- Dual scoring system which provides customers with a life cycle assessment (LCA) value alongside a rating system which measures progress towards near-zero

- Designed to incentivise the decarbonisation of both primary and secondary steelmaking

- Provides transparency and consistency across steel products for customers

- Supports the development of markets for low-carbon emissions steel

14 June 2022

ArcelorMittal ('the Company') has today published a concept for a low-carbon emissions steel standard to help incentivise the decarbonisation of steelmaking globally and support the creation of market demand for physical steel products which would be classified as lower, and ultimately near-zero, carbon emissions steel.

The creation of clear definitions for low-carbon emissions physical steel is an important component of 'demand pull' and 'supply push' mechanisms that are required to support the steel industry in its transition to net zero by 2050. Clear definitions will also help inform targeted policy to support the scale-up and commercialisation of these near-zero technologies.

Three core principles

At the heart of the concept are three core principles:

- It must include a dual score system comprising a LCA value for finished products (EPD for construction products) alongside a decarbonisation rating system which categorises low and near-zero carbon emissions per tonne of hot rolled steel and rewards producers as they decarbonise from their starting point.

- It must be designed in such a way that incentivises the decarbonisation of all methods of steel production through technology shifts, rather than simply through increasing scrap rates using existing technology. This can be done by using a sliding scale based on the percentage of scrap used in production, a system which is also at the heart of the ResponsibleSteel and International Energy Agency ('IEA') low-carbon emissions steel models.

- It must include a clearly defined boundary from which carbon emissions are counted for the decarbonisation rating system.

The concept is designed to be complementary to methods for rewarding virtual low-carbon steel, at least until significant amounts of physical low-carbon steel are available.

Commenting, Brad Davey, Executive Vice President, ArcelorMittal, and chair of the Company's Climate Committee, said:

"Setting a standard to classify low-carbon emissions steel during our industry's transition to net zero is critical to our decarbonisation journey. We have spent a lot of time thinking about how to do this in a fair way that incentivises all steelmakers to reduce emissions and ultimately achieve net zero. At the heart of our concept is a system that ensures that all steelmakers, both primary and secondary, are incentivised to further improve their emissions, and progress towards near zero is recognised and rewarded.

"We know that there are many organisations giving this question a lot of thought. We are in close discussion with several of these organisations and have welcomed the opportunity to share our expertise of steelmaking with them as they develop their recommendations. As this is such a critical topic for the industry, we decided to directly publish the key principles we believe should be at the core of any system to officially categorise lower and near zero carbon steel.

"We believe these principles will help incentivise the industry and will also prove intrinsic in providing transparency and clarity to steel consumers, guiding their purchasing decisions and helping to develop green steel lead markets."

Geert van Poelvoorde, Executive Vice President and CEO of ArcelorMittal Europe, added:

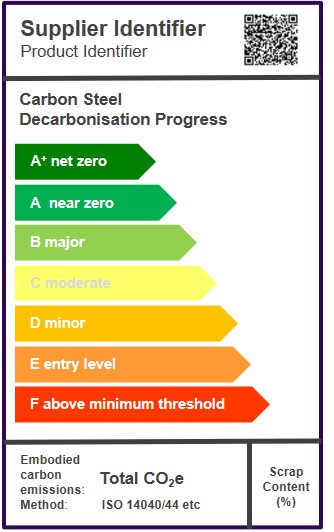

"We know that our customers want low-carbon steel products. That is why we launched the XCarb green steel certificates which have proved very popular with our customers. However, these are virtual low-carbon products and we must also have a system that defines what constitutes physical low-carbon steel during the transition to near and ultimately net zero. This will help support a return on the investment required to transition to low-carbon steelmaking which will be more costly than the technologies used today. We believe it is important that any standard has a dual approach that clearly states the LCA value of the product as well as a rating to show decarbonisation progress. This makes the embodied carbon content of the product clear to customers but also the progress that producer is making towards near zero - a vital component of ensuring every company contributes to achieving the Paris Agreement."

A dual scoring system to enable like-for-like comparisons and incentivise decarbonisation

Any standard must incorporate a dual score consisting of: a LCA value for finished products so that customers can clearly see the embodied carbon emissions of the steel they purchase, and; a decarbonisation rating system akin to the labelling system already used in the EU for white goods, which measures the level of steel producers' decarbonisation progress.

Sliding scale based on percentage of scrap input

Any standard must incentivise all steel producers to progress towards net zero, irrespective of the technology they start with. The carbon emissions in a tonne of steel is heavily influenced by the metallic input used in steelmaking, with secondary steelmaking (scrap-based) carrying a much lower carbon footprint than primary steelmaking (iron ore based). Although scrap steel has an important role to play in the decarbonisation of the global steel industry, it is a finite resource which is already fully utilised, and primary steel will continue to be needed to meet steel demand until well beyond 2050. Therefore, we firmly align with the view of both ResponsibleSteel and the IEA that a low-carbon emissions steel standard needs to incorporate a sliding scale which accounts for the metallic input (primary/iron ore vs. secondary/scrap) of steelmaking and incentivises decarbonisation through the introduction of low-carbon emissions technology rather than simply by increasing the amount of scrap used.

Boundary

It is critical that a consistent boundary is used in order to enable a like-for-like comparison between steel producers for the decarbonisation rating system, and that this boundary is representative of the core emissions of steel production. Therefore, in its initial phase our concept proposes a core steel system boundary that can be readily measured today, based on the Net-Zero Steel Pathway Methodology Project, which counts all Scope 1 and 2 emissions as well as selected Scope 3 emissions from ironmaking, steelmaking, casting and rolling1. As measuring methodology and primary upstream emissions data becomes available this boundary would then be extended in a second phase to include upstream emissions.

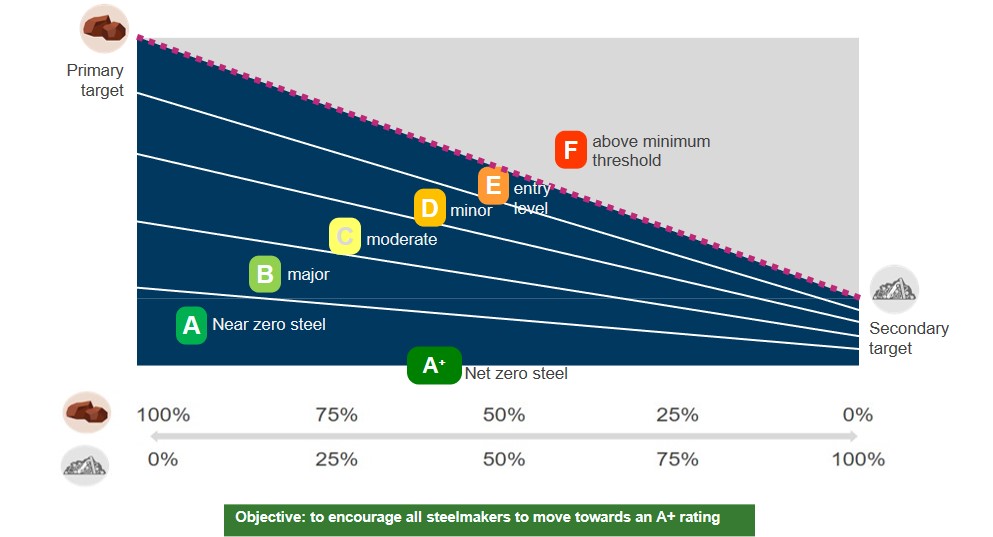

The graph below demonstrates the concept of how the decarbonisation rating system would work.

A steel producer's position on the graph would be based on their embodied carbon emissions per tonne of hot rolled steel (y-axis) and the metallic input they use (x-axis). The producer's position would fall above or below a threshold line, indicating whether they would be producing low-carbon emissions steel or not.

Furthermore, steel producers which fall on or below the threshold would then be split into six bands - A+ to E - with the producer progressing through the bands as they decarbonise. This system could therefore be used by policy makers and customers to incentivise producers to further decarbonise in order to attain a higher rating (with A and A+ being the highest and the only category where producers could claim their steel to be near zero (A) or net zero (A+)). Similar to ResponsibleSteel and the IEA, the threshold for near-zero steel should be set at a level which supports all potential decarbonisation routes.

Finally, any standard should also still recognise the early actions taken by first movers to enable customers to report reductions in their Scope 3 emissions through the purchase of virtual certificates. This should be represented through the inclusion of the 'S' certificate.

For further details on ArcelorMittal's proposal for a low-carbon emissions standard please visit https://corporate.arcelormittal.com/climate-action/low-carbon-emissions-steel-standardor have a look at our animated video which explains the standard and its methodology here - https://www.youtube.com/watch?v=6S5rDGasH-s.

ENDS

About ArcelorMittal

ArcelorMittal is the world's leading steel and mining company, with a presence in 60 countries and primary steelmaking facilities in 16 countries. In 2021, ArcelorMittal had revenues of $76.6 billion and crude steel production of 69.1 million metric tonnes, while iron ore production reached 50.9 million metric tonnes.

Our purpose is to produce ever smarter steels that have a positive benefit for people and planet. Steels made using innovative processes which use less energy, emit significantly less carbon and reduce costs. Steels that are cleaner, stronger and reusable. Steels for electric vehicles and renewable energy infrastructure that will support societies as they transform through this century. With steel at our core, our inventive people and an entrepreneurial culture at heart, we will support the world in making that change. This is what we believe it takes to be the steel company of the future.

ArcelorMittal is listed on the stock exchanges of New York (MT), Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish stock exchanges of Barcelona, Bilbao, Madrid and Valencia (MTS).

For more information about ArcelorMittal please visit: http://corporate.arcelormittal.com/

| Contact information ArcelorMittal Investor Relations | |

| General | +44 20 7543 1128 |

| Retail | +44 20 3214 2893 |

| SRI | +44 20 3214 2801 |

| Bonds/Credit | +33 171 921 026 investor.relations@arcelormittal.com (mailto:investor.relations@arcelormittal.com) |

| Contact information ArcelorMittal Corporate Communications | |

| Paul Weigh Tel: E-mail: | +44 20 3214 2419 press@arcelormittal.com (mailto:press@arcelormittal.com) |

1 To see exactly what is included in the boundary please see https://corporate.arcelormittal.com/media/phendpxm/arcelormittal-low-emissions-steelmaking-standards-proposal.pdf