First Gold Drill Targets Identified by Ground Geophysics over Gold and Arsenic Soil Anomalies at Erongo Project

HALIFAX, NOVA SCOTIA / ACCESSWIRE / February 1, 2022 / Namibia Critical Metals Inc. ("Namibia Critical Metals" or the "Company" or "NMI") (TSXV:NMI)(OTC PINK:NMREF) is pleased to provide an update on exploration activities on its 95% owned Erongo and Grootfontein Projects.

The company has completed a multiple tool geophysical survey over the Kanona Target on the Erongo Project for drill target generation over previously defined coinciding gold and arsenic anomalies (see Press Release July 28, 2021):

- Combined magnetic, IP and pole-dipole EM survey targeted area of gold and arsenic anomalies at Kanona North.

- Identified coinciding conductivity and magnetic anomalies point to a structural target forming a fold structure in a second order fault zone over 1.5 km.

- Drill plan established to test the targets with 14 RC holes of 3,700 m.

Darrin Campbell, President, stated "We are encouraged by the results from our early-stage exploration activities throughout 2021 and are excited to begin the first phase of drilling on the Erongo Project where solid exploration by systematic soil sampling and multiple tool ground geophysics has identified a first drill ready target."

Erongo and Grootfontein Projects

The Erongo and Grootfontein Projects consists of three Exclusive Prospecting Licences ("EPLs") with a total area of 172,842 ha (1,728 km2) and cover ground prospective for orogenic gold mineralisation and various types of base metal mineralisations. The Company's EPLs are located in the Central Namibian Gold Belt which hosts a number of significant orogenic gold deposits including the Navachab Gold Mine, B2Gold's Otjikoto Gold Mine and Osino's more recent discovery of the Twin Hills deposit.

Gold Exploration Targets at Erongo

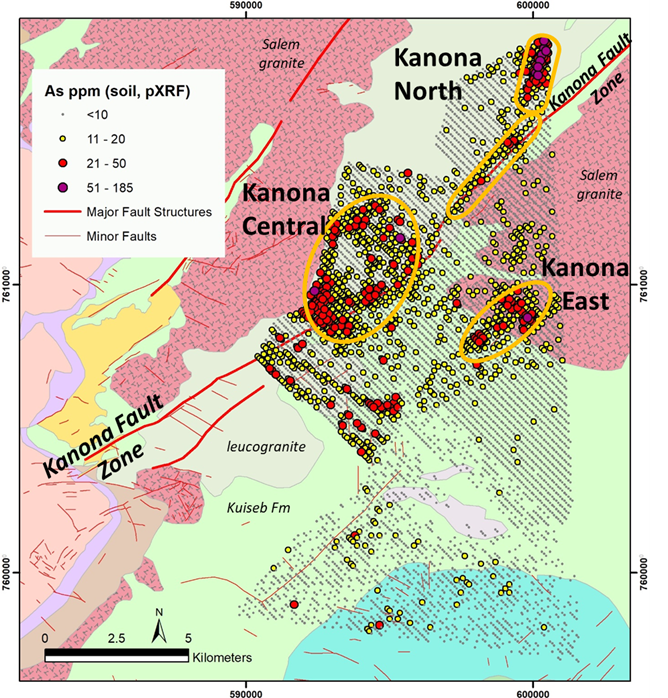

The Erongo Project area comprises 337 km2 and is largely underlain by metasediments of the Damaran Supergroup dominated by a turbiditic sequence of metapelites of the Kuiseb Formation and syntectonic granites of the Damaran Orogen. The Kuiseb Formation hosts the Twin Hills gold deposit of Osino Resources just 20 km south of the Erongo Project. The structural interpretation of the entire project area delineated the Omaruru Fault Zone and the Kanona Fault Zone, both of which are considered prospective for structurally controlled orogenic gold mineralization. The project area has extensive alluvial or calcrete cover and regional soil sampling was undertaken as the initial exploration tool to identify areas of interest. Analysis of over 8,000 soil samples delineated several arsenic anomalies (the key gold pathfinder element) which were confirmed by low detection limit gold assays based on which three target areas have been defined (Figure 1):

- Kanona North Target has a strike length of 4 km which clearly follows a lower order structure splaying off the main Kanona Fault. This target is defined by the most intense arsenic anomaly in the area and occurs within the Kuiseb Formation and syntectonic leucogranites.

- Kanona Central Target is similarly situated along the Kanona Fault over a strike length of 6 km but displays a broader, less confined arsenic anomaly within the Kuiseb Formation and syntectonic leucogranites.

- Kanona East Target is a northeast trending linear anomaly with a strike length of 2.5 km correlating with an interpreted dyke swarm cross-cutting the Karibib Formation into Salem granite.

Figure 1: Key gold exploration targets at the Erongo Project (arsenic anomalies from handheld XRF analyses of soils). Sampling lines 200 m apart.

Ground Geophysics at Erongo Project

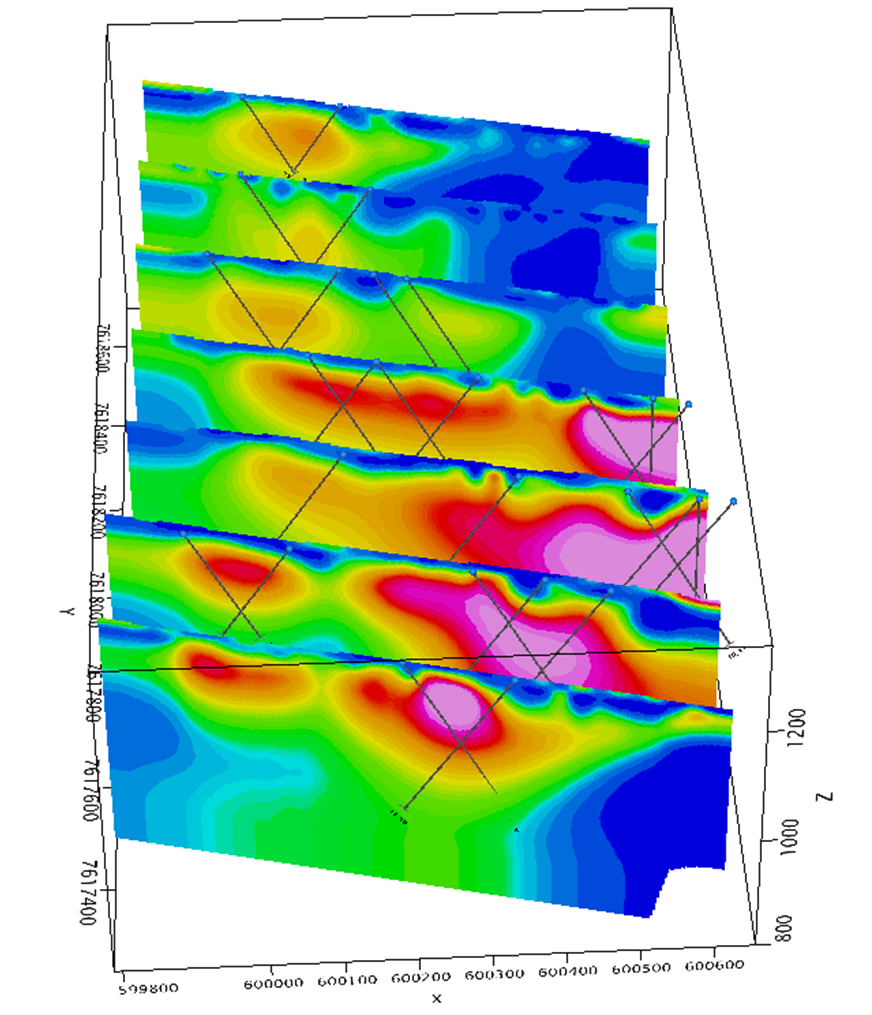

The central 1.5 km long Kanona North Target was prioritised for ground geophysical surveys. Combined ground magnetics, gradient array induced polarization, and pole-dipole induced polarization surveys were conducted by Gregory Symons Geophysics (GSG) in December 2021 to identify drill targets and to develop an efficient combination of survey tools and set-ups for further ground geophysics in the area. A total of 57 line kilometers of ground magnetics was surveyed over the target. One setup of gradient array induced polarization (GAIP) with 12 lines and 7 lines of pole-dipole induced polarization (PDIP) were surveyed.

The strongest IP anomaly based on GAIP and PDIP data occurs in the southeast ("Anomaly 1"). A slightly weaker and shallower IP "Anomaly 2" appears to the west and northwest. IP Anomaly 1 correlates with a strong magnetic anomaly, showing a divergence to the north. Based on the EM, magnetic and mapping data, the host structure is interpreted as a fold zone along the Kanona North second order fault, a structural setting generally conducive for structurally controlled gold mineralisation.

Figure 2: Plan with the interpretation of geophysical data at Kanona North target. Pink polygons show the position of the IP Anomalies 1 (east) and 2 (northwest). The red dots are the positions of the IP anomalies as taken off the PDP modelled IP sections. Pink lines are weaker trends in the gradient array IP. The stippled line is an area of a broad magnetic anomaly defined by the RTP magnetic image while the dotted lines indicate magnetic units based on the RTP-TDR image.

Figure 3: Reconnaissance drill plan (black lines) on 3D perspective showing the PDP IP response from Line 11 in the South to Line 21 in the north. Anomaly 1 in the east is well defined. Anomaly 2, to the west, is distinctly weaker and shallower.

Based on the geophysical targets an initial drill program of 14 RC holes for a total of 3,700 m is planned. Ground preparation is in progress.

Gold Prospectivity of the Grootfontein Project

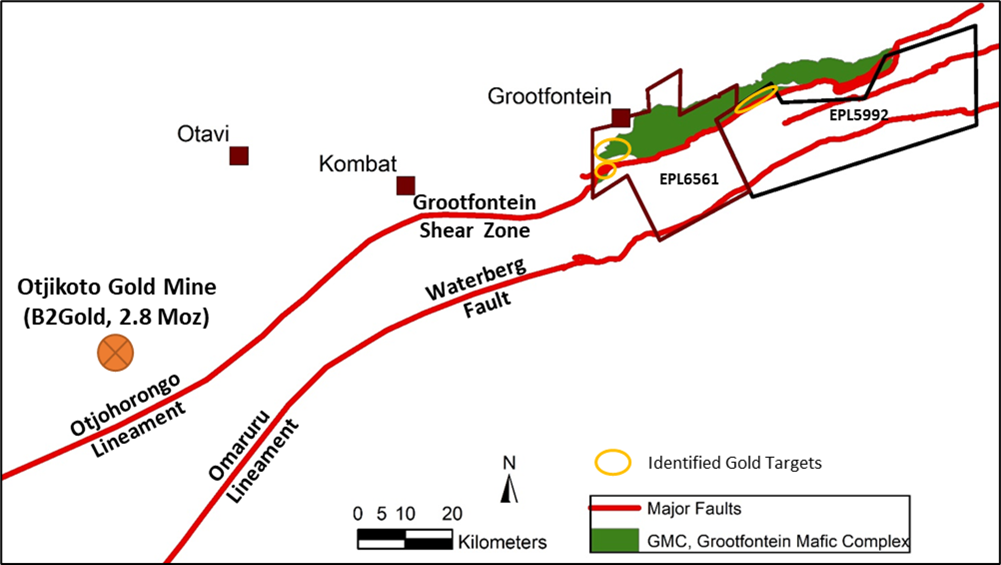

The Grootfontein project comprises two EPLs covering 1,392 km2 located 80 km northeast of B2 Gold's Otjikoto Gold Mine. The geology of the property is dominated by the Grootfontein Mafic Complex ("GMC"). Grootfontein lies at the eastern extremity of the Central Namibian Gold Belt where the Grootfontein Shear Zone ("GSZ") transects the GMC (Figure 4).

Previous exploration by Namibia Critical Metals included geochemical soil surveys which delineated the Highland Gold Target and several other gold and gold pathfinder anomalies in the periphery and contact zone of the Grootfontein Mafic Complex with Meso- and Neoproterozoic metasediments (Press Release March 26, 2021). Gold anomalies occur within the mafic rocks of the GMC itself and in basement and Damaran Supergroup rocks in proximity to the Grootfontein Shear Zone. Second order structures related to the Grootfontein Shear Zone form the key targets for gold exploration. The project area has extensive alluvial and calcrete cover.

Figure 4: Location of the Grootfontein EPLs and relationship to major structures within the Central Namibian Gold Belt.

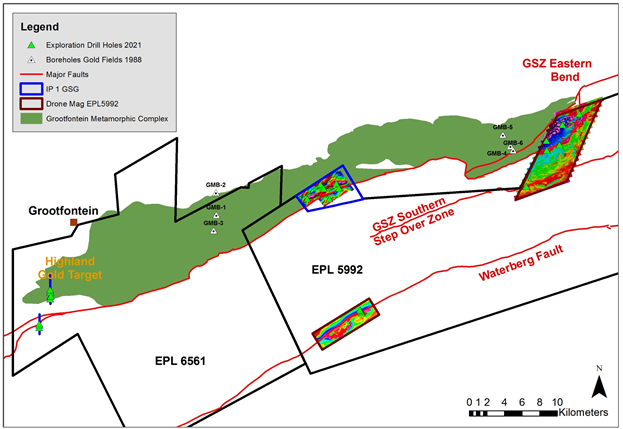

Progress on Grootfontein Project

The planned SkyTEM survey over large parts of the Grootfontein Project (Press Release April 26, 2021) had to be cancelled as the Namibian Air Force extended the "no-fly" zone from 5 to 10 nautical miles around the Grootfontein Air Base centrally located on EPL 6561. All communication of the Company and SkyTEM with the Ministry of Defense was to no avail and SkyTEM demobilised from Namibia. This was a major setback for exploration of the Grootfontein Project as most of the potentially gold mineralised structures fell into the newly declared "no-fly" zone. The planned airborne survey will now have to be off-set with time intense ground EM surveys.

In order to comply with the technical exploration commitment towards the Ministry of Mines and Energy, the Company decided to go ahead with stratigraphic and reconnaissance drilling on inferred structural targets delineated based on broad magnetic and electromagnetic anomalies (see Press Release July 28, 2021). 24 reverse circulation (RC) drill holes of a total of 4,466 m were drilled in Q3-4 2021. The holes on the Eastern Bend target showed an anomalous gold value of 71 ppb over 1 metre possibly and several low grade base metal intercepts. The gold anomaly underlines the principle fertility of the structural zones for gold mineralisation but also points to the missing targeting precision without guiding conductivity anomalies produced by EM surveys. The holes in the west on Highland target returned weak base metal anomalies. The drilling and geophysical data will be re-evaluated.

Due to the restrictions on air-borne surveys, the Company plans to enroll an extended ground based IP program over the identified main structural targets with a focus on the "Eastern Bend" target.

Figure 5: Grootfontein Project with main structures of the Grootfontein Shear Zone (GSZ), drill collar positions of the 2021 reconnaissance drilling program and the key target areas.

Quality Assurance and Quality Control

Sampling and sample assaying of the RC reconnaissance campaign at Grootfontein have been monitored through a quality assurance quality control ("QAQC") program. Samples were taken as 2 kg split. Sample submissions to the laboratory included Certified Reference Material, blanks and duplicate samples. QAQC samples make up 10% of all samples submitted. Logging and sampling was completed at the Company's exploration base in Grootfontein, Namibia. The samples were securely transported to the Activation Laboratories Ltd. sample prep facility in Windhoek, Namibia. The samples were dried and crushed to 95% <2 mm, split to 350 g and pulverized to 95% <75 µm. Sample pulps were sent to Activation Laboratories Ltd. in Ontario, Canada for analysis. Gold & PGEs analysis was done by 50 g fire assay assay (Actlabs code: 1C-Exploration) with nitric acid fusion and ICP-MS finish. In addition, pulps underwent 4-Acid digestion and multi-element analysis by INAA combined with the ICP-MS techniques for base metal analysis.

About Namibia Critical Metals Inc.

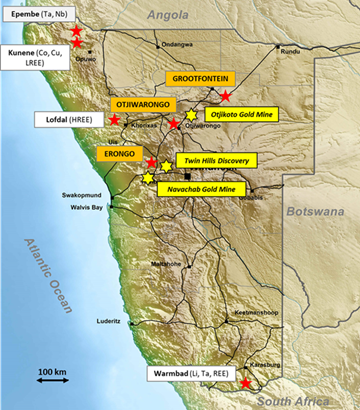

Namibia Critical Metals Inc. holds a diversified portfolio of exploration and advanced stage projects in Namibia focused on the development of sustainable and ethical sources of metals for the battery, electric vehicle and associated industries. The two advanced stage projects in the portfolio are Lofdal and Epembe. The Company also holds significant land positions in areas favourable for gold mineralization.

Figure 6: Location of Namibia Critical Metals' projects highlighting position of gold projects (Erongo, Otjiwarongo and Grootfontein) in relation to important gold mines in the Central Namibian Gold Belt

Heavy Rare Earths: The Lofdal Dysprosium-Terbium Project is the Company's most advanced project being fully permitted with a Mining Licence (ML 200) issued in 2021. The project is being developed in joint venture with Japan Oil, Gas and Metals National Corporation ("JOGMEC").

About Japan Oil, Gas and Metals National Corporation (JOGMEC) and the JV

JOGMEC is a Japanese government independent administrative agency which among other things seeks to secure stable resource supplies for Japan. JOGMEC has a strong reputation as a long term, strategic partner in mineral projects globally. The mandated areas of responsibilities within JOGMEC relate to oil and natural gas, metals, coal and geothermal energy. JOGMEC facilitates opportunities with Japanese private companies to secure supplies of natural resources for the benefit of the country's economic development.

Rare earths are of critical importance to Japanese industrial interests and JOGMEC has extensive experience with all aspects of the sector. JOGMEC provided Lynas with US$250,000,000 in loans and equity in 2011 to ensure supplies of the Light Rare Earths metals suite to the Japanese industry.

Namibia Critical Metals currently owns a 95% interest in the Lofdal project with the remaining 5% held for the benefit of historically disadvantaged Namibians. The terms of the JOGMEC joint venture agreement with the Company stipulate that JOGMEC provides $3,000,000 in Term 1 and $7,000,000 in Term 2 to earn a 40% interest in the Lofdal project. Term 3 calls for a further $10,000,000 of expenditures to earn an additional 10% interest. JOGMEC can also purchase another 1% for $5,000,000 and has first right of refusal to fully fund the project through to commercial production and to purchase all production at market prices. The collective interests of NMI and historically disadvantaged Namibians cannot be diluted below a 26% carried working interest upon payment of $5,000,000 to JOGMEC for the dilution protection. The JV Agreement is structured such that no NMI equity will be issued and it is totally non-dilutive to NMI shareholders. To date, JOGMEC, has approved funding Term 1 and 2 expenditures totaling $6,600,000.

Gold: The Company's Exclusive Prospecting Licenses ("EPLs") prospective for gold are located in the Central Namibian Gold Belt which hosts a number of significant orogenic gold deposits including the Navachab Gold Mine, the Otjikoto Gold Mine and more recently the discovery of the Twin Hills deposit. At the Erongo Gold Project, stratigraphic equivalents to the meta-sediments hosting the recent Osino gold discovery at Twin Hills have been identified and exploration is progressing over this highly prospective area. The Grootfontein Base Metal and Gold Project has potential for magmatic copper-nickel mineralization, Mississippi Valley-type zinc-lead-vanadium mineralization and Otjikoto-style gold mineralization. Interpretation of geophysical data and regional geochemical soil sampling have identified first gold targets.

Tantalum-Niobium: The Epembe Tantalum-Niobium-Uranium Project is at an advanced stage with a well-defined, 10 km long carbonatite dyke that has been delineated by detailed mapping and radiometric surveys and over 11,000 meters of drilling. Preliminary mineralogical and metallurgical studies including sorting tests (XRT), indicate the potential for significant physical upgrading. Further work will be undertaken to advance the project to a preliminary economic assessment stage.

The common shares of Namibia Critical Metals Inc. trade on the TSX Venture Exchange under

Qualified Person's Statement

Rainer Ellmies, PhD, MScGeol, EurGeol, AusIMM is Vice President Exploration of Namibia Critical MetalsInc. and the Company's Qualified Person. He has reviewed and approved the scientific and technical information in this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information please contact:

The foregoing information may contain forward-looking information relating to the future performance of Namibia Critical Metals Inc. forward-looking information, specifically, that concerning future performance, is subject to certain risks and uncertainties, and actual results may differ materially. These risks and uncertainties are detailed from time to time in the Company's filings with the appropriate securities commissions.

SOURCE: Namibia Critical Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/686586/Namibia-Critical-Metals-Inc-Identifies-First-Gold-Targets-at-Erongo-Gold-Project-in-Namibia