VANCOUVER, BC / ACCESSWIRE / September 9, 2022 / Gander Gold Corporation ("Gander Gold" or the "Company") (CSE:GAND) (OTCQB:GANDF) is pleased to announce that, subject to regulatory approval, it has arranged a non-brokered private placement (the "Private Placement") with strategic investors to raise up to $3,210,000.

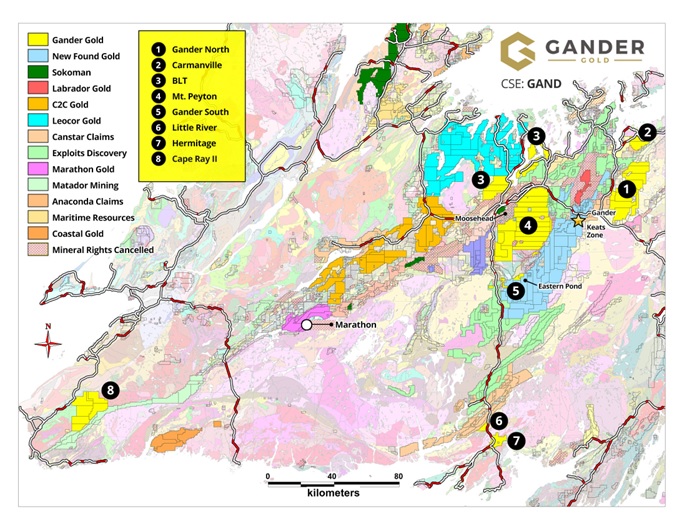

Mr. Mark Scott, Gander Gold President and CEO, commented: "Excellent progress at our flagship Gander North Project and exciting new developments at the Mount Peyton Project have triggered fresh interest in Gander Gold, one of the largest mineral claim owners in all of Newfoundland. This private placement will go toward ramping up exploration at both properties while we also test for potential new discoveries elsewhere across our highly prospective 2,263 sq. km land package.

"Following this financing, Gander Gold will continue to have a very attractive share structure with no warrants and a majority of the shares owned by Sassy Gold and Eric Sprott," concluded Mark Scott.

Private Placement Terms

- Up to 4,000,000 common shares (each a "Share") at $0.27 per Share for aggregate gross proceeds of up to $1,080,000;

- Up to 3,500,000 flow-through shares (each a "FT Share") at $0.31 per FT Share for aggregate gross proceeds of up to $1,085,000; and

- Up to 2,750,000 charitable flow-through shares (each a "Charitable FT Share") at $0.38 per Charitable FT Share for aggregate gross proceeds of up to $1,045,000.

Net proceeds from the Private Placement will be used to fund ongoing exploration activities at Gander Gold's properties in Newfoundland and for general working capital.

Completion of the Private Placement is subject to certain conditions, and receipt of all necessary regulatory approvals.

All securities issued in the Private Placement are subject to a hold period of four months and one day following the closing date of the Private Placement. Finder's fees may be payable in accordance with the policies of the Canadian Securities Exchange.

CEO Video Message

To view a short video clip from Gander Gold CEO Mark Scott, please visit GanderGold.com or use this direct link:

https://youtu.be/NLmgB9N7zDQ

Gander Gold - Dominant Land Position In Newfoundland

Acknowledgement

Gander Gold Corporation acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of Newfoundland and Labrador.

About Gander Gold Corporation

Gander Gold is an exploration stage resource company currently engaged in the identification, acquisition and exploration of high-grade precious metal and base metal projects in the Central Newfoundland Gold Belt. Its focus is on its eight projects in the Canadian province of Newfoundland & Labrador, namely the Gander North, Mt. Peyton, Cape Ray II, BLT, Carmanville, Gander South, Little River and Hermitage projects, which comprise 9,052 claims or approximately 2,263 km², making Gander Gold Corporation one of the largest claimholders in Newfoundland.

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES AND DOES NOT CONSTITUTE AN OFFER OF THE SECURITIES DESCRIBED HEREIN

Contact Info:

Mark Scott

Chief Executive Officer & Director

info@gandergold.com

Terry Bramhall

Gander Gold - Corporate Communications

1.604.833.6999 (mobile)

1.604.675.9985 (office)

terry.bramhall@gandergold.com

The CSE has neither approved nor disapproved the contents of this news release. Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

The securities referred to in this news release have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any applicable securities laws of any state of the United States, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons (as such term is defined in Regulation S under the U.S. Securities Act) or persons in the United States unless registered under the U.S. Securities Act and any other applicable securities laws of the United States or an exemption from such registration requirements is available.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of these securities within any jurisdiction, including the United States. Any public offering of securities in the United States must be made by means of a prospectus containing detailed information about the company and management, as well as financial statements.

SOURCE: Gander Gold Corporation

View source version on accesswire.com:

https://www.accesswire.com/715352/Gander-Gold-Arranges-32-Million-Private-Placement