 3.99 g/t gold and 132 g/t silver over 4.57 m, hole GP-21-003;

- Numerous rock and chip samples from surface exposures and underground workings in various parts of the property, returning between 5 g/t gold and 37.3 g/t gold;

- The staking of 194 new mineral claims to cover undocumented and newly discovered veins on the flanks of the known vein complex;

- The purchase of a 100% interest in patented claims covering a major portion of the past-producing Grand Central vein system;

- Signing of additional purchase agreements, which collectively secure a 75% interest in patented claims that cover extensive historical workings, including another important past-producer, and provide access for exploration along strike of the Great Western and Orleans Mines; and,

- A substantial increase in GGL's land holdings at Gold Point from 4.49 km2 to 19.88 km2.

"GGL has undertaken a very aggressive acquisition program to capitalize on results that indicate a much larger target area than was seen by historical miners," states Doug Eaton, CEO and director of GGL. "We now see potential for multiple underground operations and, more importantly, have discovered broad zones of lower grade mineralization that historical workers would have ignored, which collectively suggest excellent potential for bulk-tonnage, open-pit production."

The Gold Point section of GGL's website contains comprehensive maps and figures showing the expanded property holdings and results of recent work programs.

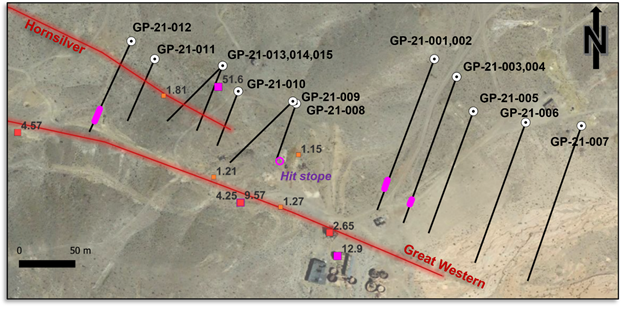

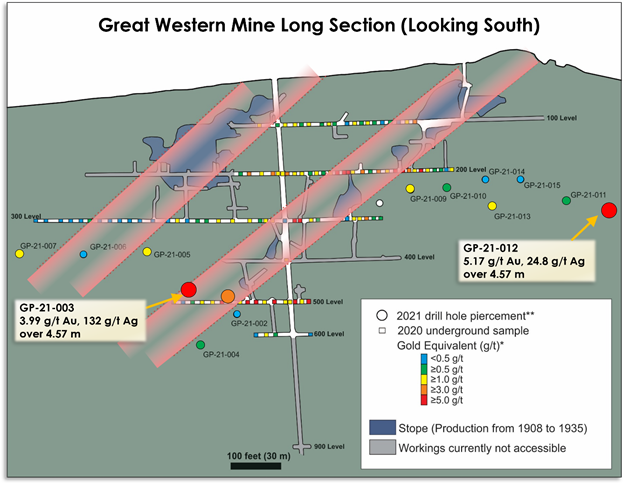

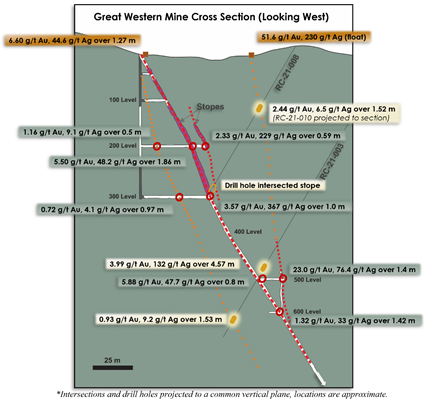

The maiden drill program was performed with a track-mounted reverse-circulation ("RC") rig and comprised 15 holes totalling 2,874 m. The holes are all located near, or directly along strike of underground workings at the Great Western Mine, which were rehabilitated and resampled earlier in 2021 (see Company news release dated April 6, 2021).

The drill program successfully achieved four objectives: 1) to confirm that ore shoots extend beyond mineralization mapped in the underground workings; 2) to determine whether mineralization is confined to discrete veins or extends into adjacent, fractured and altered wallrocks; 3) to explore for new ore shoots along strike of the underground workings; and 4) to search for additional veins that might parallel the known vein structure. Holes GP-21-001 and -003 intersected the targeted ore shoots where expected near the 500' level; Hole GP-21-008 encountered an unmapped stope where an ore shoot was expected near the 300' level; and Hole GP-21-012 discovered an impressive new ore shoot 125 m along strike to the west of the underground workings. All four of these holes intersected thick sections of mineralization in wallrocks directly adjacent to the targeted vein, and several of the holes cut new mineralized structures further into the hanging wall and/or footwall. The table below lists mineralized intercepts obtained from the RC drilling:

| HOLE | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | AuEQ (g/t)* |

| GP-21-001 | 85.35 | 86.87 | 1.52 | 0.73 | 36.1 | 1.25 |

| and | 163.07 | 173.74 | 10.67 | 0.78 | 16.3 | 1.01 |

| and | 188.98 | 196.60 | 7.62 | 0.19 | 1.2 | 0.21 |

| GP-21-002 | 150.88 | 152.40 | 1.52 | 0.47 | 2.6 | 0.51 |

| GP-21-003 | 152.40 | 161.55 | 9.15 | 2.40 | 80 | 3.54 |

| including | 153.93 | 158.50 | 4.57 | 3.99 | 132 | 5.88 |

| and | 182.88 | 185.93 | 3.05 | 0.20 | 4.2 | 0.26 |

| and | 198.12 | 202.69 | 4.57 | 0.24 | 2.8 | 0.28 |

| and | 210.31 | 216.41 | 6.10 | 0.36 | 4.4 | 0.42 |

| GP-21-004 | 179.83 | 184.41 | 4.57 | 0.26 | 21.4 | 0.57 |

| GP-21-005 | 128.02 | 143.26 | 15.24 | 0.21 | 24.8 | 0.76 |

| and | 179.83 | 184.41 | 4.57 | 0.30 | 2.5 | 0.34 |

| GP-21-007 | 135.64 | 138.69 | 3.05 | 0.20 | 63.4 | 1.11 |

| GP-21-008** | 94.49 | 106.68 | 12.19 | 0.41 | 8.5 | 0.53 |

| including | 105.16 | 106.68 | 1.52 | 1.06 | 18.8 | 1.33 |

| GP-21-009 | 48.79 | 51.82 | 3.05 | 0.59 | 26.6 | 0.97 |

| and | 94.49 | 109.73 | 15.24 | 0.36 | 10.3 | 0.51 |

| Including | 96.01 | 100.59 | 4.57 | 0.66 | 12.3 | 0.84 |

| GP-21-010 | 4.57 | 18.29 | 13.72 | 0.67 | 11.6 | 0.84 |

| including | 12.19 | 13.72 | 1.52 | 2.44 | 6.5 | 2.53 |

| and | 86.87 | 100.59 | 13.72 | 0.33 | 7.8 | 0.44 |

| including | 92.97 | 94.49 | 1.52 | 0.71 | 4.5 | 0.77 |

| GP-21-011 | 73.15 | 79.25 | 6.10 | 0.33 | 4.4 | 0.39 |

| GP-21-012 | 96.01 | 108.21 | 12.19 | 2.22 | 13.6 | 2.41 |

| including | 99.06 | 103.63 | 4.57 | 5.17 | 24.8 | 5.52 |

| and | 185.93 | 190.50 | 4.57 | 0.36 | 1.54 | 0.38 |

| GP-21-013 | 24.38 | 28.96 | 4.57 | 0.59 | 11.4 | 0.75 |

| and | 105.16 | 109.73 | 4.57 | 0.43 | 32.4 | 0.89 |

*Gold Equivalent was calculated using a 70:1 silver to gold ratio based on current metal prices and assume 100% recovery of both metals.

**Hole GP-21-008 intersected a stope below the 200' level and was terminated early. The intersections shown in the table above are located in the hanging wall of this stope.

*** Holes GP-21-006, GP-21-014, and GP-21-015 do not contain any significant intersections.

Encouraging gold results were also obtained from surface work conducted earlier this year. These results, combined with the promising drill results, prompted the Company to stake additional claims on the periphery of the property and to acquire interests in two areas of patented claims. The acquisitions more than quadruple the size of the Gold Point project from 4.49 km2 to 19.88 km2.

The largest acquisition was made on the western side of the property where prospecting and rock sampling identified an area of veining in a series of undocumented historical prospecting pits, located near a faulted contact between the Jurassic Sylvania intrusive complex and Precambrian Wyman Formation sediments. The new claims cover the contact area and prospective pediment along strike of the known vein system. Several rock samples taken by GGL along the contact returned assays better than 10 g/t gold with a peak value of 37.3 g/t gold. A sample collected by the Nevada Bureau of Mines and Geology at historical workings in the far west of the new claim block yielded 1,000 g/t silver and 1.25 g/t gold.

The second acquisition lies along the eastern edge of the property where a soil geochemical survey outlined three areas of anomalous gold values. The soil survey involved the collection of 528 samples in a grid pattern located east of a broad alluvial flat, where extensions of past-producing veins are projected to occur. Follow-up of the anomalous results showed that two of them coincide with prospective vein showings. The southerly anomaly starts near the Hornsilver America shaft and forms a band that extends to the east. Previous rock sampling at this shaft returned 13.7 g/t gold, while chip sampling yielded 2.65 g/t gold over 1.2 m. Prospecting along a second anomalous band to the north discovered a 25' long adit and a series of prospect pits containing chalcedonic quartz. The third anomaly is on the northeast side of the grid where an isolated cluster of high values has not yet been explained. All of these anomalies warrant additional exploration.

All of the newly staked claims, pending approval from the Bureau of Land Management, will be owned 100% by GGL, with no encumbrances or underlying royalty interests.

The third significant addition in the acquisition campaign was completed when the Company, purchased a 100% interest in three patented claims (0.24 km2) that cover the Grand Central Vein, which is located approximately 430 m southwest of the Great Western Vein. These patented claims were purchased for US$85,000 from an arm's-length estate. A 2% net smelter return royalty is payable on mineral production from the claims with GGL having the optional right to purchase ½ of the royalty for US$1 million and a Right of First Refusal on the remaining royalty.

Several shafts and adits are located on the Grand Central patented claims. The most significant being a shaft that reaches 140' (43 m) in depth and has an estimated 130 m of horizontal workings. No record exists of small-scale mining that took place on the claims in the early to mid-1900s, however historical samples collected from the 140' level in 2007 reportedly included 5.41 g/t gold over 1.52 m and 4.39 g/t gold over 0.91 m. A rock sample of brecciated quartz vein that was collected by GGL in 2021 from a trench beside the shaft yielded 26.8 g/t gold.

Other rock samples collected by GGL elsewhere on the Grand Central claims also returned high values. Two rock samples taken from a dump beneath an adit, located 350 m west of the main shaft, graded 28.3 and 5.75 g/t gold. This adit is 75 m south of two bedding parallel veins that lie 25 m apart and strike obliquely toward the Grand Central Vein. Chip samples taken across the bedding parallel veins assayed 32.7 g/t gold over 20 cm and 25.7 g/t gold over 15 cm.

The fourth and fifth acquisitions made by the Company involve another group of patented claims, known as the Lime Point claims, which consists of 4 claims encompassing 44 acres (0.18 km2). The Company has purchased a ¾ interest in the claims and granted a 1% NSR royalty.

The Lime Point claims are of strategic interest. Most significantly, they lie on trend of known veins in the Gold Point camp, including the Great Western Vein. The majority of the surface trace of this vein lies on the Tom claims that GGL has under option from Nevada Rand LLC and Silver Range Resources Ltd. (see Company news release dated July 29, 2020), however to the north of the 2021 drill area, the surface trace of this vein nears the boundary with the Lime Point claims. Under Nevada mining law, the down-dip extension of a vein belongs to the owner of the surface trace, so long as the vein continuity is maintained. This is referred to as the "Apex Rule". If the vein continuity is broken by a fault or the vein is off-set to an en-echelon structure, ownership of the deeper, offset portion of the vein belongs to the party whose claims overlie that portion of the vein. Acquisition of the Lime Point claims eliminates this risk and has important logistical and permitting implications.

There are several significant old workings on the Lime Point claims. The largest working has a shaft that is reported to be approximately 600' deep. This was the site of one of the first mines in the Gold Point camp and was in operation until sometime in the mid-1940s. The claims cover a large vein that can be traced on surface for over 430 m. Ten of sixteen samples collected by GGL along this vein graded better than 1.0 g/t gold, with a peak value of 10.7 g/t gold.

The recent exploration results and new acquisitions have greatly expanded the scope of the Gold Point project. Planning for the next round of exploration is underway and is expected to include: 1) additional RC drilling at the Great Western Mine and elsewhere on the property; 2) rehabilitation and sampling of underground workings at the Orleans and Grand Central mines; and, 3) detailed geological mapping and prospecting, soil geochemical surveys and excavator trenching in some of the newly acquired areas. The objective of future work will be to fully evaluate the potential of this district-scale project for underground and bulk-tonnage mining.

About the Great Western Mine

The Great Western Mine is the second largest underground working on the Gold Point Project, after the Orleans Mine. It was discovered in 1905 and first mined in 1907. A mill was built next to the main shaft in 1913, and the mine continued to operate intermittently until the mid-1930s. Ohio Mining Company bought the mine in 1931 to gain access to the mill to process ore from their nearby Orleans Mine, the largest former producing mine on the Gold Point property. Following the sale, no large-scale production is known to have occurred at the Great Western Mine. The mines at Gold Point were leased to U.S. Milling and Minerals Co. ("USM&M") between 1958 and 1962, which focused primarily on the adjacent Orleans Mine. Their long-term plan was to connect the Orleans and Great Western mines at the 1,000' level. Although they did not complete this plan, they did perform significant rehabilitation on the Great Western Mine in preparation. All of USM&M's operations abruptly ceased in 1962 due to corporate issues related to another nearby mine. The last known rehabilitation and exploration work on the Great Western Mine occurred in the mid 1980's.

About Gold Point

The Gold Point project is accessible via highway 774 and serviced by electricity. It hosts a camp-scale precious metal system that consists of numerous gold and silver rich quartz veins. These high-grade veins are typically 1 to 2 m in width and locally up to 7 m wide. Two veins (Orleans and Great Western) were intermittently mined from the 1880s through to the early 1960s. Existing underground workings are mostly open and are dry to approximately 275 m below surface on the Orleans Vein (1020 ft level) and 240 m on the Great Western Vein, (960 ft level). Historical records indicate that the mines had high cut-off grades (about 10 g/t gold), suggesting that well mineralized areas likely remain in un-mined portions of the developed workings. This assumption is further supported by a report that describes 35 historical samples collected post-mining across the Orleans Vein from the 960 ft to 1020 ft levels, which averaged 0.389 opt (13.3 g/t) gold including a vein on the 1000 ft level that returned 7.97 opt (273.2 g/t) gold over 0.5 m. Additionally, 21 samples from the 600 ft to 1020 ft levels reportedly averaged 0.314 opt (10.77 g/t) gold. Historical records indicate that approximately 74,000 ounces were produced from the Orleans and Great Western Mines, with recoveries of 92% to 98% for gold through cyanidation.

All analyses were performed by ALS Global - Geochemistry Analytical Labs in Reno, Nevada or North Vancouver, British Columbia. Samples were routinely analyzed for gold by a 50 g fire assay followed by atomic absorption (Au-AA26) and 48 elements by inductively coupled plasma-mass spectrometry (ME-MS61).

Technical information in this news release has been reviewed and approved by Matthew R. Dumala, P.Eng., a geological engineer with Archer, Cathro & Associates (1981) Limited and a qualified person for the purposes of National Instrument 43-101.

About GGL Resources Corp.

GGL is a seasoned, Canadian-based junior exploration company, focused on the exploration and advancement of under evaluated mineral assets in politically stable, mining friendly jurisdictions. The Company has recently acquired an option on the Gold Point project in the prolific Walker Lane Trend, Nevada, which consolidated several gold-silver veins, two of which were past producing high-grade mines. The Company also holds the McConnell gold-copper project located 22 kilometers southeast of the Kemess Mine in north-central BC, and promising diamond exploration projects in Nunavut and the Lac de Gras diamond district of the Northwest Territories. Lac de Gras is home to Canada's first two diamond mines, the world class Diavik and Ekati mines discovered in the 1990s. GGL also holds diamond royalties on mineral leases in close proximity to the Gahcho Kué diamond mine in the Northwest Territories.

ON BEHALF OF THE BOARD

"David Kelsch"

David Kelsch

President, COO and Director

For further information concerning GGL Resources Corp. or its various exploration projects please visit our website at www.gglresourcescorp.com or contact:

Investor Inquiries Richard Drechsler Corporate Communications Tel: (604) 687-2522 NA Toll-Free: (888) 688-2522 rdrechsler@strategicmetalsltd.com | Corporate Information Linda Knight Corporate Secretary Tel: (604) 688-0546 info@gglresourcescorp.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward looking statements based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of exploration and other risk factors beyond its control, and actual results may differ materially from the expected results.

SOURCE: GGL Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/676462/GGL-Resources-Corp-Hits-at-Great-Western-Mine-and-Greatly-Expands-Gold-Point-Project-Nevada