TORONTO, ON / ACCESSWIRE / August 30, 2022 / Power Nickel Inc. (the "Company" or "Power Nickel") (TSX-V:PNPN)(OTCBB:CMETF)(Frankfurt IVVI) has filed on SEDAR the Technical Report entitled "NI 43 101 Technical Report and Mineral Resource Estimate for the Nisk Project, Eeyou Istchee James Bay territory, Québec". The Technical Report was prepared by 3DGeo Solution Inc. (3DGS) of Val-d'Or, Québec, to support the disclosure of the Nisk Project 2022 Mineral Resource Estimate on July 19, 2022. The Technical Report is available on SEDAR and will be made available on the company's website.

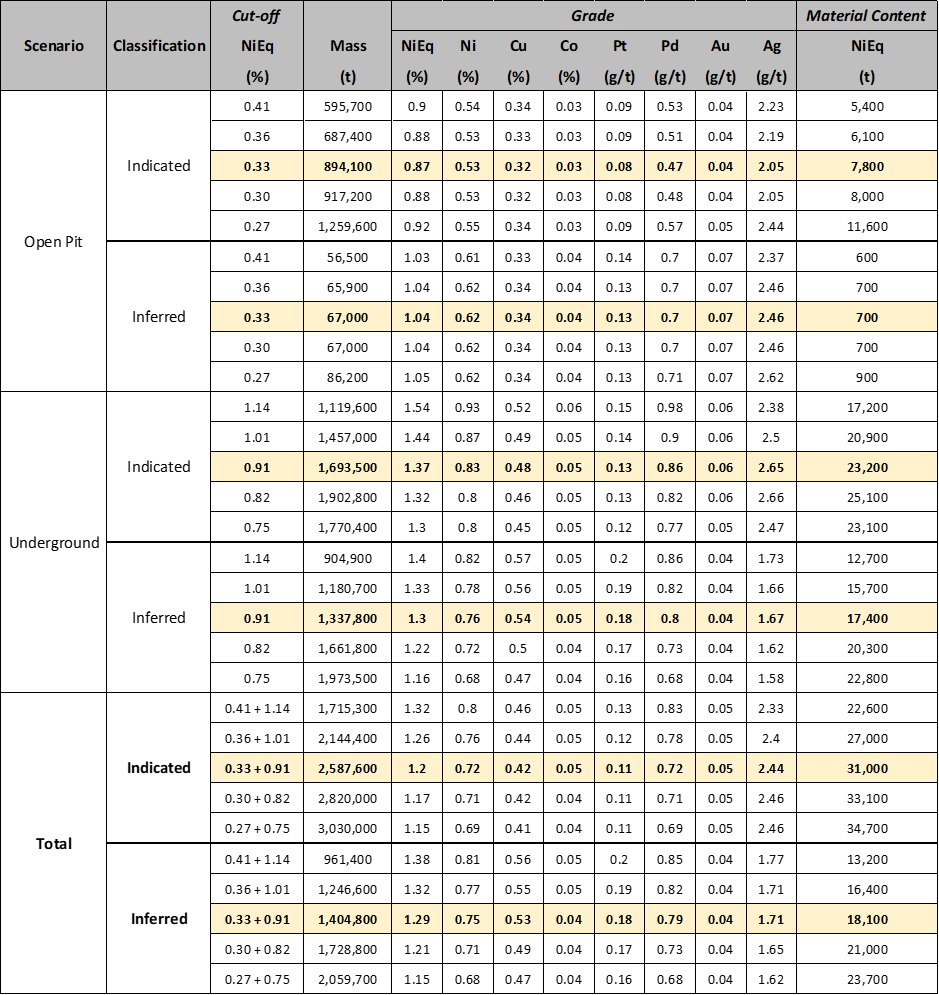

Outlined below is a summary of Power Nickel's Nisk Project Mineral Resource Estimate; with an effective date of May 17, 2022:

The Mineral Resource has been defined in both Open-Pit and Underground mining scenarios

The combined estimated Indicated Resources is 2.6 million tonnes grading 1.20 %NiEq, using a base case cut-off grade of 0.33 %NiEq for open pit constrained resources and a base case cut-off grade of 0.91 %NiEq for underground constrained resources.

The combined estimated Inferred Resources is 1.4 million tonnes grading 1.29 %NiEq, using a base case cut-off grade of 0.33 %NiEq for open pit constrained resources and a base case cut-off grade of 0.91 %NiEq for underground constrained resources.

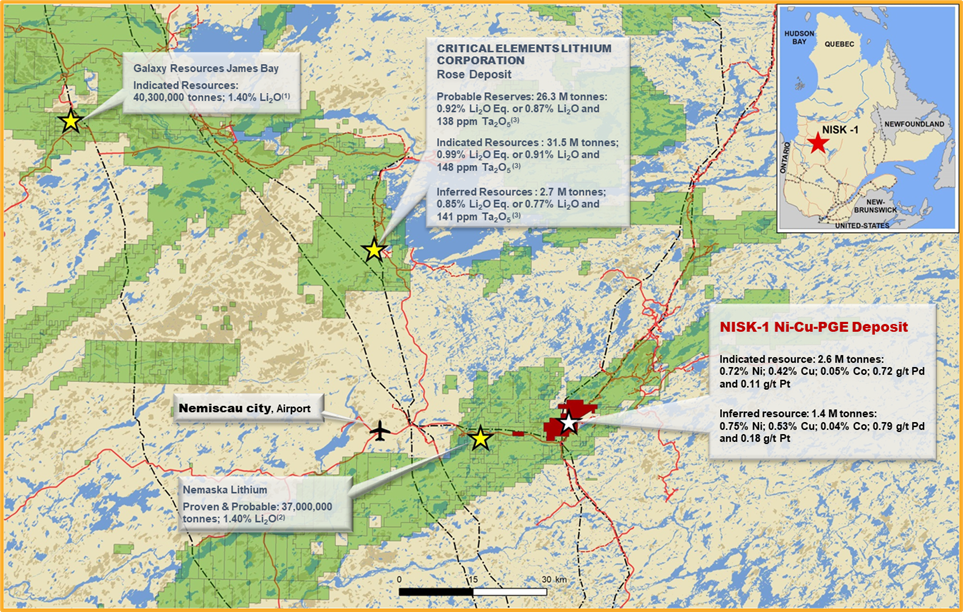

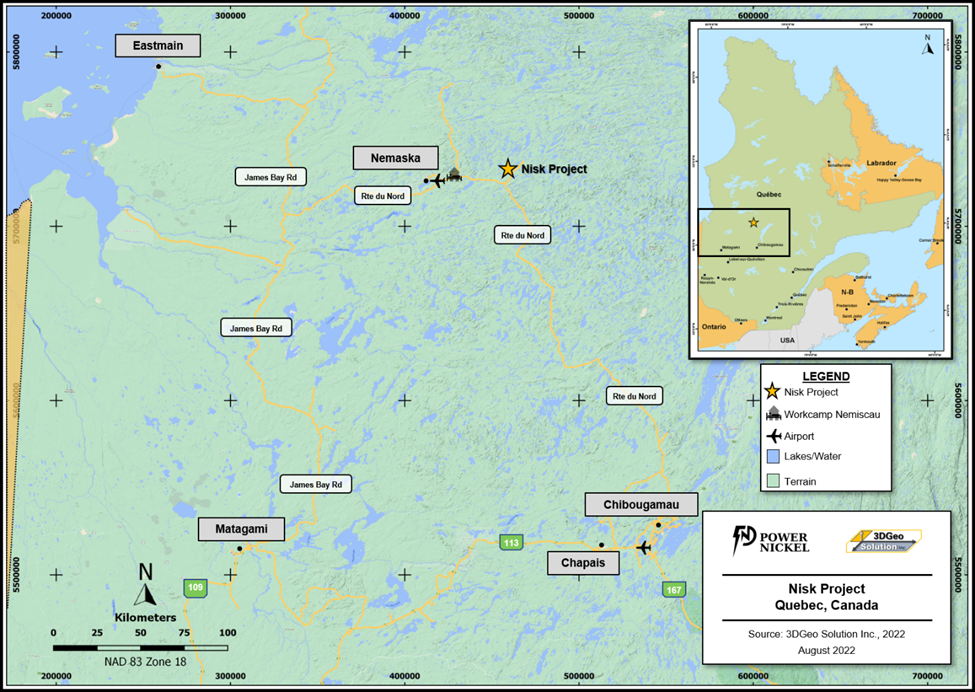

The Nisk Project is located south of James Bay, a region that is the site of several mining projects (Figure 1) and improving infrastructure (Figure 2).

Figure 1 - Location of the Nisk Project with respect to the location of other known deposits.

Figure 2 - Location of the Nisk Project with respect to the current infrastructure available in the area.

Power Nickel completed the acquisition of its option to acquire up to 80% of the Nisk Project from Critical Elements Lithium Corp. The Nisk Project comprises a significant land position (20 kilometers of strike length) with numerous high-grade Nickel intercepts. Since completion of the option, Power Nickel retained 3DGeo Solution Inc to create a geological model of the Nisk Project and used this as a guide to the very successful initial Power Nickel 2400-metre drill program completed last December and reported in March of 2022.

Based on this drill program and the historical drill results, 3DGeo Solution Inc. was mandated to produce a NI 43-101 compliant Mineral Resource Estimate and Technical Report. Engineering work related to defining a constraining pit shell and underground mineable shapes was contracted to InnovExplo Inc. The Highlights of the Mineral Resource Estimate and Technical Report are below.

Table 1 - 2022 Nisk Project Mineral Resource Estimate.

Note: NiEq = Nickel Equivalent, Ni = Nickel, Cu = Copper, Co = Cobalt, Pt = Platinum, Pd = Palladium, Au = Gold, Ag = Silver, % = Percent, g = Gram, t = Metric tonne

Notes to Accompany Mineral Resource Table:

1. The Independent Qualified Persons for the purposes of this Mineral Resource Estimate (MRE), as defined in NI 43-101, is Kenneth Williamson, P.Geo.. (OGQ # 1490) of Solution 3DGéo inc. The effective date of the estimate is May 17, 2022. 2. The estimate of the mineral resources of the Nisk Project complies with the "CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines" of November 29, 2019. The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy, and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014), and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council. 3. These mineral resources are not mineral reserves since their economic viability has not been demonstrated. 4. The resources are presented before dilution and in situ and are considered to have reasonable prospects of economic extraction. Isolated and discontinuous blocks with a grade greater than the selected cut-off grade are excluded from the estimate of underground mineral resources. The blocks that must be included, i.e., isolated blocks with a grade below the cut-off grade located within potentially mineable volumes, have been included in the mineral resource estimate. 5. As of May 17, 2022, the database included a total of 66 drill holes (59 historic and seven recent 2021 drill holes) totaling 15,266.3 meters of drilling. 6. A value of half of the assay lab detection limit for each element was used as a grade for the un-assayed core. 7. The assays were grouped within the mineralized domains in composites of 1.00 meters in length. 8. The block model was prepared using Leapfrog® Geo and Edge software. The block model consists of 2-meter parent blocks and sub-blocks of 1 meter. The block model has a dip azimuth of 340°. 9. An interpolation according to the "inverse distance squared" ("ID2") method was performed to estimate the grades in the interpreted mineralized volume. 10. An interpolation according to the "inverse distance squared" ("ID2") method was performed to estimate the Density (SG) in the interpreted mineralized volume. Sample intervals with missing SG values were calculated based on a strong correlation with %Ni. The calculation used was SG = (0.7001 x %Ni) + 2.6751. 11. The "Open Pit" mineral resources are presented at a cut-off grade of 0.33 %NiEq and are confined within a "Whittle" pit shell. The "Underground" mineral resources are presented at a cut-off grade of 0.91 %NiEq and are confined within volumes defined using "DSO" (Deswik Stope Shape Optimizer). These volumes correspond to groups of contiguous blocks with a reasonable size to be exploited by underground mining methods. 12. The engineering work required for the cut-off grade estimation and the creation of the DSO volumes were performed by InnovExplo Inc., and the following economic parameters were used: US $8.00/lb Nickel, $3.00/lb Cu, $25.00/lb Cobalt, $1000/Oz Platinum, $1000/Oz Palladium, $1300/Oz Gold, and $17.00/Oz Silver; Exchange rate of USD/CAD 1.30, metallurgical recovery of 85%, total processing cost CA $40.00/t, mining cost CA $6.00/t, mining overburden cost CA $4.20/t, underground mining cost CA $110.00/t, G&A cost CA $12.20/t, northern logistics costs CA $10.00/t. It should be noted that the G&A cost could be underestimated depending on the extraction sequence chosen. 13. The independent qualified person is not aware of any environmental, licensing, legal, title-related, tax, socio-political or marketing-related issue, or any other relevant issue that could have a material impact on the estimate of mineral resources. 14. The numbers of tonnes are rounded to the nearest hundred to reflect uncertainties, which may cause slight differences. |

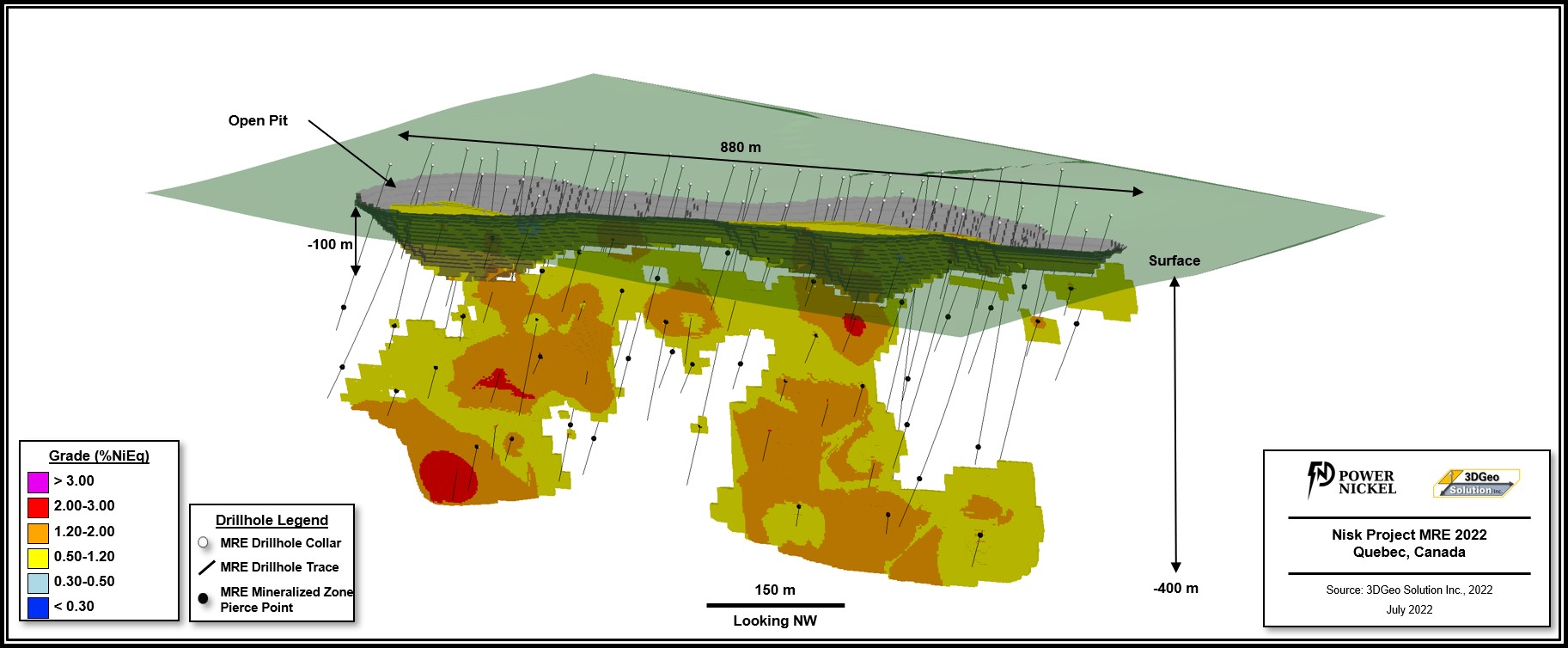

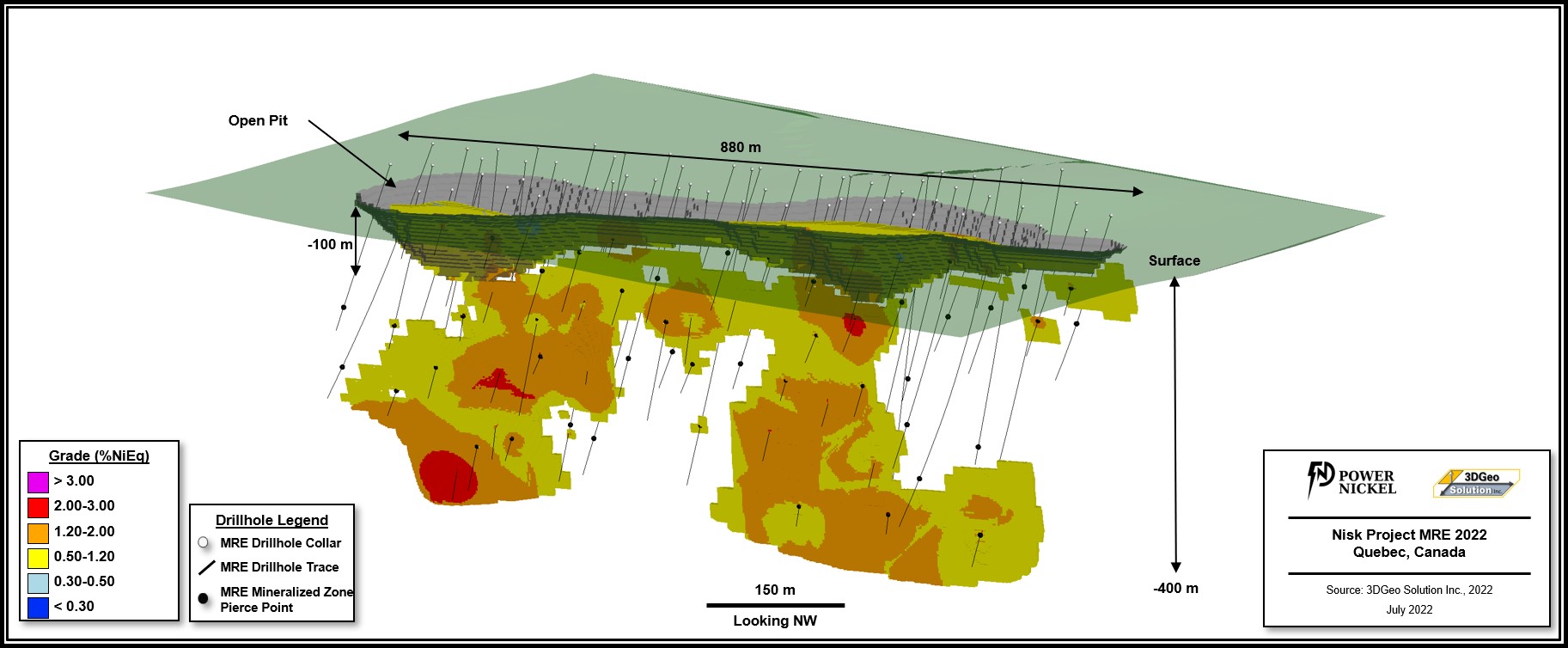

"Power Nickel was extremely pleased with the inaugural Mineral Resource Estimate and Technical Report. When taken in context with our very conservative assumptions and the clear infill drilling opportunities, as outlined below in the two figures showing isometric views of the potentially economic pit-constrained and underground stope-constrained mineral resources, we feel we have shown Nisk has significant commercial potential. The resource update has clearly indicated some additional infill drilling is needed, and these holes, as well as step-out targets, are now in the process of being permitted as part of our upcoming fully funded drill program," commented Power Nickel CEO Terry Lynch. "We already have permitted several drill targets to the flanks of the current deposit designed to extend the deposit and test new potential pods for additional resources. Historically, Nickel Sulfide deposits don't exist in isolated solo deposits but typically have a string of pearl formation where multiple pearls or pods of resources are assembled in a close geographic area. The next round of drilling, commencing in September, will focus on infill drilling targets outlined by the Mineral Resources Estimate and Technical Report and on this search to extend and discover new Nickel pods. We expect this phase of drilling to continue through the fall with a minimum of 3,000 meters drilled and a maximum of 7,000 meters depending on our ability to continue to intersect the Black Peridotite rock, which is carrying the Nickel grade in the Nisk deposit."

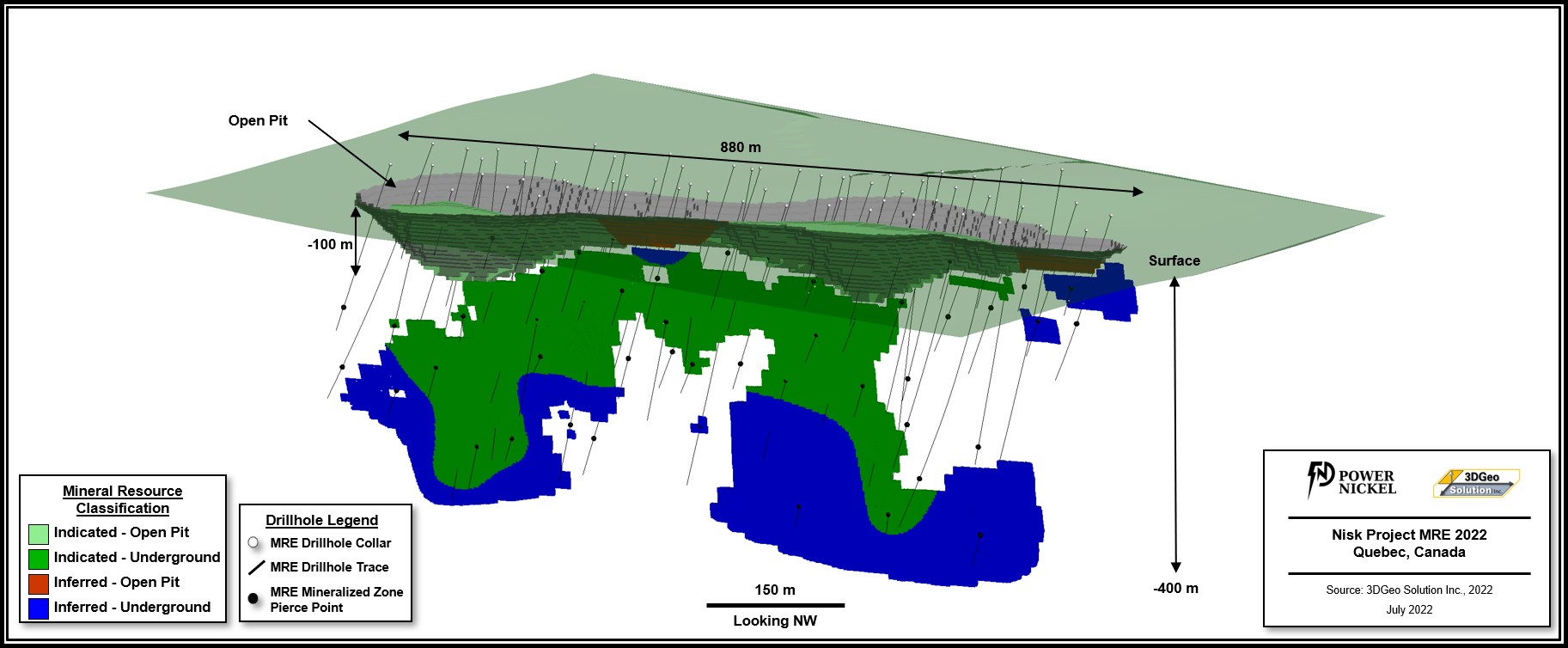

Figure 3 shows the grade of the Nickel Equivalent (%NiEq) mineral resources, and Figure 4 shows the mineral resource classification (indicated and inferred). Note that portions of the deposit still contain unclassified mineral potential and requiring more infill drilling to potentially include this in a future updated MRE.

Figure 3 - Isometric view of the 2022 Nisk Project Mineral Resource Estimate, showing both the open pit constrained resources (using a cut-off grade of 0.33 %NiEq) and the underground constrained resources (at a cut-off grade of 0.91 %NiEq).

Figure 4 - Isometric view of the 2022 Nisk Project Mineral Resource Classification, showing both the open pit constrained resources (using a cut-off grade of 0.33 %NiEq) and the underground constrained resources (at a cut-off grade of 0.91 %NiEq).

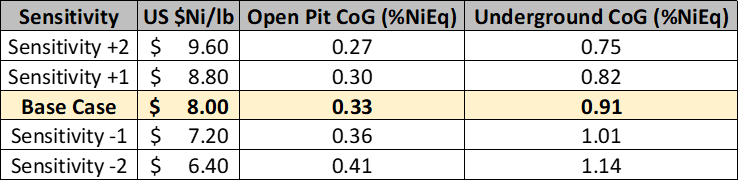

Table 2 shows the different cut-off grade (CoG) sensitivities based on Nickel Price (+/- 10% and 20% of the base case scenario). The base case scenario is highlighted in light yellow. Table 3 shows the CoG and correlated Nickel metal prices in USD$ per pound.

Table 2 - 2022 Nisk Project Mineral Resource Estimate Cut-off Grade Sensitivity.

Note: NiEq = Nickel Equivalent, Ni = Nickel, Cu = Copper, Co = Cobalt, Pt = Platinum, Pd = Palladium, Au = Gold, Ag = Silver, % = Percent, g = Gram, t = Metric tonne; Base Case highlighted in light yellow.

Table 3 - 2022 Nisk Project Mineral Resource Estimate Cut-off Grade Sensitivity with Correlated Nickel Price Sensitivity.

Qualified Persons

This Technical Report has been prepared by Kenneth Williamson, P.Geo., M.Sc. and Matthew DeGasperis, P.Geo., B.Sc., from 3DGS. The 2022 MRE was designed by Kenneth Williamson, P.Geo., M.Sc.

Kenneth Williamson, P.Geo., M.Sc., is a professional geologist member in good standing of the Ordre des Géologues du Québec (OGQ license #1490) and the Professional Geoscientists of Ontario (license #2176) and is the independent qualified person ("QP") as defined by NI 43-101 for all sections of the Technical Report.

Matthew DeGasperis, P.Geo., B.Sc., is a professional geologist member in good standing of the Ordre des Géologues du Québec (OGQ license #2261) and the Professional Geoscientists of Ontario (license #3438) and is the independent qualified person ("QP") as defined by NI 43-101 for all sections of the Technical Report, except for Item 14 - Mineral Resource Estimate. Work performed on Item 14 has been done under the direct supervision of Kenneth Williamson, P.Geo.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on high-potential copper, gold, and battery metal prospects in Canada and Chile.

On February 1, 2021, Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE: TSXV)

The NISK property comprises a significant land position (20 kilometers of strike length) with numerous high-grade intercepts. Power Nickel, formerly Chilean Metals, is focused on confirming and expanding its current high-grade nickel-copper PGE mineralization historical resource by preparing a new Mineral Resource Estimate in accordance with NI 43-101, identifying additional high-grade mineralization, and developing a process to potentially produce nickel sulphates responsibly for batteries to be used in the electric vehicles industry.

Power Nickel (then called Chilean Metals) announced on June 8th, 2021, that an agreement has been made to complete the 100% acquisition of its Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in a total of 67 million ounces of gold, 569 million ounces of silver, and 27 billion pounds of copper. This property hosts two known mineral showings (gold ore and magee) and a portion of the past-producing Silverado mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described as polymetallic veins containing quantities of silver, lead, zinc, plus/minus gold, and plus/minus copper.

Power Nickel is the 100-per-cent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. It also owns a 3-per-cent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit, recently sold to a subsidiary of Teck Resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3-per-cent NSR for $ 3 million at any time. The Copaquire property borders Teck's producing Quebrada Blanca copper mine in Chile's first region.

For further information on Power Nickel Inc., please contact:

Mr. Terry Lynch, CEO

647-448-8044

terry@powernickel.com

For further information, readers are encouraged to contact:

Power Nickel Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

SOURCE: Power Nickel Inc.

View source version on accesswire.com:

https://www.accesswire.com/713968/Power-Nickel-Files-the-NI-43-101-Technical-Report-for-the-Mineral-Resource-Estimate-of-the-Nisk-Project