- Annual average EBITDA of US$348MM and average annual free cash flow of US$235MM over 21 year life of mine ("LOM")

- Annual production targeted at approx. 5.0 million tonnes of high grade, low impurity, iron concentrate grading ~65% iron with 0.52% V2O5 per tonne of concentrate

- Total operating costs of US$66/t of concentrate over LOM (freight to China included)

- Initial Capex estimated at US$574 million includes US$118 million contingency

- Payback period under 2 years

- 21-year LOM uses under one third of current total mineral resources

- Open pit mining operation with a LOM strip ratio less than 0.9:1

- Current mine plan uses only Indicated Resources in the North Zone

- Additional upside from the potential to expand development from the current North Zone Inferred Resources (471Mt) and South Zone Indicated (119Mt) and Inferred (76Mt) Resources

TORONTO, ON / ACCESSWIRE / September 8, 2022 / Voyager Metals Inc. ("Voyager" or the "Company") (TSXV:VONE), announces the filing of the Technical Report entitled "NI 43-101 Technical Report - Preliminary Economic Assessment (PEA) of the Mont Sorcier Project, Province of Quebec, Canada. As a result of a review by staff of the Ontario Securities Commission, the Company wishes to clarify certain aspects of its disclosure from the July 25, 2022 news release regarding at the Mont Sorcier Iron and Vanadium Project. The PEA was completed by DRA Global an independent engineering and consulting group, with input from independent consulting group InnovExplo Inc ("InnovExplo") for the Mineral Resource Estimate ("MRE") and independent consulting group Soutex Inc ("Soutex") for the Mineral Processing & Metallurgical Testing and Recovery Methods. The report has an effective date of September 8, 2022. The PEA was completed using only the Indicated Resources of the most recent MRE that was filed on Sedar on July 22, 2022.

PEA Summary Results (Note: All Figures in US$, unless otherwise noted)

Parameter | Unit | LOM Total / Avg. | |

| General | |||

| Base Iron Ore Price (62% Fe) | US$/t | $100.00 | |

| Vanadium Credit | US$/t | $15.00 | |

| High Grade Premium (65% Fe) | US$/t | $20.00 | |

| Mine Life | Years | 21 | |

| Production Summary | |||

| LOM Magnetite Payable | kt | 104,303 | |

| Operating Costs | |||

| Total On-site Operating Costs | US$/t | $21.90 | |

| Royalties | US$/t | $4.10 | |

| Total Cash Costs | US$/t | $26.00 | |

| Sustaining Capital | US$/t | $2.20 | |

| All-in Sustaining Costs (AISC) | US$/t | $28.20 | |

| Rail Transport (FOB Port) | US$/dmt conc | $18.00 | |

| Ocean Freight to China (CFR China) | US$/dmt conc | $20.00 | |

| CFR China US$/t sold | $66.20 | ||

| Capital Costs | |||

| Initial Capital Costs | kUS$ | $574,000 | |

| Sustaining Capital Costs | kUS$ | $226,680 | |

| Closure Costs | kUS$ | $50,400 | |

| Financials | |||

| Pre-Tax NPV (8%) | MUS$ | $2,407 | |

| Pre-Tax IRR | % | 52.3% | |

| Pre-Tax Payback | Years | 1.5 | |

| Post-Tax NPV (8%) | MUS$ | $1,607 | |

| Post-Tax IRR | % | 43.0% | |

| Post-Tax Payback | Years | 1.8 | |

| per t concentrate | 21-year LoM | ||

| Revenue / t | US$ | 135 | |

| NSR / t | US$ | 97 | |

| EBITDA / t | US$ | 70 | |

| Net Profit / t | US$ | 42 | |

| Revenue per year | US$/y | 670,518 | |

| EBITDA per year | US$/y | 347,778 | |

| Free cash Flow Post Tax | US$/y | 234,768 | |

The reader is advised that the PEA summarized in this press release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions. Where reference is made to Inferred Mineral Resources, these are considered to be too speculative to be used in an economic analysis except as allowed for by NI 43-101 in PEA studies. The PEA summarized herein is based solely on Indicated Minerals Resources and not based on any Inferred Mineral Resources. There is no guarantee the project economics described herein will be achieved. The Technical Report is available for review under the Company's profile on SEDAR and on the Company's website.

Non-IFRS Measures

This news release may contain references to EBITDA, Cash Costs, AISC per tonne of iron concentrate produced, free cash flow and other such measures, all of which are non-IFRS measures and do not have standardized meanings under IFRS. Therefore, these measures may not be comparable to similar measures presented by other issuers.

Management uses EBITDA, Cash Costs, AISC, free cash flow and other such measures as measures of operating performance to assist in assessing the Company's ability to generate future liquidity through operating cash flow to fund future working capital needs and to fund future capital expenditures, as well as to assist in comparing financial performance from period to period on a consistent basis. The Company believes that these measures are used by and are useful to investors and other users of the Company's financial statements in evaluating the Company's operating and cash performance because they allow for analysis of its financial results without regard to special, non-cash and other non-core items, which can vary substantially from company to company and over different periods.

The Company calculates EBITDA as NSR subtracting operational expenditure (OPEX) and subtracting Royalties.

The Company defines free cash flow as a measure of the Corporation's ability to generate and manage liquidity. It is calculated starting with the net cash flows from operating activities (as per IFRS) and then subtracting capital expenditures and lease payments.

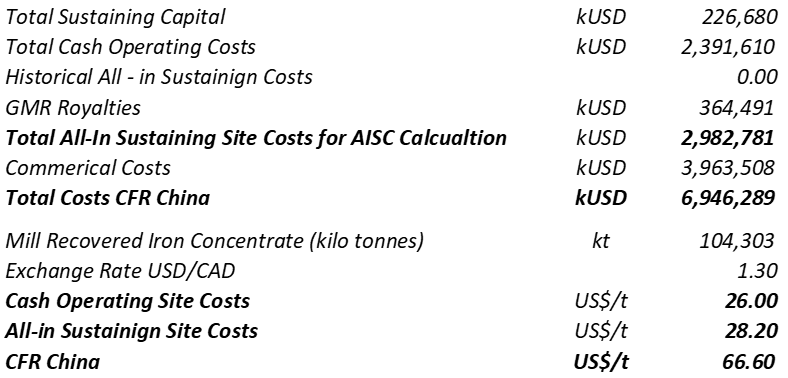

A description of the significant cost components that make up the forward looking non IFRS financial measures cash operating costs, AISC and CFR China costs per tonne of iron concentrate produced is shown in the table below:

Qualified Persons Statements

The PEA and other scientific and technical information contained in this news release were prepared by various "qualified persons" in accordance with the Canadian regulatory requirements set out in NI 43-101.

The overall PEA NI 43-101 report was compiled (with inputs from other QPs as indicated) by Mr. Tim Fletcher, P. Eng. (PEO No. 90451964), a Senior Project Manager with DRA Americas who is independent of the Company. The mining methods, mining CAPEX and OPEX, and economic analysis were developed by Mr. Daniel M. Gagnon, P. Eng. (OIQ No. 118521), Senior Mining Engineer and VP Mining and Geology for DRA Americas who is an independent qualified person. The CAPEX and OPEX were developed by Mr. Mr. Tim Fletcher, P. Eng.

The PEA is based on the Innovexplo MRE 2022 which has been produced by: Marina IUND, P.Geo. (OGQ No.?1525), Carl Pelletier, P.Geo. (OGQ, No.?384), and Simon Boudreau, P.Eng. (OIQ No. 132338), all of whom are Independent qualified persons, as defined under NI 43-101.

As it relates to Mineral Processing and Metallurgical Testing and Recovery Methods, the content was prepared and/or approved by Mathieu Girard, P. Eng. (OIQ No.?129366), who is an independent qualified person as defined under NI 43-101.

The technical information contained in this news release has been reviewed and approved by Mr. Clinton Swemmer of Voyager Metals, a Qualified person under NI43-101.

About Voyager Metals Inc.

Voyager Metals Inc is a mineral exploration company headquartered in Toronto, Canada. The Company is focused on advancing its Mont Sorcier, Vanadium-rich, Magnetite Iron Ore Project, located just outside of Chibougamau, Quebec.

At Mont Sorcier, Voyager is rapidly advancing the project towards Feasibility Study and permitting. The project currently has Indicated Resources of 679M tonnes grading 27.8% magnetite and 0.20% V2O5, with the potential to produce 195M tonnes of magnetite concentrate grading ~65% Fe and 0.52% vanadium pentoxide (V2O5) and a further Inferred Resource estimated at 547M tonnes grading 26.1% magnetite and 0.17% V2O5.

For more information about Voyager please visit our website at: www.voyagermetals.com

ON BEHALF OF THE BOARD OF DIRECTORS OF VOYAGER METALS INC.

Cliff Hale-Sanders,

President and CEO

Tel: +1-416-819-8558

csanders@voyagermetals.com

David Ball

Vice President, Corporate Development

Tel.: +1-647-796-0068

dball@voyagermetals.com

info@voyagermetals.com

www.voyagermetals.com

Cautionary Note Regarding Forward-Looking Statements:

This news release contains "forward looking statements" or "forward-looking information" (collectively "Forward-Looking Statements") that involve a number of risks and uncertainties. Forward Looking Statements are statements that are not historical facts and are generally, but not always, identified by the use of forward looking terminology such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "guidance", "outlook", "intends", "anticipates", "believes", or variations of such words and phrases or that state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms or similar expressions. The Forward-Looking Statements in this press release relate to, among other things: the future exploration performance of the Company. Forward Looking Statements are based on certain key assumptions and the opinions and estimates of management and Qualified Persons (in the case of technical and scientific information), as of the date such statements are made, and they involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any other future results, performance or achievements expressed or implied by the Forward Looking Statements. In addition to factors already discussed in this news release, such factors include, among others: there being no assurance that the Company will upgrade a significant portion of the North Zone to the Measured and Indicated categories to support the pending feasibility study; as well as those risk factors discussed or referred to in the Company's MD&A under the heading "Risk Factors" and under the heading "Forward-looking statements and use of estimates" which include further details on material assumptions used to develop such Forward Looking Statements and material risk factors that could cause actual results to differ materially from Forward Looking Statements, and other documents filed from time to time with the securities regulatory authorities in all provinces and territories of Canada and available on SEDAR at www.sedar.com.

The reader has been cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward Looking Statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that Forward Looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company's Forward Looking Statements reflect current expectations regarding future events and speak only as of the date hereof. Other than as it may be required by law, the Company undertakes no obligation to update Forward Looking Statements if circumstances or management's estimates or opinions should change. Accordingly, readers are cautioned not to place undue reliance on Forward Looking Statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Voyager Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/715281/Voyager-Metals-Files-Technical-Report-for-Updated-Preliminary-Economic-Assessment-at-the-Mont-Sorcier-Magnetite-Iron-and-Vanadium-Project-in-Quebec