New Near-Surface High-Grade Mineralisation Intersected at MM Prospect

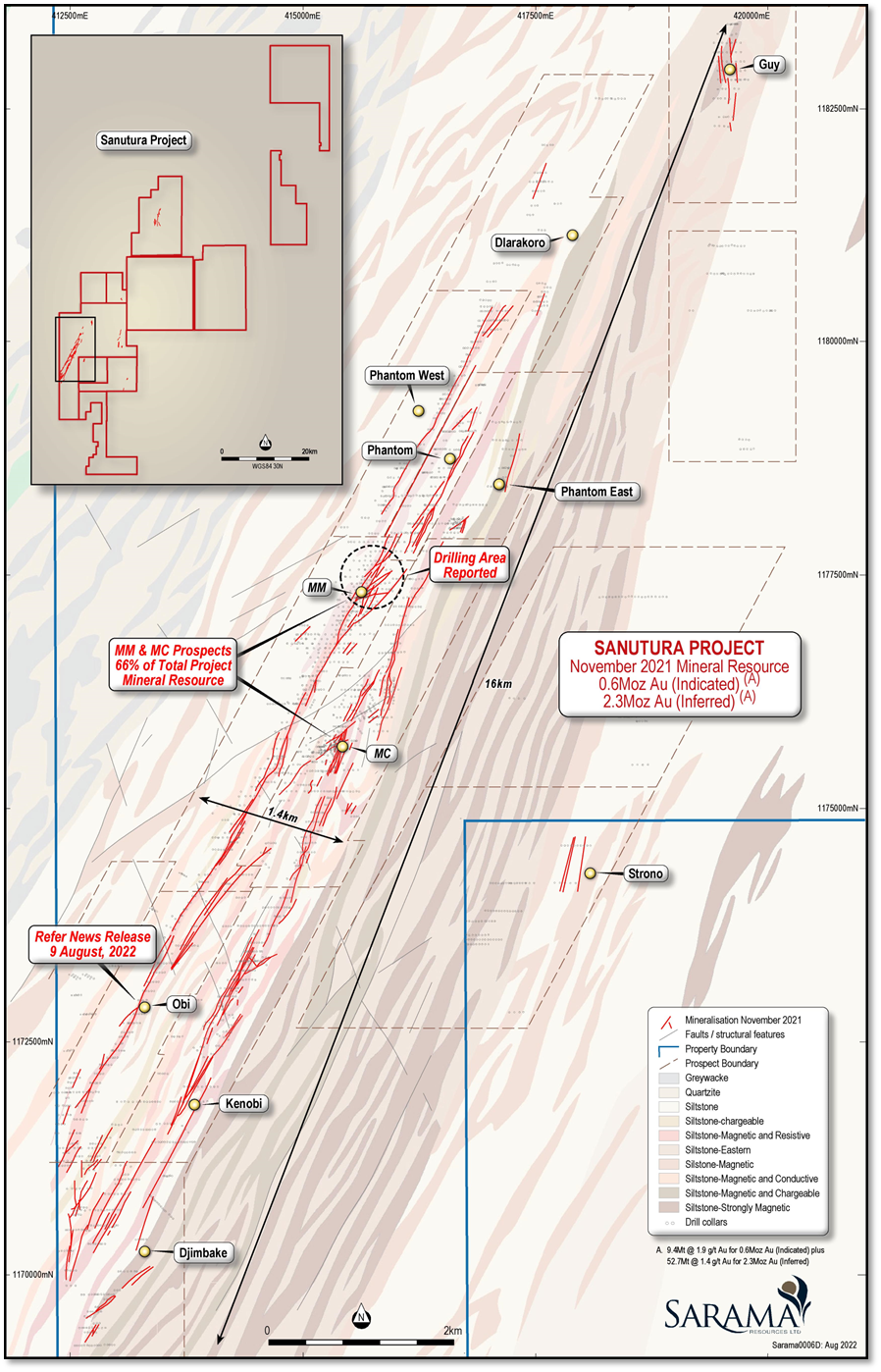

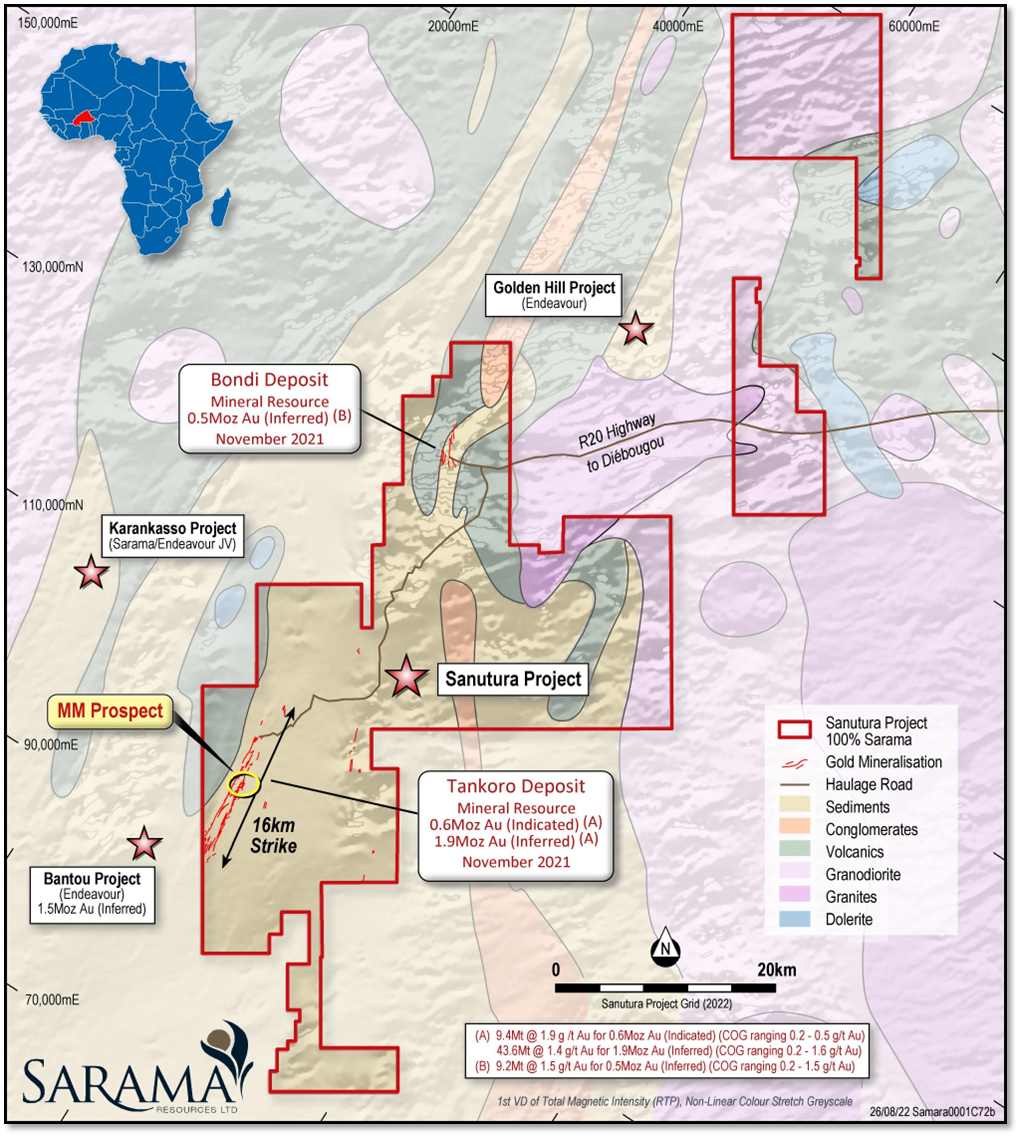

PERTH, AUSTRALIA / ACCESSWIRE / August 31, 2022 / Sarama Resources Ltd. ( "Sarama" or the "Company" ) (ASX:SRR)(TSXV:SWA) is pleased to announce that assays from a further 2,300m drilling at its 100%-owned (4) , multi-million ounce Sanutura Project (the "Project" ) confirm the discovery of new high-grade, near-surface gold mineralisation outside the current Mineral Resource at the MM Prospect (refer Figure 1); an area which is a key contributor to the Project's 0.6Moz Au (Indicated) plus 2.3Moz Au (Inferred) (1) Mineral Resource.

Highlights

- Multiple new high-grade intersections returned in oxide material at MM Prospect within the Sanutura Project

- Highlighted downhole intersections in oxide material from new assays include:

- 7m @ 8.25g/t Au from 53m in TAA254;

- 12m @ 4.26g/t Au from 21m in TAA360;

- 11m @ 4.50g/t Au from 30m in TAA252 (including 1m @ 20.20g/t Au);

- 11m @ 4.27g/t Au from 13m in TAA406;

- 5m @ 9.13g/t Au from 65m in TAA254 (intersection ended in mineralisation);

- 7m @ 4.98g/t Au from 23m in TAA234;

- 13m @ 2.68g/t Au from 11m in TAA369; and

- 11m @ 3.01g/t Au from 23m in TAA366.

- Discovery of new high-grade gold mineralisation as well as strike and up-dip extensions in oxide material; with high potential to add to the current oxide and transition component of the Mineral Resource

- Continuity of several high-grade shoots confirmed with drilling returning strong grades over broad widths

- Follow-up drilling, including greenfields exploration drilling, expected to commence in Q4 2022

Sarama's President, CEO & MD, Andrew Dinning commented:

"We are extremely pleased that this recent drilling has continued to grow the mineralised area of the MM Prospect, intersecting new, high-grade gold mineralisation and also confirming the continuity in high-value oxide zones. With its multiple lodes and abundance of high-grade intersections, the MM Prospect remains the economic focal point of the deposit and it is encouraging that new, shallow mineralisation continues to be discovered here. This drilling builds upon the recently reported exploration success at the Obi Prospect where extensive, flat-lying mineralisation with high-grade zones in oxide material was delineated, suggesting a new geological model for target generation. The MM and Obi Prospect drill results illustrate the potential for further additions to the already significant oxide and transition component of the Project's Mineral Resource and we remain confident that the ongoing +50,000m drill program will deliver into this potential. We look forward to providing a series of updates over the coming months as further results come to hand."

A Growth-Oriented Drill Program in Oxide Material

Drilling Delivers Additions and Extensions to Mineralisation at MM Prospect

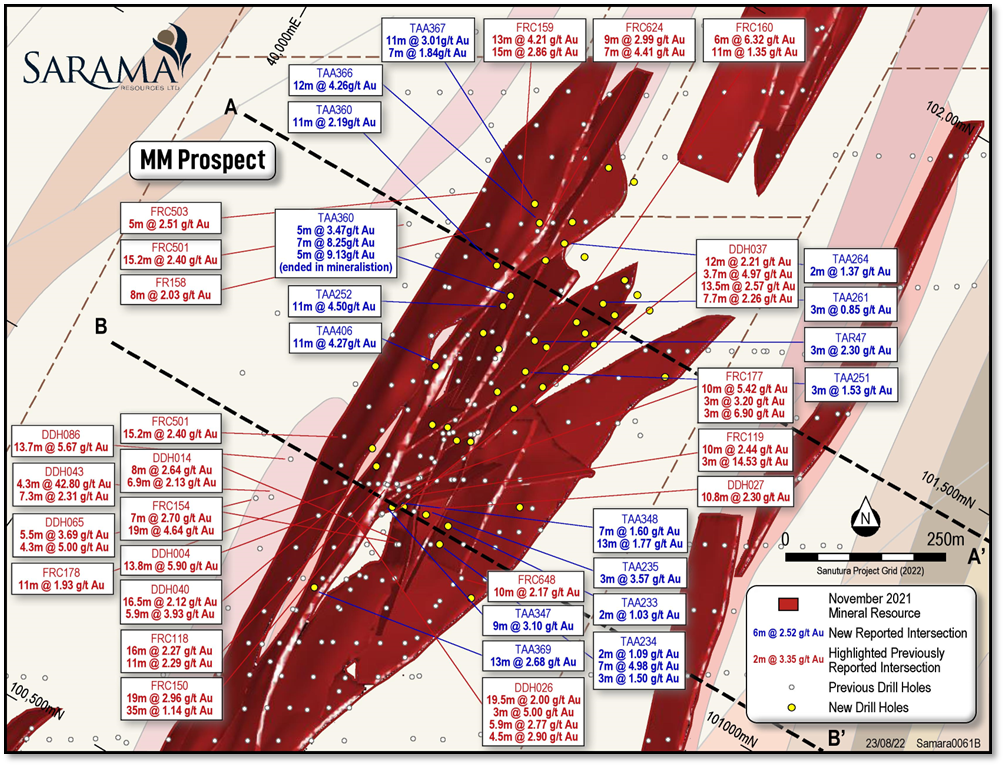

Results are being reported (refer Appendix A) for approximately 2,000m of aircore ( "AC" ) drilling (41 holes) and 300m of reverse-circulation ( "RC" ) drilling (4 holes) which commenced in May/June 2022 in the northern part of the MM Prospect (refer Figure 2). Highlighted downhole intersections from the new assays include:

- 7m @ 8.25g/t Au from 53m in TAA254;

- 12m @ 4.26g/t Au from 21m in TAA360;

- 11m @ 4.50g/t Au from 30m in TAA252 (including 1m @ 20.20g/t Au);

- 11m @ 4.27g/t Au from 13m in TAA406;

- 5m @ 9.13g/t Au from 65m in TAA254 (intersection ended in mineralisation);

- 7m @ 4.98g/t Au from 23m in TAA234;

- 13m @ 2.68g/t Au from 11m in TAA369;

- 11m @ 3.01g/t Au from 6m in TAA366;

- 13m @ 2.27g/t Au from 23m in TAA409;

- 9m @ 3.10g/t Au from 18m in TAA348;

- 11m @ 2.19 g/t Au from 22m in TAA367;

- 13m @ 1.77 g/t Au from 44m in TAA250; and

- 5m @ 3.47 g/t Au from 29m in TAA254.

The recent drilling targeted the near-surface oxide horizon to a depth of approximately 50m and is part of the ongoing +50,000m drill program at the Project which is designed to increase the current oxide and transition component of the Mineral Resource which currently stands at 0.2Moz Au (Indicated) plus 0.8Moz Au (Inferred) (2) .

An Economic Focal Point for the Sanutura Project

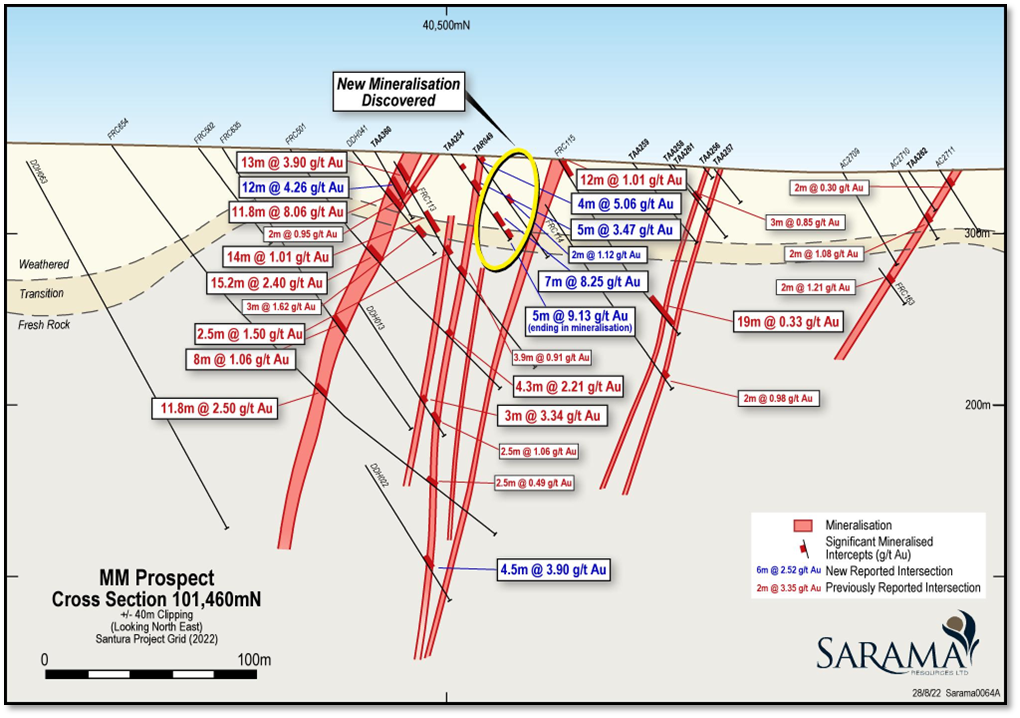

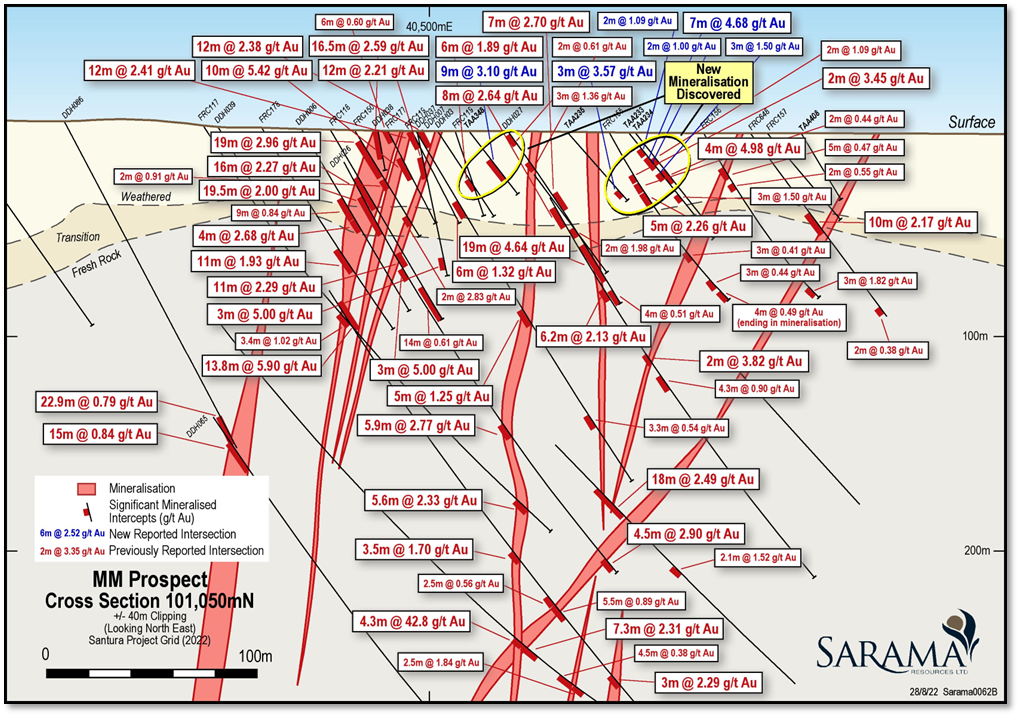

The MM Prospect features several high-grade shoots that extend from surface to a depth of approximately 600m. The recent drilling confirms the presence and continuity of shallow, higher-grade shoots and has intersected new, high-grade gold mineralisation outside of the current Mineral Resource in oxide material . Once modelled, these new zones are expected to increase the oxide component of the Mineral Resource and are anticipated to provide high-margin feed in the early stages of any mine development.

This area hosts gold mineralisation in multiple sub-parallel, steeply-dipping lenses, forming a consolidated package with a footprint up to 320m in width . The area of drilling spans approximately 1km along strike , sitting within the litho-structural corridor which hosts the 16km-long, drill-defined mineralisation that forms the deposit's Mineral Resource. Previous drilling (refer Appendix B) in the area intersected laterally extensive gold mineralisation, principally hosted in quartz-feldspar dykes striking north-north-east and gold-quartz vein-related secondary mineralisation (refer Figure 2).

Within the mineralised lode system, high-grade shoots have been modelled with significant strike and dip continuity. The lenses commence at surface and the abundance of high-grade shoots combined with the additive effect of the multiple sub-parallel lodes produces a compelling focal point for early-stage plant feed in any contemplated mine development scenario. The recently completed drill program sought to confirm the continuity of several higher-grade shoots and to test for additional oxide-hosted gold mineralisation within the consolidated lode package, but outside the Mineral Resource.

In addition to confirming the tenor and continuity of the higher-grade shoots, the program successfully intersected new, unmodelled mineralisation in 3 areas, which are expected to add to the oxide component of the Mineral Resource by way of new lodes being interpreted or existing lodes being extended up-dip and along strike (refer Figures 2-4).

The new drill intersections occur in an area with complex lode architecture, thought to be the result of several phases of structural deformation and gold-bearing fluid emplacement. Despite being relatively well drilled with spacings of 30-50m x 50m the new intersections illustrate the potential for additional mineralisation to be present in-between drilling and internal to the modelled lode package. This is particularly the case in zones closer to the principal north-north-east striking lodes which are seen to provide a fertile environment for fluid emplacement post the deformation event(s).

While the Company's exploration focus remains firmly on the near-surface oxide horizon, significant potential exists for similar mineralisation to occur at depth where drilling is more sparse. The Company anticipates following up on these new encouraging results during Q4 2022 with further shallow drilling.

An Already Large Mineral Resource with Potential to Grow

The Company's primary focus is its 100%-owned (4) Sanutura Project, which hosts a large Mineral Resource of 0.6Moz Au (Indicated) plus 2.3Moz Au (Inferred) (1) and covers an area of 1,420km 2 . The Project occupies a commanding position along 70km of strike in the prolific Houndé Belt (refer Figure 5); Burkina Faso's pre-eminent gold belt.

The Project lies 60km south of Endeavour Mining's Houndé Mine (5Moz Au); 120km south of Fortuna Silver's high-grade Yaramoko Mine (1Moz Au), and 140km south of Endeavour Mining's Mana Mine (5Moz Au), highlighting the significant gold endowment of the Houndé Belt (refer Appendix B). Endeavour Mining's Bantou Project (1.5Moz Au Inferred Mineral Resource (5) ) is located only 6km from the bulk of the Sanutura Project's main deposit, which illustrates the gold camp scale of endowment in the immediate area.

The Project has significant growth potential available and the primary objective of the current +50,000m drill program is to add to the existing 0.2Moz Au (Indicated) plus 0.8Moz Au (Inferred) (2) oxide and transition component of the Project's Mineral Resource to enhance the economics of mine development.

The recently commenced drill program has generally focused on shallow additional and extensional targets throughout the well-mineralised corridor, where mineralisation has been drill-defined for a semi-continuous strike length of 16km and where potential exists to expand the Mineral Resource at shallow depths in oxide material .

Drilling is currently on hold until the end of the wet season. The Company is currently interpreting results and revising plans for further drilling of its highest priority targets around the Mineral Resource and undertaking its regional greenfields exploration program, both commencing early in the next field season (Q4 2022).

Appendices

To access the appendices referred to in this announcement please click on the links below:

Appendix A: Summary of Recently Returned Drill Results

Appendix B: References to Previous ASX Disclosure

Appendix C: JORC Code (2012 Edition) - Table 1 Information

For further information on the Company's activities, please contact:

Andrew Dinning or Paul Schmiede

e: info@saramaresources.com

t: +61 8 9363 7600

For media enquiries, please contact:

Angela East

Media & Capital Partners

e: Angela.east@mcpartners.com.au

t: +61 428 432 025

ABOUT SARAMA RESOURCES LTD

Sarama Resources Ltd ( ASX: SRR , TSX-V: SWA ) is a West African focused gold explorer/developer with substantial landholdings in south-west Burkina Faso. Sarama is focused on maximising the value of its strategic assets and advancing its key projects towards development.

Sarama's 100%-owned (4) Sanutura Project is principally located within the prolific Houndé Greenstone Belt in south-west Burkina Faso and is the exploration and development focus of the Company. The project hosts the Tankoro and Bondi Deposits which have a combined Mineral Resource of 0.6Moz gold (Indicated) plus 2.3Moz gold (Inferred) (1) .

Together, the deposits present a potential mine development opportunity featuring an initial, long-life CIL project which may be established and paid for by the significant oxide Mineral Resource base.

Sarama has built further optionality into its portfolio including an approximate 470km² exploration position in the highly prospective Banfora Belt in south-western Burkina Faso. The Koumandara Project hosts several regional-scale structural features and trends of gold-in-soil anomalism extending for over 25km along strike.

Sarama also holds an approximate 18% participating interest in the Karankasso Project Joint Venture ( "JV" ) which is situated adjacent to the Company's Sanutura Project in Burkina Faso and is a JV between Sarama and Endeavour Mining Corp ( "Endeavour" ) in which Endeavour is the operator of the JV. In February 2020, an updated Mineral Resource estimate of 709koz gold (3) was declared for the Karankasso Project JV.

The Company's Board and management team have a proven track record in Africa and a strong history in the discovery and development of large-scale gold deposits. Sarama is well positioned to build on its current success with a sound strategy to surface and maximise the value of its property portfolio.

FOOTNOTES

- Mineral Resource estimate for Sanutura Project - 9.4Mt @ 1.9g/t Au for 0.6Moz Au (Indicated) plus 52.7Mt @ 1.4g/t Au for 2.3Moz (Inferred), reported at cut-off grades ranging 0.2-1.6g/t Au, reflecting the mining methods and processing flowsheets assumed to assess the likelihood of the Mineral Resources to have reasonable prospects for eventual economic extraction. The effective date of the Company's Mineral Resource estimate is 16 November 2021. For further information regarding the Mineral Resource estimate refer to the technical report titled "NI 43-101 Independent Technical Report Sanutura Project, South-West Burkina Faso", dated 7 February 2022 and prepared by Paul Schmiede, Rindra Le Grange and Fred Kock, and the Company's ASX Prospectus dated 11 March 2022. Paul Schmiede is an employee of Sarama. Ms Le Grange and Mr Kock are employees of Cube Consulting Pty Ltd and Orway Mineral Consultants Pty Ltd respectivley and are considered to be independent of Sarama. The technical report is available under Sarama's profile on SEDAR at www.sedar.com and the ASX Prospectus is available under Sarama's profile on ASX at www.asx.com.au .

- Oxide & transition component of the Mineral Resource for Sanutura Project - 3.2Mt @ 1.6g/t Au for 0.2Moz Au (Indicated) plus 23.4Mt @ 1.1g/t Au for 0.8Moz Au (Inferred), reported above cut-off grades of 0.2g/t Au and 0.3g/t Au for oxide and transition material respectively.

- Mineral Resource estimate for Karankasso Project - 12.74Mt @ 1.73g/t Au for 709koz Au (effective date of December 31, 2019), disclosed on 24 February 2020 by Semafo Inc ("Semafo", since acquired by Endeavour Mining Corp. "Endeavour"). For further information regarding that Mineral Resource estimate, refer to the news release "Semafo: Bantou Project Inferred Resources Increase to 2.2Moz" dated 24 February 2020 and "Semafo: Bantou Project NI43-101 Technical Report - Mineral Resource Estimate" dated 3 April 2020 and the Company's ASX Prospectus dated 11 March 2022. The news release and technical report are available under Semafo's and Endeavour's profile on SEDAR at www.sedar.com and the ASX Prospectus is available under Sarama's profile on ASX at www.asx.com.au . The Mineral Resource estimate was fully prepared by, or under the supervision of Semafo. Sarama has not independently verified Semafo's mineral Resource Estimate and takes no responsibility for its accuracy. Semafo, and now Endeavour, is the operator of the Karankasso Project JV and Sarama is relying on their Qualified Persons' assurance of the validity of the Mineral Resource estimate. Additional technical work has been undertaken on the Karankasso Project since the effective date but Sarama is not in a position to quantify the impact of this additional work on the Mineral Resource estimate referred to above.

- The Government of Burkina Faso has processed the requisite documents to facilitate the grant of the new, full-term Tankoro 2 and Djarkadougou 2 Exploration Permits (the "Permits" ) and subsequently issued the invitation to pay the permit issuance fees (the "Fees" ) and the Fees were paid within the requisite 10-day timeline. Following the payment of the Fee, the issuance of the Permit's arrêté and related paperwork becomes an administrative process during which time the Company may undertake work on the Tankoro 2 and Djarkadougou 2 Properties. The Company expects the arrêtés and related paperwork to be issued in due course. The properties, hosting the Tankoro and Bondi Deposits respectively, were formerly known as Tankoro and Djarkadougou, but have been renamed as part of the process of re-issuing the respective Permits.

- Endeavour Mining's Bantou Project Mineral Resource - 38.4Mt @ 1.2g/t Au for 1.5Moz Au (Inferred). This is the aggregate of the Mineral Resource listing for the Bantou and Bantou Nord Deposits which are located within the Bantou Project. Data is sourced from Semafo: Bantou Project NI43-101 Technical Report - Mineral Resource Estimate" dated 3 April 2020. The technical report are available under Endeavour's profile on SEDAR at www.sedar.com .

CAUTION REGARDING FORWARD LOOKING INFORMATION

Information in this news release that is not a statement of historical fact constitutes forward-looking information. Such forward-looking information includes, but is not limited to, statements regarding the Company's future exploration and development plans, the potential for the Sanutura and Karankasso Projects to host economic mineralisation, the potential to expand the existing estimated Mineral Resources at the Sanutura Project (including the present oxide and transition component), the potential to extend and add to existing mineralisation at the MM Prospect, the potential for the receipt of regulatory approvals and the timing and prospects for the issuance of the arrêtés for the Tankoro 2 and Djarkadougou 2 Exploration Permits by the Government of Burkina Faso. Actual results, performance or achievements of the Company may vary from the results suggested by such forward-looking statements due to known and unknown risks, uncertainties and other factors. Such factors include, among others, that the business of exploration for gold and other precious minerals involves a high degree of risk and is highly speculative in nature; Mineral Resources are not mineral reserves, they do not have demonstrated economic viability, and there is no certainty that they can be upgraded to mineral reserves through continued exploration; few properties that are explored are ultimately developed into producing mines; geological factors; the actual results of current and future exploration; changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company's publicly filed documents.

There can be no assurance that any mineralisation that is discovered will be proven to be economic, or that future required regulatory licensing or approvals will be obtained. However, the Company believes that the assumptions and expectations reflected in the forward-looking information are reasonable. Assumptions have been made regarding, among other things, the Company's ability to carry on its exploration activities, the sufficiency of funding, the timely receipt of required approvals, the price of gold and other precious metals, that the Company will not be affected by adverse political events, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain further financing as and when required and on reasonable terms. Readers should not place undue reliance on forward-looking information.

Sarama does not undertake to update any forward-looking information, except as required by applicable laws.

QUALIFIED PERSONS' STATEMENT

Scientific or technical information in this disclosure that relates to the preparation of the Mineral Resource estimate for the Sanutura Project is based on information compiled or approved by Paul Schmiede. Paul Schmiede is an employee of Sarama Resources Ltd and is a Fellow in good standing of the Australasian Institute of Mining and Metallurgy. Paul Schmiede has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Paul Schmiede consents to the inclusion in this news release of the information, in the form and context in which it appears.

Scientific or technical information in this disclosure that relates to exploration activities at the Sanutura Project is based on information compiled or approved by Guy Scherrer. Guy Scherrer is an employee of Sarama Resources Ltd and is a member in good standing of the Ordre des Géologues du Québec and has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Guy Scherrer consents to the inclusion in this disclosure of the information, in the form and context in which it appears.

Scientific or technical information in this disclosure that relates to the quotation of the Karankasso Project's Mineral Resource estimate and exploration activities is based on information compiled by Paul Schmiede. Paul Schmiede is an employee of Sarama Resources Ltd and is a Fellow in good standing of the Australasian Institute of Mining and Metallurgy. Paul Schmiede has sufficient experience which is relevant to the commodity, style of mineralisation under consideration and activity which he is undertaking to qualify as a Qualified Person under National Instrument 43-101. Paul Schmiede consents to the inclusion in this disclosure of the information, in the form and context in which it appears. Paul Schmiede and Sarama have not independently verified Semafo's (now Endeavour's) Mineral Resource estimate and take no responsibility for its accuracy.

COMPETENT PERSONS' STATEMENT

The Mineral Resource estimates referred to in this disclosure were first disclosed in accordance with ASX Listing Rule 5.8 in the Company's ASX Prospectus dated 11 March 2022. The Company confirms that it is not aware of any new information or data that materially affects the information included in the ASX Prospectus and that all material assumptions and technical parameters underpinning the estimates in the ASX Prospectus continue to apply and have not materially changed.

The new Exploration Results reported in this disclosure are based on, and fairly represent, information and supporting documentation prepared by Guy Scherrer. Guy Scherrer is an employee of Sarama Resources and a member of the Ordre des Géologues du Québec. Guy Scherrer has provided their prior written consent as to the form and context in which the new Exploration Results and the supporting information are presented in this disclosure.

The previously reported Exploration Results referred to in this disclosure were first disclosed in accordance with ASX Listing Rule 5.7 in the Company's ASX disclosure listed in Appendix B. The Company confirms that it is not aware of any new information or data that materially affects the information included in those previous items of disclosure.

This announcement has been authorised by the Board of Sarama Resources. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. |

SOURCE: Sarama Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/714155/Sarama-Resources--New-High-Grade-Mineralisation-Discovered