Korian places its ESG commitments at the heart of its strategy and furthers its transformation to be a European, Mission-led company

Regulatory News:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220223006045/en/

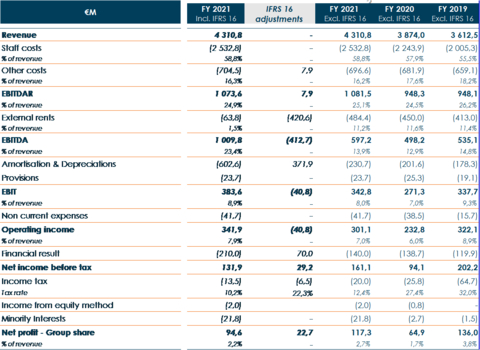

Group Income Statement (Graphic: Korian)

Korian (Paris:KORI), the leading European care and support services group for the elderly and fragile, announces its Q4 revenue and its 2021 results.

Sophie Boissard, CEO of Korian Group:

"Following two years fighting the Covid-19 pandemic and whilst the nursing home model comes under scrutiny in France, the Korian community has remained more than ever committed to providing high quality care and support to the elderly and fragile in our society, through its three activities, long term elderly care, post-acute healthcare and community care.

I would like to pay tribute to the unwavering commitment and professionalism of the Korian teams across Europe, that has enabled us to progress significantly in our environmental and social objectives, particularly focused on employment and qualifying training.

I would like to thank all our stakeholders, and in particular our residents, patients, clients and their families for their trust and the quality of our dialogue in all of the communities where we are present. We are determined to build with our stakeholders the solutions and the infrastructure to accompany and care for the elderly and vulnerable with dignity. Thus contributing to solving the societal challenges posed by ageing and chronic diseases across Europe. It's with this aim in mind that we are starting our transformation to become a European, Mission-led company."

- Committed to quality of care and quality of work

240 facilities certified ISO 9001 (29% of network versus 11% in 2020),

Net Promoter Score from family, residents and patients of 34, well above the average of BtoC services sector of 231

5,302 employees involved in a qualifying education programme: 9.7% of the Group's staff compared to 8% in 2020 and close to target of 10% for 2023

Average tenure of staff 7.4 years (up 0.5 year on 2020)

Pioneering Health and Safety at Work for the sector: Agreement signed by trade unions in France and a European Health Safety Protocole with the European Works Council

- Strengthening the sustainable business model through significant investment

Investment in employees:

- Increase in the percentage of revenue spent on staff (59% in 2021 versus 52% in 2016)

- Launch of first European Employee Shareholding Ownership Plan

Investment in the network: €409m invested to improve and extend services

Acceleration of outpatient and homecare: +50% outpatient care capacity and +20% in residential care (200 co-living and assisted living facilities)

- Performance in line with objectives

Revenue of 4,311 million: +11.3% growth of which +5.9% organic, reflecting activity normalisation

EBITDA (pre IFRS16) of 597.2 million with a margin rate of 13.9%

Net profit at €117.3 million, 2.7% of revenue, remaining down compared to 2019

FCF prior to investment of 230 million

Net income Group share 94.6 €million or 2.2% of revenue

- Solid balance sheet and reinforced liquidity

Stable operational leverage at 3.1x

Real Estate portfolio valued at 3.2 billion with a stable Loan to Value of 55%

Average maturity of the net debt extended to c.6 years and reduction of average cost to 2%

Liquidity of 1.7 billion

- 2022 financial guidance

Continued growth momentum in all three segments with an organic contribution above 4%

Continued normalization of EBITDA margin and FCF

- Next steps for the governance: transformation into a European company and the launch of the transformation to be a Mission Led company

Publication of the resolutions to the AGM on 18th May 2022

AGM to be convened on 22th June 2022

FINANCIAL INFORMATION

The consolidated financial statements for 2021 were approved by the Board of Directors at its meeting of 23th February 2022.

The Statutory Auditors are In the process of issuing a report with an unqualified opinion. The consolidated financial statements were prepared in accordance with the IFRS 16 standard. For purposes of comparability, the financial information below is presented excluding the application of IFRS 16.

About Korian

Korian, the leading European care services group for elderly and fragile people. www.korian.com

Korian has been listed on Euronext Paris Section A since November 2006 and is included in the following indices: SBF 120, CAC Health Care, CAC Mid 60, CAC Mid Small and MSCI Global Small Cap

Euronext ticker: KORI ISIN: FR0010386334 Reuters: KORI.PA Bloomberg: KORI.FP

1 European survey carried out by IPSOS with 52,368 respondants (Nursing Homes, Assisted Living and clinics)

View source version on businesswire.com: https://www.businesswire.com/news/home/20220223006045/en/

Contacts:

INVESTOR RELATIONS

Sarah Mingham

VP Investor Relations

& Financing

sarah.mingham@korian.com

Tel: +33 (0)1 55 37 53 55

Carole Alexandre

Deputy Head of

Investor Relations

carole.alexandre@korian.com

Tel: +33 (0)7 64 65 22 44

MEDIA CONTACTS

Cyrille Lachevre

Clachevre@cylans.ovh

Tél.: 06 20 42 12 08

Pascal Jentsch

VP International communications

pascal.jentsch-ext@korian.com

Tél. 07 65 18 58 55

Marjorie Castoriadis

Head of Media Relations

marjorie.castoriadis@korian.fr

Tel: +33 (0)7 63 59 88 81