Defined terms used in this announcement have the same meaning as given to them in the Company's announcement released on June 23, 2022, unless otherwise defined herein.

CALGARY, AB / ACCESSWIRE / July 7, 2022 / Southern Energy Corp. ("Southern" or the "Company") (TSXV:SOU)(AIM:SOUC), a U.S.-focused, growth-oriented natural gas producer, is pleased to announce the closing of its previously announced Offering to raise, in aggregate, gross proceeds of US$31.0 million through the issue of 46,371,927 new Common Shares. The Underwriters will not be exercising the over-allotment option granted to them in connection with the Offering.

The net proceeds from the Offering will be used to accelerate the initiation of a continuous organic drilling programme at the Company's Gwinville field, as well as increase the Company's financial flexibility for potential acquisition opportunities.

Ian Atkinson, President and CEO of Southern, commented:

"With our strengthened financial capability, we now look ahead to further exciting operational activity at Gwinville while also being capable of considering M&A opportunities in our core area of expertise from a position of strength. With a multi-year drilling inventory in Gwinville alone, we look forward to realising our forward growth potential of our goal to reach 25,000 boe/d; with more drilling anticipated to begin later this year."

"I would like to thank all of our new and existing shareholders for their support throughout this process as well as for their continued engagement in our Company."

Financial Update

On June 27, 2022, the Company entered into basis swaps covering just under 40% of our physical price exposure with a natural gas basis swap transaction to secure an average premium to NYMEX of $0.39 per MMBtu from July 1, 2022 to December 31, 2022. This opportunity exists due to increased natural gas demand in the southeast Gulf States where traditionally the pricing would range between NYMEX plus or minus $0.05 per MMBtu. Strong demand in our core area is further highlighted by spot basis where our natural gas is currently selling for a $3.40 per MMBtu premium to NYMEX. The Company continues to monitor these premium prices and is prepared to hedge additional basis exposure at these elevated basis premiums.

Calvin Yau, Chief Financial Officer of Southern, commented:

"We are now selling natural gas at a premium to NYMEX pricing which I believe is indicative of the current supply and demand dynamics we are facing in the United States, and our ability to lock in long term hedges at these elevated basis premiums is indicative that this supply demand imbalance is forecasted to remain for an extended period of time."

Admission and Total Voting Rights

Further to the Company's announcement on May 6, 2022 regarding the application to AIM for a block admission in respect of certain outstanding dilutive instruments in the Company (the "Block Admission"), the Company notes that 3,101,875 new Common Shares were issued in June 2022 pursuant to the exercise of such instruments. Accordingly, as at June 30, 2022, Southern Energy had 89,536,858 Common Shares in issue.

Following the issue of the Offering Shares, Southern has 135,908,785 Common Shares in issue. There are no Common Shares held in treasury and each Common Share entitles the holder to a single vote at general meetings of the Company. This figure may therefore be used by shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change in their interest in, the share capital of the Company.

The Placing Shares were issued and admitted to trading on AIM on July 5, 2022 and the Prospectus Offering Shares are expected to be admitted to trading on AIM at 8:00 a.m. (UK) on or around July 8, 2022.

PDMR Dealings

It is noted that certain Directors and other PDMRs of the Company have participated in the Prospectus Offering, on the same terms as all other participants, to subscribe for, in aggregate, 448,274 Prospectus Shares. Further details regarding individual participation of the Company's Directors and other PDMRs are set out in the PDMR notification forms below.

About Southern Energy Corp.

Southern Energy Corp. is a natural gas exploration and production company. Southern has a primary focus on acquiring and developing conventional natural gas and light oil resources in the southeast Gulf States of Mississippi, Louisiana, and East Texas. Our management team has a long and successful history working together and have created significant shareholder value through accretive acquisitions, optimization of existing oil and natural gas fields and the utilization of re-development strategies utilizing horizontal drilling and multi-staged fracture completion techniques.

For further information, please contact:

Southern Energy Corp.

Ian Atkinson (President and CEO) +1 587 287 5401

Calvin Yau (VP Finance and CFO) +1 587 287 5402

Strand Hanson Limited - Nominated & Financial Adviser +44 (0) 20 7409 3494

James Spinney / James Bellman / Rob Patrick

Canaccord Genuity - Joint Broker +44 (0) 20 7523 8000

Henry Fitzgerald-O'Connor / James Asensio

Hannam & Partners - Joint Broker +44 (0) 20 7907 8500

Samuel Merlin / Ernest Bell

Camarco +44 (0) 20 3757 4980

James Crothers / Billy Clegg / Hugo Liddy

Forward Looking Statements

Certain information included in this Announcement constitutes forward-looking information under applicable securities legislation. Forward-looking information typically contains statements with words such as "anticipate", "believe", "expect", "plan", "intend", "estimate", "propose", "project" or similar words suggesting future outcomes or statements regarding an outlook. Forward-looking information in this Announcement may include, but is not limited to, statements concerning the use of proceeds of the Offering, the Company's business strategy, objectives, strength and focus and the Company's capital program.The forward-looking statements contained in this Announcement are based on certain key expectations and assumptions made by Southern, including the timing of and success of future drilling, development and completion activities, the performance of existing wells, the performance of new wells, the availability and performance of facilities and pipelines, the geological characteristics of Southern's properties, the characteristics of its assets, the successful application of drilling, completion and seismic technology, benefits of current commodity pricing hedging arrangements, prevailing weather conditions, prevailing legislation affecting the oil and gas industry, commodity prices, royalty regimes and exchange rates, the application of regulatory and licensing requirements, the availability of capital, labour and services, the creditworthiness of industry partners and the ability to source and complete asset acquisitions. Although Southern believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Southern can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, the risk that the Company may apply the proceeds of the Offering differently than as stated herein depending on future circumstances; risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), constraint in the availability of services, negative effects of the current COVID-19 pandemic, commodity price and exchange rate fluctuations, geo-political risks, political and economic instability abroad, wars (including Russia's military actions in Ukraine), hostilities, civil insurrections, inflationary risks including potential increases to operating and capital costs, changes in legislation impacting the oil and gas industry, adverse weather or break-up conditions and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures. These and other risks are set out in more detail in the Final Prospectus and Southern's most recent management's discussion and analysis and annual information form, which are available under the Company's SEDAR profile at www.sedar.com.The forward-looking information contained in this Announcement is made as of the date hereof and Southern undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless required by applicable securities laws. The forward-looking information contained in this Announcement is expressly qualified by this cautionary statement.

http://www.southernenergycorp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

PDMR NOTIFICATION FORMS

| 1 | Details of the person discharging managerial responsibilities / person closely associated | |

| a) | Name |

|

| 2 | Reason for the notification | |

| a) | Position/status |

|

| b) | Initial notification/Amendment | Initial notification |

| 3 | Details of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor | |

| a) | Name | Southern Energy Corp. |

| b) | LEI | 213800R25GL7J3EBJ698 |

| 4 | Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted | |

| a) | Description of the financial instrument, type of instrument | Common shares in Southern Energy Corp.. |

| Identification code | CA8428131059 | |

| b) | Nature of the transaction | Subscription for new common shares |

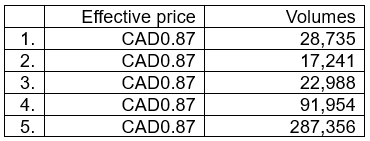

| c) | Price(s) and volume(s) |

|

| d) | Aggregated information | N/A (single transaction for each individual) |

| e) | Date of the transaction | 07 July 2022 |

| f) | Place of the transaction | Outside of a trading venue |

TR-1: Standard form for notification of major holdings

| NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and to the FCA in Microsoft Word format if possible)i | ||||||

| 1a. Identity of the issuer or the underlying issuer of existing shares to which voting rights are attachedii: | SOUTHERN ENERGY CORP | |||||

| 1b. Please indicate if the issuer is a non-UK issuer (please mark with an "X" if appropriate) | ||||||

| Non-UK issuer | ||||||

| 2. Reason for the notification (please mark the appropriate box or boxes with an "X") | ||||||

| An acquisition or disposal of voting rights | X | |||||

| An acquisition or disposal of financial instruments | ||||||

| An event changing the breakdown of voting rights | ||||||

| Other (please specify)iii: | X | |||||

| 3. Details of person subject to the notification obligationiv | ||||||

| Name | CANACCORD GENUITY GROUP INC | |||||

| City and country of registered office (if applicable) | VANCOUVER, CANADA | |||||

| 4. Full name of shareholder(s) (if different from 3.)v | ||||||

| Name | DISCRETIONARY CLIENTS | |||||

| City and country of registered office (if applicable) | As above | |||||

| 5. Date on which the threshold was crossed or reachedvi: | 05 JULY 2022 | |||||

| 6. Date on which issuer notified (DD/MM/YYYY): | 06 JULY 2022 | |||||

| 7. Total positions of person(s) subject to the notification obligation | ||||||

% of voting rights attached to shares (total of 8. A) | % of voting rights through financial instruments | Total of both in % (8.A + 8.B) | Total number of voting rights held in issuer (8.A + 8.B) vii | |||

| Resulting situation on the date on which threshold was crossed or reached | 5.0361 | 5.0361 | 5,532,110 | |||

Position of previous notification (if applicable) | N/a | |||||

8. Notified details of the resulting situation on the date on which the threshold was crossed or reachedviii | |||||||||

| A: Voting rights attached to shares | |||||||||

| Class/type of shares ISIN code (if possible) | Number of voting rightsix | % of voting rights | |||||||

Direct | Indirect | Direct | Indirect | ||||||

| CA8428133059 | 5,532,110 | 5.0361 | |||||||

| SUBTOTAL 8. A | 5,532,110 | 5.0361 | |||||||

| B 1: Financial Instruments according to DTR5.3.1R (1) (a) | |||||||||

| Type of financial instrument | Expiration datex | Exercise/ Conversion Periodxi | Number of voting rights that may be acquired if the instrument is exercised/converted. | % of voting rights | |||||

| SUBTOTAL 8. B 1 | |||||||||

| B 2: Financial Instruments with similar economic effect according to DTR5.3.1R (1) (b) | |||||||||

| Type of financial instrument | Expiration datex | Exercise/ Conversion Period xi | Physical or cash settlementxii | Number of voting rights | % of voting rights | ||||

| SUBTOTAL 8.B.2 | |||||||||

9. Information in relation to the person subject to the notification obligation (please mark the applicable box with an "X") | ||||

| Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuerxiii | ||||

| Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entityxiv (please add additional rows as necessary) | X | |||

Namexv | % of voting rights if it equals or is higher than the notifiable threshold | % of voting rights through financial instruments if it equals or is higher than the notifiable threshold | Total of both if it equals or is higher than the notifiable threshold | |

| Canaccord Genuity Group Inc. | 5.0361 | 5.0361 | ||

| Canaccord Genuity Wealth Group Holdings Limited | 5.0361 | 5.0361 | ||

| Canaccord Genuity Wealth Group Holdings (Jersey) Limited | 5.0361 | 5.0361 | ||

| Canaccord Genuity Wealth Group Limited | 5.0361 | 5.0361 | ||

| Hargreave Hale Ltd | 5.0361 | 5.0361 | ||

| 10. In case of proxy voting, please identify: | ||||

| Name of the proxy holder | ||||

| The number and % of voting rights held | ||||

| The date until which the voting rights will be held | ||||

| 11. Additional informationxvi | ||||

| The change in holding is entirely due to the participation in the placing, shares from which were admitted to AIM on the 5th July | ||||

| Place of completion | BLACKPOOL, ENGLAND |

| Date of completion | 06 JULY 2022 |

SOURCE: Southern Energy Corp.

View source version on accesswire.com:

https://www.accesswire.com/707822/Southern-Energy-Corp-Announces-Completion-of-Fundraising-and-Premium-to-NYMEX-Pricing-Contract