Intersects Nickel Bearing Massive Sulphides Underneath The Past-Producing Dumbarton Nickel Deposit

TORONTO, ON / ACCESSWIRE / April 13, 2022 / Grid Metals Corp. (the "Company") (TSXV:GRDM)(OTCQB:MSMGF) today provided a drill update on its Makwa Nickel Property. Makwa which is part of the Makwa Mayville Ni-Cu-PGM Project located in southeastern Manitoba - where the Company has just completed 14 exploration drill holes. The current Makwa drill program focused on four geophysical targets (MK02-MK05) all located close to the 2014 pit-constrained Makwa Ni-Cu-PGM resource. Results from the first drill hole at the MK02 target intersected two separate intervals of <1 metre of massive sulfide mineralization with nickel grades greater than 1.5% within a broader mineralized package including 15 metres of 0.64% and 3.5 metres of 1.14% nickel equivalent grade. Drilling at Makwa is ongoing. Drilling is also continuing at the Company's Donner Lake Lithium Project located 35 km north.

Drill hole MK22-02 was drilled underneath the former producing Dumbarton Mine horizon at the Makwa Property. Assays successfully confirm that there is nickel copper cobalt sulfide mineralization remaining below the former mine workings. The geophysical anomaly (MK02) that was targeted has a minimum strike length of 400 meters and extends at least 300 metres below the mined out part of the Dumbarton deposit. Six additional drill holes have been completed on the MK02 target with results pending. Initial results from MK22-02 are tabulated below.

Hole ID | From (m) | To (m) | Length (m) | Ni (%) | Cu (%) | Co (%) | Pd (g/t) | Pt (g/t) | Au (g/t) | NiEq* (%) |

MAK22-02 | 174.76 | 190.02 | 15.26 | 0.39 | 0.29 | 0.04 | 0.01 | 0.01 | 0.02 | 0.64 |

inc. | 181.00 | 189.00 | 8.00 | 0.50 | 0.36 | 0.04 | 0.01 | 0.01 | 0.02 | 0.81 |

and inc. | 183.00 | 186.55 | 3.55 | 0.79 | 0.28 | 0.07 | 0.02 | 0.01 | 0.01 | 1.14 |

and inc. | 184.53 | 186.55 | 2.02 | 0.97 | 0.24 | 0.08 | 0.02 | 0.02 | 0.01 | 1.34 |

with | 184.53 | 185.11 | 0.58 | 1.63 | 0.12 | 0.12 | 0.02 | 0.01 | 0.01 | 2.07 |

and with | 186.19 | 186.55 | 0.36 | 1.53 | 0.12 | 0.12 | 0.03 | 0.03 | 0.01 | 1.97 |

Above: Highlights for MAK22-02, Dumbarton Zone, Makwa nickel property. NiEq (%) = the nickel equivalent grade that was calculated using the equation: NiEq (%) = Ni (%) + 0.469 * Cu (%) + 3.125 Co (%) + 0.319 Pd (g/t) + 0.21 * Pt (g/t) + 0.319 Au (g/t). The metal price assumptions in $US used to determine the equivalency factors are: Ni - $8.00/lb; Cu - $3.75/lb; Co - $25.00/lb; Pd - $1,750/oz; Pt - $1,150/oz; Au - $1,750/oz. na = not analyzed. The true thickness of the Dumbarton Zone intercepts reported here is estimated to be 60-70% of the reported interval lengths.

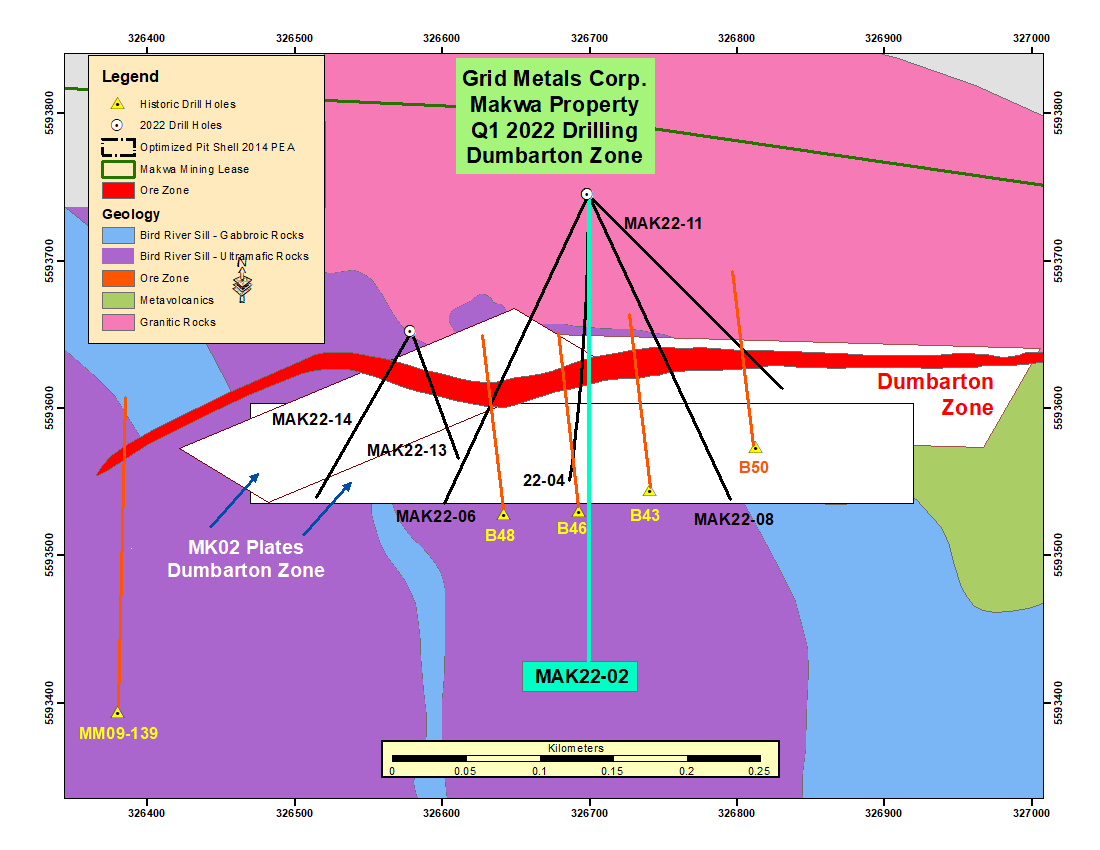

Above: Plan view map of MK02 EM conductor plates and Grid Metal's 2022 drilling locations. The modeled plates have a near vertical orientation. The Dumbarton Zone was underground mined between 1970 and 1973 to a depth of ~ 150m ( source Manitoba Mineral Inventory File No.999 ) The Grid 2022 drill holes intersected the Dumbarton Zone below the historical mine workings. Historical drill hole MM09-139 (far left) intersected 3m @ 0.85% nickel and 0.23% copper from 141m depth. The B series holes (1953) shown on this map were drilled by Falconbridge Ltd. in the area that was mined out or just below the historical underground mine workings. They include historical intersections of the Dumbarton Zone as reported by Falconbridge Ltd. (internal company drill report) of 18.3m of 1.05% Ni including 11.0m of 1.52% Ni in hole B50 and 7.6m of 1.16% Ni in hole B46.

Makwa Nickel Project - Overview and Current Drill Program

- The Makwa Nickel Deposit was the subject of a standalone positive feasibility study completed in 2007 (Micon International) for the mining and production of nickel concentrate for sale to a smelter. National Instrument 43-101 resources at Makwa included in the 2014 PEA ( RPA Inc) are 7.2Mt grading 0.61% nickel; 0.13% copper 0.36 g/t Pd and 0.10 g/t Pt in the Indicated category - all open pit constrained. The Makwa resource does not include any material from the Dumbarton Zone.

- The Makwa Deposit was incorporated into a 2014 PEA (RPA Inc.) combining the Makwa Deposit and the Mayville Cu-Ni-PGM Deposit located ~35 km to the north of Makwa. The Mayville NI 43-101 resource is a pit constrained 26.6 Mt grading 0.44% Cu; 0.18%Ni; 0.14 Pd - Indicated.

- The last drilling at Makwa was in 2010.

- The current exploration drilling program is partially guided by an extensive 2018 ground EM survey at Makwa which defined many new exploration targets

- The 14 drill holes completed this winter have tested four of the identified geophysical targets in close proximity to the Makwa open pit resource.

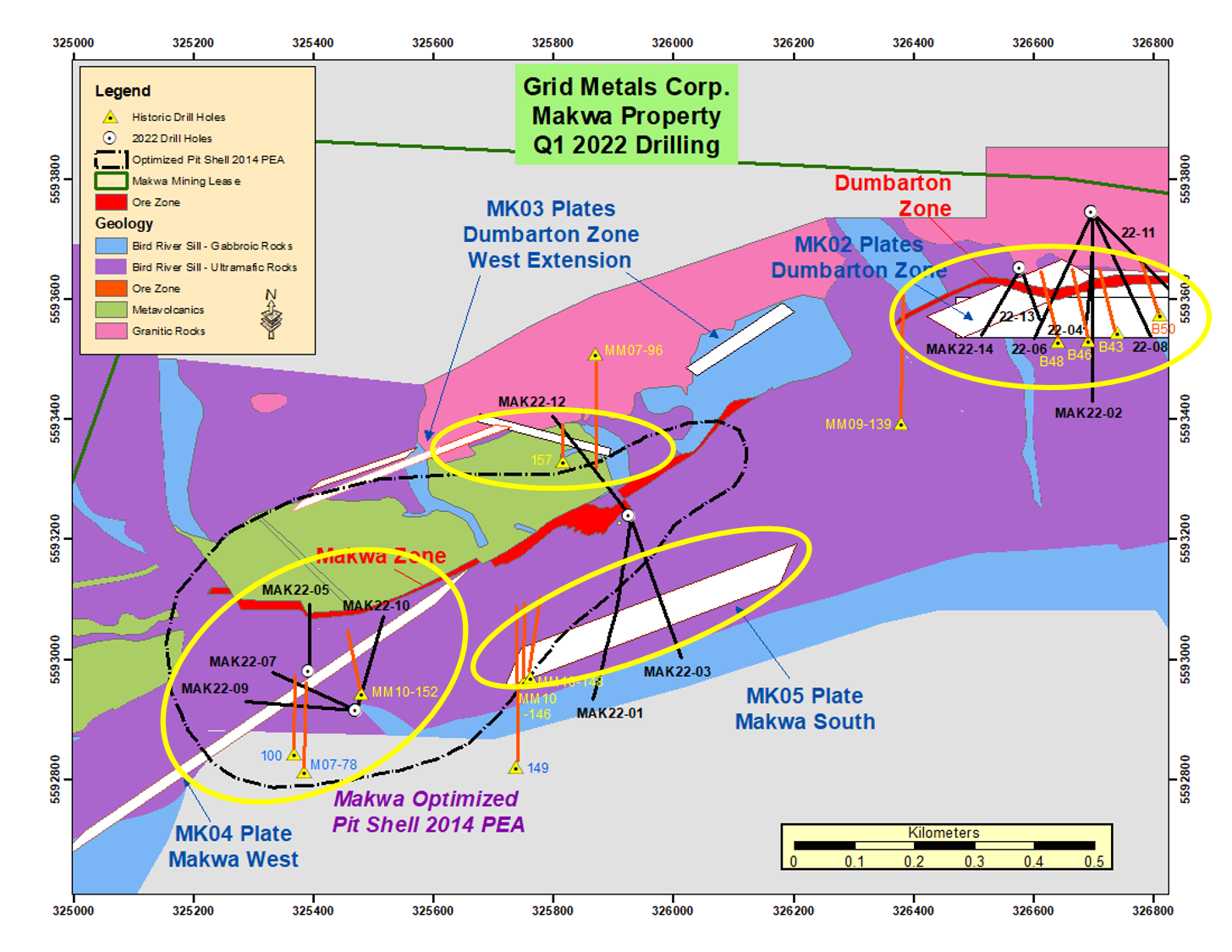

- The main targets are 1) MK04 - the deeper extension of the main mineralized zone underneath the resource pit shell; 2 and 3) MK02 and MK03, both of which are associated with the along strike extension of the Dumbarton Zone; and 4) the MK05 target, which may represent a southern offset of the main Makwa Ni-Cu-PGM deposit. MK-05 is currently being drill tested from the south.

Above: Location of the 14 diamond drill holes completed at the Makwa nickel property in January and February. Also shown are the EM conductor plate targets discussed above and relevant historical drill hole ( red line traces ) that intersected the edges of these plates. Drilling is continuing at the MK05 Plate target.

EM plate targets were generated from the Company's 2018 ground EM survey. Most of these EM conductors have been partially drill tested by limited historical drilling that, combined with the 2022 drilling results, will give a sense of their resource potential. Hole specifications for each of the 14 holes completed this winter are provided in the Appendix.

Makwa Mayville Ni-Cu-PGM-Co Project

The project has many key attributes including defined NI 43-101 resources, the project location in southeastern Manitoba serviced with renewable power and all season roads, extensive metallurgical work and previous economic studies, e.g., the 2007 PFS authored by Micon International and the 2014 PEA on the combined Makwa and Mayville deposits in 2014 authored by RPA Inc. Importantly the Company has an exploration agreement in place with the Sagkeeng First Nation on whose traditional lands the projects are situated. Additional information about exploration results and a project development schedule will be released in the coming weeks

Dr. Dave Peck, the Company's Vice President of Exploration and Business Development stated: "The resumption of activity at our Makwa nickel project is ideally timed to rising nickel prices and heightened investor and end user interest in nickel sulfide projects with strong ESG credentials located in Tier 1 mining jurisdictions. The new drilling at Makwa was designed to test prominent geophysical targets associated with known trends of nickel-copper sulfide +/- PGM mineralization that sit outside the current pit constrained mineral resources."

Donner Lake Lithium Project - Drilling Continuing

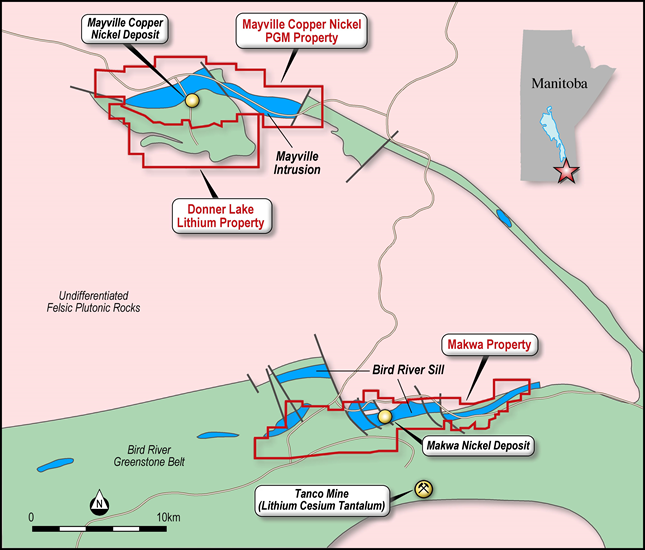

Drilling is also ongoing at the Company's 75% owned Donner Lake lithium project, located directly south of the Mayville Cu-Ni-PGM deposit in the northern part of the Bird River greenstone belt - see location map, below. The new drilling is targeting spodumene-bearing granitic pegmatite dykes that are part of the world class Winnipeg River pegmatite field, which hosts Canada's only current spodumene producer - the Tanco Mine, which has been producing cesium and/or tantalum +/- lithium from the Bernic Lake pegmatite deposit since 1968. The first two drill results from Donner Lake were announced on April 5, 2022 by the Company. Additional drilling results will be released over the coming weeks.

Above: Location of Grid Metals' Makwa and Mayville Ni-Cu-PGM properties and Donner Lake lithium property in the Bird River greenstone belt, southeastern Manitoba.

Quality Assurance and Quality Control

Grid Metals applies best practice quality assurance and quality control ("QAQC") protocols on all of its exploration programs. For the Makwa drilling program, core was logged and sampled at the Company's core facility located on the Makwa Property. Standard 1.0 metre sample lengths were used. Samples were bagged and tagged and then transported by secure carrier to the Actlabs (Thunder Bay) laboratory for sample preparation and analysis for nickel, copper, cobalt and selected major and trace element abundances using a multi-acid digestion method followed by ICP-OES analysis. Samples were also analyzed for Pd, Pt and Au using a lead collection 30 g fire assay method followed by ICP-OES analysis. The Company is using two certified reference materials ("CRMs") and one analytical blank for the Makwa program to monitor analytical accuracy and check for cross contamination between samples. The analytical results for the two CRMs and the blank for MAK22-02 results reported here did not show any significant bias compared to the certified values and the fell within the acceptable limits of variability.

Dave Peck, P.Geo., has reviewed the contents of this press release and is the qualified person for purposes of National Instrument 43-101.

About Grid Metals Corp.

Grid Metals Corp. has a portfolio of exploration and development stage properties focused on battery metals (nickel, copper, platinum group metals, cobalt, palladium and lithium) which are located in the Provinces of Manitoba and Ontario, Canada. In Manitoba the Company is currently drilling at both its Makwa Nickel Property and its Donner Lake Lithium Property.

To find out more about Grid Metals Corp., please visit www.gridmetalscorp.com.

On Behalf of the Board of Grid Metals Corp.

Robin Dunbar - President, CEO & Director

Telephone: 647 201 6844 Email: rd@gridmetalscorp.com

David Black - Investor Relations Email: info@gridmetalscorp.com 416 955-4773

Appendix: Specifications for drill holes MAK22-01 to 14, Makwa nickel property. Collar coordinates are based on a NAD83 UTM Zone 15N projection.

Hole Number | Target Plate | Easting (m) | Northing (m) | Elevation (m) | Azimuth (degrees) | Dip (degrees) | Length (m) |

MAK22-01 | MK05 | 325927 | 5593239 | 298 | 180 | -45 | 432 |

MAK22-02 | MK02 | 326699 | 5593745 | 310 | 180 | -45 | 446 |

MAK22-03 | MK05 | 325927 | 5593239 | 298 | 160 | -45 | 356 |

MAK22-04 | MK02 | 326699 | 5593745 | 310 | 180 | -60 | 371 |

MAK22-05 | Met Test | 325391 | 5592980 | 287 | 360 | -60 | 224 |

MAK22-06 | MK02 | 326699 | 5593745 | 310 | 205 | -55 | 404 |

MAK22-07 | MK04 | 325470 | 5592913 | 287 | 295 | -62 | 329 |

MAK22-08 | MK02 | 326699 | 5593745 | 310 | 155 | -55 | 398 |

MAK22-09 | MK04 | 325470 | 5592913 | 287 | 275 | -52 | 302 |

MAK22-10 | MK04 | 325470 | 5592913 | 287 | 16 | -61 | 338 |

MAK22-11 | MK02 | 325470 | 5592913 | 287 | 135 | -52 | 302 |

MAK22-12 | MK03 | 325927 | 5593239 | 298 | 322 | -45 | 299 |

MAK22-13 | MK02 | 326579 | 5593652 | 309 | 160 | -45 | 130 |

MAK22-14 | MK02 | 326579 | 5593652 | 309 | 210 | -60 | 260 |

SOURCE: Grid Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/697139/Grid-Metals-Completes-14-Drill-Holes-at-Makwa-Nickel-Deposit-Manitoba-Canada