VANCOUVER, BC and HONG KONG, CHINA / ACCESSWIRE / September 13, 2022 / Reyna Silver Corp. (TSXV:RSLV)(OTCQB:RSNVF)(FRA:4ZC) ("Reyna") is pleased to announce high-grade silver and gold results from its late 2021 to mid-2022 surface and in-mine sampling program focused on the area surrounding the Silver Zone of the historic Batopilas District, Chihuahua, Mexico. Batopilas is believed to be the highest-grade silver system in Mexico's history, having produced an estimated over 300 Moz of native silver from ores that averaged over 1500 g/t. Reyna's work has identified a previously unrecognized gold overprint on the silver mineralization (See Press Release of April 12, 2022) and the results reported here reflect districtwide exploration to understand how that gold fits into the overall district mineralization history.

Out of nearly 1500 samples, over 10% report between 1.1 and 32.6 g/t Gold and 6% report between 199 and 14,170 g/t Silver. About 25% report a combination of Gold and Silver, with 16 samples returning over 1 g/t Gold plus over 100 g/t Silver together (Table 1 to 4). These results extend several known Silver Zone vein structures by 300 to 1200m and identify 3 new silver and multiple new gold-silver veins in the largely unexplored East Belt 2 kilometers away on the east side of the Batopilas river. Further, the geochemical results appear to indicate that there are two separate gold stages superimposed on the silver mineralization in different parts of the camp, which indicates at least 3 mineralization stages, a hallmark of large, long-lived mineralization systems. The sampling program reported here is complemented by a new district-scale magneto-telluric (MT) geophysical survey and a detailed structural reanalysis. The results from these three facets will be combined to define targets for the next round of drilling.

Highlights

- Identification of a new gold zone on the east side of the river - the East Belt - paralleling the Teodoro Gold Zone (previously the "NE Gold Zone") which lies 2 km farther west.

- 300-1500m extensions into under-explored areas of the high-grade Silver Zone veins.

- 1458 sample results with 6% ranging from 199 to 14,170 gr/ton Silver with more than 10% reporting Gold values from 1.1 to 32.6 gr/ton (Tables 1 to 4)

- Recognition of two geochemically distinct gold events superimposed on earlier silver.

"Our results from applying modern exploration techniques into the underexplored parts of the historic Batopilas district reinforce our belief that exploration has only scratched the surface in Mexico," said Jorge Ramiro Monroy, Pres and CEO of Reyna Silver. "We are very excited to see what the drill reveals next, not only in these new additions to the Silver Zone, but in the new East Belt gold zone in the eastern part of the district".

Dr. Peter Megaw, Chief Exploration Advisor elaborated, "Finding the previously overlooked Teodoro Gold Zone last year launched a multifaceted field program to figure out how gold fits into the overall picture for this remarkable silver, now silver-gold district. Impressive gold values were encountered when we moved into the under-explored East Belt Zone across the Batopilas River and the overall results not only give credence to the developing Batopilas gold story, but highlight underexplored opportunities in the Batopilas high-grade silver zone as well. We are eager to drill the combination of these sampling results with the forthcoming geophysical results and the recently initiated detailed structural study".

Geochemical results indicate at least two different sources for the gold mineralization, a hallmark of a large, very active and well-mineralized system. The gold-bearing structures in the East Belt Zone are structurally similar to the Teodoro Zone (previously identified as the NE Gold Zone). However, although at least one of the East Belt gold vein types is geochemically allied to the Teodoro Gold Zone mineralization, the other is distinctly different. Encountering this parallel, multistage gold mineralization, albeit over 2 kilometers away, gives credence to a developing gold story at Batopilas.

Highlight Table

Sample Type | Zone | Sample | Au ppm | Ag ppm |

| Surface | Ag | 202349 | 0.6 | 14,170 |

| Mine Interior | Ag | 196237 | 0.1 | 3,120 |

| Mine Interior | Au | 202918 | 32.6 | 15.9 |

| Surface | Au | 109436 | 30.6 | 16 |

| Surface | Au | 202937 | 22.9 | 22 |

| Surface | Au + Ag | 202105 | 16.4 | 67 |

| Surface | Au + Ag | 202566 | 8.8 | 91 |

| Surface | Au + Ag | 202984 | 19 | 2,090 |

Table 1. Highlights from each style of mineralization: Silver, gold, and silver-gold.

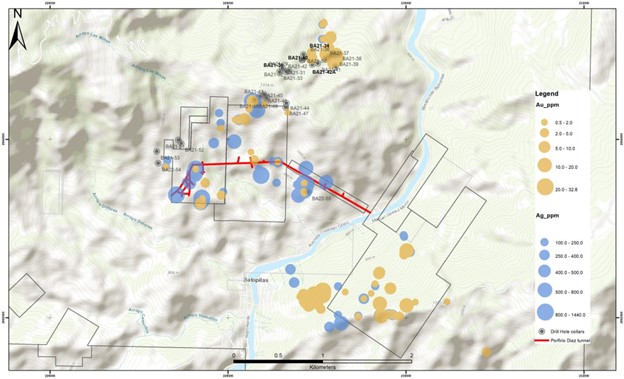

Figure 1. Map of the Batopilas District showing location of Selective Sampling survey results. Gold is in yellow, and Silver is in blue. The Porfirio Diaz Tunnel is in red. The location of drill holes from Phase 1 are in green, with the standout holes (BA21-30, 34 and BA21-40 and 42A) in black.

2022 Sampling and Exploration Program

The sampling program reported here stems from 2021-2022 geologic work and drilling that identified significant gold and mixed silver-gold mineralization outboard of the district's historic high-grade silver center. That work dramatically increased the district footprint and highlighted additional areas with potential for new gold and silver veins and extensions of previously known veins. Sampling was performed along surface traverses guided by strong geological lineaments identified in satellite imagery, projections of structural trends recognized in old mines and zones where overlooked veins were suspected. A total of 1,458 samples were collected and submitted for assay with appropriate control duplicates, standards and blanks. At least 25 percent of the samples reported either strong silver or gold anomalies or combined silver-gold anomalies.

- The East Belt is a new gold-silver zone identified on the east side of the Batopilas river, where only limited sampling had been done previously. The East Belt structures trend roughly parallel to the nearly N-S trend of the Teodoro Gold Zone discovered in 2021 over 2km to the north-west on the other side of the Batopilas river. The East Belt structures show both gold-dominant and mixed gold-silver zones as is seen at Teodoro (See Press Release, April 12, 2022). Geochemically, there appear to be two distinct gold mineralizing stages-one very similar to Teodoro, the other distinctly different. The three principal gold-rich veins of the East Belt include the new Las Pilas and Nestor veins and the southwestern extension of the historic Nevada-Valenciana native silver vein. (Figure 1., Tables 2 and 4).

- Nine silver veins of the Silver Zone were delineated through surface and underground mapping and sampling, which extended them between 300 and 1200 m beyond their known lengths. The structures show the pinch and swell of thickness from 0.2 to 1m characteristic of Batopilas. All returned significant silver values, with most of them featuring samples with over 1,000 g/t Ag. Three of these structures have never been drilled, and two have seen very little drilling. The extensions of these veins clearly warrant further drilling and a number of additional structures with shorter recognized outcrop lengths remain to be mapped and sampled in detail. (Figure 1., Table 2 and 3)

- The sampling program is complemented by a new district-scale magneto-telluric (MT) geophysical survey and a detailed structural reanalysis. The results from these three facets will be combined to define targets for the next round of drilling.

Table 2. The 16 samples returning over 1 g/t Gold plus over 100 g/t Silver together.

SAMPLE | Au g/t | Ag g/t |

196104 | 1.6 | 983 |

202216 | 2.3 | 2180 |

202547 | 2.5 | 360 |

202586 | 1.3 | 255 |

202782 | 6.8 | 1090 |

202857 | 1.1 | 102 |

202971 | 1.3 | 151 |

202978 | 2.5 | 218 |

202979 | 1.1 | 116 |

202980 | 3.2 | 437 |

202982 | 1.9 | 210 |

202984 | 19.0 | 2090 |

202990 | 1.8 | 171 |

203079 | 1.5 | 176 |

203082 | 3.1 | 319 |

Table 3. Gold Results above 5.0 g/t Au. There are also 61 samples with grades from 0.5-1.0 g/t Au, and 66 samples at 1.0-5.0 g/t Au.

| Type | SAMPLE | Au g/t | Ag g/t |

| Surface | 109423 | 5.9 | 3 |

| Surface | 109436 | 30.6 | 16 |

| Surface | 109437 | 15.7 | 15 |

| Surface | 109491 | 8.6 | 36 |

| Small adit | 187220 | 9.9 | 15 |

| Small adit | 187222 | 9.7 | 37 |

| Old Adit | 196211 | 7.8 | 41 |

| Surface | 196432 | 16.3 | 13 |

| Surface | 202105 | 16.4 | 67 |

| Surface | 202151 | 5.6 | 31 |

| Small adit | 202152 | 13.6 | 43 |

| Mine Interior | 202398 | 5.3 | 27 |

| Mine Interior | 202399 | 7.0 | 15 |

| Mine Interior | 202400 | 12.3 | 24 |

| Surface | 202423 | 6.7 | 29 |

| Small adit | 202466 | 7.4 | 4 |

| Small adit | 202469 | 9.7 | 15 |

| Surface | 202564 | 8.4 | 62 |

| Surface | 202566 | 8.9 | 91 |

| Surface | 202611 | 7.0 | 19 |

| Surface | 202612 | 12.6 | 47 |

| Surface | 202694 | 13.9 | 47 |

| Surface | 202705 | 5.9 | 20 |

| Surface | 202803 | 9.8 | 24 |

| Surface | 202808 | 7.9 | 54 |

| Mine Interior | 202918 | 32.6 | 16 |

| Mine Interior | 202919 | 14.2 | 10 |

| Mine Interior | 202920 | 19.6 | 16 |

| Surface | 202937 | 22.9 | 22 |

| Mine Interior | 202938 | 15.0 | 11 |

| Mine Interior | 202941 | 9.4 | 7 |

| Mine Interior | 202945 | 5.9 | 6 |

| Surface | 202955 | 5.9 | 12 |

| Surface | 203044 | 6.3 | 6 |

Table 4. Silver Results above 1,000 g/t Ag. In addition there are 20 samples with values between 300-600 g/t Ag, and 11 samples between 600-1000 g/t Ag. In total, 76 samples had grades greater than 199 g/t Ag.

Type | SAMPLE | Au g/t | Ag g/t | Location |

| Mine Interior | 109402 | 0.09 | 1935 | Hundido Mine |

| Mine Interior | 196065 | 0.12 | 1045 | Old Adit, no name. |

| Mine Interior | 196096 | 0.08 | 1610 | Old Mine |

| Mine Interior | 196237 | 0.12 | 3120 | Del Aire Mine |

| Mine Interior | 196455 | 0.25 | 1140 | Del Aire Mine |

| Mine Interior | 202216 | 2.36 | 2180 | Ciempies Mine |

| Mine Interior | 202227 | 0.04 | 1875 | Ford Tunnel |

| Mine Interior | 202228 | 0.05 | 1550 | Ford Tunnel |

| Mine Interior | 202229 | 0.31 | 1450 | Ford Tunnel |

| Mine Interior | 202231 | 0.61 | 1920 | Ford Tunnel |

| Mine Interior | 202232 | 0.33 | 2080 | Ford Tunnel |

| Mine Interior | 202245 | 0.044 | 1505 | Ford Tunnel |

| Mine Interior | 202316 | 0.028 | 3190 | Ford Tunnel |

| Mine Interior | 202317 | 0.102 | 1065 | Ford Tunnel |

| Surface | 202349 | 0.64 | 14170 | Surface |

| Mine Interior | 202486 | 0.12 | 1440 | Palo Mulato Mine |

| Surface | 202641 | 0.18 | 3120 | Surface |

| Surface | 202782 | 6.88 | 1090 | Surface |

| Surface | 202984 | 19.0 | 2090 | near Nestor |

Click here to watch the video

QA/QC STATEMENT

Reyna Silver, follows industry standard procedures for surface sample analysis. Surface or mine interior samples are taken in areas of veins or alteration, either in chips or in channels, as well as in old dumps or float. Sample widths are from 0.1 to 2 m, producing samples of between 0.6 and 10 kg. The samples are delivered to the internationally certified ALS Minerals laboratory facilities in Chihuahua city where the samples are prepared. ALS has a Quality management system (ISO 17025) and Assays are completed by ALS Minerals in Canada. The samples are fire assayed for Au (Au-23), and are analyzed for Ag and multi-elements using method code ICP (ICP-41) following an aqua regia digestion. Over-limits are analyzed using an appropriate method. Multi-element geochemical standards and blanks are inserted systematically into the surface sampling series to monitor lab performance. The control samples are inserted each 25 samples in the case of standards, blanks and field duplicates. Referent to the chain of custody the samples are transported from Batopilas by Reyna Silver personnel to ALS-Chemex in Chihuahua City.

QUALIFIED PERSON

Dr. Peter Megaw, Ph.D., C.P.G., the Company's Chief Exploration Advisor and Qualified Person, reviewed the technical aspects of the exploration projects described herein and is responsible for the design and conduct of the exploration program and the verification and quality assurance of analytical results. Dr. Megaw is not independent as he and/or companies with which he is affiliated hold Net Smelter Royalties on the Guigui and Batopilas Projects that predate Reyna Silver acquiring them.

ABOUT REYNA SILVER

Reyna Silver Corp. (TSXV: RSLV) is a growth-oriented junior exploration and development company focused on exploring for high-grade, district-scale silver deposits in Mexico and USA.

Reyna's principal properties are the Guigui and Batopilas Properties in Chihuahua, Mexico. Guigui covers the interpreted source area for the Santa Eulalia Carbonate Replacement District (CRD) and Batopilas covers most of Mexico's historically highest-grade silver system. The Company also has an option to acquire 80% of the Medicine Springs property in Nevada, USA as well as the early stage La Durazno and Matilde and La Reyna mineral properties in Mexico.

On Behalf of the Board of Directors of Reyna Silver Corp.

Jorge Ramiro Monroy

Chief Executive Officer

For Further Information, Please Contact:

Jorge Ramiro Monroy, Chief Executive Officer

info@reynasilver.com

www.reynasilver.com

Cautionary Statements

This document contains "forward-looking statements" within the meaning of applicable Canadian securities regulations. All statements other than statements of historical fact herein, including, without limitation, statements regarding exploration results and plans, and our other future plans and objectives, are forward-looking statements that involve various risks and uncertainties. Such forward-looking statements include, without limitation, our estimates of exploration investment, the scope of our exploration programs, and our expectations of ongoing administrative costs. There can be no assurance that such statements will prove to be accurate, and future events and actual results could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from our expectations are disclosed in the Company's documents filed from time to time via SEDAR with the Canadian regulatory agencies to whose policies we are bound. Forward-looking statements are based on the estimates and opinions of management on the date the statements are made, and we do not undertake any obligation to update forward-looking statements should conditions or our estimates or opinions change, except as required by law. Forward-looking statements are subject to risks, uncertainties and other factors, including risks associated with mineral exploration, price volatility in the mineral commodities we seek, and operational and political risks. Readers are cautioned not to place undue reliance on forward-looking statements.

SOURCE: Reyna Silver Corp.

View source version on accesswire.com:

https://www.accesswire.com/715741/Reyna-Silver-Reports-High-Grade-Silver-and-Gold-Results-from-Batopilas-Sampling-14371-gt-Silver-with-06-gt-Au-Northeast-of-the-Historic-Silver-Zone-and-326-gt-Au-in-Newly-Recognized-East-Belt-2-km-East-of-Silver-Zone